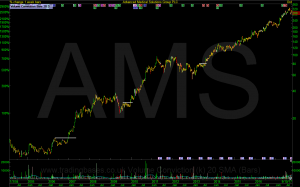

Lets face it we all want to ride a big trend. We’d be crazy not to. In this article Jason Needham looks at the trailing stop to see how much trend we can capture by comparing a few methods. If you plan to ride a trend then you’re going to need a trailing exit to […]