Based on conversations with a first hand source, Bruce believes the narrative about Ukraine may be too optimistic. But would be very happy to be proved wrong in the next week or two if a cease fire is signed AND upheld. Companies covered Fonix Mobile PLC, TP ICAP Group PLC and Litigation Capital Management.

The FTSE 100 was +3.1% up to 7,341 last week. The FTSE China 50 bounced +4.9% with Alibaba up last Thursday +30% after Liu He, a top economic official said that Beijing would take measures to support the economy. One interpretation is that dual listed Chinese large cap tech companies like BABA and Tencent have been trading lower as investors worried that they would be de-listed from the NYSE. Instead investors now believe the Chinese authorities will allow proper audits of their financials, as the USA is requiring.

The FTSE 100 was +3.1% up to 7,341 last week. The FTSE China 50 bounced +4.9% with Alibaba up last Thursday +30% after Liu He, a top economic official said that Beijing would take measures to support the economy. One interpretation is that dual listed Chinese large cap tech companies like BABA and Tencent have been trading lower as investors worried that they would be de-listed from the NYSE. Instead investors now believe the Chinese authorities will allow proper audits of their financials, as the USA is requiring.

The S&P 500 was up +5.9% and Nasdaq 100 +6.1%. Brent Crude fell back below $100 per barrel, but is still up +26% YTD. The US 10 year bond yield has risen to 2.19%, a 33bp increase since the first week of March, as both the Fed and the BoE raised interest rates. Note though, the flat yield curve at the long end (ie 2 year v 10 year yield) suggests bond markets believe Central Banks still have inflation under control.

All this optimism signals Ukraine will soon resolve – I think that’s wrong, as I set out below.

The Telegram channel Vladikavkaz News reported that Russian tanks from South Ossetia were being redeployed to reinforce troops in Ukraine, while Ramzan Kadyrov, the Chechen leader, posted a video claiming that he was in Ukraine and his men were fighting 20km from Kyiv. Sending reinforcements from the Caucasus seems to contradict the view that Putin is ready to sign AND uphold a ceasefire agreement.

My friend Matt has published a piece in The Times pointing out that if we are to isolate Russia, we need to include former Soviet countries (Armenia, Kazakhstan, Kyrgyzstan and even Belarus) in our trading / economic sphere of influence. I’ve known Matt since he was working for the EU Monitoring Mission in Mtskheta sorting out border disputes between the Georgians and the two Russian backed break away provinces (South Ossetia and Abkhazia). He’s an interesting source of information, for instance telling me a couple of years ago that the South Ossetian “Central Bank” was providing correspondent banking and payment services for the Russian backed breakaway region in the Donbass. Originally the Kremlin did not recognise the Donbass republics in Ukraine, because this would have contravened the “Minsk Agreement” – the 2014 ceasefire agreement that was supposed to resolve the conflict which Russia had signed. Putin could have had a lasting peace in Donbass from 2014, but that didn’t suit his agenda. Instead Moscow chose to financially support the Donbass via South Ossetia and send in “little green men” as a way of backing the province without being seen to be doing so.

That suggests to me that even if a cease fire agreement is signed – it may be “more honour’d in the breach than the observance.” Matt has also suggested to me that some of the Western media narrative about Ukraine coming together in the face of aggression from Russia may be over optimistic. He’s spent several years in Donbass observing the conflict first hand. Most journalists stay in Kyiv and Lviv, even a few years ago it was difficult and dangerous to visit the conflict zone, so they tend to report a Kyiv-centric version of events. Matt is no longer in Ukraine now, but his time there suggests that the grass roots support of Kyiv, and the mayors and administrators that have been imposed on the cities in the East, might not be as strong as our media would have you believe.

Markets seem to be anticipating a quick resolution of the conflict, I hope that’s correct but for now I am more cautious. I will be very glad to be proved wrong in the next week or two, because the human toll of the conflict is horrible to see.

This week I look at another Direct Carrier Billing company: Fonix Mobile, but unlike Bango last week, profitable and cash generative. Also TP ICAP the interdealer broker and Litigation Capital Management.

Fonix Mobile PLC H1 Dec results

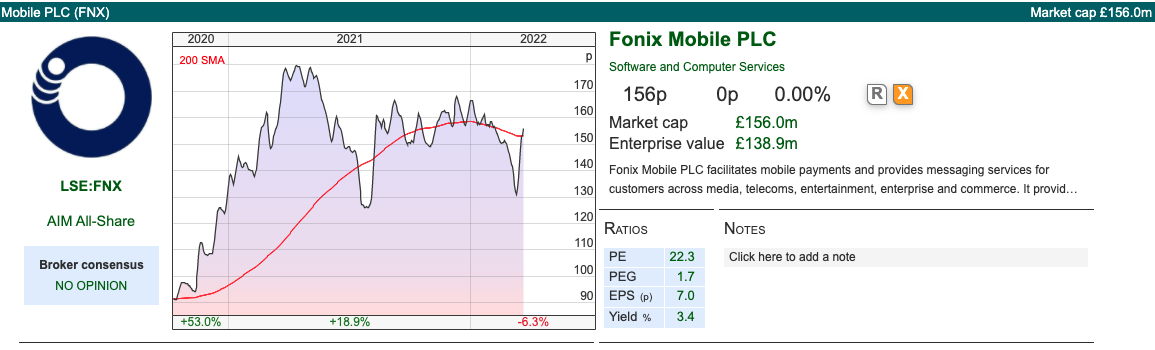

Fonix Mobile PLC, the mobile payments company with a June year end reported revenue +16% to £29m and statutory PBT +49% to £5.2m. These figures are in line with guidance given at a trading update at the end of January (Adjusted EBITDA £7m, gross profit £5.5m). They had £6m of net cash on the balance sheet at the end of December, which excludes cash held on behalf of customers.

Fonix Mobile PLC, the mobile payments company with a June year end reported revenue +16% to £29m and statutory PBT +49% to £5.2m. These figures are in line with guidance given at a trading update at the end of January (Adjusted EBITDA £7m, gross profit £5.5m). They had £6m of net cash on the balance sheet at the end of December, which excludes cash held on behalf of customers.

Like Boku, Bango and IMI Mobile (the latter bought by Cisco for £550m at the end of 2020), Fonix specialises in Direct Carrier Billing (DCB) allowing phone users to buy items and the payment amount is charged to their mobile phone bill. From a technical perspective, Fonix provides APIs to merchants allowing both ‘text to buy’ and ‘click to buy’ purchases. However, unlike the other DCB’s Fonix is focused on the UK rather than the global market.

The global DCB area is a volume and scale business (for instance, helping Netflix or Spotify receive payments in dozens of different countries) and requires agreements between parties such as Google and Apple (who own the app stores) and Mobile Network Operators, like Vodafone (who own the infrastructure). Instead Fonix works with UK brands (ITV, BT, charities like BBC Children In Need and Comic Relief, plus they’ve just signed a contract with BOTB) that operate outside the app environment, hence they do not need to pay the 30% revenue share to the app store. They’ve also just developed “direct to consumer refunds” which they think will drive public transport ticket use cases.

The global DCB area is a volume and scale business (for instance, helping Netflix or Spotify receive payments in dozens of different countries) and requires agreements between parties such as Google and Apple (who own the app stores) and Mobile Network Operators, like Vodafone (who own the infrastructure). Instead Fonix works with UK brands (ITV, BT, charities like BBC Children In Need and Comic Relief, plus they’ve just signed a contract with BOTB) that operate outside the app environment, hence they do not need to pay the 30% revenue share to the app store. They’ve also just developed “direct to consumer refunds” which they think will drive public transport ticket use cases.

History Founded in 2006 as D2See by William Neale the company specialised in SMS billing, messaging and voice shortcodes. The latter is a premium rate 5 or 7 digit number eg 61500 rather than a longcode 11 digit number that includes a geographic prefix – such as 0207 for inner London. This is useful for TV voting, chatlines and information services. Fonix clients include Powwownow (conference calling) and BT (powering most of the UK TV voting such as The X Factor and Strictly Come Dancing).

Rob Weisz, the current CEO joined in 2014. The company IPO’ed in October 2020 at 90p per share, valuing it at £90m. The selling shareholders (William Neale and other management insiders) sold a third of the company (50,000 shares) but didn’t raise any new money.

Cashflow SharePad’s “Quality” ratios show a mixed message, with high RoCE and high EBIT margins – but very poor cash measures. That’s due to some large working capital movements because FNX collects money from phone users which is then paid to the receiving organisation. There are large shifts based on timing. Helpfully the company provides an “underlying” cashflow statement which adjusts this. That shows Net Cash Generated from Operating Activities of £5.2m less £305K Cash from Investing Activities and a £3.6m Cash from Financing Activities which is the dividend that they paid. They same issue affects ROCE on SharePad, 202% ROCE but CROCI -194%. FinnCap, their broker, provide an “underlying” RoCE based on Free Cash Flow forecast of 98% 2022F and 80% 2023F, so the company is highly profitable and generating an impressive amount of cash.

Valuation FinnCap are forecasting revenue growth +11% Jun 2022F, and +10% to £58m FY 2023F. The shares are trading on a PER of 18x FY 2023F. Unusually for a mobile payments company growing at +10% per year, they payout 6p (a 75% payout ratio) as a dividend, putting the shares on a yield of 3.9%.

Ownership William Neale the founder (through Ganton Ltd) still owns 26% after the IPO. In the “DD” tab SharePad shows this holding duplicated. Richard Thompson (through Starnevesse Ltd) another insider still owns 10.2%. The Chief Exec’s (Rob Weisz) 8.5% shareholding has a 24 month lock-up (ie until October 2022), the other selling shareholders lock-up has already expired so they could have sold down their post IPO holdings if they had wanted to. Slater Investments own 9.7%.

Opinion I like the way that Fonix Mobile is expanding. Focusing on a small profitable niche, and then expanding internationally as organisations they serve require support overseas. Tech companies often operate in an ecosystem, and provide services or expertise for others who can’t figure out how to do things themselves. I’m reading Jimmy Soni’s book on PayPal at the moment, and I hadn’t realised just how dependent Elon Musk’s X.com and Peter Thiel’s Confinity were on a single use case (eBay traders who wanted to send and receive money via email.) Direct Carrier Billing is a market where investors really need a deep understanding of both competition and regulation, but this has certainly piqued my interest.

TP ICAP FY Dec Results

This interdealer broker (IDP) that was formed from a 2016 all-share merger between Tullett Prebon and ICAP valuing the combined group at £1.2bn, announced FY Dec 2021 results. It’s worth looking at IDPs when financial volatility increases, in part because vol generates a helpful revenue environment, but secondly because IDP’s can give some indication of what’s going on in the financial “plumbing”. IDPs act as intermediaries between banks trading credit derivatives, interest rate swaps, commodities contracts and FX options.

The business has been in a secular decline since after the financial crisis, regulators are keen to see more standardised financial products trading on exchanges, rather than on the “Over The Counter” (OTC) trades which are not centrally cleared. Moving trading on to exchanges is not a silver bullet though, the London Metal Exchange has just closed for a week and cancelled $3.9bn of trades after Xiang Guangda’s Tsingshan Holding Group which mines tons of nickel was caught in a short squeeze trying to hedge it’s nickel production. The problem seems to have been something that IDPs had been warning about – that much of the OTC trades can’t be exchange traded because they’re not standardised. Nickel may be the first of many commodity markets to become dysfunctional, the FT reported that energy traders are calling for emergency Central Bank intervention.

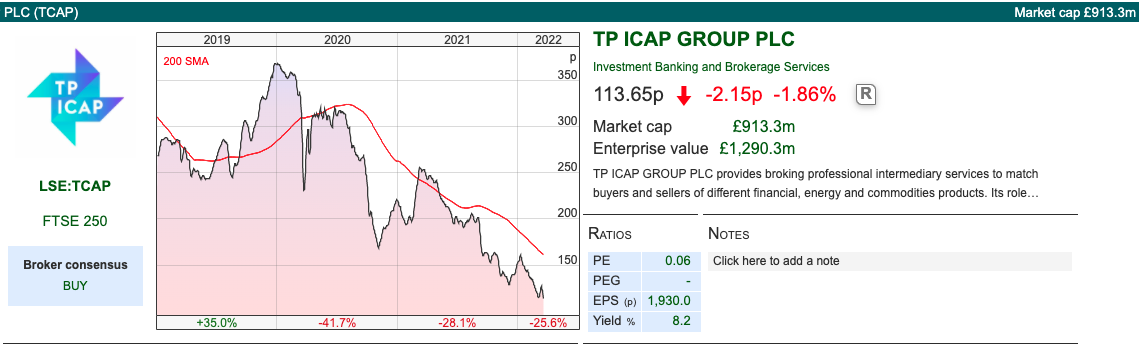

TP ICAP reported revenues +8% to £1.9bn, though that was helped by the acquisition of $575m Liquidnet, a US trading venue. On an organic basis revenue was down -1%, hindered by a tough comparative period in the prior year (ie 2020 volatility at the start of the pandemic was helpful in that). Statutory PBT was down -81% to £24m. Adjusting for Liquidnet, restructuring costs and similar gives adj PBT of £177m, down -21%.

Current trading It’s worth noting though that 2022 has got off to a better start than last year. TP ICAP is typically a beneficiary of volatility. Group revenue was +4% ex acquisition until 11 March v the same period last year (+16% higher including Liquidnet). They note in the statement that periods of extreme volatility, such as has we’ve seen in recent weeks, can have “complex second-order effects on market participant behaviour and activity drivers, such as risk-taking appetite, and liquidity capacity.” That sounds less upbeat than I would have expected.

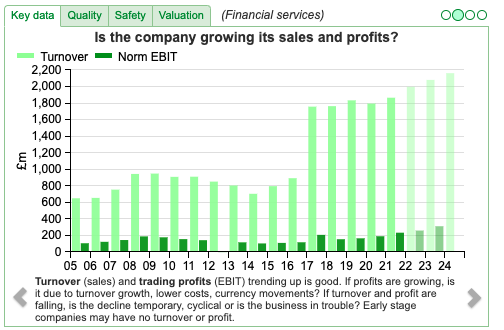

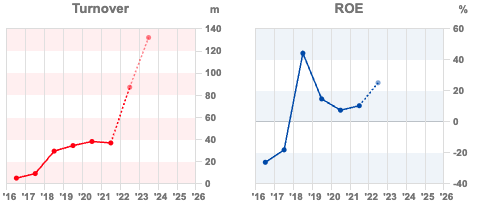

Guidance Management are reluctant to give guidance on how they see revenue progressing for the rest of the year. They do say that Russian clients accounted for just 0.5% of 2021 revenue. They’ve lost £4m on failed trade settlements, and have potential to lose a further £9m. That said since the merger the company does seem to be making good progress on both a turnover and EBIT level.

Valuation The shares are trading on just 4.3x 2023F falling to below 4x 2024F. The business is trading on 0.5x historic sales, suggesting that investors believe that the business is in decline. SharePad’s quality measures show RoCE of 7.7% and CRoCI of 3.2%. One concern is the balance sheet, which has £1.85bn of intangible assets versus £1.98bn of equity – so tangible book value is less than £150m. That compares to Net Debt of £243m and gross loan liabilities of £839m. I wouldn’t be surprised to see management raise more equity.

Ownership Schroders own 11.5%, Liontrust 10.2%, Jupiter 8.9% and Silchester 5.1% – that’s a shareholder register of surprisingly high quality institutions for a company that trading on 4x forecast earnings.

Opinion The outlook statement is less positive than I was expecting. The chart looks awful as the share price has been in decline over the last few years, but it looks like now some of the downsides of moving contracts on to exchanges is being recognised. TP ICAP does have scale and network effects – plus the cost base ought to be more flexible than a universal bank. It’s speculative but I’m wondering if the bad news is in the price and commodity inflation and rising interest rates might mark a change in fortunes?

Litigation Capital Management H1 Results to Dec

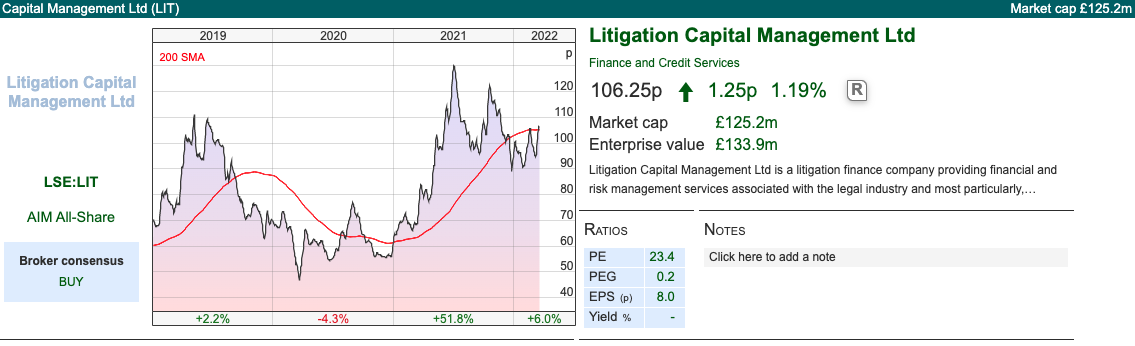

This Sydney headquartered but AIM listed (since Dec 2018) litigation financer reported its first set of results since the Executive Vice Chairman, Nick Rowles-Davies had his employment terminated on grounds of gross misconduct (the RNS said it was due to his expense claims which contravened company policy). The share price fell -23% on the day of that RNS in December last year.

The results themselves show H1 revenue to December increased 2.4x to AUD $19m and statutory PBT of AUD $4m versus AUD $1.4m loss last year. The reporting currency is Australian dollars (current exchange rate 1.81 to £ GBP.) Cockerhoop on Twitter points out that in note 4 of the accounts, LIT reveals that 95% (AUD $18.4m) of revenue came from just one UK customer. Even if that is one customer with multiple cases, that still seems like significant concentration risk.

Unlike Burford, LIT recognises contracts at historic cost rather than writing up the value of cases through “fair value” accounting. Despite the more conservative accounting, results are still hard to forecast because it’s impossible to know the timing of judgements or out of court settlements. The AUD $4m statutory PBT translates into a ROIC of 261% and an IRR of 199% – well above both LIT’s 10 year average and that reported by Burford (mid 90% ROIC).

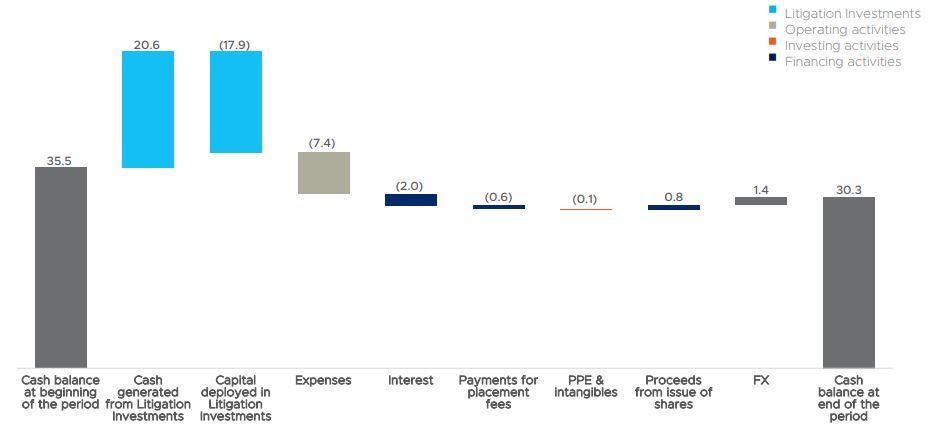

Cash v Profits Theoretically historic cost accounting should mean that cash and PBT are similar, however LIT shows an AUD $8m fall in the cash on their balance sheet. Excluding Third Party Funds (asset management vehicles from which LIT derives a fee) cash falls by AUD $5.2m – that is an AUD $9m gap between statutory reported PBT and the movement in cash. There’s no explanation why this is, apart from the chart below I’ve taken from the analyst pack, which shows cash generated from cases they’ve won net of money invested in future cases is a AUD $2.7m positive, versus operating expenses of AUD $7.4m.

Management reported a 10.5 year average Return on Invested Capital of 162%. It’s important to notice though that this is not the same as group Return on Capital Employed or similar. Litigation funders report returns from concluded legal cases divided by the amount of expenditure incurred in funding that asset (ie capital employed fighting the case, not the group’s capital employed which would include the AUD $7.4m expenses in the chart above). For comparison, Burford ROIC on a similar basis was 95% at their H1 results.

So these high ROIC figures considerably overstate returns to shareholders on a group-wide basis. Sharepad shows LIT’s group RoCE of c. 10% FY June 2021 and 2020.

Valuation Canaccord, their broker, are forecasting revenue to treble from FY Jun 2020 and 2021 levels to AUD $138m FY Jun 2023F. Adj EPS of AUD 20c FY June 2022F and AUD 30c FY June 2023F. That implies RoE of 23% this year and 28% next year (versus a c. 10% achieved in FY June 2020 and 2021). That could make sense if we see that the AUD $47m they raised when they moved to AIM in Dec 2018 mark a step change in revenues a few years later. In GBP Canaccord forecast NAV to be 55p June 2022F, so the shares are already trading on 1.9x – I think implying that the increase in returns is already being anticipated.

Opinion Litigation funders were supposed to be winners from the pandemic. LIT is the best performer since the start of 2020, up +54% which is creditable but the rest of the sector has been a disappointment. Management suggest that disappointment is due to court processes slowing down due to the pandemic and the fundamentals should soon re-assert themselves.

That could be correct. But I do worry though, that unlike fund managers seeing inflows, there’s much less operational gearing financing legal matters. Returns don’t seem to scale in the same way that investments made by equity fund managers do, in my opinion. Burford, which I own, reports results on Tuesday 29th March.

Bruce Packard

brucepackard.com

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

Weekly Market Commentary 21/03/22 | FNX, TCAP, LIT | Off Ramps

Based on conversations with a first hand source, Bruce believes the narrative about Ukraine may be too optimistic. But would be very happy to be proved wrong in the next week or two if a cease fire is signed AND upheld. Companies covered Fonix Mobile PLC, TP ICAP Group PLC and Litigation Capital Management.

The S&P 500 was up +5.9% and Nasdaq 100 +6.1%. Brent Crude fell back below $100 per barrel, but is still up +26% YTD. The US 10 year bond yield has risen to 2.19%, a 33bp increase since the first week of March, as both the Fed and the BoE raised interest rates. Note though, the flat yield curve at the long end (ie 2 year v 10 year yield) suggests bond markets believe Central Banks still have inflation under control.

All this optimism signals Ukraine will soon resolve – I think that’s wrong, as I set out below.

The Telegram channel Vladikavkaz News reported that Russian tanks from South Ossetia were being redeployed to reinforce troops in Ukraine, while Ramzan Kadyrov, the Chechen leader, posted a video claiming that he was in Ukraine and his men were fighting 20km from Kyiv. Sending reinforcements from the Caucasus seems to contradict the view that Putin is ready to sign AND uphold a ceasefire agreement.

My friend Matt has published a piece in The Times pointing out that if we are to isolate Russia, we need to include former Soviet countries (Armenia, Kazakhstan, Kyrgyzstan and even Belarus) in our trading / economic sphere of influence. I’ve known Matt since he was working for the EU Monitoring Mission in Mtskheta sorting out border disputes between the Georgians and the two Russian backed break away provinces (South Ossetia and Abkhazia). He’s an interesting source of information, for instance telling me a couple of years ago that the South Ossetian “Central Bank” was providing correspondent banking and payment services for the Russian backed breakaway region in the Donbass. Originally the Kremlin did not recognise the Donbass republics in Ukraine, because this would have contravened the “Minsk Agreement” – the 2014 ceasefire agreement that was supposed to resolve the conflict which Russia had signed. Putin could have had a lasting peace in Donbass from 2014, but that didn’t suit his agenda. Instead Moscow chose to financially support the Donbass via South Ossetia and send in “little green men” as a way of backing the province without being seen to be doing so.

That suggests to me that even if a cease fire agreement is signed – it may be “more honour’d in the breach than the observance.” Matt has also suggested to me that some of the Western media narrative about Ukraine coming together in the face of aggression from Russia may be over optimistic. He’s spent several years in Donbass observing the conflict first hand. Most journalists stay in Kyiv and Lviv, even a few years ago it was difficult and dangerous to visit the conflict zone, so they tend to report a Kyiv-centric version of events. Matt is no longer in Ukraine now, but his time there suggests that the grass roots support of Kyiv, and the mayors and administrators that have been imposed on the cities in the East, might not be as strong as our media would have you believe.

Markets seem to be anticipating a quick resolution of the conflict, I hope that’s correct but for now I am more cautious. I will be very glad to be proved wrong in the next week or two, because the human toll of the conflict is horrible to see.

This week I look at another Direct Carrier Billing company: Fonix Mobile, but unlike Bango last week, profitable and cash generative. Also TP ICAP the interdealer broker and Litigation Capital Management.

Fonix Mobile PLC H1 Dec results

Like Boku, Bango and IMI Mobile (the latter bought by Cisco for £550m at the end of 2020), Fonix specialises in Direct Carrier Billing (DCB) allowing phone users to buy items and the payment amount is charged to their mobile phone bill. From a technical perspective, Fonix provides APIs to merchants allowing both ‘text to buy’ and ‘click to buy’ purchases. However, unlike the other DCB’s Fonix is focused on the UK rather than the global market.

History Founded in 2006 as D2See by William Neale the company specialised in SMS billing, messaging and voice shortcodes. The latter is a premium rate 5 or 7 digit number eg 61500 rather than a longcode 11 digit number that includes a geographic prefix – such as 0207 for inner London. This is useful for TV voting, chatlines and information services. Fonix clients include Powwownow (conference calling) and BT (powering most of the UK TV voting such as The X Factor and Strictly Come Dancing).

Rob Weisz, the current CEO joined in 2014. The company IPO’ed in October 2020 at 90p per share, valuing it at £90m. The selling shareholders (William Neale and other management insiders) sold a third of the company (50,000 shares) but didn’t raise any new money.

Cashflow SharePad’s “Quality” ratios show a mixed message, with high RoCE and high EBIT margins – but very poor cash measures. That’s due to some large working capital movements because FNX collects money from phone users which is then paid to the receiving organisation. There are large shifts based on timing. Helpfully the company provides an “underlying” cashflow statement which adjusts this. That shows Net Cash Generated from Operating Activities of £5.2m less £305K Cash from Investing Activities and a £3.6m Cash from Financing Activities which is the dividend that they paid. They same issue affects ROCE on SharePad, 202% ROCE but CROCI -194%. FinnCap, their broker, provide an “underlying” RoCE based on Free Cash Flow forecast of 98% 2022F and 80% 2023F, so the company is highly profitable and generating an impressive amount of cash.

Valuation FinnCap are forecasting revenue growth +11% Jun 2022F, and +10% to £58m FY 2023F. The shares are trading on a PER of 18x FY 2023F. Unusually for a mobile payments company growing at +10% per year, they payout 6p (a 75% payout ratio) as a dividend, putting the shares on a yield of 3.9%.

Ownership William Neale the founder (through Ganton Ltd) still owns 26% after the IPO. In the “DD” tab SharePad shows this holding duplicated. Richard Thompson (through Starnevesse Ltd) another insider still owns 10.2%. The Chief Exec’s (Rob Weisz) 8.5% shareholding has a 24 month lock-up (ie until October 2022), the other selling shareholders lock-up has already expired so they could have sold down their post IPO holdings if they had wanted to. Slater Investments own 9.7%.

Opinion I like the way that Fonix Mobile is expanding. Focusing on a small profitable niche, and then expanding internationally as organisations they serve require support overseas. Tech companies often operate in an ecosystem, and provide services or expertise for others who can’t figure out how to do things themselves. I’m reading Jimmy Soni’s book on PayPal at the moment, and I hadn’t realised just how dependent Elon Musk’s X.com and Peter Thiel’s Confinity were on a single use case (eBay traders who wanted to send and receive money via email.) Direct Carrier Billing is a market where investors really need a deep understanding of both competition and regulation, but this has certainly piqued my interest.

TP ICAP FY Dec Results

This interdealer broker (IDP) that was formed from a 2016 all-share merger between Tullett Prebon and ICAP valuing the combined group at £1.2bn, announced FY Dec 2021 results. It’s worth looking at IDPs when financial volatility increases, in part because vol generates a helpful revenue environment, but secondly because IDP’s can give some indication of what’s going on in the financial “plumbing”. IDPs act as intermediaries between banks trading credit derivatives, interest rate swaps, commodities contracts and FX options.

The business has been in a secular decline since after the financial crisis, regulators are keen to see more standardised financial products trading on exchanges, rather than on the “Over The Counter” (OTC) trades which are not centrally cleared. Moving trading on to exchanges is not a silver bullet though, the London Metal Exchange has just closed for a week and cancelled $3.9bn of trades after Xiang Guangda’s Tsingshan Holding Group which mines tons of nickel was caught in a short squeeze trying to hedge it’s nickel production. The problem seems to have been something that IDPs had been warning about – that much of the OTC trades can’t be exchange traded because they’re not standardised. Nickel may be the first of many commodity markets to become dysfunctional, the FT reported that energy traders are calling for emergency Central Bank intervention.

TP ICAP reported revenues +8% to £1.9bn, though that was helped by the acquisition of $575m Liquidnet, a US trading venue. On an organic basis revenue was down -1%, hindered by a tough comparative period in the prior year (ie 2020 volatility at the start of the pandemic was helpful in that). Statutory PBT was down -81% to £24m. Adjusting for Liquidnet, restructuring costs and similar gives adj PBT of £177m, down -21%.

Current trading It’s worth noting though that 2022 has got off to a better start than last year. TP ICAP is typically a beneficiary of volatility. Group revenue was +4% ex acquisition until 11 March v the same period last year (+16% higher including Liquidnet). They note in the statement that periods of extreme volatility, such as has we’ve seen in recent weeks, can have “complex second-order effects on market participant behaviour and activity drivers, such as risk-taking appetite, and liquidity capacity.” That sounds less upbeat than I would have expected.

Guidance Management are reluctant to give guidance on how they see revenue progressing for the rest of the year. They do say that Russian clients accounted for just 0.5% of 2021 revenue. They’ve lost £4m on failed trade settlements, and have potential to lose a further £9m. That said since the merger the company does seem to be making good progress on both a turnover and EBIT level.

Valuation The shares are trading on just 4.3x 2023F falling to below 4x 2024F. The business is trading on 0.5x historic sales, suggesting that investors believe that the business is in decline. SharePad’s quality measures show RoCE of 7.7% and CRoCI of 3.2%. One concern is the balance sheet, which has £1.85bn of intangible assets versus £1.98bn of equity – so tangible book value is less than £150m. That compares to Net Debt of £243m and gross loan liabilities of £839m. I wouldn’t be surprised to see management raise more equity.

Ownership Schroders own 11.5%, Liontrust 10.2%, Jupiter 8.9% and Silchester 5.1% – that’s a shareholder register of surprisingly high quality institutions for a company that trading on 4x forecast earnings.

Opinion The outlook statement is less positive than I was expecting. The chart looks awful as the share price has been in decline over the last few years, but it looks like now some of the downsides of moving contracts on to exchanges is being recognised. TP ICAP does have scale and network effects – plus the cost base ought to be more flexible than a universal bank. It’s speculative but I’m wondering if the bad news is in the price and commodity inflation and rising interest rates might mark a change in fortunes?

Litigation Capital Management H1 Results to Dec

This Sydney headquartered but AIM listed (since Dec 2018) litigation financer reported its first set of results since the Executive Vice Chairman, Nick Rowles-Davies had his employment terminated on grounds of gross misconduct (the RNS said it was due to his expense claims which contravened company policy). The share price fell -23% on the day of that RNS in December last year.

The results themselves show H1 revenue to December increased 2.4x to AUD $19m and statutory PBT of AUD $4m versus AUD $1.4m loss last year. The reporting currency is Australian dollars (current exchange rate 1.81 to £ GBP.) Cockerhoop on Twitter points out that in note 4 of the accounts, LIT reveals that 95% (AUD $18.4m) of revenue came from just one UK customer. Even if that is one customer with multiple cases, that still seems like significant concentration risk.

Unlike Burford, LIT recognises contracts at historic cost rather than writing up the value of cases through “fair value” accounting. Despite the more conservative accounting, results are still hard to forecast because it’s impossible to know the timing of judgements or out of court settlements. The AUD $4m statutory PBT translates into a ROIC of 261% and an IRR of 199% – well above both LIT’s 10 year average and that reported by Burford (mid 90% ROIC).

Cash v Profits Theoretically historic cost accounting should mean that cash and PBT are similar, however LIT shows an AUD $8m fall in the cash on their balance sheet. Excluding Third Party Funds (asset management vehicles from which LIT derives a fee) cash falls by AUD $5.2m – that is an AUD $9m gap between statutory reported PBT and the movement in cash. There’s no explanation why this is, apart from the chart below I’ve taken from the analyst pack, which shows cash generated from cases they’ve won net of money invested in future cases is a AUD $2.7m positive, versus operating expenses of AUD $7.4m.

Management reported a 10.5 year average Return on Invested Capital of 162%. It’s important to notice though that this is not the same as group Return on Capital Employed or similar. Litigation funders report returns from concluded legal cases divided by the amount of expenditure incurred in funding that asset (ie capital employed fighting the case, not the group’s capital employed which would include the AUD $7.4m expenses in the chart above). For comparison, Burford ROIC on a similar basis was 95% at their H1 results.

So these high ROIC figures considerably overstate returns to shareholders on a group-wide basis. Sharepad shows LIT’s group RoCE of c. 10% FY June 2021 and 2020.

Valuation Canaccord, their broker, are forecasting revenue to treble from FY Jun 2020 and 2021 levels to AUD $138m FY Jun 2023F. Adj EPS of AUD 20c FY June 2022F and AUD 30c FY June 2023F. That implies RoE of 23% this year and 28% next year (versus a c. 10% achieved in FY June 2020 and 2021). That could make sense if we see that the AUD $47m they raised when they moved to AIM in Dec 2018 mark a step change in revenues a few years later. In GBP Canaccord forecast NAV to be 55p June 2022F, so the shares are already trading on 1.9x – I think implying that the increase in returns is already being anticipated.

Opinion Litigation funders were supposed to be winners from the pandemic. LIT is the best performer since the start of 2020, up +54% which is creditable but the rest of the sector has been a disappointment. Management suggest that disappointment is due to court processes slowing down due to the pandemic and the fundamentals should soon re-assert themselves.

That could be correct. But I do worry though, that unlike fund managers seeing inflows, there’s much less operational gearing financing legal matters. Returns don’t seem to scale in the same way that investments made by equity fund managers do, in my opinion. Burford, which I own, reports results on Tuesday 29th March.

Bruce Packard

brucepackard.com

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.