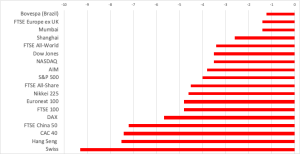

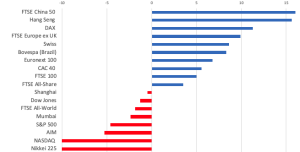

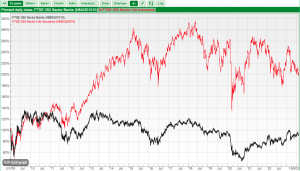

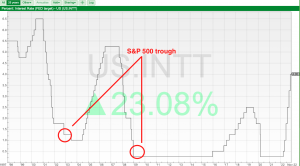

A look at how scanning headlines is no substitute for assessing closely the investment case of individual stocks. Companies covered PEEL, CPI, OHGR The FTSE 100 was down less than half a percent to 8,792 over the last 5 trading days. The Nasdaq100 and S&P500 were both up around +1% over the same timeframe. The […]