IPO activity on AIM has hit a 20-year low, which Maynard speculates could be a buy signal for shares on the junior market. Plus coverage of ULVR, RDW, EKF and RNO.

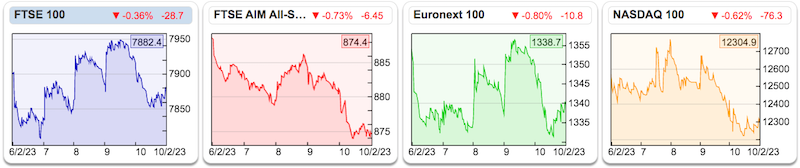

Another weekly commentary from me while Bruce is away. I had hoped the FTSE 100 would add just 1.2% to surpass the 8,000 milestone for this report, but sadly the market had other ideas. I will have to leave Bruce to one day celebrate that landmark; he’s back next week.

The FTSE 100 instead dropped 0.2% during what was a negative five trading days for most indices. The Euronext 100 fell 1% while the likes of Brazil, Hong Kong and the Nasdaq all lost approximately 2%.

The FTSE AIM All-Share (AXX) also lost 2% to extend its awful performance since its formation during 1996. Launched at 1,000, the AXX closed last week at a miserable 874.

Broker Cenkos admitted last week that its 2022 results would show a breakeven performance due to “significantly depressed market conditions“.

Cenkos noted the total money raised on AIM was currently at its lowest since 2003, while money raised through AIM IPOs was at its lowest since the junior market launched during 1995.

The LSE’s stats show just £136m was raised through AIM flotations last year — versus the record £10b during 2006 and a yearly £1.8b average.

Private investors are always told to avoid flotations as they are so often priced at inflated valuations. Wishful thinking perhaps, but AIM IPO activity at a 20-year low could mean current valuations are far from inflated and may even be a buy signal for AIM shares generally.

Below I look at the annual results from Unilever (floated 1939), half-year figures from Redrow (floated 1994), a profit warning from EKF Diagnostics (floated 2002) and upbeat trading at Renold (floated 1946).

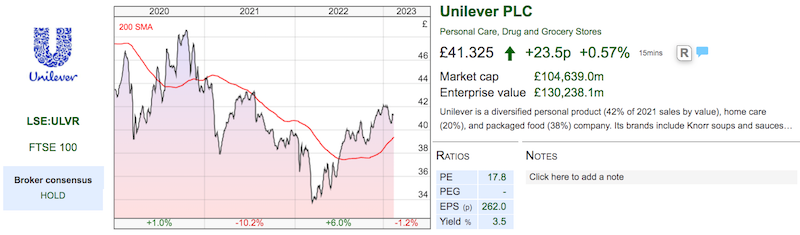

Unilever (ULVR): Final results

NEWS: Last week’s underlying annual numbers from the consumer goods conglomerate showed sales up 9%, operating profit up 1% and earnings down 2%. The dividend was declared at EUR 0.43 per share for the ninth consecutive quarter.

Underlying sales growth of 9% was in fact ULVR’s best for at least 20 years, and was driven by “disciplined pricing action in response to high input cost inflation“. Prices for the group’s soaps, bleaches, ice creams and spreads were lifted an average 11%, but caused underlying product volumes to drop 2%.

ULVR has not experienced annual product volume reducing since at least 2009 and admitted that volume growth would again be “negative” during the first half of 2023. For the second half, ULVR claimed it was “too early to say whether volume will turn positive”.

Despite ULVR’s collection of popular brands, the group’s declining volumes suggest consumers are not averse to buying alternative products if shelf prices become too high.

ULVR expects underlying sales growth for 2023 to be at least 4% with a “modest” margin improvement weighted towards the second half. The £41 shares barely moved last week and value ULVR at approximately 18 times earnings and supply a 3.7% trailing yield.

OPINION: These annual figures were the last to be presented by chief exec Alan Jope, who stands down this summer after five years at the helm. His comments about 2023 may therefore become very stale when new boss Hein Schumacher introduces his own operational strategies and financial targets.

ULVR’s chairman said Mr Schumacher had delivered “significant portfolio and organisation change” at former employer Royal FrieslandCampina, which hints at what may eventually be in store for Unilever.

Whether Mr Schumacher’s ambitions will meet the approval of shareholders Nelson Peltz and Terry Smith remains to be seen. Press reports indicate Mr Peltz and Mr Schumacher have “worked closely together before“, which should be encouraging for frustrated shareholders.

Such frustrations were expressed (again) by Mr Smith within his latest annual letter, which claimed ULVR had “missed every target it set out when it summarily rejected the Kraft Heinz bid approach“.

That $143b approach six years ago immediately pushed ULVR’s shares to £38, though interestingly enough Kraft Heinz’s stock has since crashed from $90 to $40.

No wonder Mr Smith described ULVR’s abortive £50b bid last year for GSK’s consumer business as a “near-death experience“. Mega-deals often signal desperation from the instigating party and are prompted typically by trying to remedy their own shortcomings.

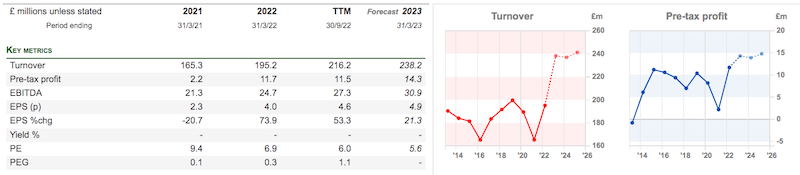

Redrow (RDW): Half-year report

NEWS: RDW continues to trade below book value following the house builder’s half-year statement. The shares dropped 1% to 531p last week, versus a declared book value of 579p per share.

The figures did not read too badly after “the Government’s disastrous mini-budget drove significant increases in mortgage rates during an existing cost of living crisis“. Revenue slipped 2%, profit dipped 3% and the dividend was unchanged after cancellation rates surged to 28%.

Legal completions dropped 10%, so lifting the average selling price by 6% to £399k minimised the mini-budget damage. Strip out affordable housing and the average selling price climbed 11% to £465k.

The second-half omens appeared relatively positive; reservations per outlet per week have rallied from 0.38 during H1 to 0.51 during the first few weeks of H2. RDW acknowledged 2023 would be “challenging” but claimed early indications were “better than anticipated“.

Full-year guidance was downgraded a fraction, with underlying earnings and the dividend now both projected to be 13% down on 2022 at 84p per share and 28p per share respectively. The prospective P/E is therefore 6 and the likely yield is 5%. But do note RDW’s projections imply H2 earnings will drop almost 20%, in part due to higher property taxes.

OPINION: RDW looked like a better buy during October when I noted the 400p shares were “a very intriguing opportunity” that allowed “contrarian investors to buy £1 of Redrow assets for just 72p“.

Only during the banking crash and the pandemic crash had the stock dropped below NAV by so far. Mind you, buying house-building assets of 579p per share for 531p is still not expensive by historical standards. These shares at times traded at 1.8x NAV between 2014 and 2020, so in buoyant market conditions the price would be a tenner.

The balance sheet retains net cash of £107m, or 32p per share, which ought to limit operational problems should property-market trouble arise. RDW notably spent £97m during H1 on share buybacks at 470p, which for now seems a commendable use of shareholder money.

The long-term worry of course is mortgage rates being permanently reset higher and fewer home buyers accepting RDW’s £465k average selling price — regardless of the property’s build quality and energy efficiency.

Similar to ULVR, RDW has only sustained profits (and NAV) because selling prices were lifted to counteract higher costs — which in turn led to a reduction to volumes. I suspect RDW will have to start increasing completions to get that NAV rating back to anywhere close to 1.8x.

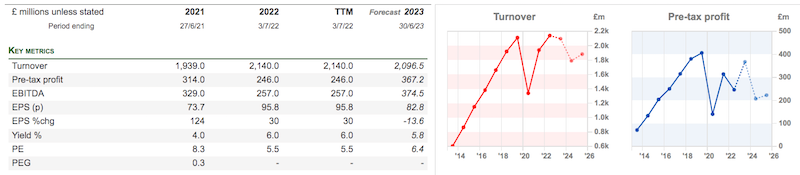

EKF Diagnostics (EKF): Trading update

NEWS: Developments at EKF last week might interest fans of small-cap super-investor Christopher Mills. The shares of this healthcare diagnostics specialist are a favourite of Mr Mills but dived 26% following what appeared to be a mild profit warning.

EKF confirmed 2022 revenue would be in line with expectations, although adjusted Ebitda would be “slightly below” forecast. A slower-than-expected transition to non-Covid sales within the group’s contract manufacturing and laboratory testing divisions caused the shortfall.

The problems look to have emerged during Q4, given September’s interims had claimed 2022 adjusted Ebitda was running in line with projections. Nerves may have been rattled by the underperforming laboratory testing operation being acquired only two years ago.

Another worry is EKF’s “enzyme fermentation facility“; delays with a 14,500-litre fermenter will reduce this division’s progress during 2023. The facility may be where EKF’s real potential lies; divisional half-year sales surged 96% although they did represent just 5% of the group’s top line.

“Large exceptional costs” being recognised in the upcoming results sound ominous and have unsurprisingly prompted a management reshuffle. Julian Baines has become executive chairman while the CEO has been demoted off the board. Mr Baines was EKF’s chief exec between 2009 and 2021.

Mr Mills meanwhile transfers from non-exec chairman to become an ordinary non-exec.

OPINION: Christopher Mills must surely be among the most accomplished stock-pickers in the London market. He has managed the North Atlantic Smaller Companies Investment Trust (NASCIT) since 1982 and has delivered NAV growth of nearly 200x during his leadership.

NASCIT and other funds controlled by Mr Mills own 29% of EKF. At the last count, EKF was NASCIT’s largest individual shareholding at 5% of the trust’s NAV.

The archives suggest NASCIT started buying EKF around 12p during early 2016 and, despite the warning last week, the 29p shares still show a healthy gain over seven years. Returns for NASCIT include dividends of 3p per share and modest share distributions in Renalytix AI and Verici Rx.

Forecasts for 2022 show EKF’s earnings collapsing nearly 50% but the dividend remaining unchanged, in part perhaps because net cash last week was confirmed at £11m. The P/E may be approximately 17 and yield could top 4%, and that income may be very reasonable for a small healthcare stock that could be enduring only temporary growth pains.

A simple alternative to evaluating EKF would be to just ride along with Mr Mills through NASCIT, which at £40 is trading at almost 20% below its last reported NAV.

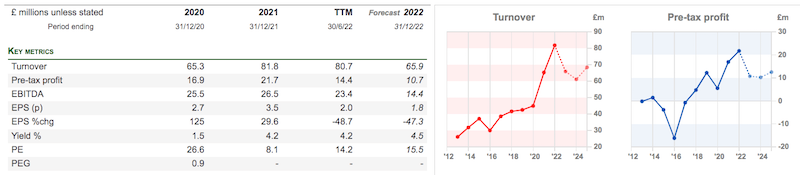

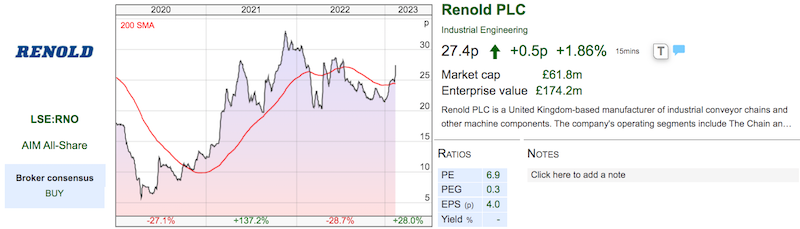

Renold (RNO): Trading Update

NEWS: This “leading international supplier of industrial chains and related power transmission products” watched its shares gain 8% last week following details of upbeat trading.

RNO stated turnover had climbed 25% to £199m and the group’s order intake had advanced 19% to £217m during the ten months to 31 January.

The top-line progress was in part supported by currency movements as well as passing on higher material costs to customers. Assisted also by expenditure reductions and efficiency programmes, RNO confirmed full-year underlying profit would be in excess of market forecasts.

The order book at a £104m record high and recent a Spanish acquisition meeting expectations were other highlights. Indeed, last week’s statement followed a £9m contract win to supply industrial couplings to BAE Systems. A similar £11m contract was announced during 2021.

Earnings are now expected to improve 13% to approach 5p per share, which would value the 27p shares at a lowly 6x multiple. Current forecasts indicate no hint of an ordinary dividend, though, which has been missing at RNO since 2005.

OPINION: RNO is 150 years old and floated 77 years ago, so the present £62m market cap suggests manufacturing industrial components has not been the most lucrative of long-term activities. Despite last week’s uptick, the shares remain 90% below their 1990s peak.

The lowly 6x rating is due mostly to the engineer’s pension deficit. At the last count the scheme’s shortfall was £61m — virtually equal to the market cap — and a 25-year ‘deficit reduction’ agreement still has 15 years to run.

Be aware that payments to shore up pension deficits effectively bypass the income statement, so RNO’s declared earnings are somewhat inflated versus cash flow.

November’s interims for example reported a £9m operating profit before pension payments of £3m. The preceding annual figures meanwhile stated a £16m operating profit before pension payments of £5m.

Those annual figures also showed scheme assets of £150m delivering member benefits of £11m, of which £1m had to be raised by selling investments.

The concern now is how the same benefits of £11m will be supported, given November’s interims disclosed the market value of the scheme’s assets had slid to £119m. Extra cash flow could have to be taken to fund greater contributions to prevent further assets being sold to pay the pensions.

Maynard Paton

Maynard writes about his portfolio at maynardpaton.com and co-hosts the Private Investor’s Podcast with Roland Head. He does not own any shares mentioned within this commentary.

Got some thoughts on this week’s commentary from Maynard? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

Weekly Market Commentary | 14/02/23 | ULVR, RDW, EKF, RNO | AIM’s IPO buy signal

IPO activity on AIM has hit a 20-year low, which Maynard speculates could be a buy signal for shares on the junior market. Plus coverage of ULVR, RDW, EKF and RNO.

Another weekly commentary from me while Bruce is away. I had hoped the FTSE 100 would add just 1.2% to surpass the 8,000 milestone for this report, but sadly the market had other ideas. I will have to leave Bruce to one day celebrate that landmark; he’s back next week.

The FTSE 100 instead dropped 0.2% during what was a negative five trading days for most indices. The Euronext 100 fell 1% while the likes of Brazil, Hong Kong and the Nasdaq all lost approximately 2%.

The FTSE AIM All-Share (AXX) also lost 2% to extend its awful performance since its formation during 1996. Launched at 1,000, the AXX closed last week at a miserable 874.

Broker Cenkos admitted last week that its 2022 results would show a breakeven performance due to “significantly depressed market conditions“.

Cenkos noted the total money raised on AIM was currently at its lowest since 2003, while money raised through AIM IPOs was at its lowest since the junior market launched during 1995.

The LSE’s stats show just £136m was raised through AIM flotations last year — versus the record £10b during 2006 and a yearly £1.8b average.

Private investors are always told to avoid flotations as they are so often priced at inflated valuations. Wishful thinking perhaps, but AIM IPO activity at a 20-year low could mean current valuations are far from inflated and may even be a buy signal for AIM shares generally.

Below I look at the annual results from Unilever (floated 1939), half-year figures from Redrow (floated 1994), a profit warning from EKF Diagnostics (floated 2002) and upbeat trading at Renold (floated 1946).

Unilever (ULVR): Final results

NEWS: Last week’s underlying annual numbers from the consumer goods conglomerate showed sales up 9%, operating profit up 1% and earnings down 2%. The dividend was declared at EUR 0.43 per share for the ninth consecutive quarter.

Underlying sales growth of 9% was in fact ULVR’s best for at least 20 years, and was driven by “disciplined pricing action in response to high input cost inflation“. Prices for the group’s soaps, bleaches, ice creams and spreads were lifted an average 11%, but caused underlying product volumes to drop 2%.

ULVR has not experienced annual product volume reducing since at least 2009 and admitted that volume growth would again be “negative” during the first half of 2023. For the second half, ULVR claimed it was “too early to say whether volume will turn positive”.

Despite ULVR’s collection of popular brands, the group’s declining volumes suggest consumers are not averse to buying alternative products if shelf prices become too high.

ULVR expects underlying sales growth for 2023 to be at least 4% with a “modest” margin improvement weighted towards the second half. The £41 shares barely moved last week and value ULVR at approximately 18 times earnings and supply a 3.7% trailing yield.

OPINION: These annual figures were the last to be presented by chief exec Alan Jope, who stands down this summer after five years at the helm. His comments about 2023 may therefore become very stale when new boss Hein Schumacher introduces his own operational strategies and financial targets.

ULVR’s chairman said Mr Schumacher had delivered “significant portfolio and organisation change” at former employer Royal FrieslandCampina, which hints at what may eventually be in store for Unilever.

Whether Mr Schumacher’s ambitions will meet the approval of shareholders Nelson Peltz and Terry Smith remains to be seen. Press reports indicate Mr Peltz and Mr Schumacher have “worked closely together before“, which should be encouraging for frustrated shareholders.

Such frustrations were expressed (again) by Mr Smith within his latest annual letter, which claimed ULVR had “missed every target it set out when it summarily rejected the Kraft Heinz bid approach“.

That $143b approach six years ago immediately pushed ULVR’s shares to £38, though interestingly enough Kraft Heinz’s stock has since crashed from $90 to $40.

No wonder Mr Smith described ULVR’s abortive £50b bid last year for GSK’s consumer business as a “near-death experience“. Mega-deals often signal desperation from the instigating party and are prompted typically by trying to remedy their own shortcomings.

Redrow (RDW): Half-year report

NEWS: RDW continues to trade below book value following the house builder’s half-year statement. The shares dropped 1% to 531p last week, versus a declared book value of 579p per share.

The figures did not read too badly after “the Government’s disastrous mini-budget drove significant increases in mortgage rates during an existing cost of living crisis“. Revenue slipped 2%, profit dipped 3% and the dividend was unchanged after cancellation rates surged to 28%.

Legal completions dropped 10%, so lifting the average selling price by 6% to £399k minimised the mini-budget damage. Strip out affordable housing and the average selling price climbed 11% to £465k.

The second-half omens appeared relatively positive; reservations per outlet per week have rallied from 0.38 during H1 to 0.51 during the first few weeks of H2. RDW acknowledged 2023 would be “challenging” but claimed early indications were “better than anticipated“.

Full-year guidance was downgraded a fraction, with underlying earnings and the dividend now both projected to be 13% down on 2022 at 84p per share and 28p per share respectively. The prospective P/E is therefore 6 and the likely yield is 5%. But do note RDW’s projections imply H2 earnings will drop almost 20%, in part due to higher property taxes.

OPINION: RDW looked like a better buy during October when I noted the 400p shares were “a very intriguing opportunity” that allowed “contrarian investors to buy £1 of Redrow assets for just 72p“.

Only during the banking crash and the pandemic crash had the stock dropped below NAV by so far. Mind you, buying house-building assets of 579p per share for 531p is still not expensive by historical standards. These shares at times traded at 1.8x NAV between 2014 and 2020, so in buoyant market conditions the price would be a tenner.

The balance sheet retains net cash of £107m, or 32p per share, which ought to limit operational problems should property-market trouble arise. RDW notably spent £97m during H1 on share buybacks at 470p, which for now seems a commendable use of shareholder money.

The long-term worry of course is mortgage rates being permanently reset higher and fewer home buyers accepting RDW’s £465k average selling price — regardless of the property’s build quality and energy efficiency.

Similar to ULVR, RDW has only sustained profits (and NAV) because selling prices were lifted to counteract higher costs — which in turn led to a reduction to volumes. I suspect RDW will have to start increasing completions to get that NAV rating back to anywhere close to 1.8x.

EKF Diagnostics (EKF): Trading update

NEWS: Developments at EKF last week might interest fans of small-cap super-investor Christopher Mills. The shares of this healthcare diagnostics specialist are a favourite of Mr Mills but dived 26% following what appeared to be a mild profit warning.

EKF confirmed 2022 revenue would be in line with expectations, although adjusted Ebitda would be “slightly below” forecast. A slower-than-expected transition to non-Covid sales within the group’s contract manufacturing and laboratory testing divisions caused the shortfall.

The problems look to have emerged during Q4, given September’s interims had claimed 2022 adjusted Ebitda was running in line with projections. Nerves may have been rattled by the underperforming laboratory testing operation being acquired only two years ago.

Another worry is EKF’s “enzyme fermentation facility“; delays with a 14,500-litre fermenter will reduce this division’s progress during 2023. The facility may be where EKF’s real potential lies; divisional half-year sales surged 96% although they did represent just 5% of the group’s top line.

“Large exceptional costs” being recognised in the upcoming results sound ominous and have unsurprisingly prompted a management reshuffle. Julian Baines has become executive chairman while the CEO has been demoted off the board. Mr Baines was EKF’s chief exec between 2009 and 2021.

Mr Mills meanwhile transfers from non-exec chairman to become an ordinary non-exec.

OPINION: Christopher Mills must surely be among the most accomplished stock-pickers in the London market. He has managed the North Atlantic Smaller Companies Investment Trust (NASCIT) since 1982 and has delivered NAV growth of nearly 200x during his leadership.

NASCIT and other funds controlled by Mr Mills own 29% of EKF. At the last count, EKF was NASCIT’s largest individual shareholding at 5% of the trust’s NAV.

The archives suggest NASCIT started buying EKF around 12p during early 2016 and, despite the warning last week, the 29p shares still show a healthy gain over seven years. Returns for NASCIT include dividends of 3p per share and modest share distributions in Renalytix AI and Verici Rx.

Forecasts for 2022 show EKF’s earnings collapsing nearly 50% but the dividend remaining unchanged, in part perhaps because net cash last week was confirmed at £11m. The P/E may be approximately 17 and yield could top 4%, and that income may be very reasonable for a small healthcare stock that could be enduring only temporary growth pains.

A simple alternative to evaluating EKF would be to just ride along with Mr Mills through NASCIT, which at £40 is trading at almost 20% below its last reported NAV.

Renold (RNO): Trading Update

NEWS: This “leading international supplier of industrial chains and related power transmission products” watched its shares gain 8% last week following details of upbeat trading.

RNO stated turnover had climbed 25% to £199m and the group’s order intake had advanced 19% to £217m during the ten months to 31 January.

The top-line progress was in part supported by currency movements as well as passing on higher material costs to customers. Assisted also by expenditure reductions and efficiency programmes, RNO confirmed full-year underlying profit would be in excess of market forecasts.

The order book at a £104m record high and recent a Spanish acquisition meeting expectations were other highlights. Indeed, last week’s statement followed a £9m contract win to supply industrial couplings to BAE Systems. A similar £11m contract was announced during 2021.

Earnings are now expected to improve 13% to approach 5p per share, which would value the 27p shares at a lowly 6x multiple. Current forecasts indicate no hint of an ordinary dividend, though, which has been missing at RNO since 2005.

OPINION: RNO is 150 years old and floated 77 years ago, so the present £62m market cap suggests manufacturing industrial components has not been the most lucrative of long-term activities. Despite last week’s uptick, the shares remain 90% below their 1990s peak.

The lowly 6x rating is due mostly to the engineer’s pension deficit. At the last count the scheme’s shortfall was £61m — virtually equal to the market cap — and a 25-year ‘deficit reduction’ agreement still has 15 years to run.

Be aware that payments to shore up pension deficits effectively bypass the income statement, so RNO’s declared earnings are somewhat inflated versus cash flow.

November’s interims for example reported a £9m operating profit before pension payments of £3m. The preceding annual figures meanwhile stated a £16m operating profit before pension payments of £5m.

Those annual figures also showed scheme assets of £150m delivering member benefits of £11m, of which £1m had to be raised by selling investments.

The concern now is how the same benefits of £11m will be supported, given November’s interims disclosed the market value of the scheme’s assets had slid to £119m. Extra cash flow could have to be taken to fund greater contributions to prevent further assets being sold to pay the pensions.

Maynard Paton

Maynard writes about his portfolio at maynardpaton.com and co-hosts the Private Investor’s Podcast with Roland Head. He does not own any shares mentioned within this commentary.

Got some thoughts on this week’s commentary from Maynard? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.