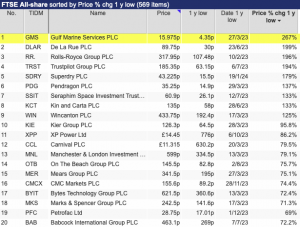

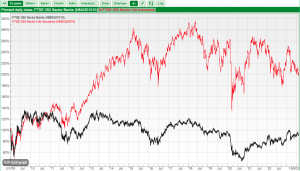

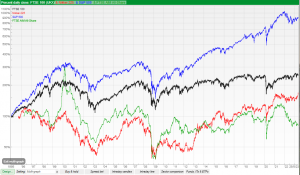

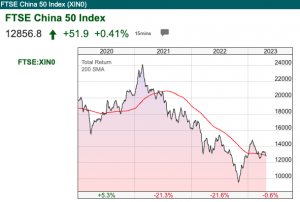

Some background reading on cybersecurity and hacking, topical in the wake of Crowdstrike-related chaos from last week. Companies covered TRST, RNO and CRL. The FTSE 100 rose +0.5% to 8,216 last week. Nasdaq100 and S&P500 were down -4% and -2% respectively. For contrast, the Russell 2000 small cap index jumped +7%, encouraged by helpful inflation […]