Bruce suggests that rather than ARM’s successful IPO, the likely catalyst for more companies coming to market will be retail flows into funds. Companies covered ELIX, FEVR and FDEV.

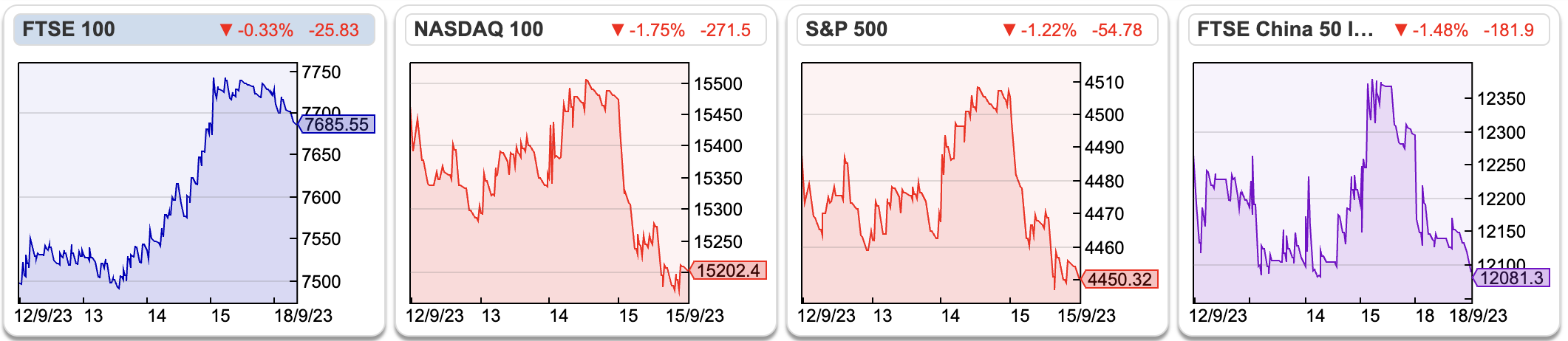

The FTSE 100 was up +2.6% last week to 7,688 helped by mining stocks and financials. The Nasdaq100 and S&P500 were both down less than -0.5%. The price of oil rose +4.2% to $94 per barrel (Brent Crude, ticker BZ-MT). That’s now up by a third since late June.

The FTSE 100 was up +2.6% last week to 7,688 helped by mining stocks and financials. The Nasdaq100 and S&P500 were both down less than -0.5%. The price of oil rose +4.2% to $94 per barrel (Brent Crude, ticker BZ-MT). That’s now up by a third since late June.

Last week the ECB raised interest rates to 4%, and this week the BoE is expected to raise rates to 5.5%, the highest since early 2008. There’s also an annual decision on how much Quantitative Tightening to do, last year the amount was £80bn, made up of £34bn sales to the market and £46bn of maturing gilts which rolled off. Confusingly the BoE then bought £20bn of gilts in Q4 last year to support the price of government bonds following the Truss/Kwarteng budget. In all, the BoE owned £895bn of gilts following over a decade of Quantitative Easing, which suggests that it will take around a decade to unwind QE at the current pace.

Arm listed on the NYSE last week and rose +25% on the first day of trading. That’s good news for the 28 banks who worked on the deal, who earned circa $100m in fees. In the US we should see food delivery app Instacart and marketing software Klaviyo come to market. There seem to be a few self-interested quotes from investment bankers, suggesting that the IPO market is now re-opening. Both Michael Taylor and I are sceptical of this.

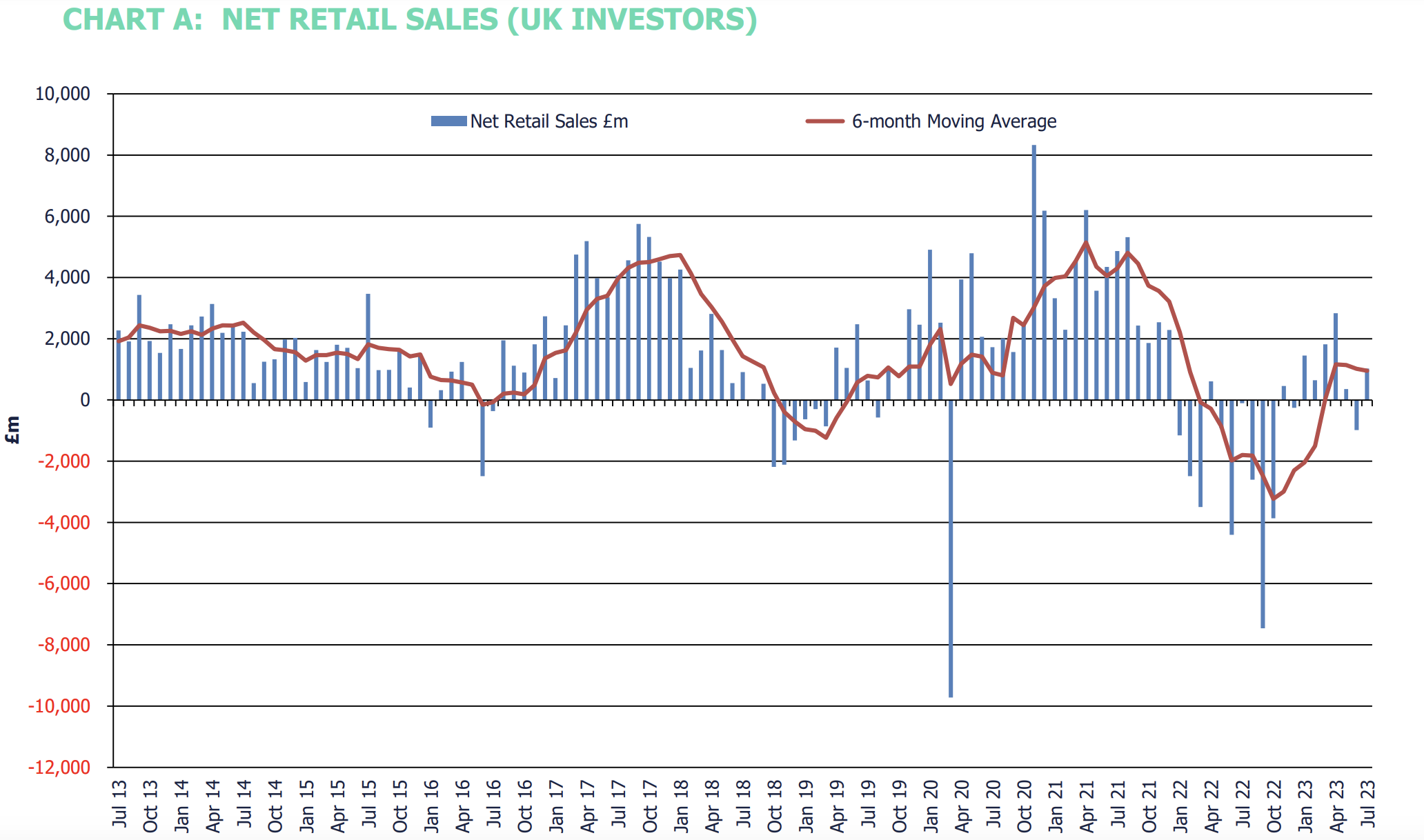

In my view, there’s a correlation with inflows into funds and IPOs. After all, it makes sense that if fund managers are suddenly receiving large sums of money from their retail clients, they will look to deploy this in new issues coming to the stock market. I have taken the chart below from the Investment Managers Association, which shows that we are a long way from the days of late 2020 / early 2021 when the market was so buoyant and net retail sales of funds was very positive.

As I noted a few weeks ago, retail fund flows are normally a good contrarian indicator. That is, if you have the money available to invest in markets, then future expected returns tend to be higher in the medium term when professional fund managers are forced sellers. So I continue to invest my own money into this market.

This week I look at Fevertree Drinks and management consultancy Elixirr H1 Jun results and Frontier Developments profit warning.

Fevertree Drinks H1 Jun 2023

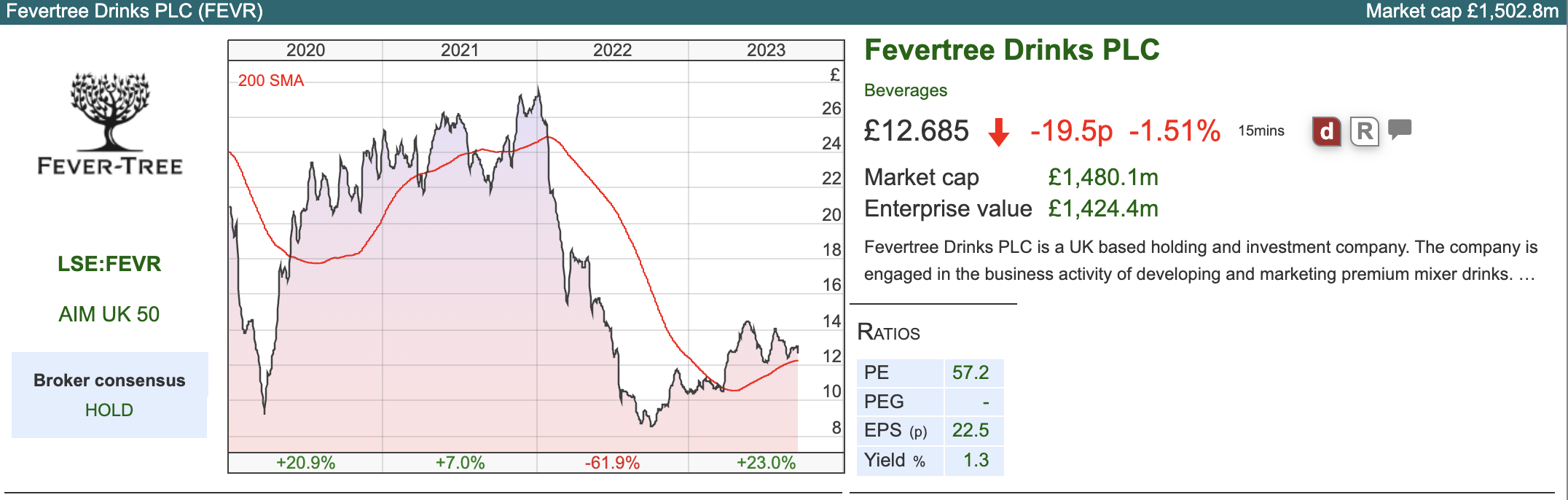

Now that Fevertree has fallen by 2/3 from its high of almost £40 per share, I’ve made a mental note to revisit the investment case. The tonic water and mixer company released H1 results to June, showing +9% revenue growth. Within that, the UK and RoW didn’t contribute much to revenue growth, but the US expansion +40% (+32% on a constant currency basis), really punched above its weight. That means the US and Europe combined contributed 136% of group revenue growth, as the table below shows. They blamed the low growth in the UK on the poor summer weather, which they expect to have an impact into H2.

|

H1 22 |

H1 23 |

Growth |

Delta |

(%) Delta |

| UK |

53.5 |

53.7 |

0% |

0.2 |

1% |

| US |

40.1 |

56.1 |

40% |

16 |

109% |

| Europe |

52.3 |

56.2 |

7% |

3.9 |

27% |

| RoW |

15 |

9.6 |

-36% |

-5.4 |

-37% |

| Group |

160.9 |

175.6 |

9% |

14.7 |

100% |

H1 PBT was down -96% to just £1.4m. That was caused by a 6.7% decrease in the gross margin from 37.4% H1 last year to 30.7% H1 this year, caused by elevated glass pricing and other inflationary pressures. So much for premium consumer brands being inflation-proof.

Administrative expenses were up +17% to £50m, which is a higher increase than both group revenue and inflation generally. Not included in the cost of sales or admin expenses was a further £3.3m provision made against quarantined US inventory, which the company has split out as a one-off. The group’s net cash declined from £100m end of June last year to £75.8m June this year.

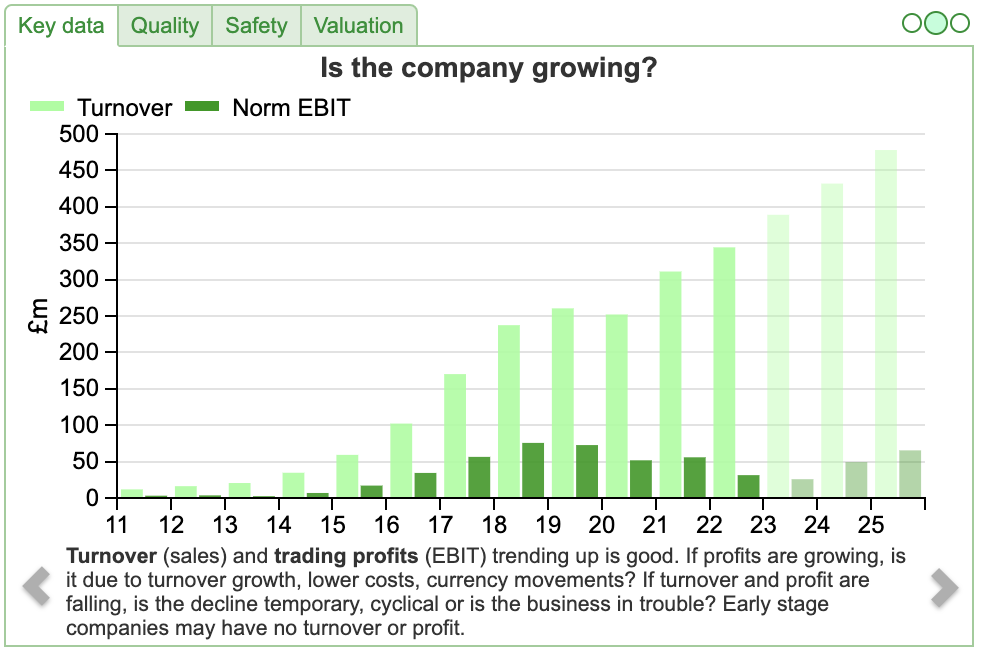

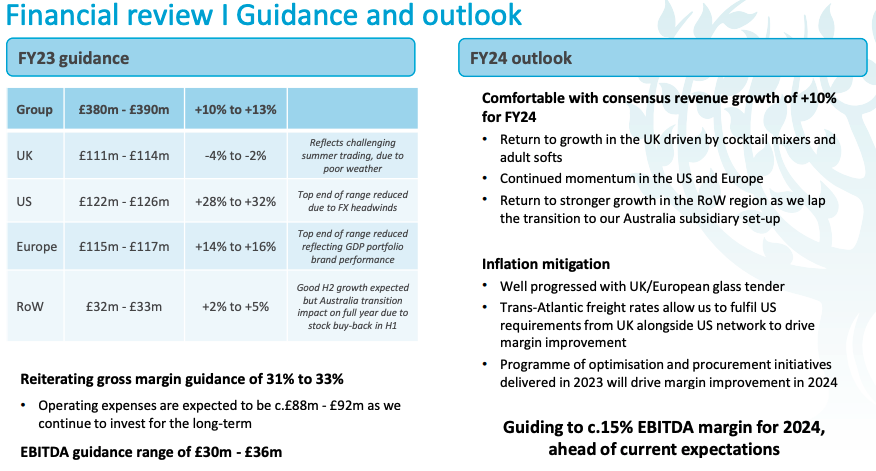

Outlook statement: Management said they expect to deliver FY revenue of between £380m and £390m. That compares to Sharepad forecasts of £393m FY Jan 2023F, however, the new forecast still implies an acceleration from +9% revenue in H1 to between +11% and +17%. The outlook statement also talks about “significant margin improvement” in FY Dec 2024F, suggesting EBITDA margins of c. 15% and that they were comfortable with Dec 2024F revenue growth expectations (Sharepad shows +10%).

Valuation: The shares are trading on a still PER 40x FY Dec 2024F dropping to 30x PER the following year. I think that investors must be assuming that as inflation subsides, then the EBIT margin will improve to the historic levels of c. 30% achieved in 2018. That’s possible, but by no means a certainty.

Opinion: The company is undoubtedly a strong brand with a good story, and has fallen significantly. It’s interesting to me that both Terry Smith and Nick Train are fans, the latter bought the shares after they halved, only to see the share price half again. Phil Oakley has also written up the investment case at the start of this year, and compares the valuation against Nichols, Coca-Cola HBC, Britvic and AG Barr, concluding that FEVR’s high valuation multiples meant that there might be better value elsewhere in the sector.

Elixirr H1 June 2023

This management consultancy and technology company announced a £6m acquisition alongside H1 results to June. They are buying Responsum, an AI company for £6m total consideration, of which $3.4m will be paid in shares issued at 540p (a 7% discount to the market price).

The H1 results look positive with a +23% increase in revenue to £41m. Some of that includes previous acquisitions, but underlying organic revenue growth was up +14% compared to H1 22. Statutory PBT was up +17% to £9.9m. They had net cash (no bank debt, ex-office leases, ex-contingent consideration) of £19.5m. I would suggest deducting £5.7m of contingent consideration recorded on the face of the balance sheet, of which roughly half was a current liability (i.e. due within the next 12 months) from their net cash figure. Minus contingent consideration and the cash paid for Responsum would give net cash of c. £12m.

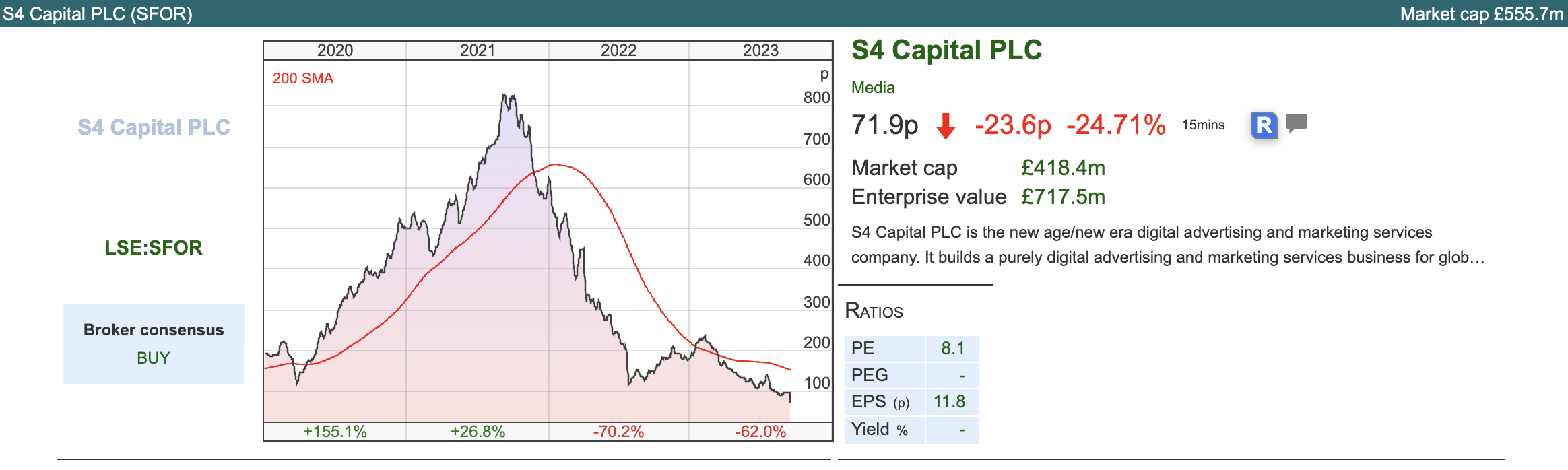

SFOR comparison: I had a brief look at SFOR, Sir Martin Sorrell’s new advertising agency roll-up which also reported on Monday. This has net debt of £109m versus a market cap of £419m and owes £111m of contingent consideration due in the next 12 months. The cash consideration payments to be paid for previous acquisitions mean that they expect to see net debt rise by the year-end to £180-220 million. I haven’t covered SFOR in any more detail, except to say that I can see why the share price has been punished, falling by a quarter on the morning of their results. One thing that occurs to me is that Sir Martin’s “golden share” which gives him control over S4 Capital, might put off institutions from supporting the company if it does need to raise fresh money in 2024.

Outlook: ELIX achieved record revenue in August, so they feel comfortable with guidance of £85-£90m of FY revenue with an adjusted EBITDA margin of 28-30%. Sharepad suggests that EBITDA margin converts to PBT of £22m FY Dec 2023F.

Outlook: ELIX achieved record revenue in August, so they feel comfortable with guidance of £85-£90m of FY revenue with an adjusted EBITDA margin of 28-30%. Sharepad suggests that EBITDA margin converts to PBT of £22m FY Dec 2023F.

Valuation: The shares are trading on PER 15x FY Dec 2024F and FY Dec 2025F. That looks reasonable for a fast-growing people business and translates to 3x price/sales. FinnCap, now called Cavendish, has published a 15-page broker note on ELIX; the tone is very upbeat but they have left their estimates unchanged.

Opinion: This looks OK, though I note it is very difficult to work out from the outside how differentiated the offering is for B2B software and management consulting companies. The valuation looks about right to me. When I last looked at it, I seem to remember ELIX were relying heavily on revenue from banking sector clients. If readers have any specialist knowledge on this company, then do share in the chat. I certainly prefer the investment case to SFOR, which looks to be going badly wrong.

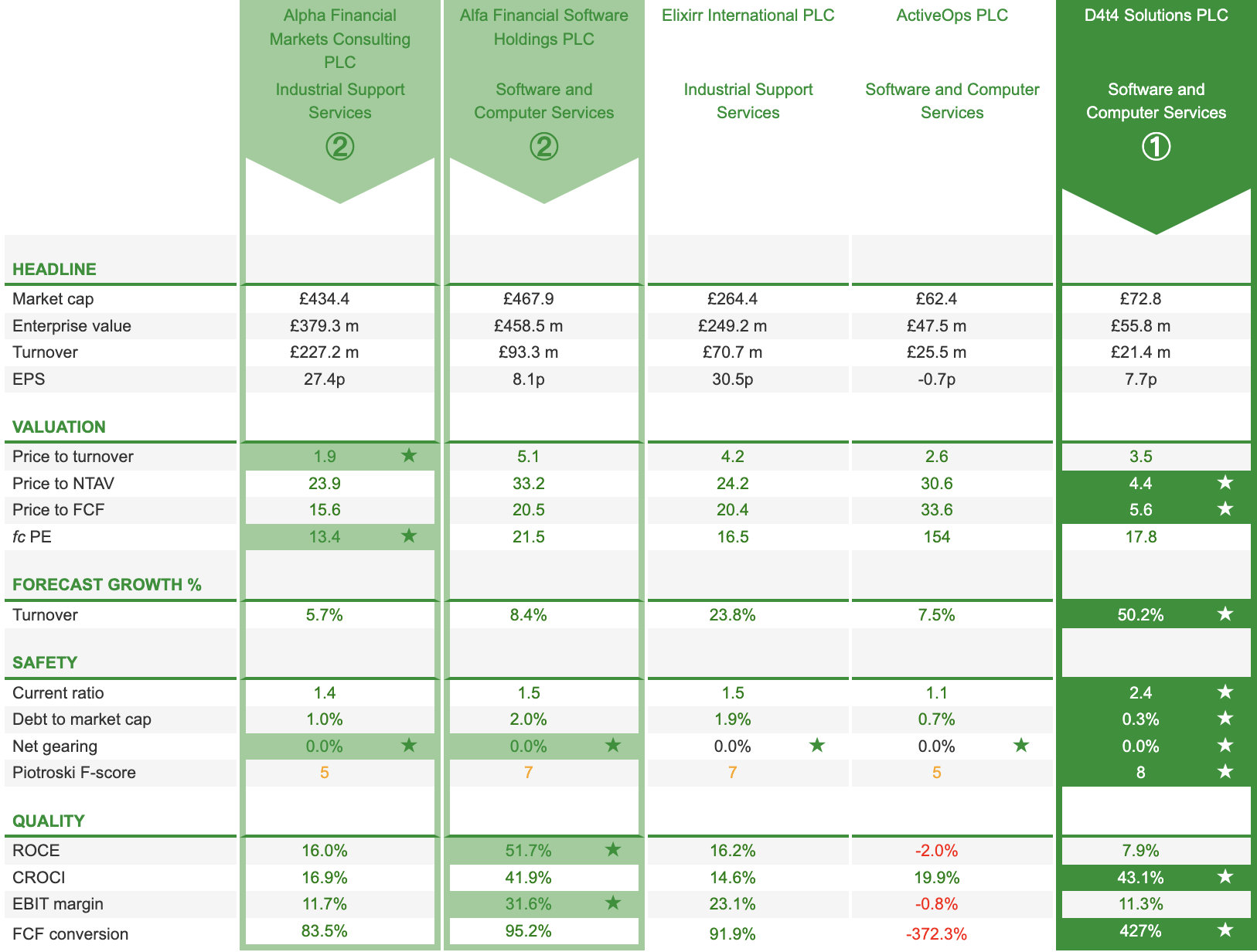

I have used Sharepad’s compare tab to look at the valuation of similar companies like D4T4, and Active Ops which I wrote about a couple of months ago. I’ve added in Alpha Financial Markets and Alfa Financial Software to the comparison table.

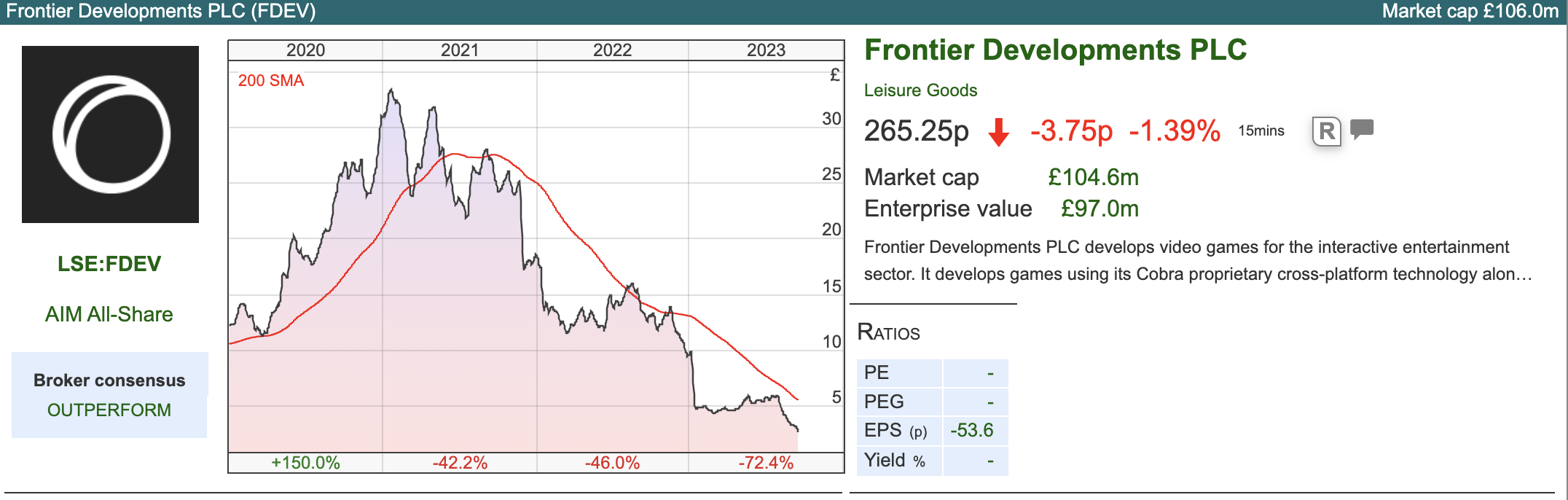

Frontier Developments FY May 2023

I pitched this computer games company at the Mello BASH earlier this month, then two days later they released disappointing results. Frontier’s self-published game portfolio includes Elite Dangerous, Planet Coaster, Planet Zoo, Jurassic World Evolution, F1® Manager and Warhammer 40,000: Chaos Gate – Daemonhunters.

The shares are off more than -90% from their peak, despite having cash of £25m (24% of their market cap) at the end of August. That financial position is also confirmed in the “going concern” statement, which says that even when they stress test their annual budget they have sufficient cash resources in all the negative scenarios that they could think of.

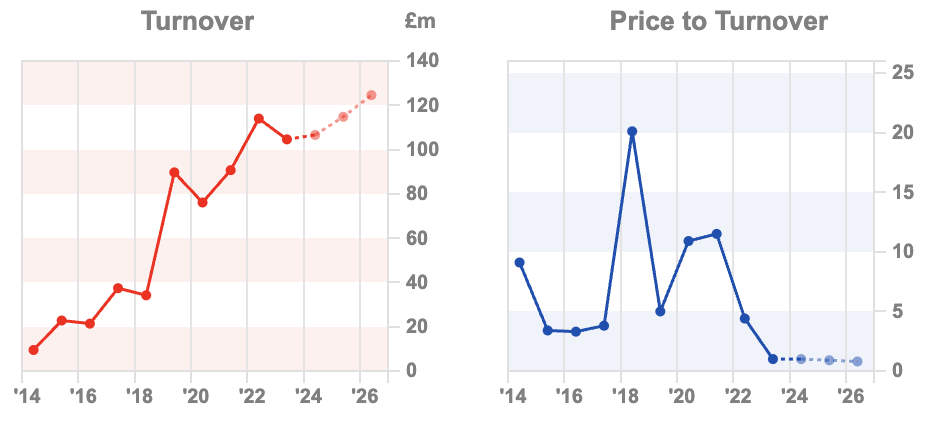

Sharepad shows that they have de-rated spectacularly from their price/turnover multiple of over 20x in 2018 to 1x current forecasts.

The results themselves showed revenues down -8% to £105m, following a disappointing Christmas last year and underperformance of F1® Manager 2022 and their Foundry Label published games. That was known about in their June trading update. However, they have now said this financial year has started badly as in July 2023 the release of F1® Manager 2023 has so far not delivered the expected sales.

The results themselves showed revenues down -8% to £105m, following a disappointing Christmas last year and underperformance of F1® Manager 2022 and their Foundry Label published games. That was known about in their June trading update. However, they have now said this financial year has started badly as in July 2023 the release of F1® Manager 2023 has so far not delivered the expected sales.

They say that consensus FY May 2024F revenue expectations and Adjusted EBITDA are for £108m (ie +3% growth) and a loss of £9m respectively. That compares to Adj EBITDA loss of £5m FY May 2023, and positive £7m EBITDA FY May 2022. Note that for FDEV their Adj EBITDA figure is close to “cash” because they deduct the capitalised charge of game development – in FY May 2023 £38m, or 71% of gross R&D spend – from the given adj EBITDA figure. It also means their figure is more negative than Sharepad’s EBITDA figure of £29m FY May 2024F, which doesn’t expense that game development charge.

Further down the P&L, there were more costs that resulted in a statutory LBT of £27m FY May 2023, versus £1m PBT the prior year. That accounting loss was driven by intangible write downs of Foundry, their Third Party Publishing label which they’ve now closed down, and faster (i.e. higher) amortisation charge for the F1 manager.

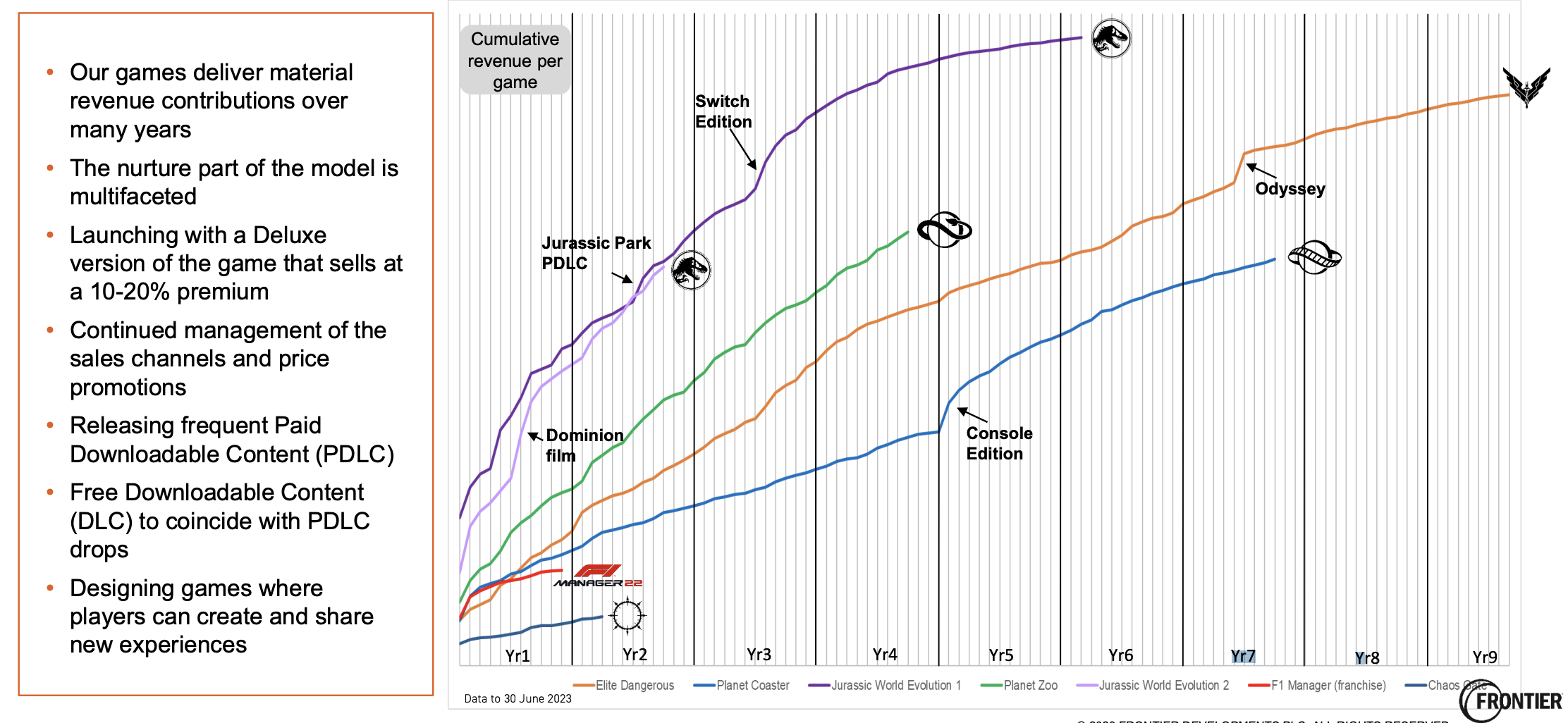

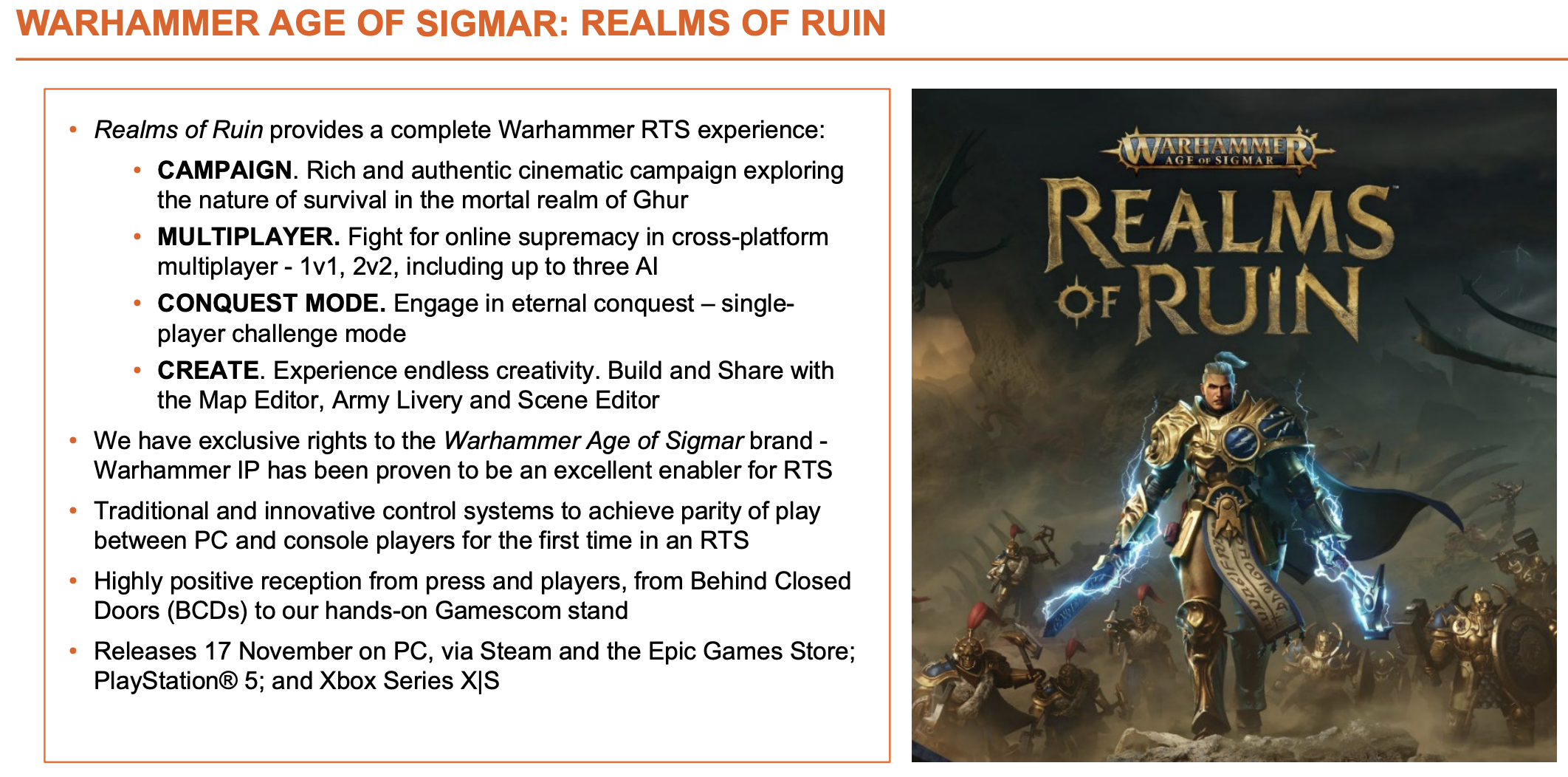

Outlook: I don’t think management have any more insight than investors about which games are likely to catch the imagination, so I take their guidance with some scepticism. However, it is worth bearing in mind that around 70% of revenue comes from games that have already been released, which they do have good visibility on, as the above chart from their presentation shows. The Chief Exec says that he is “very excited” about their upcoming Warhammer game, Realms of Ruin to be released in November does attract new players.

Outlook: I don’t think management have any more insight than investors about which games are likely to catch the imagination, so I take their guidance with some scepticism. However, it is worth bearing in mind that around 70% of revenue comes from games that have already been released, which they do have good visibility on, as the above chart from their presentation shows. The Chief Exec says that he is “very excited” about their upcoming Warhammer game, Realms of Ruin to be released in November does attract new players.

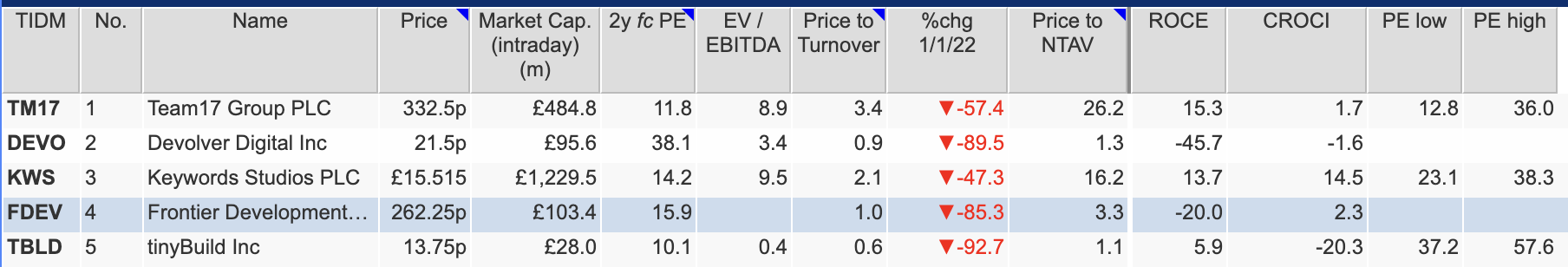

Valuation: FDEV shares are trading on around 1x FY May 2024F and 2025F revenue. The shares are forecast to be loss-making next year. Assuming that the company can eventually generate revenue and profits, with a margin of c. 20%, that would imply a PER of c. 5x (ie £125m of forecast revenue, 20% margin, 25% tax gives c. £20m of after-tax profits). The entire sector is looking very bombed out with three stocks (DEVO, FDEV and TBLD) down more than -85% since the beginning of last year.

Opinion: I bought this in the first half of the year, however given the strong cash position and the possibility of a positive surprise I have averaged down. The gross margin is an attractive 64%, and the £24m of cash means there’s a combination of safety with genuine operational gearing if results turn out to be better than the low bar that management have set themselves. On a risk-reward basis this is looking attractive to my mind, the idiosyncratic investment case should be uncorrelated with the rest of the stock market. As always I’m sharing my thought process on how I react when a company I own disappoints. My risk tolerance is likely higher than some readers, so please DYOR. I wouldn’t want anyone to follow me blindly, only to discover I’ve lost myself in the realms of ruin.

Opinion: I bought this in the first half of the year, however given the strong cash position and the possibility of a positive surprise I have averaged down. The gross margin is an attractive 64%, and the £24m of cash means there’s a combination of safety with genuine operational gearing if results turn out to be better than the low bar that management have set themselves. On a risk-reward basis this is looking attractive to my mind, the idiosyncratic investment case should be uncorrelated with the rest of the stock market. As always I’m sharing my thought process on how I react when a company I own disappoints. My risk tolerance is likely higher than some readers, so please DYOR. I wouldn’t want anyone to follow me blindly, only to discover I’ve lost myself in the realms of ruin.

Conclusion

Bruce owns FDEV.

Bruce co-hosts the Investors’ Roundtable Podcast with Roland Head, Mark Simpson and Maynard Paton. To listen you can sign up here: privateinvestors.supercast.com

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

Weekly Market Commentary | 19/09/23 | ELIX, FEVR, FDEV | Investing against the flows

Bruce suggests that rather than ARM’s successful IPO, the likely catalyst for more companies coming to market will be retail flows into funds. Companies covered ELIX, FEVR and FDEV.

Last week the ECB raised interest rates to 4%, and this week the BoE is expected to raise rates to 5.5%, the highest since early 2008. There’s also an annual decision on how much Quantitative Tightening to do, last year the amount was £80bn, made up of £34bn sales to the market and £46bn of maturing gilts which rolled off. Confusingly the BoE then bought £20bn of gilts in Q4 last year to support the price of government bonds following the Truss/Kwarteng budget. In all, the BoE owned £895bn of gilts following over a decade of Quantitative Easing, which suggests that it will take around a decade to unwind QE at the current pace.

Arm listed on the NYSE last week and rose +25% on the first day of trading. That’s good news for the 28 banks who worked on the deal, who earned circa $100m in fees. In the US we should see food delivery app Instacart and marketing software Klaviyo come to market. There seem to be a few self-interested quotes from investment bankers, suggesting that the IPO market is now re-opening. Both Michael Taylor and I are sceptical of this.

In my view, there’s a correlation with inflows into funds and IPOs. After all, it makes sense that if fund managers are suddenly receiving large sums of money from their retail clients, they will look to deploy this in new issues coming to the stock market. I have taken the chart below from the Investment Managers Association, which shows that we are a long way from the days of late 2020 / early 2021 when the market was so buoyant and net retail sales of funds was very positive.

As I noted a few weeks ago, retail fund flows are normally a good contrarian indicator. That is, if you have the money available to invest in markets, then future expected returns tend to be higher in the medium term when professional fund managers are forced sellers. So I continue to invest my own money into this market.

This week I look at Fevertree Drinks and management consultancy Elixirr H1 Jun results and Frontier Developments profit warning.

Fevertree Drinks H1 Jun 2023

Now that Fevertree has fallen by 2/3 from its high of almost £40 per share, I’ve made a mental note to revisit the investment case. The tonic water and mixer company released H1 results to June, showing +9% revenue growth. Within that, the UK and RoW didn’t contribute much to revenue growth, but the US expansion +40% (+32% on a constant currency basis), really punched above its weight. That means the US and Europe combined contributed 136% of group revenue growth, as the table below shows. They blamed the low growth in the UK on the poor summer weather, which they expect to have an impact into H2.

H1 PBT was down -96% to just £1.4m. That was caused by a 6.7% decrease in the gross margin from 37.4% H1 last year to 30.7% H1 this year, caused by elevated glass pricing and other inflationary pressures. So much for premium consumer brands being inflation-proof.

Administrative expenses were up +17% to £50m, which is a higher increase than both group revenue and inflation generally. Not included in the cost of sales or admin expenses was a further £3.3m provision made against quarantined US inventory, which the company has split out as a one-off. The group’s net cash declined from £100m end of June last year to £75.8m June this year.

Outlook statement: Management said they expect to deliver FY revenue of between £380m and £390m. That compares to Sharepad forecasts of £393m FY Jan 2023F, however, the new forecast still implies an acceleration from +9% revenue in H1 to between +11% and +17%. The outlook statement also talks about “significant margin improvement” in FY Dec 2024F, suggesting EBITDA margins of c. 15% and that they were comfortable with Dec 2024F revenue growth expectations (Sharepad shows +10%).

Valuation: The shares are trading on a still PER 40x FY Dec 2024F dropping to 30x PER the following year. I think that investors must be assuming that as inflation subsides, then the EBIT margin will improve to the historic levels of c. 30% achieved in 2018. That’s possible, but by no means a certainty.

Opinion: The company is undoubtedly a strong brand with a good story, and has fallen significantly. It’s interesting to me that both Terry Smith and Nick Train are fans, the latter bought the shares after they halved, only to see the share price half again. Phil Oakley has also written up the investment case at the start of this year, and compares the valuation against Nichols, Coca-Cola HBC, Britvic and AG Barr, concluding that FEVR’s high valuation multiples meant that there might be better value elsewhere in the sector.

Elixirr H1 June 2023

This management consultancy and technology company announced a £6m acquisition alongside H1 results to June. They are buying Responsum, an AI company for £6m total consideration, of which $3.4m will be paid in shares issued at 540p (a 7% discount to the market price).

The H1 results look positive with a +23% increase in revenue to £41m. Some of that includes previous acquisitions, but underlying organic revenue growth was up +14% compared to H1 22. Statutory PBT was up +17% to £9.9m. They had net cash (no bank debt, ex-office leases, ex-contingent consideration) of £19.5m. I would suggest deducting £5.7m of contingent consideration recorded on the face of the balance sheet, of which roughly half was a current liability (i.e. due within the next 12 months) from their net cash figure. Minus contingent consideration and the cash paid for Responsum would give net cash of c. £12m.

SFOR comparison: I had a brief look at SFOR, Sir Martin Sorrell’s new advertising agency roll-up which also reported on Monday. This has net debt of £109m versus a market cap of £419m and owes £111m of contingent consideration due in the next 12 months. The cash consideration payments to be paid for previous acquisitions mean that they expect to see net debt rise by the year-end to £180-220 million. I haven’t covered SFOR in any more detail, except to say that I can see why the share price has been punished, falling by a quarter on the morning of their results. One thing that occurs to me is that Sir Martin’s “golden share” which gives him control over S4 Capital, might put off institutions from supporting the company if it does need to raise fresh money in 2024.

Valuation: The shares are trading on PER 15x FY Dec 2024F and FY Dec 2025F. That looks reasonable for a fast-growing people business and translates to 3x price/sales. FinnCap, now called Cavendish, has published a 15-page broker note on ELIX; the tone is very upbeat but they have left their estimates unchanged.

Opinion: This looks OK, though I note it is very difficult to work out from the outside how differentiated the offering is for B2B software and management consulting companies. The valuation looks about right to me. When I last looked at it, I seem to remember ELIX were relying heavily on revenue from banking sector clients. If readers have any specialist knowledge on this company, then do share in the chat. I certainly prefer the investment case to SFOR, which looks to be going badly wrong.

I have used Sharepad’s compare tab to look at the valuation of similar companies like D4T4, and Active Ops which I wrote about a couple of months ago. I’ve added in Alpha Financial Markets and Alfa Financial Software to the comparison table.

Frontier Developments FY May 2023

I pitched this computer games company at the Mello BASH earlier this month, then two days later they released disappointing results. Frontier’s self-published game portfolio includes Elite Dangerous, Planet Coaster, Planet Zoo, Jurassic World Evolution, F1® Manager and Warhammer 40,000: Chaos Gate – Daemonhunters.

The shares are off more than -90% from their peak, despite having cash of £25m (24% of their market cap) at the end of August. That financial position is also confirmed in the “going concern” statement, which says that even when they stress test their annual budget they have sufficient cash resources in all the negative scenarios that they could think of.

Sharepad shows that they have de-rated spectacularly from their price/turnover multiple of over 20x in 2018 to 1x current forecasts.

They say that consensus FY May 2024F revenue expectations and Adjusted EBITDA are for £108m (ie +3% growth) and a loss of £9m respectively. That compares to Adj EBITDA loss of £5m FY May 2023, and positive £7m EBITDA FY May 2022. Note that for FDEV their Adj EBITDA figure is close to “cash” because they deduct the capitalised charge of game development – in FY May 2023 £38m, or 71% of gross R&D spend – from the given adj EBITDA figure. It also means their figure is more negative than Sharepad’s EBITDA figure of £29m FY May 2024F, which doesn’t expense that game development charge.

Further down the P&L, there were more costs that resulted in a statutory LBT of £27m FY May 2023, versus £1m PBT the prior year. That accounting loss was driven by intangible write downs of Foundry, their Third Party Publishing label which they’ve now closed down, and faster (i.e. higher) amortisation charge for the F1 manager.

Valuation: FDEV shares are trading on around 1x FY May 2024F and 2025F revenue. The shares are forecast to be loss-making next year. Assuming that the company can eventually generate revenue and profits, with a margin of c. 20%, that would imply a PER of c. 5x (ie £125m of forecast revenue, 20% margin, 25% tax gives c. £20m of after-tax profits). The entire sector is looking very bombed out with three stocks (DEVO, FDEV and TBLD) down more than -85% since the beginning of last year.

Conclusion

Bruce owns FDEV.

Bruce co-hosts the Investors’ Roundtable Podcast with Roland Head, Mark Simpson and Maynard Paton. To listen you can sign up here: privateinvestors.supercast.com

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.