This week Bruce takes a look at Elon Musk’s Twitter activism and what the London Stock Exchange might learn from Musk’s other activities. Companies covered computer game publisher DEVO, online identity company IGP and management consultancies AFM and ELIX.

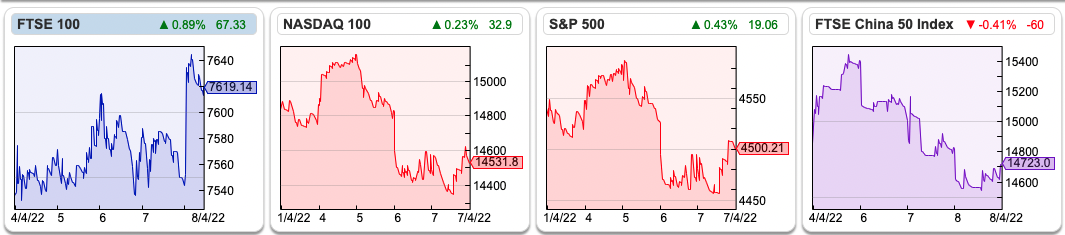

The FTSE 100 was 7,619 +1.1% last week. The UK index of blue chips has been the second best performing index so far this year +2.2% YTD, behind the Brazilian Bovespa which is up +12%. The German DAX has been the worst performer -11% YTD, just below the Shanghai index also -11%. The US 10y Government bond continued to sell off. The yield rose to 2.66%, as people digested the Fed’s messaging on how the Central Bank would reduce the $9 trillion of assets that have accumulated from Quantitative Easing. $95 billion a month of tightening sounds a large number, but if that rate is sustained it will take almost 8 years for all the QE to be reversed. The consensus seems to be that tightening will affect the long end of the curve (that is 10 year yields could continue to rise higher).

Twitter was up +24% last week, after Elon Musk announced that he had bought 9.2% of the company, and was appointed to the Board a couple of days later. The company looks expensive on conventional ratios. SharePad shows a PER of 57x, and on 7.5x sales, though possibly good value compared to Tesla on 99x PER and 22x sales. Twitter has already been the subject of one activist hedge fund campaign. Elliott made an approach with a list of demands in March 2020. The hedge fund bought 9% and received a seat on the Board. One concern that the activist had was that Jack Dorsey, then CEO, was also running Square (the $80bn payments company he founded that’s now called Block) and lacked of focus. Elliott has now backed off, presumably because the Twitter share price was up 3.5x from the March 2020 low and Jack Dorsey has been replaced. However the financials of the company do still look like a shareholder activist could pressure management to improve: SharePad’s quality measures shows low ROCE, poor cash conversion and margins that I would have expected to be higher.

Elon Musk on the other hand, appears to be more focused on non-financial issues at Twitter: such as the lack of an edit button. Being the richest man in the world Elon Musk can buy shares in any public company he chooses. You can’t buy “cool” with money though.

Musk went clubbing in Berlin the weekend after announcing his Twitter purchase, but much to the amusement of the locals, failed to get into Berghain. In case you’re not familiar with it, Berghain is a huge club in an abandoned power station that plays techno music. It opens at midnight on Saturday night and stays open continuously until Monday midday. The queue takes hours, and there is a good chance that after waiting patiently inline the bouncer (an intimidating chap called Sven) will reject you for not being cool enough – Britney Spears has also been turned away. Musk claims that he wasn’t denied entry, but instead waited in line then refused to go in because they wrote “PEACE” on the building. I’m not sure that anyone believes that.

Berghain strikes me as an interesting example of a business that chooses not to maximise its revenue, which in turn makes the brand more valuable. I feel like this is a lesson for the London Stock Exchange, which welcomed resources stocks from the former Soviet Union ENRC, Evraz, Polyus Gold and Polymetal despite low free floats and dubious corporate governance.

So perhaps the LSE could look more closely at the “dress sense” of some of the companies seeking to list in London, and apply more discriminating entry criteria? The same goes for the Premier League when it comes to football club ownership

Mello is Monday evening. David has AdEPT Telecom, Duke Royalty and The Property Franchise group presenting. He’ll be hosting a physical event in Chiswick, Wednesday 25th – Thursday 26th May Smaller Growth and Mid-Cap Companies. I’m sure that these events take a lot of hard work behind the scenes, so if you appreciate his effort the best way to show your support is buying a ticket and attending.

This week I look at recent IPO computer game company Devolver Digital, digital identity company Intercede and a comparison between two management consultancies focused on banks and asset managers: Elixirr and Alpha Financial Markets Consulting.

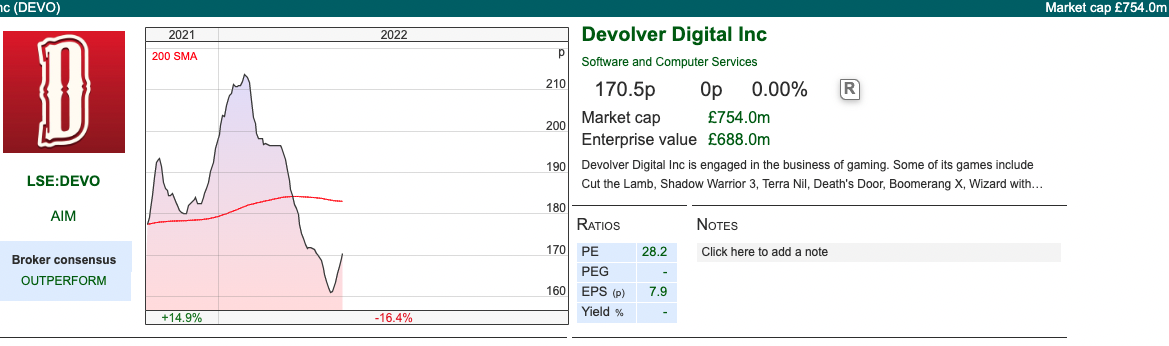

Devolver Digital FY Dec 2021

This US based computer games publisher, which IPO’ed on AIM in November last year, announced FY results. They describe themselves as “purveyors of fine digital entertainment wares from independent artists worldwide.” That means that they back games developers similar to a Venture Capital style approach but for computer games. Unlike FDEV, they don’t develop the games themselves, but work with developers/studios receiving and vetting over 2,000 unsolicited game title pitches each year at varying stages of completion (that is from initial concept to fully-formed games.) Devolver does not require developers to hand over the IP or sequel rights to their games, which management believe is attractive to the creative types who develop the games.

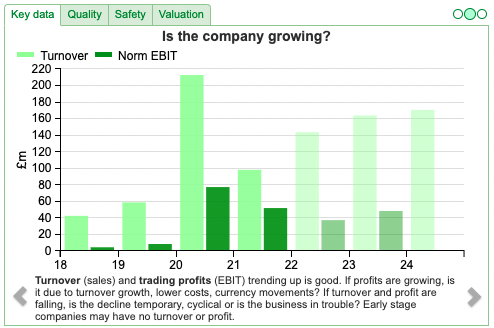

In H2 2020 they had a huge hit, with a game called Fall Guys, helped no doubt by the pandemic when alternative forms of entertainment were not available. This was developed by a British studio Mediatonic, quickly becoming the most downloaded PlayStation Plus game title in history. The game generated $151 million revenue in the year to 31 December 2020 alone. The studio Mediatonic was acquired by Epic Games in March 2021, at which point Devolver also sold the publishing rights to Epic Games.

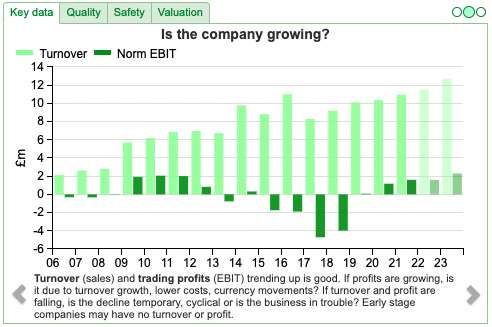

The SharePad chart shows the “one off” nature of 2020 revenue and profits. Revenues were $212m in 2020 versus $98m 2021 just reported. The company reports in dollars, so the currency sign is wrong on the Y axis.

This means we need to treat the statutory results with caution, because that $212m includes $142m of revenue of Fall Guys that was above what DEVO had budgeted for. Add to that a couple of gains on sale ($115m in H1 2021). When they sold publishing rights to Fall Guys to Epic Games there was a gain on sale, but then a second gain when they sold Intellectual Property owned by one of their subsidiary studios. Plus they’ve made five acquisitions since 2020 and the usual distortions from the IPO process (one off professional fees but also large stock based compensation pre-IPO.)

The company didn’t need to raise money at Nov 2021 IPO, they had net cash of $44m Dec 2020, but presumably thought timing was propitious following their exceptional hit and possibly a coming slowdown in game sales as people go to the pub, music gigs, nightclubs in abandoned power stations etc as lockdown ends. Frontier Developments is down -46% in the last 6 months, so I can understand management’s thinking that it was better to come to market sooner rather than later.

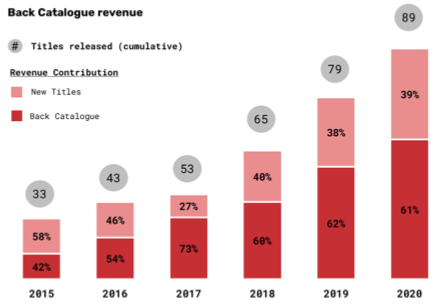

It does mean that the underlying trends are difficult to understand though, because of the number of adjustments. With that in mind the company’s definition of FY normalised revenue was +38% to $98m. They don’t give an equivalent normalised profit figure, instead adjusted EBITDA down -39%. The graphic below is from their Admission Document which shows the historic revenue split.

History: Devolver was founded in 2009 and set out to be the type of publisher that developers would want to work with. They don’t demand IP or sequel rights. The history actually goes back earlier than the founding of the company though because Harry Miller, Rick Stults and Mike Wilson had co-founded another game publisher (Gathering of Developers) in the 1990s then sold to Take Two in 2000. I wrote about Take Two here, when they lost out when Electronic Arts who out bid them for Codemasters at the end of 2020, paying c. $1.2bn.

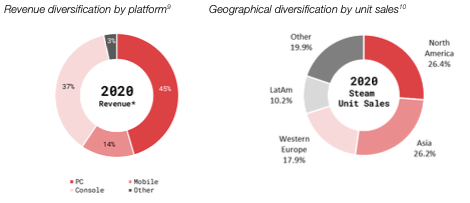

The founders reunited in 2007 and sold to SouthPeak Games, then going on to found Devolver Digital in 2009, which originally specialised in releasing PC games on the Steam distribution platform. They have now expanded beyond PC games to Xbox, PlayStation consoles and Google’s Stadia. The price at the IPO in Nov 2021 was 157p, valuing the company at £694m market cap. They raised £30m of new money, but the bulk of the money (£154m) went to the selling shareholders.

Devolver is similar to a music label – they are involved in promoting games on the various platforms. They have a network of influencers who generate excitement about the titles that Devolver publishes. By way of example, the number of titles released annually on Steam has gone from 285 in 2009 to 9,692 in 2020 – game developers need help to bring their games to the attention of gamers.

Acquisitions: Following their windfall gains from their hit Fall Guys, Devolver management seem to have gone on a shopping spree. In October 2020, they bought CroTeam, a game developer based in Croatia for $27m. In H1 2021, they bought Good Shepherd, Nerial and Firefly all game developers for $41m, $17m and $27 total consideration respectively. Then early in H2 2021 they bought Dodge Roll for $11m total consideration. Total intangible assets, which includes goodwill, IP and capitalised software development costs comes to $163m on the balance sheet (versus shareholders equity of $245m).

Ownership: Following the IPO management still own 57% (Harry Miller the Exec Chair / co-founder still owns 22%) of the enlarged share capital. Insiders now have a 12 month lock-in arrangement, which will expire this year in November, when they’ll be able to sell more shares. Other than that, the largest shareholder is NetEase which owns 8.0% of the shares. Sony own 5%, Slater Investments 4.7% and Chelverton Asset Management own 3%.

Valuation: The shares are trading on 28x FY Dec 2024F and 5x sales the same year. That seems reasonable for a business that can generate high, but volatile, Returns on Capital. One aspect to mention is that around 60% of annual revenue comes from the company’s back catalogue of games, which does give some comfort given how “hit or miss” video games can be.

Opinion: Their head office is in Delaware in the US, and it’s not clear why they have come to AIM rather than Nasdaq. Add to that it looks like management have timed their IPO to take advantage of an exceptionally good 2020, not because they needed the money. I can see that the business model makes sense though, as there are many similarities between Venture Capital style pay-offs and computer games.

Intercede FY March 2022 Profit Warning

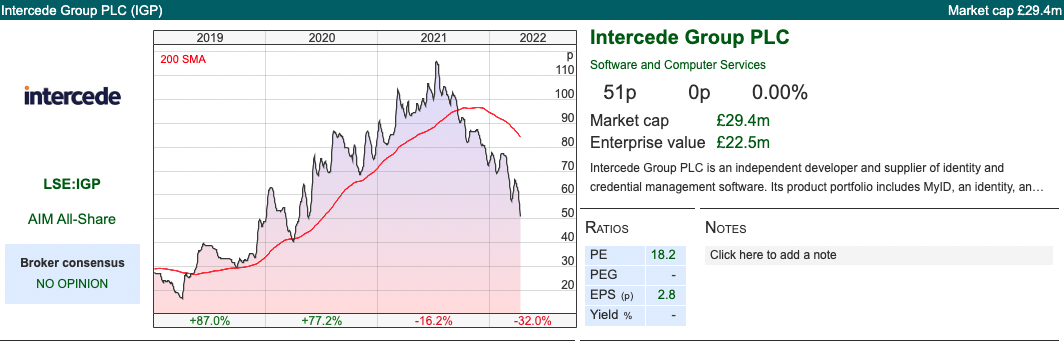

This digital identity and credential management company has put out a couple of “contract win” announcements over the last couple of months. Indeed last week’s announcement is headed “Trading Update and Contract Win”, however the share price reaction down -20% on the morning of the RNS suggests otherwise. To be clear, good quality companies can face difficulty about when to recognise contract wins that fall either side of their year ends, but I dislike the combination of several upbeat contract win announcements and then disappointing revenue expectations.

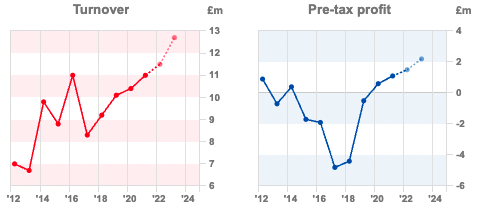

Broker forecasts: FinnCap, their broker, was previously forecasting £11.5m of revenue and PBT £1.5m FY March 2022F. That previous forecast implies 5% revenue growth, versus the RNS which now suggests a -9% revenue decline to £10m this year. Their broker is now expecting less than £50K of profits this year (FY March 2022F) and just £100K of PBT in FY March 2023F.

History: The business was founded in 1992 and was an early distributor of internet security products, for example “firewalls”. Intercede came to market in 2001 at 60p per share, raising £2m and valuing the company at £10m. Even back then Intercede had an impressive customer list (Admission Document lists Barclays, Lloyds TSB, Abbey National, several UK government departments and the NHS). The interesting aspect for me is that this ought to have been a growth area, yet the company’s revenue peaked at £11m 2016.

Notable too, is that SharePad shows the company was loss making for 5 years between 2013 and 2019. That indicates to me that while the company might have an impressive list of client wins, it has an even more impressive list of clients that have left – rather contradicting management who claim that their relationships are sticky. It is also a reminder that just because a business has an attractive gross profit margin in the 90s, doesn’t necessarily mean that it will enjoy the benefits of operational gearing, or can easily grow revenue to scale the business model.

US revenue is c. 80% of group revenue, clients listed now on the website include US Department of Homeland Security, Wells Fargo, US Nuclear Regulatory Commission, Boeing and Lockheed Martin. The main product is MyID, there’s a 3 minute animation video here. The idea is that usernames and passwords are not as secure as Intercede’s technology, which creates a secure ID with multi factor authentication (requiring a user device plus a PIN code and maybe a third factor, like a finger print). I am a Lloyds Bank customer, and they have this when logging into bank accounts on my phone, but Lloyds are no longer listed as a client of Intercede, which suggests to me that the technology (which management say took 1000 person years to create) is not as clever or unique as might be first imagined.

Ownership: Jacques Tredoux owns 29% in his own name, and a further 26% via the Azalia Trust. Other shareholders are Liontrust AM 5.7%, Herald IM 5.4% and Miton 3.9%. The original founder Richard Parris still owns 4.6%.

Valuation: EPS of 0.2p in 2023F, quadrupling to 0.8p 2024F. I think that progression the year after next demonstrates considerable faith that the future will look different to the past. If 2024F numbers are achieved that puts the shares on 72x PER. On the other hand 2.4x 2024F revenues shows that perhaps the company is under earning and there could be value if they can grow.

Opinion: This strikes me as a good story with poor execution. There is considerable fear of hacking, even before the Ukraine war, so companies are investing in this area. But somehow Intercede has failed to benefit. For comparison, GB Group which also does Digital Identity has a market cap of £1.4bn, trades on 23x 2024F and is up by 10x in the last decade.

Elixirr (FY Dec Results) and Alpha FMC (FY March Trading Update)

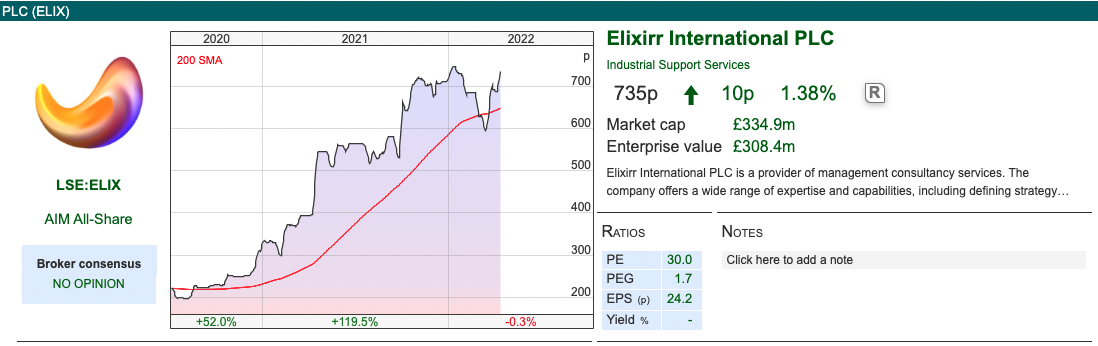

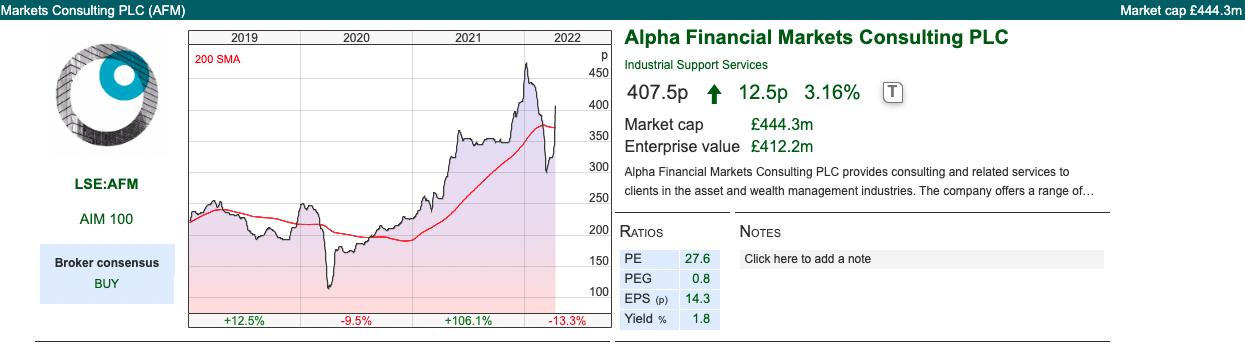

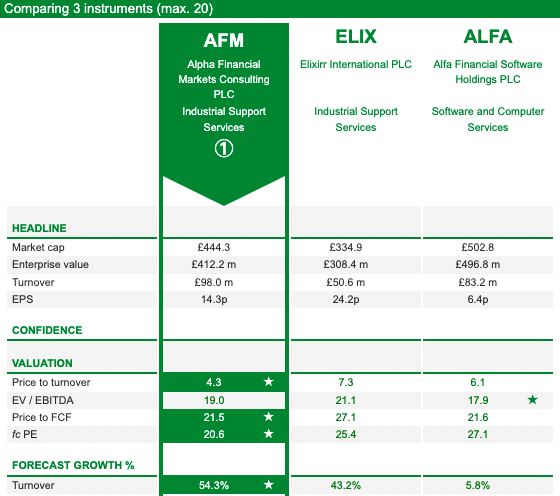

These two management consulting businesses both reported strong results last week. They both have a focus on financial services, though Elixirr is more banking and Alpha more asset management. Confusingly there is also Alfa Financial Software Holdings (ALFA), which is slightly larger but slower growing. I’ve shown all three in the comparison but ALFA reported its December year results a month ago.

Elixirr reported FY results with organic revenue +35% or including acquisitions +67% to £51m. PBT more than doubled to £12m. Alpha FMC says in a very brief trading update that FY March 2022 revenue and adj EBITDA were “significantly ahead” of market forecasts, without telling us what those forecasts are. Sharepad shows an updated forecast of +54% to £151m and adj EBITDA +52% to £33m for Alpha FMC. There’s a danger that consulting fees, like marketing spend, are easy items on the budget to cut costs if there is a downturn, so it’s interesting that both businesses are not (yet) seeing any pressure. There’s also a risk that employees leave and set up in competition. For instance Elixirr’s management are ex Accenture. Elixirr had net cash of £32m and contingent consideration of £1.8m at FY Dec 2021.

Elixirr reported FY results with organic revenue +35% or including acquisitions +67% to £51m. PBT more than doubled to £12m. Alpha FMC says in a very brief trading update that FY March 2022 revenue and adj EBITDA were “significantly ahead” of market forecasts, without telling us what those forecasts are. Sharepad shows an updated forecast of +54% to £151m and adj EBITDA +52% to £33m for Alpha FMC. There’s a danger that consulting fees, like marketing spend, are easy items on the budget to cut costs if there is a downturn, so it’s interesting that both businesses are not (yet) seeing any pressure. There’s also a risk that employees leave and set up in competition. For instance Elixirr’s management are ex Accenture. Elixirr had net cash of £32m and contingent consideration of £1.8m at FY Dec 2021.

That compares to AFM, which although it had £40m of cash on the balance sheet last year, also had a £39.5m liability from earn-out and deferred consideration.

Valuation: The table above shows that on most valuation (eg Price/Earnings and Price/Sales ratios) measures ELIX trades at a premium to AFM. Some of that though could be reflecting AFM’s more risky profile though.

Opinion: I’m wary of this sector, given where we are in the cycle and that these are relatively recent IPOs. So far they haven’t run into problems, but similar to the supply chain, I think it would be naïve to assume that we can extrapolate from the previous 6 months. If I had to choose, I would probably disagree with SharePad’s ranking and plump for Elixirr because of the much lower contingent consideration and generally stronger balance sheet.

Bruce Packard

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

Hi just want say that this article is very nice and very informative article.I will make sure to be reading your blog more.

online casino