The FTSE stayed level around 6580, while Nasdaq hit a new high of 12752.

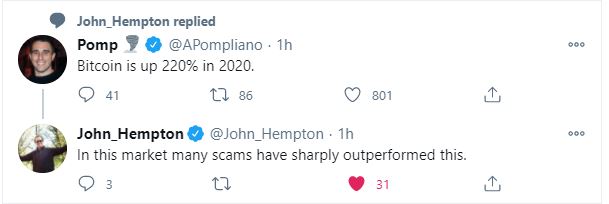

Bitcoin rose through $20,000 for the first time.

I have a dim memory of a party in South London, around 2006-2007, when someone began trying to convince me that everyone could create their own electronic currency. After all, he said, money held and transferred between bank accounts was just computer code: ones and zeros, the amount of digitised cash stored on banks computers dwarfed paper money already. There are many safe guards to prevent counterfeiting paper cash, but how do those safeguards work for digital money? Napster showed that any song could be digitally copied and shared across the world for free. Why does it take so long and cost so much to transfer digital money? My question was, why would people believe in unproven alternative currencies? Fast forward 15 years, and I still don’t think that there is a rational answer to my question, except that beliefs become established for reasons that are not rational.

That said, I’m really looking forward to when Covid ends, so that it is safe to meet people at parties.

Last week Codemasters received a rival bid from Electronic Arts for 604p, and the shares are now trading higher than 650p suggesting investors believe there will be at least one more bid for the computer games company. I look at IG Group which has also reported strong numbers benefitting from lockdown and Concurrent Technology, which also said it would be ahead of expectations for FY December.

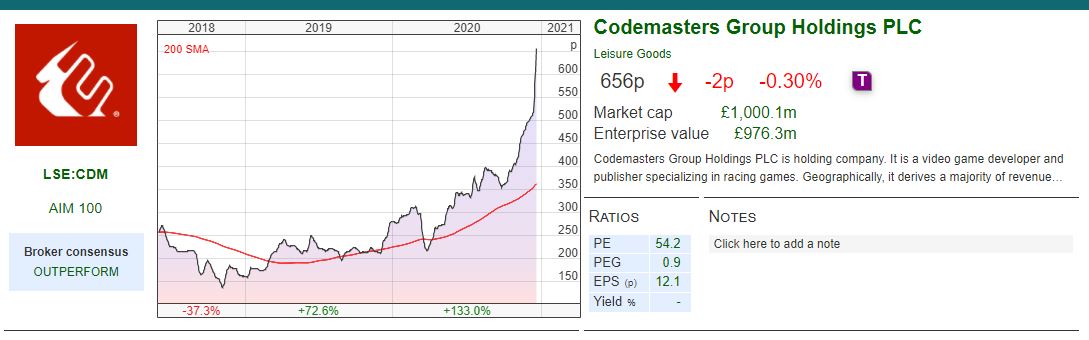

Codemasters bid

Codemasters received a competing bid from Electronic Arts (EA) of 604p in cash valuing the company at £945m. Codemaster’s Board withdrew their previous recommendation of the Take Two offer (120p in cash, 0.02834 shares of Take Two) which values Codemasters at 528p.* That is EA’s bid is a 14% premium to Take Two, plus it is all in cash rather than shares. As of September 30, EA had over $4bn of cash on their balance sheet, and is the second biggest computer game company in the US (after Activision Blizzard) so can easily afford the £945m or $1.2bn.

EA has a number of sports game franchises (FIFA, Madden NFL, NBA, NHL) plus a “Need for Speed” and “Real Racing” franchises that it believes will benefit from collaboration between EA and Codemasters teams. EA also believes they can use their game analytics, central development and technology teams plus support services like quality verification, compliance and localisation skills to create synergies. Interestingly the latter is exactly the area where Keywords Studios operates in, so possibly if the computer game industry consolidates into large, fully integrated companies there will be less need to outsource the non-core activities to KWS?

The Codemasters Board will adjourn the General Meeting which was to be held on 21 December 2020. In response Take-Two put out a statement noting the new offer, and a further announcement may be made.

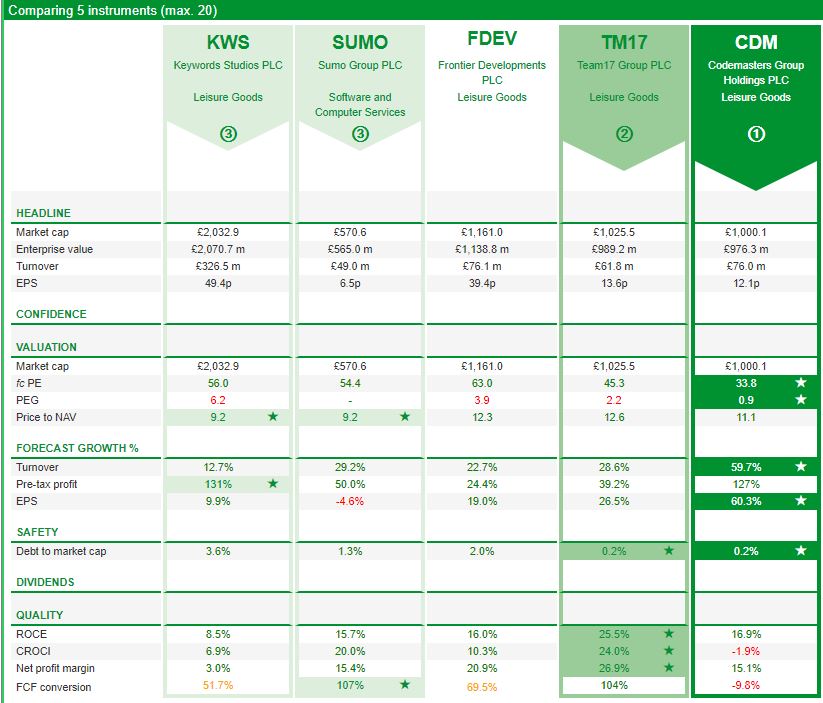

This looks like good news for shareholders. The shares were up 23% last week, trading above 650p, suggesting that holders of the shares believe that we will see a bidding war, with at least one higher bid. Other UK computer game companies are Sumo, Team 17, Frontier Dev, Keywords Studios. I have shown the SharePad comparison table on the following page: excluding CDM, the forecast PE ratios range from 45x (Team17) to 63x (Frontier Developments) suggesting this is currently a hot sector. Interestingly CDM has the lowest PE ratio in the sector on 34x, and most attractive PEG ratio, despite being the bid target. There’s a whole tutorial on the compare feature here.

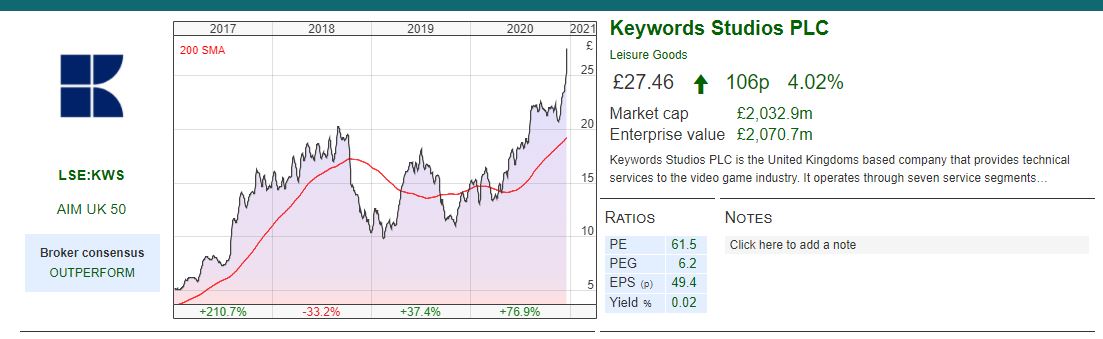

Keywords Studios acquisition

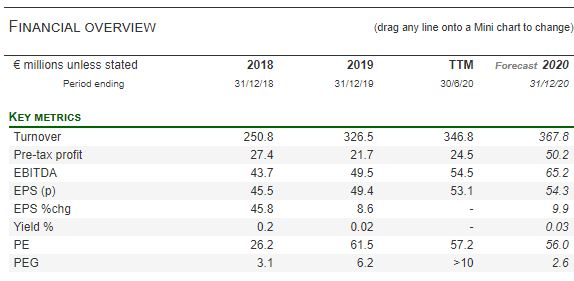

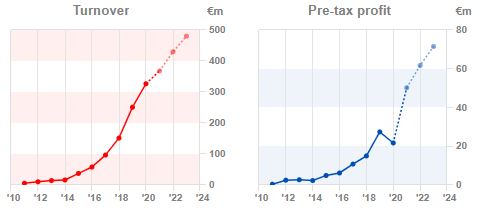

Sticking with computer games, Keywords Studios, the service provider for the industry (ie testing, artwork, quality assurance, language translation, localisation and audio services) announced three separate acquisitions last week. The first was High Voltage, an unlisted US competitor for a total consideration of up to US$50m. The second and third were much smaller Indigo Pearl (total consideration £2m) and Jinglebell Communications (€1.8m total consideration) were announced in the same RNS announcement.

Sticking with computer games, Keywords Studios, the service provider for the industry (ie testing, artwork, quality assurance, language translation, localisation and audio services) announced three separate acquisitions last week. The first was High Voltage, an unlisted US competitor for a total consideration of up to US$50m. The second and third were much smaller Indigo Pearl (total consideration £2m) and Jinglebell Communications (€1.8m total consideration) were announced in the same RNS announcement.

Founded in 1993, High Voltage is headquartered in Chicago, and is forecast to make $9m of EBITDA. Keywords is paying $24m in cash, issuing $10m of shares and $17m in a mix of cash and shares. KWS reported €101m of net cash at the end of June this year, so can easily afford the initial $24m in cash. The announcement says that High Voltage worked closely with Epic Games on “Fortnite” – one of the most successful games in recent history, which achieved 125m players within a year of release in 2017.

Keywords acquisition led expansion continues apace. Since their IPO in July 2013 at 123p, Keywords has made around 50 “bolt-on” acquisitions, with a mix of shares and cash. Share count has grown from 40m in 2013 to 73.5m today.

Given the high rating, High Voltage’s $9m EBITDA is around 15% Keywords $60m (H1 20 annualised EBITDA) but consideration is just 2% of KWS market cap. Keywords is currently trading on 36x EV/EBITDA, but is paying 5x the same multiple for High Voltage**.

The shares are trading on over 5x historic revenue, and 55x forecast PER. Though growth in revenue has been spectacular in the last five years, RoCE has been trending down and has now fallen below 10%. I think the high valuation implies that investors believe that RoCE will improve significantly, which may be a challenge give that it is hard to see conditions becoming more attractive for computer games as lockdowns end.

3 years ago I sold this stock at below £10, thinking that the shares were expensive on 34x earnings, and 8x sales. Aside from valuation, I worried that there was significant integration risk with buying so many overseas businesses (there are 7,000 employees spread across 21 countries), however so far management have done well to prove me wrong. The acquisition led growth and lack of own unique game IP (cf Codemasters), means that I doubt that KWS would be an attractive bid target for one of the larger US players. Well done to holders, though I think I would be nervous about the demanding valuations for the whole sector.

IG Group trading update (H1 to 30 Nov)

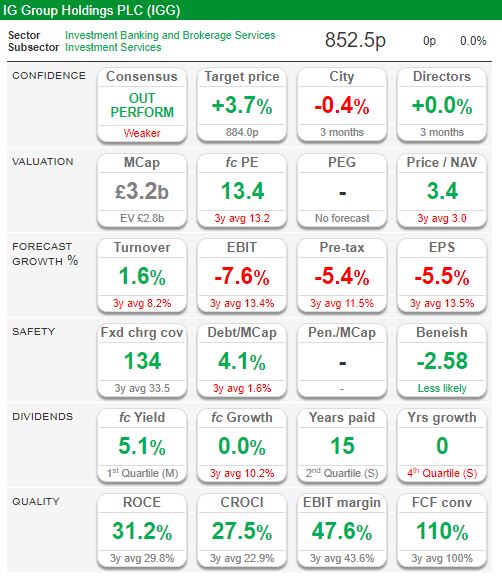

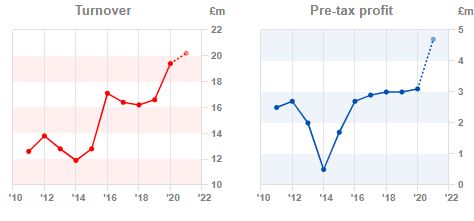

This online trading company put out a H1 trading statement (six months ending 30 Nov). Q1 (ie June- August) was very strong, even as lockdowns were loosened over the summer, and this continued into Q2 (ie Sept-November) up +71% to £207m v Q2 last year. H1 Net Trading Revenue should be £416m +66% (v previous year H1 250m).

This company has reported very attractive financials, average RoCE in the last 5 years has been 31%. The gross profit margin is 98% and the operating profit margin is 46%. However investors have never really rewarded the company with a high valuation, perhaps fearful of regulatory pressure forcing changes to the business model. The shares tend to be hit by concerns about regulatory intervention, given around 82% of CFD traders lose money.*** As an example, the precipitous 46% drop at the end of 2016 was caused by the FCA releasing a consultation paper proposing stricter rules. There was another similar steep sell of a couple of years later, when the previous Chief Executive’s departure was announced.

The immediate overhang has gone, because the FCA finalised its stricter rules in July 2019 i) limiting leverage ii) guaranteeing traders can’t lose more than the total funds in their trading account iii) banning cash inducements to current and potential customers iv) standardised risk warnings, revealing what percentage of clients lost money. IG Group says 70% of CFD revenue comes from jurisdictions where restrictions on the sale and marketing of CFDs have been implemented.

As so many customers lose money and stop trading, CFD groups have to continue acquiring new customers. IG spent £62m last FY on targeted online marketing, which is presumably going to firms like Tremor, as well as Google and Facebook. That said, retention is also a skill, IG Group say 55% of CFD revenue comes from customers who have been trading with the company for at least 3 years.

IG Group point out that they make money on transactions and Net Trading Revenue is driven by client activity. Unlike some competitors (presumably including Plus500) they do not take the other side of client positions, but lay the risk off in the market. So the IG business model does not benefit from clients’ trading losses, and IG doesn’t lose money when their clients trade profitably. In addition they probably do enjoy some “network effects” as more traders use the platform, they can internalise client flow (individual trades offset each other) and then hedge the residual exposure externally in the market. Investment banks’ trading desks try to do the same, but with institutional flows.

In May 2019 the company set out a 3 year growth strategy, splitting their net trading revenue into

- “Core Markets” (UK, EU, EMEA, Australia and Singapore) £540m FY 20 or 83% of Group Net Trading Revenue expected to grow at 3-5%

- “Significant Opportunities” (Japan, US, Greater China) £108m FY 20 or 17% of Group Net Trading Revenue by £100m to £160m in FY 22.

Ironically these targets look too easily achievable now, given that this August they reported FY to May 20 Core Markets was up +29% and Significant Opportunities was +85%.

Both computer games and online trading companies have enjoyed a bonanza in 2020 as people have looked for entertainment in their own homes. Unlike computer games companies where investors are prepared to pay over 50x earnings, IG Group and the other online trading companies are reporting higher level of profitability and a lower valuation.

Management Remuneration: Chief Exec basic salary is £610K, and then is rewarded for i) Total Shareholder Return (25% weighting) ii) an earnings per share target (55% weighting) which in FY 20 was 41% ahead of the maximum target set iii) non-financial strategic metric (20% weighting). Payout will be capped at 500% of salary for the Chief Executive and 400% of salary for the other Executive Directors. To my mind it looks like Executives will enjoy a substantial windfall of gains for performance targets set pre-Covid.

Out of curiosity I have been an IG customer, I was playing with small amounts of money and very disciplined about cutting my losses. I found that I was actually cutting my losses too quickly (from memory I set a 7% down stop loss, and I kept being stopped out). I felt that probably there were easier ways of making money than competing against computer algos (no one has built an algo that identifies ten-baggers yet). Maybe, rather than using their site to trade frequently, investors could enjoy higher returns by owning equity in IG Group? So I think the risks reward profile of investing in IG Group could make sense for some people. I would encourage investors to read the regulatory papers on this and also Stuart Wheeler (the founder) has written a biography.

Concurrent Technologies FY December Trading Update

The Company confirmed in a Trading Statement for FY ending 30 December that it expects to report revenues and profitability ahead of market expectations with cash generation remaining strong.

This company was founded in 1985 and has been listed since 1996 – unfortunately that means their Admission Document is not available on their website. They make computers for commercial and rugged environments, and customers are in the Defence (68% of revenue), Aerospace, Telecoms and Transport sectors. They are also a successful exporter to international customers with around half of Group revenue comes from North America, and the UK is under 10%.

H1 results to June 30 show that revenue was down by £300K to £9.2m, mainly due to a large order in H1 19. Statutory PBT H1 20 was £1.2m, down sharply due to an insurance payout in H1 19. The company has a long history of profitability back more than 20 years, and was profitable through both the financial crisis and the internet bubble bursting. Gross profit margin is currently 53% though RoCE has been trending down from 15% FY 2015 to most recently reported 9.6% Trailing 12M. Balance sheet is strong with £10m of cash end of June, no debt and £22m book value.

Following the RNS, their broker Cenkos raised sales by revenue forecasts by 8% to £20.2m for FY 20F. Basic and Adjusted EPS are 3.1p and 6.1p respectively, putting the stock on adjusted PER 18x FY20F. There are no forecasts for 2021F or 2022F which is surprising since this seems a stable business. Cenkos talk positively about the tailwind of 5G rollout and large-scale network infrastructure upgrades but there are no numbers to back this up.

Institutions: Miton owns 15.9% and Liontrust 11.1%. Jane Annear the Managing Director owns 2.1m shares, just under 3% of the company. Concurrent has also been tipped by Lord Lee in the past, but I’m not sure if he still owns it.

This company looks similar to Solid State which I covered last week. Unlike Solid State they haven’t engaged with either PI world or Investor Meets Company. I phoned an ex-colleague, Bob Huxford their Financial PR man at Newgate, who was kind enough to send me through the broker note. He said that historically the company hasn’t been open to the idea of doing a recorded presentation online to self-directed investors, but this is something that hopefully will change in future. This looks a good quality company, though I would like to understand it better before feeling more confident about future prospects and the potential to increase returns.

Bruce Packard

Notes

*Take Two offer 120p in cash, plus 0.02834 x $190 / 1.32 $/£ exchange rate

** Assuming that High Voltage Enterprise Value does not contain significant debt. Software companies are main consist of intangible assets, so I think this is a safe assumption.

***I’ve seen various different numbers quoted for percentage of CFD traders lose money. 82% comes from an FCA analysis of a representative sample of accounts. CFD providers counter that often the CFD is being used to hedge a position in the equity market, so just using the losing side of a hedging trade is unfair.

https://www.fca.org.uk/publications/policy-statements/ps19-18-restricting-contract-difference-products

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

Weekly Commentary: 21/12/20 – Bidding up Codemasters

The FTSE stayed level around 6580, while Nasdaq hit a new high of 12752.

Bitcoin rose through $20,000 for the first time.

I have a dim memory of a party in South London, around 2006-2007, when someone began trying to convince me that everyone could create their own electronic currency. After all, he said, money held and transferred between bank accounts was just computer code: ones and zeros, the amount of digitised cash stored on banks computers dwarfed paper money already. There are many safe guards to prevent counterfeiting paper cash, but how do those safeguards work for digital money? Napster showed that any song could be digitally copied and shared across the world for free. Why does it take so long and cost so much to transfer digital money? My question was, why would people believe in unproven alternative currencies? Fast forward 15 years, and I still don’t think that there is a rational answer to my question, except that beliefs become established for reasons that are not rational.

That said, I’m really looking forward to when Covid ends, so that it is safe to meet people at parties.

Last week Codemasters received a rival bid from Electronic Arts for 604p, and the shares are now trading higher than 650p suggesting investors believe there will be at least one more bid for the computer games company. I look at IG Group which has also reported strong numbers benefitting from lockdown and Concurrent Technology, which also said it would be ahead of expectations for FY December.

Codemasters bid

Codemasters received a competing bid from Electronic Arts (EA) of 604p in cash valuing the company at £945m. Codemaster’s Board withdrew their previous recommendation of the Take Two offer (120p in cash, 0.02834 shares of Take Two) which values Codemasters at 528p.* That is EA’s bid is a 14% premium to Take Two, plus it is all in cash rather than shares. As of September 30, EA had over $4bn of cash on their balance sheet, and is the second biggest computer game company in the US (after Activision Blizzard) so can easily afford the £945m or $1.2bn.

EA has a number of sports game franchises (FIFA, Madden NFL, NBA, NHL) plus a “Need for Speed” and “Real Racing” franchises that it believes will benefit from collaboration between EA and Codemasters teams. EA also believes they can use their game analytics, central development and technology teams plus support services like quality verification, compliance and localisation skills to create synergies. Interestingly the latter is exactly the area where Keywords Studios operates in, so possibly if the computer game industry consolidates into large, fully integrated companies there will be less need to outsource the non-core activities to KWS?

The Codemasters Board will adjourn the General Meeting which was to be held on 21 December 2020. In response Take-Two put out a statement noting the new offer, and a further announcement may be made.

This looks like good news for shareholders. The shares were up 23% last week, trading above 650p, suggesting that holders of the shares believe that we will see a bidding war, with at least one higher bid. Other UK computer game companies are Sumo, Team 17, Frontier Dev, Keywords Studios. I have shown the SharePad comparison table on the following page: excluding CDM, the forecast PE ratios range from 45x (Team17) to 63x (Frontier Developments) suggesting this is currently a hot sector. Interestingly CDM has the lowest PE ratio in the sector on 34x, and most attractive PEG ratio, despite being the bid target. There’s a whole tutorial on the compare feature here.

Keywords Studios acquisition

Founded in 1993, High Voltage is headquartered in Chicago, and is forecast to make $9m of EBITDA. Keywords is paying $24m in cash, issuing $10m of shares and $17m in a mix of cash and shares. KWS reported €101m of net cash at the end of June this year, so can easily afford the initial $24m in cash. The announcement says that High Voltage worked closely with Epic Games on “Fortnite” – one of the most successful games in recent history, which achieved 125m players within a year of release in 2017.

Keywords acquisition led expansion continues apace. Since their IPO in July 2013 at 123p, Keywords has made around 50 “bolt-on” acquisitions, with a mix of shares and cash. Share count has grown from 40m in 2013 to 73.5m today.

Given the high rating, High Voltage’s $9m EBITDA is around 15% Keywords $60m (H1 20 annualised EBITDA) but consideration is just 2% of KWS market cap. Keywords is currently trading on 36x EV/EBITDA, but is paying 5x the same multiple for High Voltage**.

The shares are trading on over 5x historic revenue, and 55x forecast PER. Though growth in revenue has been spectacular in the last five years, RoCE has been trending down and has now fallen below 10%. I think the high valuation implies that investors believe that RoCE will improve significantly, which may be a challenge give that it is hard to see conditions becoming more attractive for computer games as lockdowns end.

3 years ago I sold this stock at below £10, thinking that the shares were expensive on 34x earnings, and 8x sales. Aside from valuation, I worried that there was significant integration risk with buying so many overseas businesses (there are 7,000 employees spread across 21 countries), however so far management have done well to prove me wrong. The acquisition led growth and lack of own unique game IP (cf Codemasters), means that I doubt that KWS would be an attractive bid target for one of the larger US players. Well done to holders, though I think I would be nervous about the demanding valuations for the whole sector.

IG Group trading update (H1 to 30 Nov)

This online trading company put out a H1 trading statement (six months ending 30 Nov). Q1 (ie June- August) was very strong, even as lockdowns were loosened over the summer, and this continued into Q2 (ie Sept-November) up +71% to £207m v Q2 last year. H1 Net Trading Revenue should be £416m +66% (v previous year H1 250m).

This company has reported very attractive financials, average RoCE in the last 5 years has been 31%. The gross profit margin is 98% and the operating profit margin is 46%. However investors have never really rewarded the company with a high valuation, perhaps fearful of regulatory pressure forcing changes to the business model. The shares tend to be hit by concerns about regulatory intervention, given around 82% of CFD traders lose money.*** As an example, the precipitous 46% drop at the end of 2016 was caused by the FCA releasing a consultation paper proposing stricter rules. There was another similar steep sell of a couple of years later, when the previous Chief Executive’s departure was announced.

The immediate overhang has gone, because the FCA finalised its stricter rules in July 2019 i) limiting leverage ii) guaranteeing traders can’t lose more than the total funds in their trading account iii) banning cash inducements to current and potential customers iv) standardised risk warnings, revealing what percentage of clients lost money. IG Group says 70% of CFD revenue comes from jurisdictions where restrictions on the sale and marketing of CFDs have been implemented.

As so many customers lose money and stop trading, CFD groups have to continue acquiring new customers. IG spent £62m last FY on targeted online marketing, which is presumably going to firms like Tremor, as well as Google and Facebook. That said, retention is also a skill, IG Group say 55% of CFD revenue comes from customers who have been trading with the company for at least 3 years.

IG Group point out that they make money on transactions and Net Trading Revenue is driven by client activity. Unlike some competitors (presumably including Plus500) they do not take the other side of client positions, but lay the risk off in the market. So the IG business model does not benefit from clients’ trading losses, and IG doesn’t lose money when their clients trade profitably. In addition they probably do enjoy some “network effects” as more traders use the platform, they can internalise client flow (individual trades offset each other) and then hedge the residual exposure externally in the market. Investment banks’ trading desks try to do the same, but with institutional flows.

In May 2019 the company set out a 3 year growth strategy, splitting their net trading revenue into

Ironically these targets look too easily achievable now, given that this August they reported FY to May 20 Core Markets was up +29% and Significant Opportunities was +85%.

Both computer games and online trading companies have enjoyed a bonanza in 2020 as people have looked for entertainment in their own homes. Unlike computer games companies where investors are prepared to pay over 50x earnings, IG Group and the other online trading companies are reporting higher level of profitability and a lower valuation.

Management Remuneration: Chief Exec basic salary is £610K, and then is rewarded for i) Total Shareholder Return (25% weighting) ii) an earnings per share target (55% weighting) which in FY 20 was 41% ahead of the maximum target set iii) non-financial strategic metric (20% weighting). Payout will be capped at 500% of salary for the Chief Executive and 400% of salary for the other Executive Directors. To my mind it looks like Executives will enjoy a substantial windfall of gains for performance targets set pre-Covid.

Out of curiosity I have been an IG customer, I was playing with small amounts of money and very disciplined about cutting my losses. I found that I was actually cutting my losses too quickly (from memory I set a 7% down stop loss, and I kept being stopped out). I felt that probably there were easier ways of making money than competing against computer algos (no one has built an algo that identifies ten-baggers yet). Maybe, rather than using their site to trade frequently, investors could enjoy higher returns by owning equity in IG Group? So I think the risks reward profile of investing in IG Group could make sense for some people. I would encourage investors to read the regulatory papers on this and also Stuart Wheeler (the founder) has written a biography.

Concurrent Technologies FY December Trading Update

The Company confirmed in a Trading Statement for FY ending 30 December that it expects to report revenues and profitability ahead of market expectations with cash generation remaining strong.

This company was founded in 1985 and has been listed since 1996 – unfortunately that means their Admission Document is not available on their website. They make computers for commercial and rugged environments, and customers are in the Defence (68% of revenue), Aerospace, Telecoms and Transport sectors. They are also a successful exporter to international customers with around half of Group revenue comes from North America, and the UK is under 10%.

H1 results to June 30 show that revenue was down by £300K to £9.2m, mainly due to a large order in H1 19. Statutory PBT H1 20 was £1.2m, down sharply due to an insurance payout in H1 19. The company has a long history of profitability back more than 20 years, and was profitable through both the financial crisis and the internet bubble bursting. Gross profit margin is currently 53% though RoCE has been trending down from 15% FY 2015 to most recently reported 9.6% Trailing 12M. Balance sheet is strong with £10m of cash end of June, no debt and £22m book value.

Following the RNS, their broker Cenkos raised sales by revenue forecasts by 8% to £20.2m for FY 20F. Basic and Adjusted EPS are 3.1p and 6.1p respectively, putting the stock on adjusted PER 18x FY20F. There are no forecasts for 2021F or 2022F which is surprising since this seems a stable business. Cenkos talk positively about the tailwind of 5G rollout and large-scale network infrastructure upgrades but there are no numbers to back this up.

Institutions: Miton owns 15.9% and Liontrust 11.1%. Jane Annear the Managing Director owns 2.1m shares, just under 3% of the company. Concurrent has also been tipped by Lord Lee in the past, but I’m not sure if he still owns it.

This company looks similar to Solid State which I covered last week. Unlike Solid State they haven’t engaged with either PI world or Investor Meets Company. I phoned an ex-colleague, Bob Huxford their Financial PR man at Newgate, who was kind enough to send me through the broker note. He said that historically the company hasn’t been open to the idea of doing a recorded presentation online to self-directed investors, but this is something that hopefully will change in future. This looks a good quality company, though I would like to understand it better before feeling more confident about future prospects and the potential to increase returns.

Bruce Packard

Notes

*Take Two offer 120p in cash, plus 0.02834 x $190 / 1.32 $/£ exchange rate

** Assuming that High Voltage Enterprise Value does not contain significant debt. Software companies are main consist of intangible assets, so I think this is a safe assumption.

***I’ve seen various different numbers quoted for percentage of CFD traders lose money. 82% comes from an FCA analysis of a representative sample of accounts. CFD providers counter that often the CFD is being used to hedge a position in the equity market, so just using the losing side of a hedging trade is unfair.

https://www.fca.org.uk/publications/policy-statements/ps19-18-restricting-contract-difference-products

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.