Monthly Fund Focus: Beyond AI and the US, an Indian equities ETF, and managing downside risk

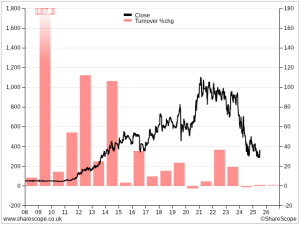

David Stevenson argues the global equity rally is broadening beyond AI and the US, highlighting new opportunities across markets and sectors. He also examines a new Indian equities ETF, revisits HgCapital after its sell-off, and explores how funds can help investors manage downside risk. In this month’s funds article, we examine whether the broad equity