Investors are often intrigued with companies where the share price has fallen a long way. If it can recover, then there could be potential for big gains, especially if the company’s business can improve.

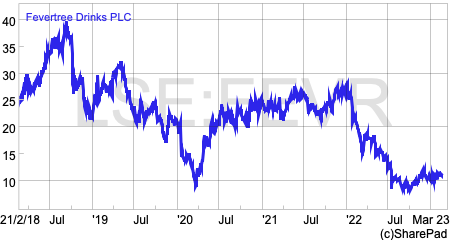

Premium soft drinks company Fevertree was loved by the stock market five years ago, but has experienced a dramatic fall from grace as the strong profit momentum in its business has dried up and reversed. The shares which peaked at nearly £40 in late 2018 now trade at just over £11.

Is the current share price an opportunity for adventurous investors or could more pain still be in store?

Why soft drinks companies can be good investments

Soft drinks are a classic consumer staple product which people buy week in, week out. This means that the companies that make them can have relatively stable revenues and profits and therefore a lower risk profile than more economically sensitive businesses. These characteristics have tended to lead to generous stock market valuations being attached to their shares – especially if it comes with prospect of further growth on top.

This is borne out in the investment performance of a basket of consumer staples shares.

The iShares S&P 500 Consumer Staples exchange traded fund (LSE:ICSU) which contains some of the biggest and most successful sector protagonists in the world has returned a handsome 78.2 per cent to investors over the last five years. That’s better than very popular investment funds such as Fundsmith Equity (+72%) and has thrashed the FTSE-All share index (+30.1%).

In stark contrast, Fevertree’s performance has been disappointing with total shareholder returns of -51.8 per cent.

Why has it all gone wrong for Fevertree shares after its previous stellar performance?

I’m going to use SharePad to help me to try and answer this question.

Business performance snapshot

One of the most useful features of SharePad is its custom financials feature. This allows you to build a table that contains the key items of what you want to look at such as business performance, valuation or trends in a particular measure.

Below is my go to snapshot for quickly weighing up a company.

Note: Phil uses his own custom financial tables and some custom item names e.g. Revenue = Turnover. You can learn how to create your own customer tables with this video: https://www.youtube.com/watch?v=UyU4sNDWsLU

This is very basic analysis but as with many things in life, keeping things simple is no bad thing and can give you a powerful insight into what might be going on with a company.

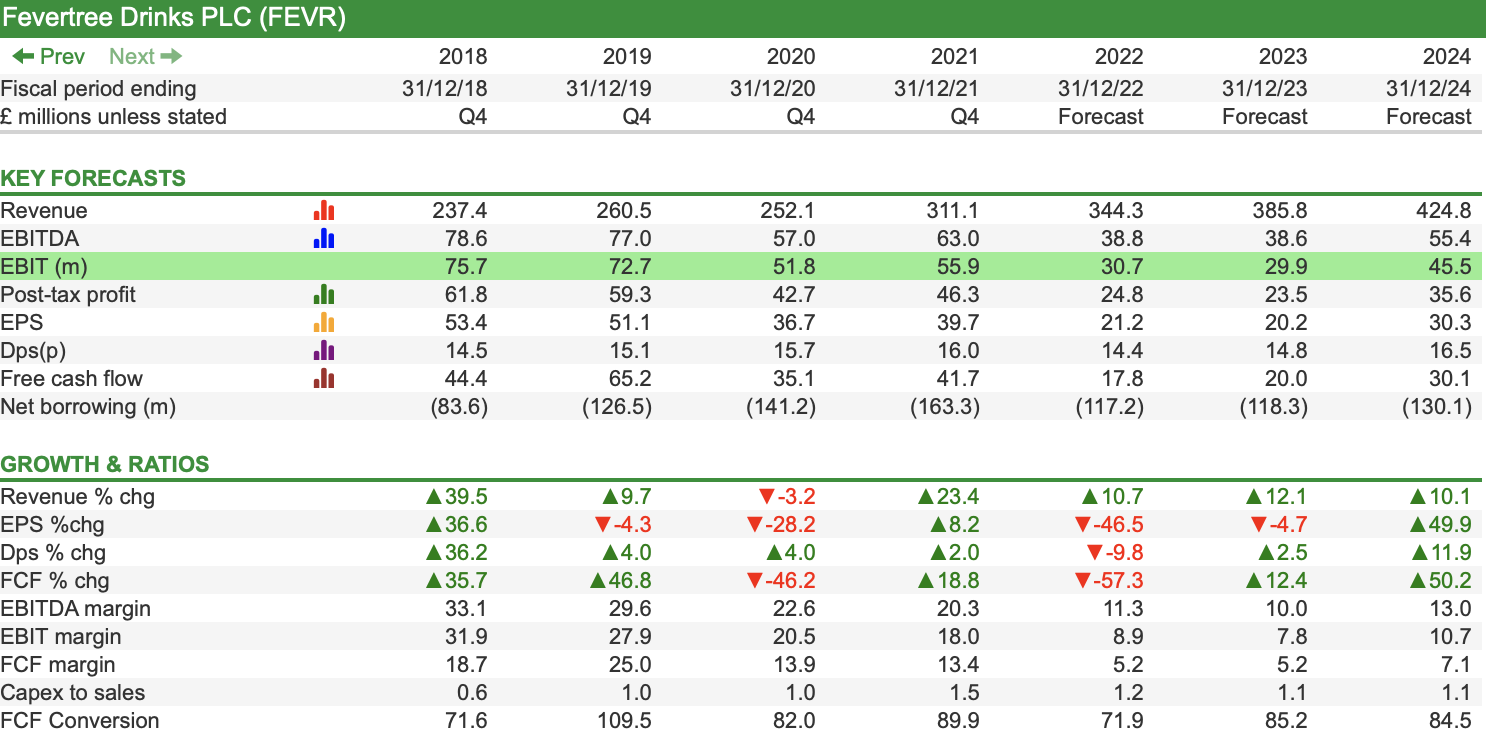

Revenue is the first item I look at. Without revenue growth, I am unlikely to have a successful long-term investment. Fevertree checks out well here.

Revenue growth ideally translates into profit growth. I look at three main measures of profit:

- Gross profit – the profit made from selling products and services before general overhead costs.

- Trading or operating profit or earnings before interest and tax (EBIT) – the profit after all operating costs have been expensed. For me, this is probably the best measure of profit as unlike pre-tax profit or net profit it is not influenced by how the company is financed or the rate of tax on its profits.

- Net profit – the profit that belongs to shareholders.

I’m also looking at trends in how much money is being invested in the business (operating capital); the amount of surplus or free cash flow, cash and borrowing levels. I like companies with healthy cash balances and not too much borrowing because they tend to be less risky.

The trend in the number of shares is something to keep an eye on and is often overlooked. A rising share count can be a warning sign that existing shareholders are continually seeing their stake in the business being diluted.

A stable share count is no bad thing whilst one that is shrinking is a sign that a company is buying back its own shares which can be a good thing providing it is not paying too much for them. It can also be a sign that a company cannot reinvest its cash in wealth creating investments which could mean its ability to grow in the future is limited.

It’s also a good idea to look and see if there are big differences between a company’s adjusted earnings per share (EPS) – a number that is intended to reflect its underlying financial performance and one it wants you to focus on – and its reported EPS which includes all gains and losses. Big differences can be a sign of aggressive accounting which is something you definitely want to check out and stay clear of.

Fevertree is not performing as well as it was

Gross margins tell you how profitable a company is at selling its products and services. Gross profit is defined as revenues less the cost of sales. Gross margin expresses gross profit as a percentage of revenue.

The higher the gross margin, the more profitable a company’s sales are. If a company has a gross margin of 60 per cent that is the same as saying that it makes something for 40 (100 minus 60) and sells it for 100.

Fevertree is selling a premium product for a premium price (its bottles of tonic sell at £4 per litre in Tesco compared with £1.80 for Schweppes and 80p for own label) and this goes a long way to explaining its very high historic gross margins.

However, soaring input costs (especially sea freight, energy and glass) have seen them fall sharply. This largely explains the fall in EBITDA, operating profit and free cash flow margins as well.

When combined with increased growth investment (particularly in working capital such as stock building and trade credit) its return in operating capital employed (ROOCE) is far lower than it was just a few years ago.

The company has had the misfortune to be impacted by Covid-19 which saw pubs, restaurants and travel destinations go into hibernation and soaring costs. This means on key measures of financial performance the business does not look as good as it used to be. That said, many companies would love to still be as profitable.

Getting behind the numbers

Despite its current difficulties, I think Fevertree has developed a highly effective business model. The ongoing uncertainty is whether it can be scaled sufficiently to make its shares a good investment at the current price.

Its key strength is that it has created mixer drinks that tap into the growing long-term trend of people wanting to consume better and more up-market products. This is known as premiumisation.

With a big focus on natural ingredients and fewer calories, the company has been able to grow and gain market share across its chosen markets. It has become the dominant force in premium mixers in the UK and has set about trying to do this in Europe, the US and countries such as Canada, Australia and recently Japan.

One of the company’s biggest growth challenges is getting its products into supermarkets, bars, hotels and leisure outlets. A key requirement for business success is a sizeable and efficient distribution network. This is something which has taken drinks industry giants such as Coca-Cola, Diageo and Pepsi decades to build and get right.

Progress here has been good but it will take time to build scale.

It’s not just about getting the infrastructure on the ground either. The economics of Fevertree’s business are arguably changing as its business has become an international one (two-thirds of sales are outside the UK compared with 50% five years ago).

Fevertree has been able to post impressive ROOCE figures in the past by adopting an asset-light business model. Production, bottling and logistics have been outsourced to third parties leaving the company to focus on ingredients and marketing.

Leveraging highly profitable sales on someone else’s assets has worked wonders in the UK but might not be as easy to do over larger geographic areas. That said, the move to localised production in the US and Australia will reduce the need to pay the current very high shipping costs.

The other thing to consider is whether Fevertree is having to sell at lower gross margins to make distribution gains – particularly in the US. It has previously alluded to tinkering with its pricing and this would not be too surprising.

That said, it is possible that pricing and scale will mean that the kind of returns Fevertree was making in the UK might not be achievable overseas. They probably don’t need to be but they need to be high enough to make the company more valuable.

Fevertree’s ability to grow its revenue is evidence of its highly effective marketing strategy. It has built this up by partnering with global spirits companies and opening themed bars in key transport locations and at big sporting events.

Unlike some of the biggest consumer companies whose product portfolio may have become a bit stale and vulnerable to competition, Fevertree has kept on developing new products to win more customers. Its sparkling pink grapefruit drink has been a hit with tequila and vodka drinkers whilst it has moved into new markets such as cocktail mixers.

These are all good signs of a management team with its fingers on the pulse of the company’s target markets.

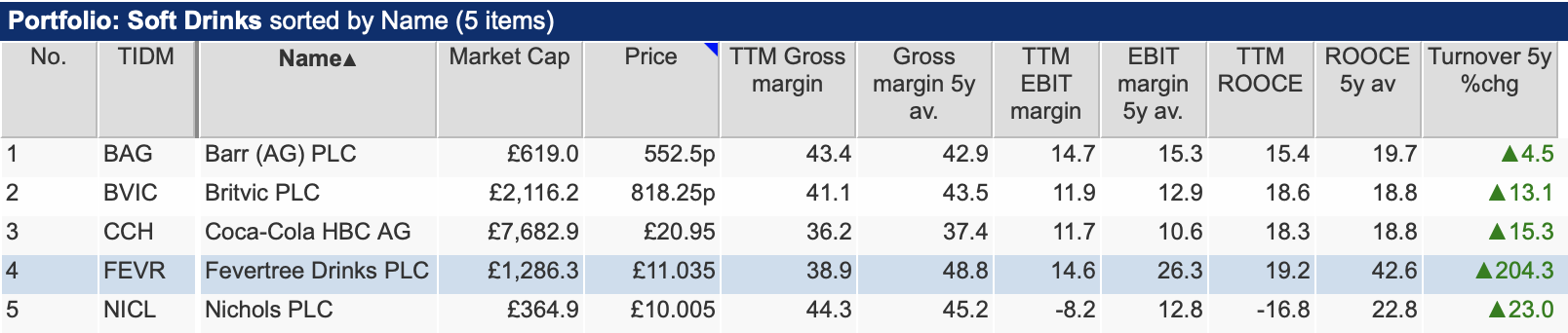

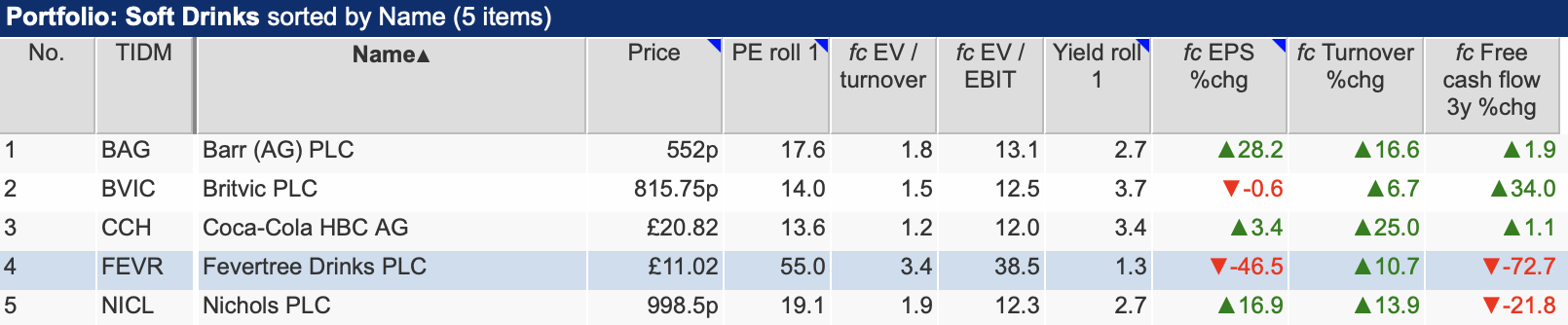

How does Fevertree stack up against its peers?

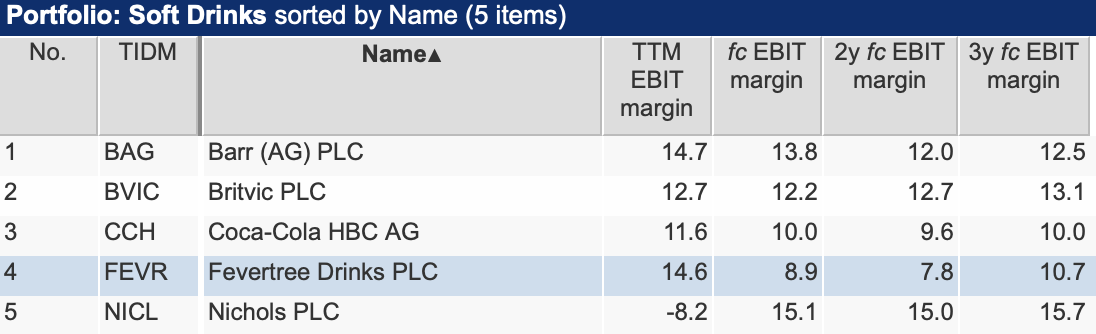

Revenue growth aside, Fevertree is no longer a standout performer in its sector on a measure such as ROOCE. The trend in margins suggests that Fevertree’s performance is likely to get worse before it gets better.

This begs the question as to whether Fevertree deserves to maintain its current large valuation premium.

Can the company recover?

The short answer is yes it could. However, predicting the future profits of many companies is something that investors and analysts don’t tend to be very good at.

A couple of years ago, City analysts were expecting Fevertree to make EPS of around 60p for the year ending December 2022. That number is now expected to be around 20p and explains a great deal behind the company’s slumping share prices.

The problem for investors now, is that very few people see Fevertree’s profitability improving anytime soon.

Strong revenue growth in the US is expected this year as is a recovery in the UK but Europe ended 2022 with very weak sales momentum having previously been a source of strength.

Costs remain a big problem with glass costs alone expected to wipe £20m off profits in 2023. Energy costs could come down given recent trends in oil and gas prices but will probably help profits in 2024 rather than this year.

As sales volumes pick up from local production in the US and Australia, the company should benefit from the economies of scale that have previously served it so well in the UK combined with a significant drop off in sea freight costs.

In more favourable times this would see its margins increase but it looks as if this not going to happen quickly. The underlying progress here is welcome though and will help profits when energy and glass costs hopefully come down.

Looking at current consensus forecasts and putting them into a SharePad custom financial table, the outlook for revenue is something to cheer. Sadly, a recovery in margins looks some way off.

Note: Phil uses his own custom financial tables and some custom item names e.g. Revenue = Turnover. You can learn how to create your own customer tables with this video: https://www.youtube.com/watch?v=UyU4sNDWsLU

Even in 2024, EPS is currently expected to be way below pre-Covid 19 levels on a sales base that could be more than 60 per cent higher. That’s a very sobering prediction

Cost inflation is an industry issue but it seems that Fevertree’s margins are expected to take more of a battering than most of its UK-listed peers over the next few years.

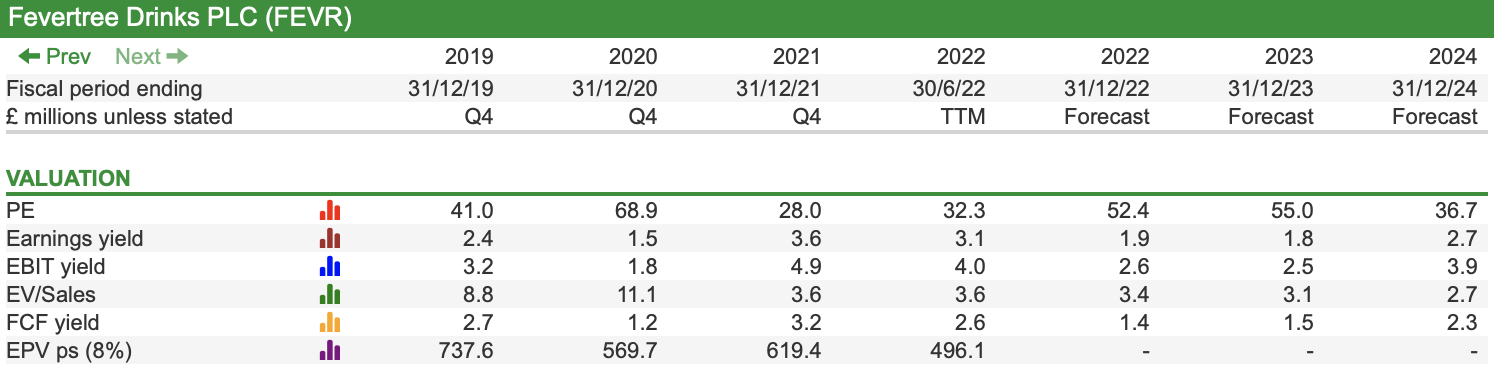

Premium valuation continues to look vulnerable

Note: Phil uses his own custom financial tables and some custom item names e.g. Revenue = Turnover. You can learn how to create your own customer tables with this video: https://www.youtube.com/watch?v=UyU4sNDWsLU

Despite levels of profitability that are no longer outstanding, Fevertree shares continue to trade at a very high valuation which looks hard to justify.

Investors are currently being asked to pay £55 for each £1 of forecast earnings for Fevertree when they could buy the same amount of Coca-Cola Hellenic’s or Britvic’s earnings for about £14.

There is nothing new in this big valuation difference but the investment environment is much different to what it was just a couple of years ago.

We have moved from times where valuation seemed to be a mere afterthought as long as a company’s earnings were growing and forecasts were being revised higher to one where investors are a lot fussier.

Better value seems to exist elsewhere in the UK soft drinks sector. The shares of AG Barr, Britvic Coca-Cola Hellenic and Nichols may be worth a closer look.

One of the biggest killers of investment returns is a contraction in the valuation or rating attached to a company’s profits (known as multiple compression). This is what a higher interest rate world has been doing to highly valued stocks in general over the last year. Where profits disappoint the damage can be even more severe.

On a one-year forecast rolling PE of 55 times, it is unlikely that a higher rating is going to be a source of positive investor returns for Fevertree shareholders right now.

Earnings growth – the other key long-term driver – looks difficult in the short term. Dividends are not going to be a material source of shareholder returns given the low dividend yield and modest outlook for dividend growth.

That said, Fevertree did pay out some of its sizeable cash balance last year with a 42.9p special dividend and further one-off payments are possible.

In a nutshell, it looks hard to make money from Fevertree’s shares at the current share price. Losing money looks more likely. I can’t predict the future, but if Fevertree shares were substantially lower than they are now over the next few years I would not be surprised.

Taking a more optimistic tone, a resolution to the ongoing conflict in Ukraine and a sharp reduction of input cost inflation that would probably follow could see a healthy bounce in the share price.

A takeover is possible given the attraction of the company’s products. That said, paying a premium on an existing high valuation reduces the financial attraction to a buyer.

It also has to be questioned as to whether acquiring a business, even with pre-covid levels of profitability, would add much to the business or value of the soft drinks and spirits giants.

~

Phil Oakley

Got some thoughts on this week’s article from Phil? Share these in the SharePad chat. Login to SharePad – click on the chat icon in the top right – select or search for a specific share.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.