The VIX index is currently below 16, signalling some complacency may be creeping back into markets, so Bruce looks at the deterioration in near term liquidity measures. Stocks covered: SDI, D4T4 and JIM.

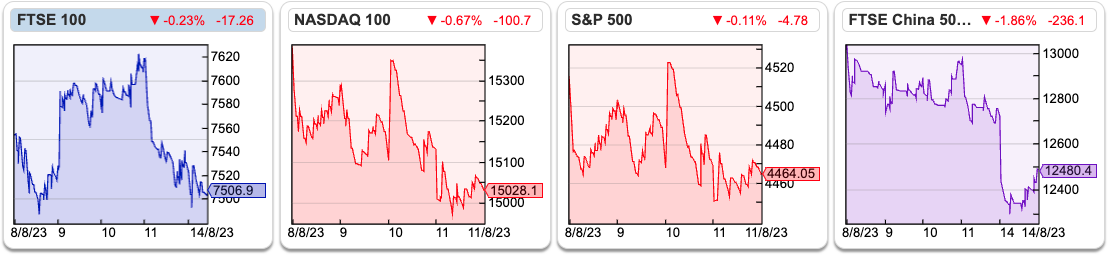

The FTSE 100 was down -0.6% to 7,509, while the Nasdaq100 fell -1.6% and the S&P500 was down -0.3%. The price of Natural Gas (ticker NG-MT) +8% in the last five trading days has started to rise while copper was down -3.5% over the same time period and has fallen below both its 16 day and 64 day moving average. Mike Howell at Crossborder Capital is warning that liquidity is beginning to drain out of global markets, but not because Central Banks like the BoE, Federal Reserve and ECB are raising interest rates. Instead, the Japanese Central Bank’s Yield Curve Control means that the yield on long dated bonds has risen (so the price of Japanese bonds fall) which in turn means that if borrowers are using these bonds as collateral, they face a bigger haircut. This means government bond yields across the globe are likely to rise, if that’s the case then “growth” stocks that have had a strong start to the year may also fall.

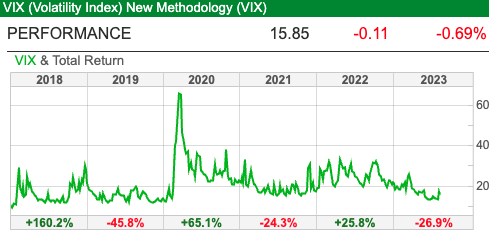

Crossborder’s Global Liquidity Index (GLI) fell back to 16.5 (normal range 0-100) at the end of last month from 20.9 in June. Their July datapoint gives the lowest reading since January, signalling growing liquidity tensions. The fall is largely down to weaker Private Sector Liquidity (25 from 32) and weaker Cross-border Flows (44 from 57). Howell suggests that the US 10Y Govt bond yield, currently 4.2%, is more likely to rise above 5% than fall back to 3.5%. The VIX volatility index (Sharepad ticker: VIX) is currently below 16, which could be signalling that investors are too relaxed about risk/reward in the coming months.

One way of understanding the 2007-9 financial crisis, and the Eurozone crisis that followed it 2011-2 was in terms of cross border flows of capital. Countries with persistent trade deficits like the USA and UK needed to offer trade surplus countries something in return for the goods that they were importing. This led to a situation where foreign countries, particularly China and oil-exporting nations like Saudi Arabia, were accumulating large amounts of US dollars debts due to their trade surpluses.

The financial imbalances were so large that there wasn’t enough government debt to fund this, so investment banks (with the help of rating agencies like S&P and Moody’s) created AAA rated securities from household debt, mainly mortgages. When these supposedly “risk free” assets turned out to be worthless, this created a crisis. Within the Eurozone something similar happened, but in this instance German and French banks were lending into the Greek banking system and buying Greek government debt, on the implicit understanding that the ECB would protect them from the credit risk. The debt burden of Greece, and other countries like Portugal, Ireland and Spain, was unsustainable though, causing banks to re-evaluate the “risk free” nature of lending cross border in Euros.

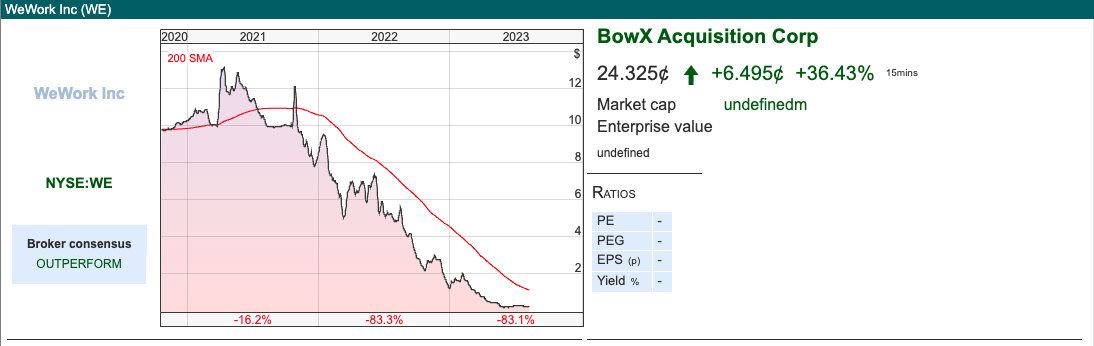

Fast forward a decade, and gulf states may have learnt their lesson. Rather than cross border debt, they have begun to invest in equity, for instance high profile intangible trophy assets like sports teams (Man City, Newcastle FC, Paris St Germain) and pre-IPO Venture Capital stories like Uber and WeWork, (ticker NYSE:WE, but officially called BowX after the SPAC it merged into giving it a $9bn market cap). It seems likely that many of these cross-border investments will disappoint though. WE was once valued at $47bn, however management said last week that it faces “substantial doubt” about its ability to continue as a going concern. The WE market cap is currently less than $400m.

If WeWork collapses, the Vision Fund and the Saudis will lose money, but I think will be less of a systemic collapse than when Lehman Brothers failed. Cross border flows of capital need to go somewhere, but by its nature it’s hard to generate a high return on surplus capital (that’s why it is called surplus). The German Landesbanken faced the same problem in the 1990s and 2000’s.

That said, rather than aiming a firehose of money at US Venture Capital, it would be nice if the “dumb money” invested in some of the overlooked FTSE and AIM shares that I own. This week I look at SDI results and D4T4, followed by a brief comment on JIM.

SDI FY April Results

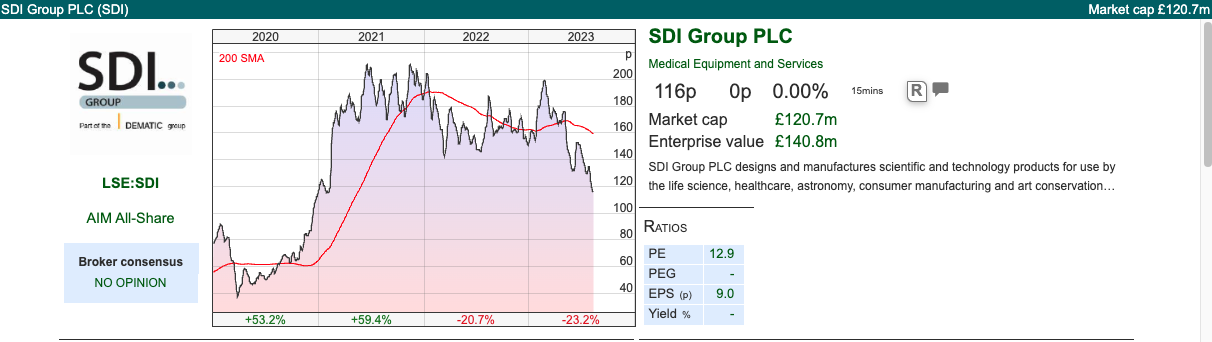

This scientific instruments maker and optic lenses specialist with an April year end is down -23% YTD. They reported trading “in line” in May for FY Apr 2023, but FinnCap their broker slashed EPS forecasts for FY Apr 2024F by -21% to 7.3p, which I covered here.

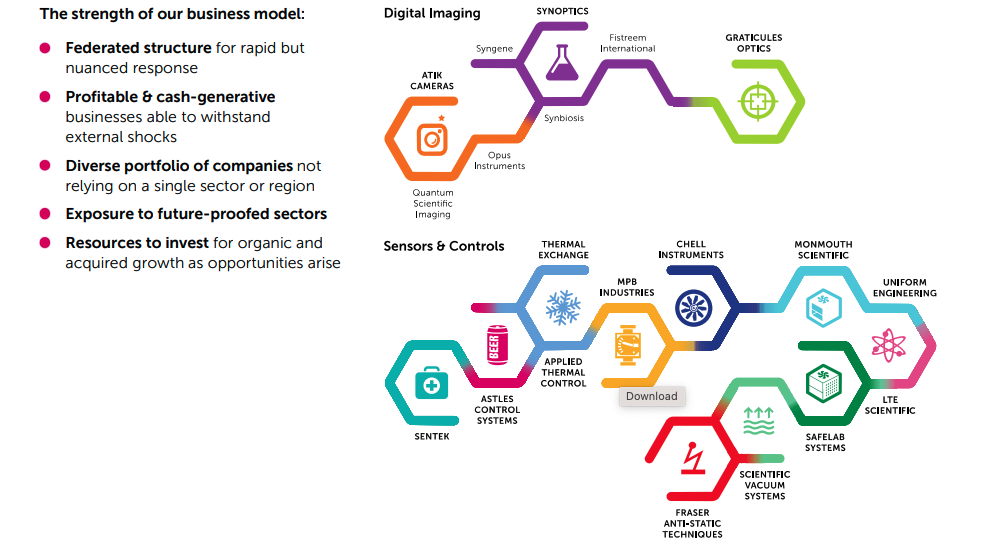

Last week SDI announced FY April results, with revenues +36% to £68m, but reported PBT down -41% to £5.8m. Adjusting out amortisation, goodwill writedowns, acquisition costs and share-based payments the results were in-line. The group has made 17 acquisitions since 2015, so perhaps for such an acquisitive company, we should pay attention to these non-cash items.

Around half of revenues comes from overseas, and they operate out of 20 locations worldwide with c. 530 employees. The +36% revenue growth has come from companies that they’ve recently bought, LTE (July 2022 for £5.4m), Fraser Anti Static Techniques (FAST for £17m in Oct 2022,) plus in the previous financial year Scientific Vacuum Systems (January 2022) and Safelab (March 2022). Absent those acquisitions and revenue growth drops from +36% to +1% on an organic basis. Given that organic growth was just under +4% in H1, that implies the group was going backwards on an H2 v H2 last year basis.

Management took a £3.5m impairment charge against Monmouth Scientific and Uniform acquisitions, plus a £1.8m amortisation charge for intangible assets, £351K of share-based payments and £331K of acquisition costs, all of which reduced reported PBT to £5.8m. That £3.5m impairment charge looks high, given that SDI bought Monmouth in 2020 for £6.1m. According to Martin Flitton, who has spoken with management, the business is overcoming the problematic issues related to the writedown, with a change of Monmouth’s leadership it is now on track to deliver half a million pounds of profit this year (versus £400K when they bought the business in Dec 2020).

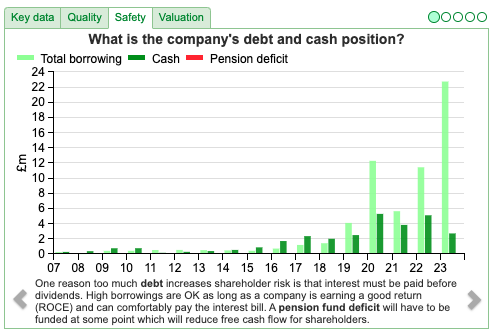

Net debt ex lease liabilities and contingent consideration was £13.3m April 2023 versus £1.1m net cash 12 months before then. Management suggest that they have an unstretched balance sheet, but worth noting that following the impairment writedown the face of the balance sheet shows £41.35m of intangible assets, which is slightly higher than shareholders’ equity of £41.26m. Net debt including contingent consideration for past acquisitions rises by just under £1m to £14.25m.

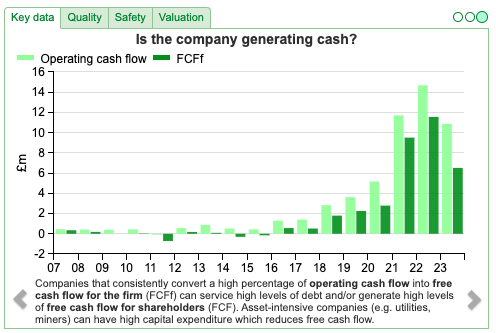

That looks reasonable, as long as the business continues to generate healthy cashflow and management don’t take on too much more debt to fund acquisitions. Management’s commentary and FinnCap’s broker note both suggests that more acquisitions are likely though. Management say that their financial position is “unstretched”; I would be more cautious. Depending how the economy progresses this feels like the wrong time to be borrowing money to buy other companies. I’m not against SDI making further acquisitions, but there may be more attractive opportunities in 12 months’ time. Cashflow from operations before working capital movement and taxes was £15m, but drops to below £8m after working capital (£4m), interest (£1m) taxes paid (£3m).

Outlook: Management expect to deliver FY April 2024F in line with revenue and profit expectations. They mention supply chain difficulties as well as challenges finding good staff, plus higher interest costs as rates rise. FinnCap are forecasting a -21% fall in EPS Apr 2024F to 7.2p and introduce Apr 2025F forecasts of 8.1p. In other words FY Apr 2023 just reported was peak earnings, due to the one off nature of their Atik Camera’s PCR business.

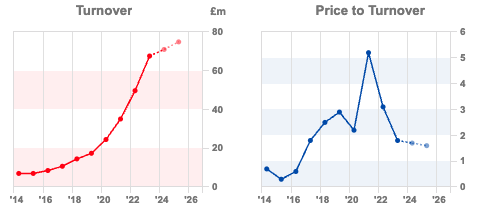

Valuation: That puts the shares on 16x PER Apr 2024F and 14x PER Apr 2025F. The 3 year average RoCE is attractive, but lower than JDG (RoCE 23% 3 year average) to which it is often compared. The price/sales ratio has de-rated to below 2x versus above 5x a couple of years ago.

Opinion: The shares have fallen steeply, down -40% from March this year. I own the shares, but feel like in the near term they might become cheaper, before growing into their previous valuation. Below £1 per share I think I would look to increase my position. There’s also a video on InvestorMeetCompany which I haven’t watched yet.

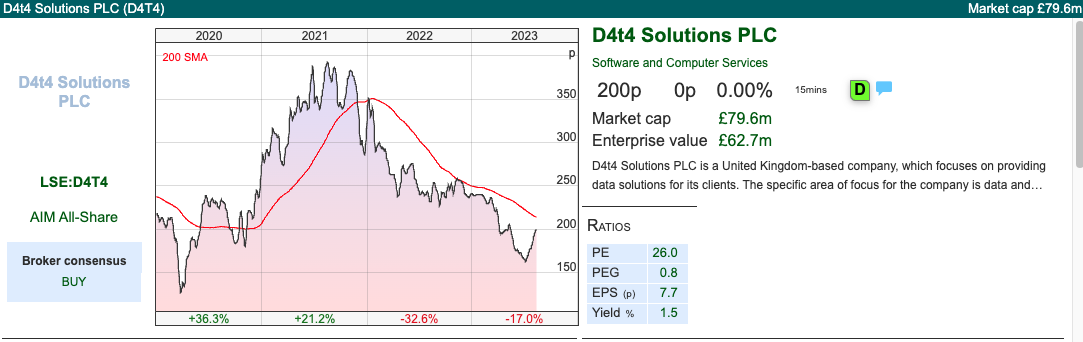

D4T4 AGM Trading Update (FY Mar 2024F)

I last covered this company in July 2021, when I suggested that management departures might signal a more difficult future. D4T4 provides enterprise software and fraud protection through the Celebrus software and data platform. In June 2021 the Chief Exec/co-Founder Peter Kear stepped down, another co-Founder was also leaving, as was the Finance Director. On top of that, the company reported trading “in line with expectations” for the new financial year (then FY Mar 2022). Yet similar to SDI in May this year, despite reporting “in-line” trading, FinnCap their broker reduced their forecasts for adj PBT by -31% to £3.8m. The reduction was caused by higher costs, mainly marketing spend to roll out a new fraud prevention product. I noted at the time the company was trading on 55x forecast PER, which left very little room for error. As a reminder, investors need to be careful of any RNS saying that results are “in line” if at the same time management are quietly asking their broker to cut forecasts.

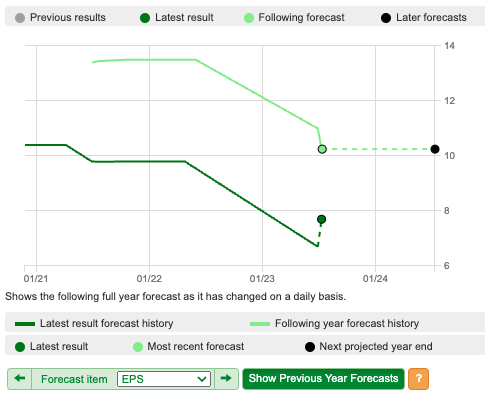

My caution in July 2021 now seems a good call, because the share price has fallen by more than half since July two years ago. More recently D4T4 shares enjoyed a bounce, so I now think it could be worth re-visiting the investment case, especially as now it looks like there is now some upward pressure on forecasts.

Last week they announced a contract win from an existing banking customer. Originally, D4T4 had expected the contract to be signed off in FY Mar 2023, management say that this contract win accounts for a large proportion of the revenue shortfall in the most recent set of results. FY Mar 2023 results were released in early July, showing revenue down -13% to £21m, versus FinnCap’s original forecast for FY Mar 2023 of £27m. One last aspect to mention is that the contract includes a high proportion of lower margin software, which implies to me that we might see pressure on the gross and EBIT margin level (60% gross margin, EBIT margin 11% FY Mar 2023).

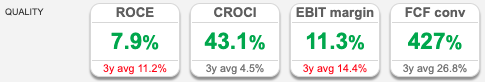

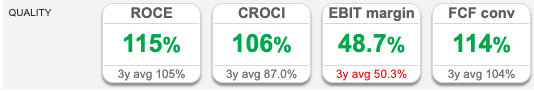

The company reported a cash balance of £17m at the end of March this year, up from £11m the previous March. They don’t feel the need to mention a “strong balance sheet” in last week’s RNS. Pleasingly the company’s trade receivables fell from £25m March 2022 to under £5m, which means that Sharepad’s CRoCI and FCF conversion metrics look very healthy as the company has now been paid for the work it has done.

Forecasts: FinnCap haven’t changed their numbers following the AGM statement, but they are forecasting +51% revenue growth for FY Mar 2024F and +27% of EPS growth to 9.8p the same year. They also forecasts revenue grow to £39m of revenue FY Mar 2026F and 14p of EPS FY Mar 2026F.

Valuation: FinnCaps forecasts put the shares on a PER of 20x Mar 2024F falling to 14x PER Mar 2026F. They are also trading on 2.5x price/sales ratio. That looks to me a reasonable Growth at a Reasonable Price valuation.

Opinion: This share now looks interesting again to me. I already own a couple of B2B software companies (Arcontect, ActiveOps, Vianet) and investors can find it hard to compare the strengths and weaknesses of these different enterprise software companies from the outside. If readers have contacts who are familiar with the software and the competitor products, that could prove a real edge.

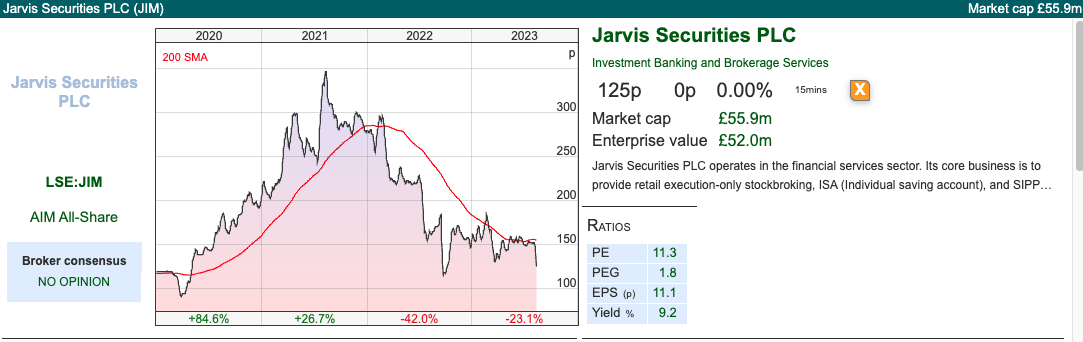

Jarvis Securities FY Dec Trading Update

This execution only stock broking firm seems to have got itself into a regulatory muddle. They first announced a problem in September last year, which saw the share price halve in value to around 90p per share. It looked like they had put these problems behind them with a “skilled persons review”, but the share price fell -18% last week, when they announced a below expectations trading update, with the company severing ties with some “Model B” clients, whose business does not meet their risk tolerance anymore.

Forecasts cut: Their broker, WH Ireland cut their revenue forecast for FY Dec 2024F by -10% to £12.9m (that compares to £14.3m peak revenue in FY Dec 2021). Somewhat surprisingly the broker cut FY Dec 2024F EPS by just -6% to 12.3p, although that adj EPS figure excludes costs from the Skilled Person Enquiry which is still ongoing. That would put the shares on a PER of 10x Dec 2024F.

The business is a good example of high margin, high RoCE company, with a shrinking top line. The low rating of 10x PER is justified if revenue continues to go backwards. However, if they can grow revenue again, without investing significant amounts of money, then the incremental returns on capital will be high (3 year RoCE 105% – that’s similar to GAW), and then the share price ought to re-rate.

Opinion: I feel like the company ought to explain clearly what’s gone wrong. Probably they can’t specifically name the clients they are walking away from for legal reasons (cf Nigel Farage and Coutts Bank fiasco), but vague comments about Model B clients aren’t really helping the investment case.

This is another stock which ought to benefit from stockmarket activity picking up, and with £5.2m of net cash at the end of July, ought to be less risky than the likes of RBGP. More than half the shares are owned by members of the Grant family, and Miton is the only institution with a disclosable stake on the register. For a company of this size, I would have thought they should be trying harder to attract retail investors, explaining what’s gone wrong and telling a compelling story about future returns.

Bruce Packard

Notes

The author owns shares in SDI.

Bruce co-hosts the Investors’ Roundtable Podcast with Roland Head, Mark Simpson and Maynard Paton. To listen you can sign up here: https://privateinvestors.supercast.com/

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

Weekly Market Commentary | 15/08/23 | SDI, D4T4, JIM | Cross border imbalances creating instability

The VIX index is currently below 16, signalling some complacency may be creeping back into markets, so Bruce looks at the deterioration in near term liquidity measures. Stocks covered: SDI, D4T4 and JIM.

The FTSE 100 was down -0.6% to 7,509, while the Nasdaq100 fell -1.6% and the S&P500 was down -0.3%. The price of Natural Gas (ticker NG-MT) +8% in the last five trading days has started to rise while copper was down -3.5% over the same time period and has fallen below both its 16 day and 64 day moving average. Mike Howell at Crossborder Capital is warning that liquidity is beginning to drain out of global markets, but not because Central Banks like the BoE, Federal Reserve and ECB are raising interest rates. Instead, the Japanese Central Bank’s Yield Curve Control means that the yield on long dated bonds has risen (so the price of Japanese bonds fall) which in turn means that if borrowers are using these bonds as collateral, they face a bigger haircut. This means government bond yields across the globe are likely to rise, if that’s the case then “growth” stocks that have had a strong start to the year may also fall.

Crossborder’s Global Liquidity Index (GLI) fell back to 16.5 (normal range 0-100) at the end of last month from 20.9 in June. Their July datapoint gives the lowest reading since January, signalling growing liquidity tensions. The fall is largely down to weaker Private Sector Liquidity (25 from 32) and weaker Cross-border Flows (44 from 57). Howell suggests that the US 10Y Govt bond yield, currently 4.2%, is more likely to rise above 5% than fall back to 3.5%. The VIX volatility index (Sharepad ticker: VIX) is currently below 16, which could be signalling that investors are too relaxed about risk/reward in the coming months.

One way of understanding the 2007-9 financial crisis, and the Eurozone crisis that followed it 2011-2 was in terms of cross border flows of capital. Countries with persistent trade deficits like the USA and UK needed to offer trade surplus countries something in return for the goods that they were importing. This led to a situation where foreign countries, particularly China and oil-exporting nations like Saudi Arabia, were accumulating large amounts of US dollars debts due to their trade surpluses.

The financial imbalances were so large that there wasn’t enough government debt to fund this, so investment banks (with the help of rating agencies like S&P and Moody’s) created AAA rated securities from household debt, mainly mortgages. When these supposedly “risk free” assets turned out to be worthless, this created a crisis. Within the Eurozone something similar happened, but in this instance German and French banks were lending into the Greek banking system and buying Greek government debt, on the implicit understanding that the ECB would protect them from the credit risk. The debt burden of Greece, and other countries like Portugal, Ireland and Spain, was unsustainable though, causing banks to re-evaluate the “risk free” nature of lending cross border in Euros.

Fast forward a decade, and gulf states may have learnt their lesson. Rather than cross border debt, they have begun to invest in equity, for instance high profile intangible trophy assets like sports teams (Man City, Newcastle FC, Paris St Germain) and pre-IPO Venture Capital stories like Uber and WeWork, (ticker NYSE:WE, but officially called BowX after the SPAC it merged into giving it a $9bn market cap). It seems likely that many of these cross-border investments will disappoint though. WE was once valued at $47bn, however management said last week that it faces “substantial doubt” about its ability to continue as a going concern. The WE market cap is currently less than $400m.

If WeWork collapses, the Vision Fund and the Saudis will lose money, but I think will be less of a systemic collapse than when Lehman Brothers failed. Cross border flows of capital need to go somewhere, but by its nature it’s hard to generate a high return on surplus capital (that’s why it is called surplus). The German Landesbanken faced the same problem in the 1990s and 2000’s.

That said, rather than aiming a firehose of money at US Venture Capital, it would be nice if the “dumb money” invested in some of the overlooked FTSE and AIM shares that I own. This week I look at SDI results and D4T4, followed by a brief comment on JIM.

SDI FY April Results

This scientific instruments maker and optic lenses specialist with an April year end is down -23% YTD. They reported trading “in line” in May for FY Apr 2023, but FinnCap their broker slashed EPS forecasts for FY Apr 2024F by -21% to 7.3p, which I covered here.

Last week SDI announced FY April results, with revenues +36% to £68m, but reported PBT down -41% to £5.8m. Adjusting out amortisation, goodwill writedowns, acquisition costs and share-based payments the results were in-line. The group has made 17 acquisitions since 2015, so perhaps for such an acquisitive company, we should pay attention to these non-cash items.

Around half of revenues comes from overseas, and they operate out of 20 locations worldwide with c. 530 employees. The +36% revenue growth has come from companies that they’ve recently bought, LTE (July 2022 for £5.4m), Fraser Anti Static Techniques (FAST for £17m in Oct 2022,) plus in the previous financial year Scientific Vacuum Systems (January 2022) and Safelab (March 2022). Absent those acquisitions and revenue growth drops from +36% to +1% on an organic basis. Given that organic growth was just under +4% in H1, that implies the group was going backwards on an H2 v H2 last year basis.

Management took a £3.5m impairment charge against Monmouth Scientific and Uniform acquisitions, plus a £1.8m amortisation charge for intangible assets, £351K of share-based payments and £331K of acquisition costs, all of which reduced reported PBT to £5.8m. That £3.5m impairment charge looks high, given that SDI bought Monmouth in 2020 for £6.1m. According to Martin Flitton, who has spoken with management, the business is overcoming the problematic issues related to the writedown, with a change of Monmouth’s leadership it is now on track to deliver half a million pounds of profit this year (versus £400K when they bought the business in Dec 2020).

Net debt ex lease liabilities and contingent consideration was £13.3m April 2023 versus £1.1m net cash 12 months before then. Management suggest that they have an unstretched balance sheet, but worth noting that following the impairment writedown the face of the balance sheet shows £41.35m of intangible assets, which is slightly higher than shareholders’ equity of £41.26m. Net debt including contingent consideration for past acquisitions rises by just under £1m to £14.25m.

That looks reasonable, as long as the business continues to generate healthy cashflow and management don’t take on too much more debt to fund acquisitions. Management’s commentary and FinnCap’s broker note both suggests that more acquisitions are likely though. Management say that their financial position is “unstretched”; I would be more cautious. Depending how the economy progresses this feels like the wrong time to be borrowing money to buy other companies. I’m not against SDI making further acquisitions, but there may be more attractive opportunities in 12 months’ time. Cashflow from operations before working capital movement and taxes was £15m, but drops to below £8m after working capital (£4m), interest (£1m) taxes paid (£3m).

Outlook: Management expect to deliver FY April 2024F in line with revenue and profit expectations. They mention supply chain difficulties as well as challenges finding good staff, plus higher interest costs as rates rise. FinnCap are forecasting a -21% fall in EPS Apr 2024F to 7.2p and introduce Apr 2025F forecasts of 8.1p. In other words FY Apr 2023 just reported was peak earnings, due to the one off nature of their Atik Camera’s PCR business.

Valuation: That puts the shares on 16x PER Apr 2024F and 14x PER Apr 2025F. The 3 year average RoCE is attractive, but lower than JDG (RoCE 23% 3 year average) to which it is often compared. The price/sales ratio has de-rated to below 2x versus above 5x a couple of years ago.

Opinion: The shares have fallen steeply, down -40% from March this year. I own the shares, but feel like in the near term they might become cheaper, before growing into their previous valuation. Below £1 per share I think I would look to increase my position. There’s also a video on InvestorMeetCompany which I haven’t watched yet.

D4T4 AGM Trading Update (FY Mar 2024F)

I last covered this company in July 2021, when I suggested that management departures might signal a more difficult future. D4T4 provides enterprise software and fraud protection through the Celebrus software and data platform. In June 2021 the Chief Exec/co-Founder Peter Kear stepped down, another co-Founder was also leaving, as was the Finance Director. On top of that, the company reported trading “in line with expectations” for the new financial year (then FY Mar 2022). Yet similar to SDI in May this year, despite reporting “in-line” trading, FinnCap their broker reduced their forecasts for adj PBT by -31% to £3.8m. The reduction was caused by higher costs, mainly marketing spend to roll out a new fraud prevention product. I noted at the time the company was trading on 55x forecast PER, which left very little room for error. As a reminder, investors need to be careful of any RNS saying that results are “in line” if at the same time management are quietly asking their broker to cut forecasts.

My caution in July 2021 now seems a good call, because the share price has fallen by more than half since July two years ago. More recently D4T4 shares enjoyed a bounce, so I now think it could be worth re-visiting the investment case, especially as now it looks like there is now some upward pressure on forecasts.

Last week they announced a contract win from an existing banking customer. Originally, D4T4 had expected the contract to be signed off in FY Mar 2023, management say that this contract win accounts for a large proportion of the revenue shortfall in the most recent set of results. FY Mar 2023 results were released in early July, showing revenue down -13% to £21m, versus FinnCap’s original forecast for FY Mar 2023 of £27m. One last aspect to mention is that the contract includes a high proportion of lower margin software, which implies to me that we might see pressure on the gross and EBIT margin level (60% gross margin, EBIT margin 11% FY Mar 2023).

The company reported a cash balance of £17m at the end of March this year, up from £11m the previous March. They don’t feel the need to mention a “strong balance sheet” in last week’s RNS. Pleasingly the company’s trade receivables fell from £25m March 2022 to under £5m, which means that Sharepad’s CRoCI and FCF conversion metrics look very healthy as the company has now been paid for the work it has done.

Forecasts: FinnCap haven’t changed their numbers following the AGM statement, but they are forecasting +51% revenue growth for FY Mar 2024F and +27% of EPS growth to 9.8p the same year. They also forecasts revenue grow to £39m of revenue FY Mar 2026F and 14p of EPS FY Mar 2026F.

Valuation: FinnCaps forecasts put the shares on a PER of 20x Mar 2024F falling to 14x PER Mar 2026F. They are also trading on 2.5x price/sales ratio. That looks to me a reasonable Growth at a Reasonable Price valuation.

Opinion: This share now looks interesting again to me. I already own a couple of B2B software companies (Arcontect, ActiveOps, Vianet) and investors can find it hard to compare the strengths and weaknesses of these different enterprise software companies from the outside. If readers have contacts who are familiar with the software and the competitor products, that could prove a real edge.

Jarvis Securities FY Dec Trading Update

This execution only stock broking firm seems to have got itself into a regulatory muddle. They first announced a problem in September last year, which saw the share price halve in value to around 90p per share. It looked like they had put these problems behind them with a “skilled persons review”, but the share price fell -18% last week, when they announced a below expectations trading update, with the company severing ties with some “Model B” clients, whose business does not meet their risk tolerance anymore.

Forecasts cut: Their broker, WH Ireland cut their revenue forecast for FY Dec 2024F by -10% to £12.9m (that compares to £14.3m peak revenue in FY Dec 2021). Somewhat surprisingly the broker cut FY Dec 2024F EPS by just -6% to 12.3p, although that adj EPS figure excludes costs from the Skilled Person Enquiry which is still ongoing. That would put the shares on a PER of 10x Dec 2024F.

The business is a good example of high margin, high RoCE company, with a shrinking top line. The low rating of 10x PER is justified if revenue continues to go backwards. However, if they can grow revenue again, without investing significant amounts of money, then the incremental returns on capital will be high (3 year RoCE 105% – that’s similar to GAW), and then the share price ought to re-rate.

Opinion: I feel like the company ought to explain clearly what’s gone wrong. Probably they can’t specifically name the clients they are walking away from for legal reasons (cf Nigel Farage and Coutts Bank fiasco), but vague comments about Model B clients aren’t really helping the investment case.

This is another stock which ought to benefit from stockmarket activity picking up, and with £5.2m of net cash at the end of July, ought to be less risky than the likes of RBGP. More than half the shares are owned by members of the Grant family, and Miton is the only institution with a disclosable stake on the register. For a company of this size, I would have thought they should be trying harder to attract retail investors, explaining what’s gone wrong and telling a compelling story about future returns.

Bruce Packard

Notes

The author owns shares in SDI.

Bruce co-hosts the Investors’ Roundtable Podcast with Roland Head, Mark Simpson and Maynard Paton. To listen you can sign up here: https://privateinvestors.supercast.com/

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.