The market saw a boom in new listings in 2020 and 2021 as companies were greedy to slurp on the capital market teat that provided fertile ground for rocketing IPOs.

Companies would list and there would be a huge secondary market in order to lap up the stock and push the price to closing highs.

Demand for the stock market had not been seen like that since the Dotcom days, where IPOs and placings were often heavily oversubscribed. In one instance I was scaled back 97.5% – meaning I received only 2.5% of my intended allocation. But it had already more than doubled in price before the opening bell went, and so I let it go for a quick profit in the premarket.

Some of these companies have even gone bust. Last year I wrote about The 90% Club – a number of stocks that had fallen more than 90% of their listing price.

There were the original members:

- Pro Cook

- Made

- Parsley Box

- Victorian Plumbing

- Music Magpie

Two of these (Made and Parsley Box) are no longer with us.

Pro Cook is not far from all-time lows.

Victoria Plumbing is still nearly down 75%.

And Music Magpie is now more than 90% down.

But how have recent IPOs done?

World Chess (CHSS)

World Chess (CHSS) listed in April.

It’s spent most of its days barely trading since listing. But given its opening price was 6.25p the company must be pleased. It’s certainly better than being lower than its IPO price even if nobody ever buys or sells the stock.

Seed Capital Solutions (SCSP)

Seed Capital Solutions listed a day later.

It’s traded only four days in the last five months.

There have been a few more prominent listings on AIM.

Ocean Harvest Technology Group (OHT)

Whilst Ocean Harvest Technology Group got off to a great start, it’s now trading at all-time lows.

It’s a niche a commercial-scale producer of seaweed blend ingredients for the animal feed market.

It produces seaweed blend ingredients for animal feed under the brand name ‘OceanFeed’ – feed ingredients for multiple species of animals.

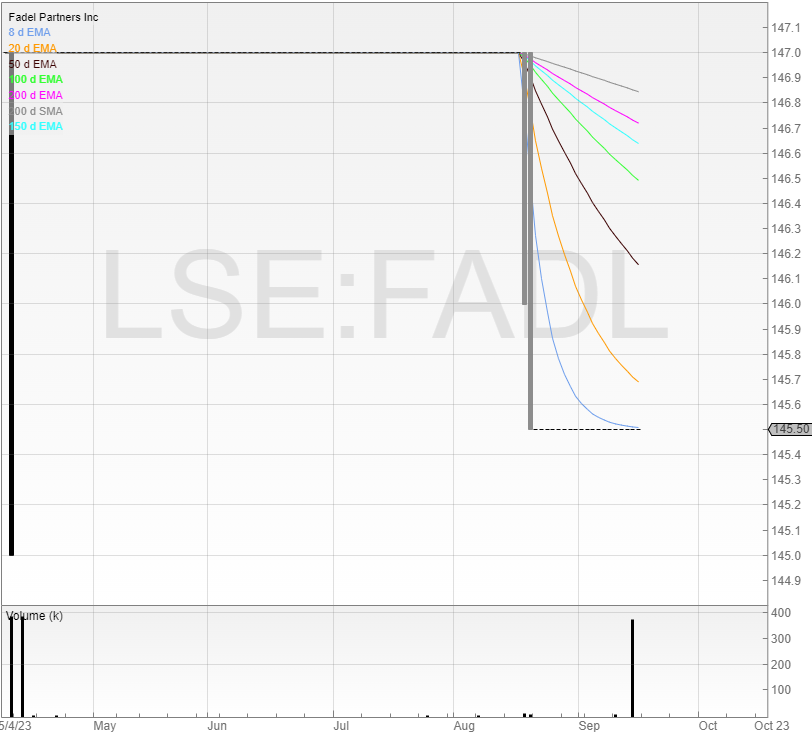

Fadel Partners (FADL)

Fadel Partners is slightly less niche.

It’s a developer of cloud-based brand compliance and rights and royalty management software, working with some licenses and licensees across media, entertainment, publishing, consumer brands, and hi-tech/gaming companies.

Fadel has two segments subscription and support revenue; and professional services.

But even though it’s in an industry more recognised to investors the stock is trading just 0.5p above its opening price, again, with many periods of no trades.

Admiral Acquisition (ADMR)

Admiral Acquisition – the biggest listing in recent months at £439.8 million on admission – has failed to capture any excitement.

Perhaps part of that is because it’s an acquisition vehicle – and so far has not made any acquisitions.

Arm Holdings (ARM.O)

Arm Holdings made a return to the market (but not the UK one) listing on the Nasdaq on Thursday.

The IPO price was revised downwards to $51, yet the stock opened at $56.10 and surged to close at $63.59.

Naturally, headlines are quick to point out that the market for great companies and IPOs is healthy.

Does this mean the IPO market is back?

Personally, I think not.

Just because one high profile IPO can be deemed a success doesn’t mean that the market is risk on.

Or that people are now going to be piling into IPOs.

High-profile tech IPOs such as Deliveroo (ROO) and THG (THG) – formerly known as The Hut Group – are still nowhere near their IPO listings.

My view is that whilst Arm’s debut IPO is not bad news for the market in general, it can’t be classified as good news because every IPO is different.

Variables such as:

- Quality of the company

- Macro environment

- Selling shareholders

- Business prospects

- Valuation

- Industry

All need to be considered.

Any dreams stagging IPOs – the method of taking IPOs and selling them with the goal of a quick profit – is unlikely to be realised any time soon.

But investor apathy, a lack of capital, and little interest in the market could mean there are opportunities out there to get involved with companies that otherwise would see a lot more demand in a better market.

Michael Taylor

Buy the Bull Market free and premium trading newsletter available at: newsletter.buythebullmarket.com

Twitter: @shiftingshares

Got some thoughts on this week’s article from Michael? Share these in the SharePad chat. Login to SharePad – click on the chat icon in the top right – select or search for a specific share or the “Traders chat”.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.