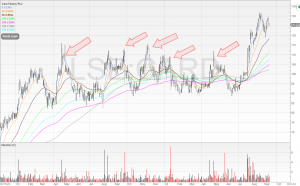

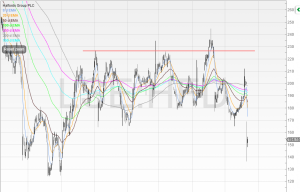

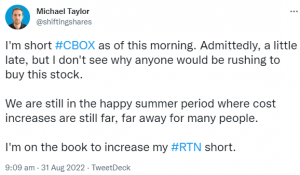

In part two of his trading hacks series, Michael dives deeper into the mindset shifts and tactics that can truly transform your trading game. This is the second article in my two-part series ‘How to hack your trading’ – you can read the first part here where I cover the first three points. We left […]