Consider Wandisco. It’s a software company that specialises in providing data management and replication services for businesses. The company was founded in 2005 and is headquartered in San Ramon, California, with additional offices in the UK, India, and Poland. Wandisco was listed on the London Stock Exchange’s AIM market in 2012 and has been a publicly traded company since then.

On 6 March 2023, the company said it was considering a US listing. And in another published interview, the chief executive David Richards claimed to have “100 percent market share”.

He also added: “Ten enterprise sales guys pulled in $127 million in bookings. We think we can get to a billion dollars of bookings with 20 salespeople, and be the most profitable company the world has ever seen.” Wow!

However, on Monday 9 March (just three days later) Wandisco announced that its shares would be suspended from trading on the London Stock Exchange’s AIM market, following the discovery of accounting irregularities.

Wandisco’s suspension from trading on the AIM market is a significant setback for the company and a blow to the AIM market. It looked like the business had finally turned a corner – winning contract after contract, but it appears that this was all false.

Whenever these things happen, many people will tell you that they told you to avoid it. And they may have done. The company was ridiculously punchy in terms of price to sales and so investors were paying a lot upfront for future growth. But nobody called it a fraud or even hinted at it being so, and so this shows that fraud spotting is both difficult to do and incredibly rare.

There was also nothing in the share price that gave anything away.

Unfortunately, frauds are going to happen and stocks can and do go to 0p. There is only one way to protect yourself and that is through position sizing.

Position sizing is both your first and last line of defence.

Let’s say you have a £20k trading account and you are risking £500 per trade. This is 2.5% of your account.

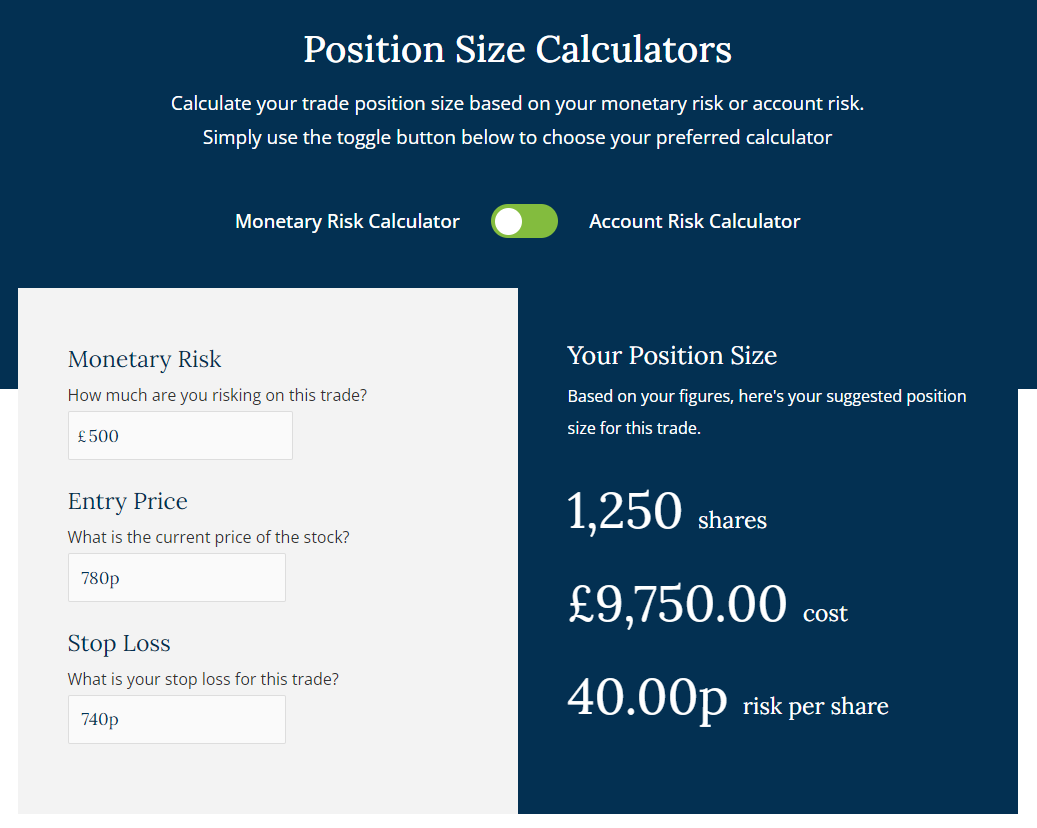

We can plug the numbers in using my position size calculator.

This gives a position size (in the example) of 1,250 shares which will carry a total cost of £9,750.

Your total risk is not £500. This is your account risk on the trade. But your total risk? £9,750.

That’s 48.75% of your trading account.

Suddenly, your intended risk on the trade now has a far greater risk. If the stock goes to 0p and you’re long, then that’s almost 50% of your account wiped out in one trade.

This is why I recommend always paying attention to your total risk.

Adding to winners is how you make large profits in stocks. Making more when you’re right and losing less when you’re wrong is a good strategy. Winners will naturally grow to be bigger percentages of your account. Stocks that are performing well have earned that responsibility.

However, one question you should always be asking yourself is: what would happen if this stock went to 0p tomorrow? Am I overexposed? Because one day it will happen.

Atlantic Lithium

Another stock that was in the news this week is Atlantic Lithium.

This was a result of Blue Orca Capital’s Twitter thread announcing it was short Piedmont Lithium.

The argument is that Ghana has a history of revoking mining rights obtained via corrupt payments.

Is this true? Who knows. The company has refuted allegations.

But the stock was – until now – slowly becoming a market darling for the lithium sector. And this short report will do some damage and take time to overcome regardless of its validity.

Again, it’s another example of why you should always consider your total risk.

This is especially the case when trading leveraged products such as spread bets and CFDs.

Final thoughts

You should be tracking your total exposure regularly and know what you’re exposed to and how much you can lose.

In bull markets, it’s easy to buy stocks and end up with a basket of longs, without realising your total exposure. I’ve noticed this to be a continued theme in traders I’ve worked with personally.

You can do this by using an account tracker or even a simple excel sheet that calculates shares with a calculation of share price multiplied by position size. Using Google Sheets you can input a formula that will give a delayed price.

As traders, our job is to manage risk and keep the risks to the upside.

When you relentlessly focus on this, you increase your chances of success dramatically.

Michael Taylor

Buy the Bull Market premium trading newsletter available at: www.buythebullmarket.com

Twitter: @shiftingshares

Got some thoughts on this week’s article from Michael? Share these in the SharePad chat. Login to SharePad – click on the chat icon in the top right – select or search for a specific share or the “Traders chat”.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.