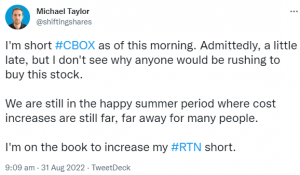

In this article, Michael looks at how to develop your ‘trading board of directors’ to level up your trading. Most people treat trading like a solo game. It is. It’s certainly not a team game. It’s a sport where everyone else can be winning, and you keep getting struck out on trades. Or a friend […]