In this article, Michael revisits the indices and looks at what they mean for traders.

Almost all of the trades I do are specific to the chart and to that company itself.

For example, a strong stock in a bear market will get bought, and a down-trending, stock-breaking support in a raging bull market will never get bought.

However, it pays to take notice of the indices.

This is because the indices tell a story of that sector of the market, or at least of that particular type of stock.

For example, the FTSE 100 is not indicative of the overall market as it’s the top 100 stocks in the UK. They’re slow growers, and are well-established businesses that are unlikely to see the same sort of growth required to be interesting for those who are seeking capital growth. But that doesn’t mean it should be ignored.

FTSE 100

It’s likely you’ll have seen the headlines about the FTSE 100 making new all-time highs.

The 8,000 mark has definitely been broken, and the funny thing about new highs is that they’re often followed by more new highs.

This is great for income investors and people who buy large caps, and of course, those who buy FTSE 100 trackers (I assume they exist).

The FTSE 100 also consists of a lot of dollars (US) earners, therefore a fall in Sterling/surge in US Dollars helps these companies due to the boost in their relative value of earnings.

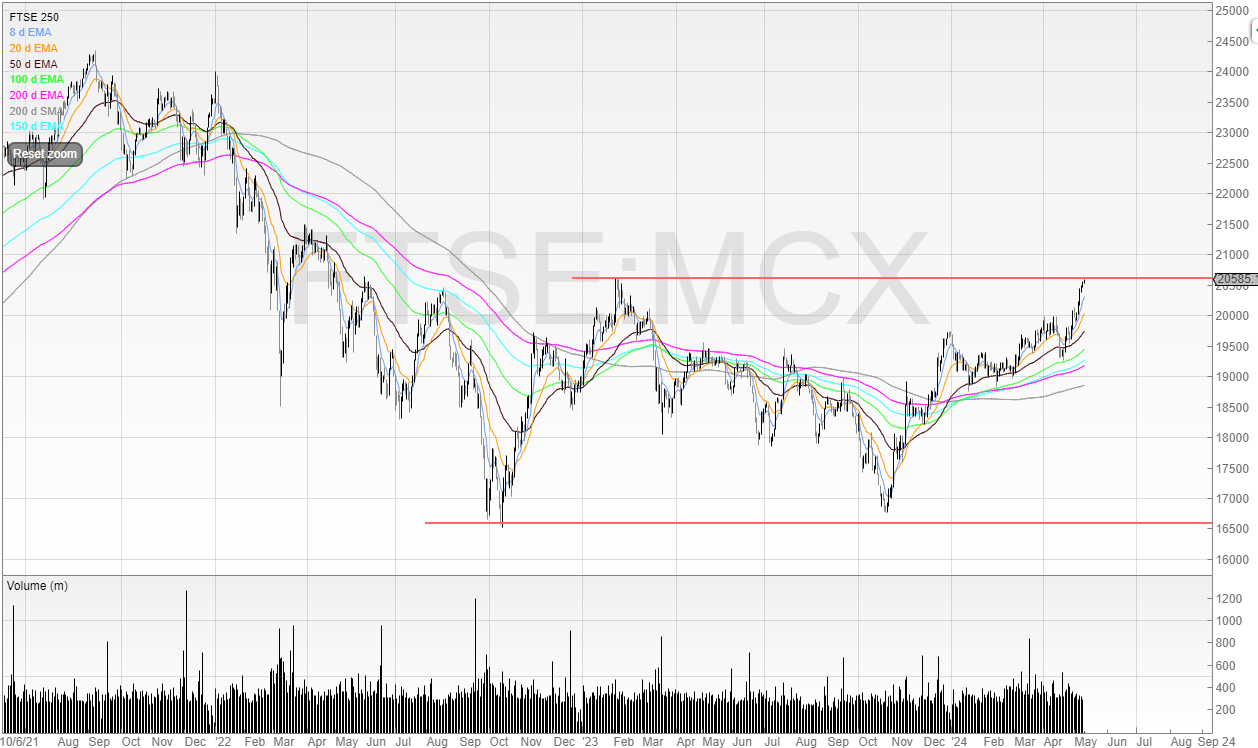

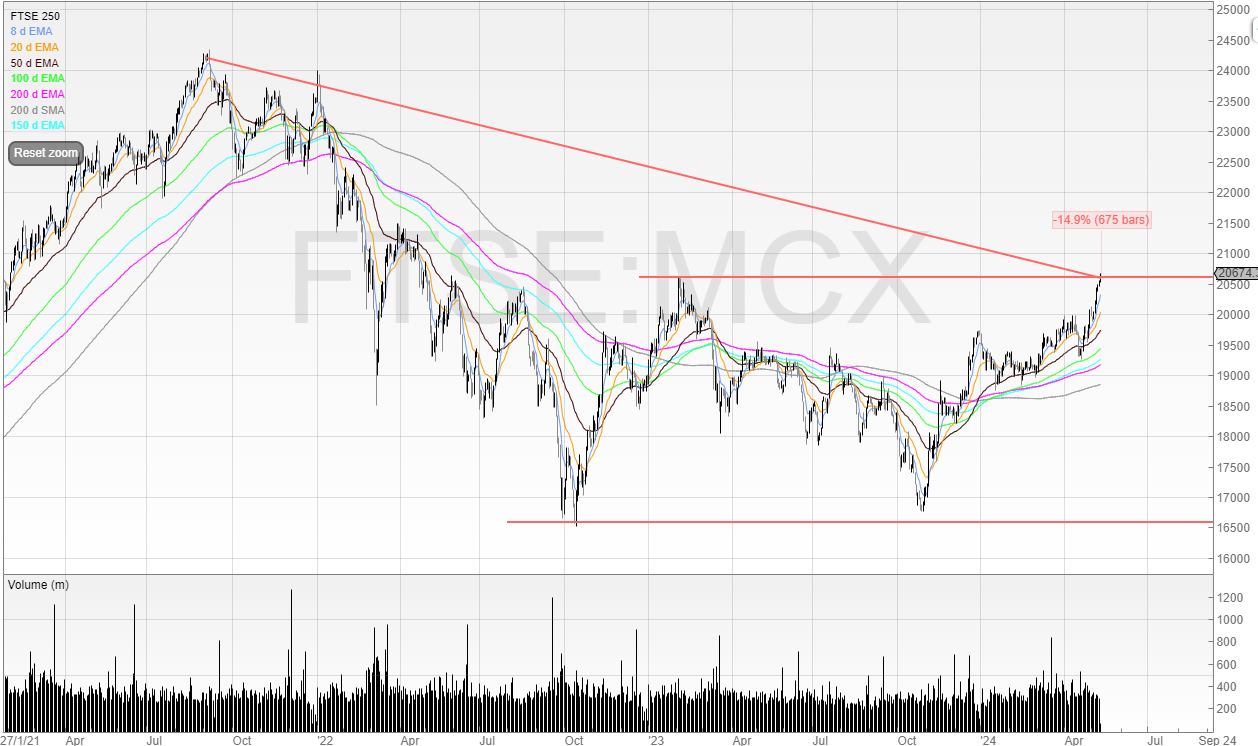

FTSE 250

The FTSE 250 is a more comparable index for those seeking capital growth.

It comprises lots of domestic companies, many who are well-known such as Games Workshop, Hargreaves Lansdown, Travis Perkins etc.

We can see that the stock didn’t reach the October 2022 lows in 2023 and is now testing the January 2023 high.

More importantly, the index is only down 14.9% peak to current trough.

That means the FTSE 250 is no longer in a bear market and is now considered to be in a bull market.

When indices are down more than 10% from their highs we call it a correction.

When indices are down 20% or more from their highs it tends to be called a bear market.

This is significant because whilst it doesn’t guarantee that we are fully out of the woods (for all we know, stocks could plummet tomorrow) but it does give credence to the thesis that we have now bottomed and the markets are looking brighter.

You may’ve seen evidence in recent price action.

Stocks that post good news actually go up, instead of being sold into and closing flat or lower.

It’s a sign that investors are looking forward in the market and are happy to take on risk.

Let’s look at the AIM All-Share next.

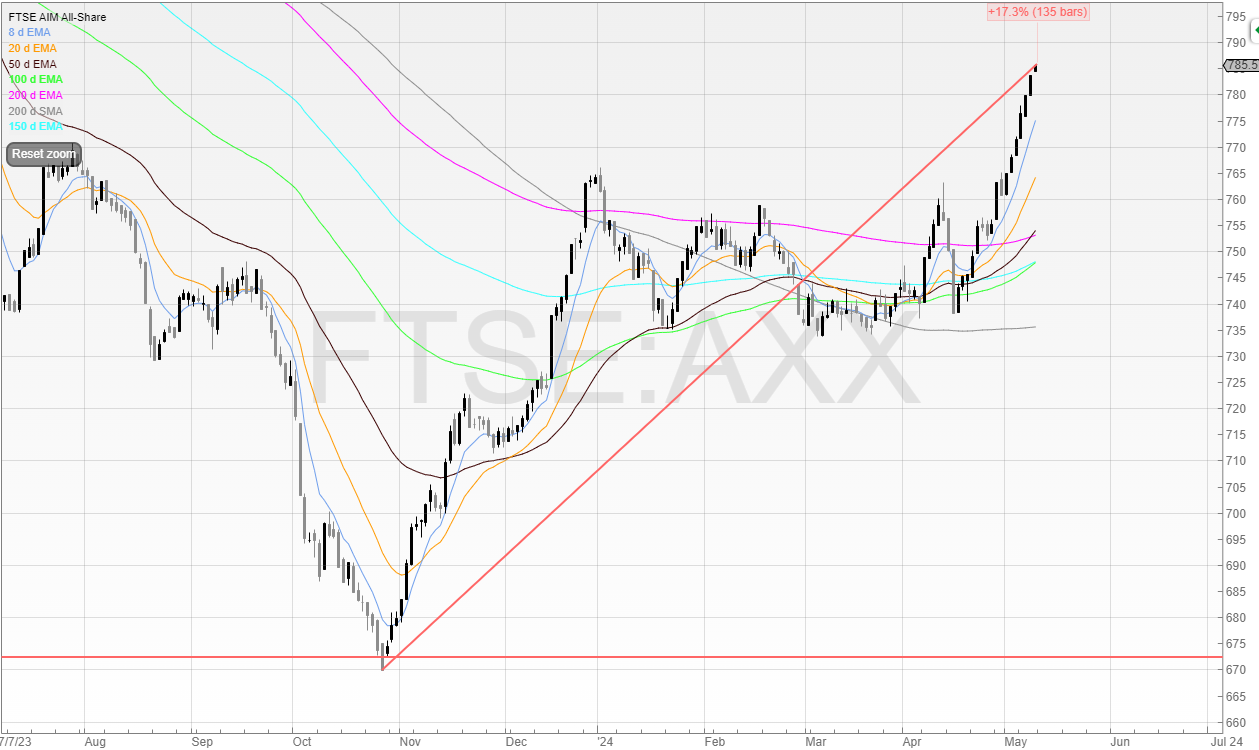

AIM All-Share

The AIM All-Share is full of the hopes and dreamers, the few that make it, and a lot of garbage.

Some of this trash has been self-clearing in recent weeks, with some companies announcing that there is a problem with the market and that being listed is hindering their valuations and ability to raise capital, and so, choosing to delist.

It’s curious, though, that solid companies with strong business models seem to have no issue raising money. While there are indeed problems with the UK stock market—so much so that the government is finally starting to realise (though I’m personally not expecting anything much to happen)—perhaps it’s because investors aren’t willing to fund speculative, unprofitable (and sometimes non-revenue generating) pharmaceutical companies.

In any case, here’s the chart.

We can see that the index smashed through October 2022’s lows to new lows before rallying.

This new low was actually multi-year support.

We can see that this level was tested in 2011, 2012, 2014, 2015, and 2016. It traded below this level only for 16 sessions in the Covid crash.

The index itself is still well off its 2021 highs.

Some investors refer to indices as being in a bull market if they are off more than 20% from their lows (even if they are still massively down from their previous highs).

We can see the index is not far from achieving this 20% trough-to-peak move.

But what does this mean? Are investors now buying into speculative garbage?

Probably not.

The index is weighted towards larger stocks, and larger stocks tend to be more established.

More established stocks are more likely to drive returns and create shareholder value than a company building a mine in a faraway land.

But what it does signal is again that investors are looking to the future with optimism and that traders can be more risk-on. Risk-on is a fancy finance term for simply being more aggressive and taking more risk, in the hopes of potentially higher returns.

GDP numbers

We also saw that GDP grew 0.6% in Quarter 1 (Jan to March) after two previous quarters of declines.

Technically, this means that the UK is now out of recession, as two negative quarters of GDP is enough to satisfy those criteria.

But here’s the kicker!

Does this mean lower rates might not be needed?

And does that mean that this news is bad because we might not get lower rates which stimulate the economy even though the economy appears to be stimulated without the lower rates?

Or is it good that the economy is growing without lower rates and that lower rates actually aren’t always good?

Unfortunately, the answer is far above my pay grade… and there’s also the old saying that economists have predicted 11 of the last two recessions.

Personally, I believe the answer we’re looking for lies in the charts.

More stocks going up means more uptrending stocks and more swing trade longs.

More stocks going down means fewer breakouts, more breakdowns, and more special situation shorts.

If hedge funds with their bigger computers, bigger teams, and bigger bankrolls can’t accurately forecast the future, then it’s unlikely we (at least myself) will be able to succeed where they can’t.

I’ve been saying for several months that I believe we’re now in an early-stage bull market and it’s finally looking like the numbers are agreeing with me.

If it continues, then the next two years should be exciting indeed.

But nothing is certain in markets aside from the certainty that there will be uncertainty!

Michael Taylor

Buy The Bull Market free and premium trading newsletter available at: newsletter.buythebullmarket.com

Twitter: @shiftingshares