It’s been a busy week in the markets and about to get a lot busier as March brings a whole load of results and trading updates.

Last week, we saw profit warnings from Halfords and FD Technologies, along with some ahead statements and a new debt facility.

Halford’s (HFD)

Halford’s put out this profit warning on Monday telling the market that it had seen a “further material weakening in three of our four core markets”.

The market didn’t like this and uncrossed down and closed red on the day.

Here’s the chart.

Notice how this could’ve appeared to be a stage 1 stock, especially if we zoom out.

This is a great example of why stop losses are necessary. It’s easy to think that Halford’s was a breakout of a stage 1 base here.

Unfortunately, any breakout traders and all shareholders were hit with a profit warning that gapped down through the resistance turned support and the stock fell to a 190p open from a close of almost 230.

These moves are inevitable in your career. No matter how much we try to manage risk, there will always be profit warnings and even frauds. Nobody suspected Patisserie Valerie of being a fraud (of course there are plenty of Harry Hindsights to tell us after the event). There is also Conviviality, where the directors bought shares a few days before the stock was suspended and went to zero.

We can mitigate these risks by not trading in front of expected earnings. Head to the News section on SharePad and check out when the last trading update or results were published.

For example, if a trading update has come out in the last week of January the year before (and potentially in the years prior too), then being long in the penultimate week of January is asking for it.

But multi-R losses can and will happen; the only thing we can do is position size to account for the stock going to zero. Because one day it will.

There is talk that Halfords is now more attractive to a bidder given that it is still profitable and has a an adequate balance sheet, but the company also tells us that “underlying PBT in 2025 will be broadly in line with that forecast in FY24 assuming that 1) There is marginal year-on-year growth in our core markets, with trading conditions seen in Q4 proving anomalous; and 2) The Cycling market normalises and margin pressure dissipates through the year. FY25 PBT will be supported by cost savings that more than offset net inflationary headwinds.”

Cycling was a booming industry during the pandemic. Everyone bought a bike, and now they’re either being used or being forgotten about, sat in sheds and garages. I’m no cycling expert but it wouldn’t surprise me that in a cost-of-living-crisis if bicycles do not become a higher priority for consumers.

For me, I see no reason to do anything here.

Just Eat Takeaway (JET)

Just Eat Takeaway has been in an earnings upgrade cycle the last few earnings updates.

This RNS was no different, with 2023 ahead of guidance and 2024 guidance receiving an upgrade.

My belief was that the stock would rally on the day due to these upgrades. I went long and unfortunately, I was wrong, and banked a small loss.

The stock has held up though, so I’ll still be watching the next earnings announcement.

It remains a mystery to me why the shares fell. Maybe the market was expecting more? Maybe, despite the upgrades, the stock is still overvalued? No idea, and at £2.6 billion market cap it could be anything.

Ocado (OCDO)

Ocado is a volatile stock and can especially be so on earnings. And this time it was no different.

We are told underlying cash flow is “well ahead of guidance” and the highlighting in yellow is mine.

The market has been risk-on in recent weeks, so I felt like a long.

Plus, the stock uncrossed only slightly higher than the same price it closed the night before.

That meant that the news premium for the stock was low.

The stock gapped up but quickly came back and as of today is trading below its pre-results.

There is some talk about the marriage between M&S and Ocado faltering. I don’t see any reason to deal in this stock unless there is significant news.

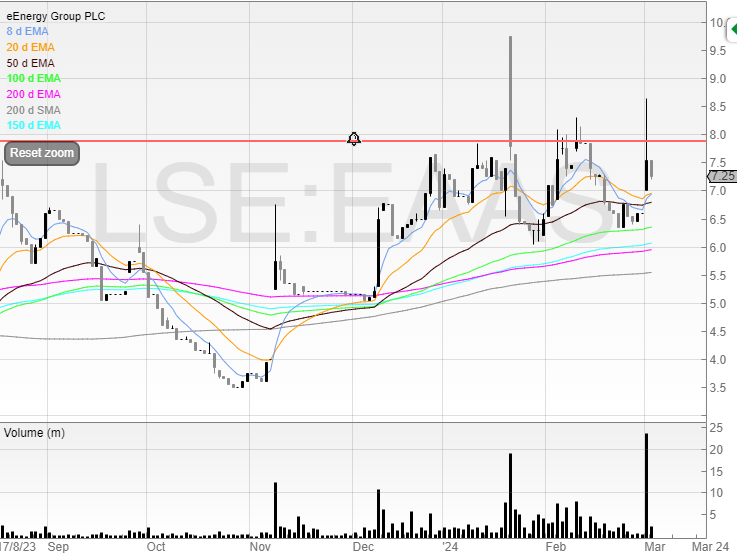

eEnergy Group (EAAS)

Finally, there was an update from eEnergy group announcing a new £40 million debt facility. Following on from the sale of the Energy Management division this puts the business with a significant net cash position (more than half the market cap) and the ability to grow and service bigger clients.

The news of the facility saw the stock put in its third highest volume day ever, and so whilst there appears to be plenty of sellers for now, if the stock breaks through the 7.9p area I’d be looking to add.

Michael holds a long position in EAAS.

Michael Taylor

Buy the Breakout trading newsletter available at: www.shiftingshares.com/newsletter

Twitter: @shiftingshares