Following on from my last article where I discussed intraday trading, it makes sense to write about swing trading.

Intraday trading sounds glamorous and for this reason, it gets a lot more attention.

Tell people you’re a day trader and people will hang onto your every word. But tell people you trade long-term trends and you’ll bore them.

But swings and trends are by far the easiest way to make money in stocks.

Remember Jesse Livermore? If you don’t, the book Reminiscences of a Stock Operator is well worth a read. But here’s a quote from the book…

“It never was my thinking that made the big money for me. It always was my sitting. Got that? My sitting tight! It is no trick at all to be right on the market. You always find lots of early bulls in bull markets and early bears in bear markets. I’ve known many men who were right at exactly the right time and began buying or selling stocks when prices were at the very level which should show the greatest profit. And their experience invariably matched mine–that is, they made no real money out of it. Men who can both be right and sit tight are uncommon.”

The reality is that most people come to the market wanting to trade often.

Their need to trade often prevents them from riding big winners – the key to making money in stocks.

We can see this on the bulletin boards.

The most talked about stocks are often stocks that are unprofitable, or have balance sheets resembling a train wreck, or are drilling for some resource in a faraway land. In short, blue-sky stocks that if they come off will do incredibly well.

The problem is that most of these blue-sky stocks don’t come off – and they do incredibly badly.

It’s far better to focus on boring companies that are more likely to trend than to focus on the high-risk garbage.

Here’s a tweet I posted yesterday:

Few people engaged. Most of the time I post trades like this nobody is interested.

But I’m sure if I’d posted about the hottest stock that day then it would’ve been 10 retweets and 100 likes!

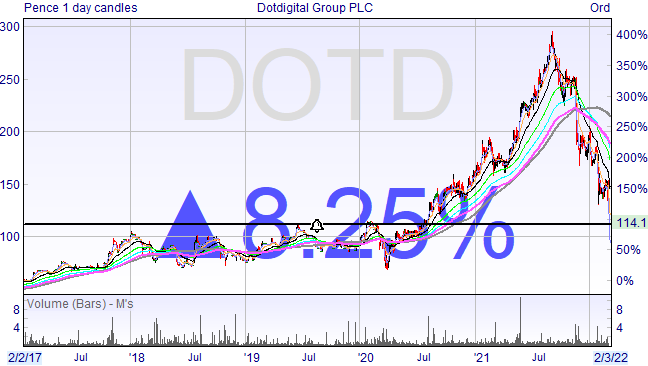

And this stock may be a losing trade. Nothing is guaranteed. But it could be moving out of a stage 1 base and into an early stage 2 uptrend.

Naturally, I’d like it to replicate its run in 2020 but the situation is now completely different.

Back in July, e-commerce was seeing a boom and then in November 2020 we had Vaccine Day.

All of this new money coming into the market had to go somewhere and it caused a general uplift in all stocks (even the trash!).

The problem now is that all those who were trapped underwater are likely going to be a drag on the price and sell as the stock price goes higher.

This is why I look for stocks that have extended periods of sideways trading. I want those holders to be replaced by new holders ready to get on board a trend.

Essentially, what I’m looking for is the average price per share bought to come right down. Because people who are not suffering heavy losses are not looking to immediately sell.

Sideways trading ensures that shares move from the bored and disgruntled to the optimistic and potentially longer-term holders.

Why are trends best for most traders?

I believe trend following is one of the best models for traders because, unlike intraday trading, you don’t need to be at the screens for extended periods of time.

You can prepare the trade well in advance (the Dotdigital trade had been in my ShareScope for months before the alert went off) and know what levels you’re getting out at on the downside.

You can set stop losses either on DMA (Direct Market Access) or use alerts to track the price. Or you can use stop losses on a spread bet account or actually give the order to your broker to do on a best endeavours basis.

It’s also less stressful.

From 7 am, there are 50 minutes before the opening auction where you would need to have:

- Found some trade candidates through the RNS

- Checked the broker forecasts

- Looked at the chart to see what happened on the last update

- Analyse the recent price action to determine a level

- Look for support and resistance

- Work out where your downside is on the trade and what can happen…

With trend following, you can take your time and do all of this in advance, and wait for the alert and the price to come to you.

I love intraday trading and don’t see any reason to stop. But the best trades are always in the trends – and I’ll be sharing some I’m looking at in my newsletter next week.

Michael Taylor

Buy the Bull Market premium trading newsletter available at: https://www.buythebullmarket.com/

Twitter: @shiftingshares

Got some thoughts on this week’s article from Michael? Share these in the SharePad chat. Login to SharePad – click on the chat icon in the top right – select or search for a specific share or the “Traders chat”.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.