It is harder for many private investors to wrap their head around this thought: buying a price only when the stock is higher.

The natural instinct is to think that if the stock is lower now, then it can be bought now, and sold higher later. This does, after all, go with the old stock market saying “buy low, sell high”.

The problem with “buy low, sell high” is that it doesn’t actually say much at all. Does it? Sure – it makes sense. But how? And why? It’s a platitude with no useful practical advice. What if you buy low and it goes lower? What then? How do you know when it is the right high? Everyone can buy low and sell for scraps. But if the stock goes lower and you don’t cut it then you can suddenly find your account deeply in the red.

The stock market produces lots of discomfort, of which us as mere humans are not naturally built well to equipped with. It’s uncomfortable to realise a loss, so the natural instinct is to let it run. And it’s also uncomfortable to run winners, and so the natural instinct is to close it quickly and bank the gain.

But (and at the risk of using another platitude here) the way to make money in trading stocks is to cut your losses and run your winners. Therefore, it’s likely that all successful traders will have a great deal of discomfort about themselves.

That is, until you train yourself to feel differently.

I now love taking small losses. Naturally, I’d prefer winning trades, but I’m always glad to take a small loss and be thankful it isn’t a big one. I’ve long since accepted that losses are an occupational price of doing business, much like trading commissions and data fees. They are inevitable.

The idea of buying higher may still not make much sense at the moment, but please allow me to explain.

Trading is a game where you manoeuvre your pieces around the board in specific ways based on probability. For example, more often than not, a stock that breaks significant resistance will carry on going higher as the stock is now through a big obstacle. Imagine a battering ram on a rotting wooden door.

I may be able to buy cheaper today. But do I have the same percentage odds that the stock will continue?

It’s not about buying cheap. It’s about buying with the odds on your side.

Here’s a stock I’ve been watching for months: AfriTin Mining.

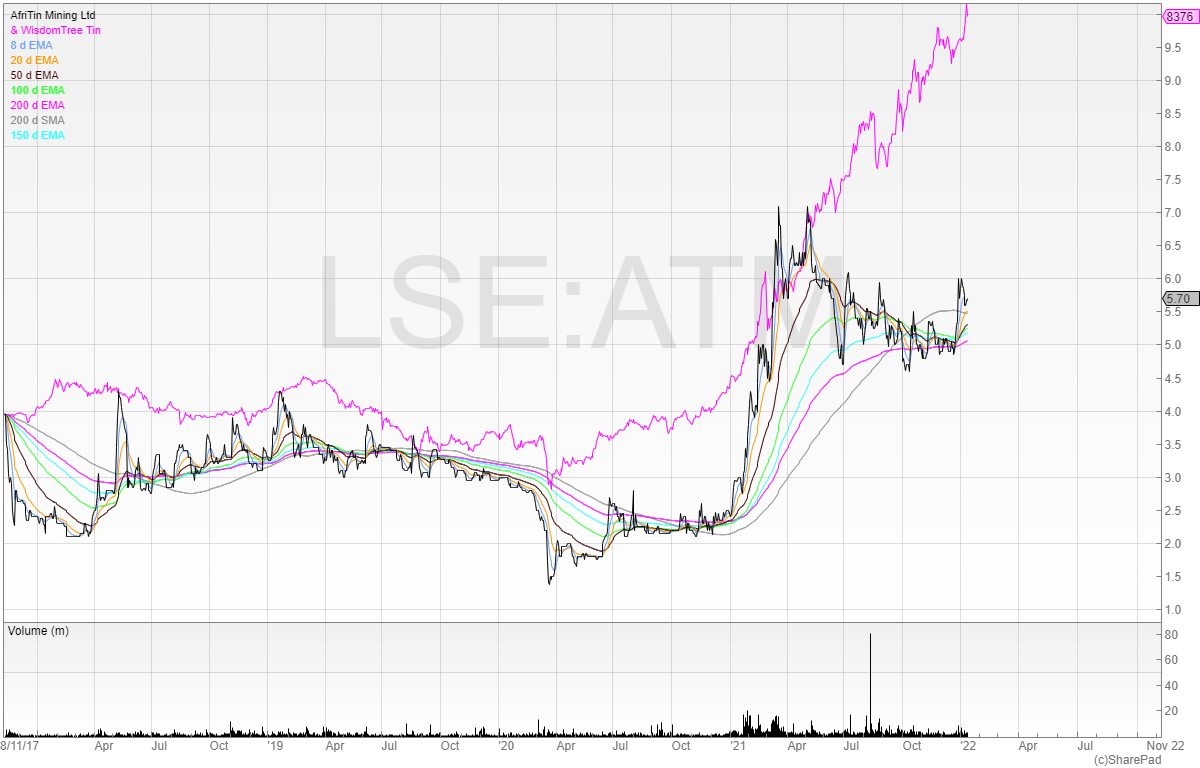

We can see that early in 2021 the volume started to increase and the price went from 2p to breaking 7p. We can see that it pulled back and again attacked 7p, only for the stock to put in a double top.

Since then, the stock has fallen into a slump. Consolidation has been taking place with those who are banking profits from the large selling to new investors who are picking up the stock. The company is one of only three listen tin producers for Western investors. It owns the largest tin mine in the world, Uis, which is already in production and the company is already expanding this.

AfriTin is forecast to make only £0.7m in net income for this year, growing to £3.7m in 2023. This is under the assumption of a $28,000/t tin price. This clearly leaves a risk and an opportunity (as is the case with all companies linked to commodities) with the tin price.

I’ve overlayed the WisdomTree Tin ETF on top of the AfriTin chart here. It tracks the “Bloomberg Tin Subindex”.

We can see that although the tin price has moved sharply in recent weeks – the gap between the stock and the commodity it produces is widening.

There’s no guarantee it should close, and the price of tin can always fall back, but if you believe there to be a new bull market in tin then there is risk to the upside on these forecasts.

However, let’s look at the AfriTin chart closer.

I’m interested in going long this stock once it breaks out of the 7p range (the closing high was 7.1p).

I could buy now, and the stock could trend sideways for another year. That’s not interesting to me, because it doesn’t fit in my strategy. Opportunity cost is a real cost to traders, and I’d rather have the call option in cash providing optionality, or be in stocks that are moving.

AfriTin may never get to 7p. But if it does, I’ll be buying the breakout.

If you have any other breakout ideas – I’d love to hear them.

Michael Taylor

Buy the Breakout trading newsletter available at: www.shiftingshares.com/newsletter

Twitter: @shiftingshares

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

Thanks for the analysis Michael. I’m tempted for a “base cheat” on a break out over the ledge at 6.2p with an add point on the 7p break out. But, as you pointed out, you’ve got to balance the possibility of higher returns with the opportunity cost if it never makes it. I see they are also exploring the option of extracting lithium and tantalum from the mining by-products which would be a useful diversification if it proves economic.

Hi Spencer – I’ve thought about this too but the base is too volatile for my liking. Plus, the opportunity puts me off.

I’ll wait forever if I have to.

Thanks for the insight. I’ve generally been a bit too impatient in the past and often found myself tying up capital in extended base builds whilst other opportunities go by. Trying to be a bit more disciplined!

You could put a zigzag swing file on a chart and trade all the break outs of the swings – WD Gann taught that way back in the 1920’s – which is a simplistic breakout method if used with strict rules and correctly – Triangle breakouts, darvas box/rectangle box breakouts, breakouts from Fibonacci/geometric zones

All depends on what you’re aiming for from the position/trade/Investment