In this article, Michael looks at trading external news events and opportunities that are set up as a result.

External events that have an effect on a stock but are not directly news events from the stock can be hugely profitable.

I talked about the Supreme Court of The United States’ decision to allow sports gambling in the US and how I traded that in my video here, and so it’s always great to be prepared for these events.

We had the vaping consultation news released last Sunday evening, and many of the results of the consultation had already been leaked into the press in the weeks and days before the official announcement, therefore (in my opinion) it shouldn’t have been a surprise to anyone.

There are two stocks that are directly linked to this: Chill Brands and Supreme

Chill Brands (CHLL)

Chill Brands has no rechargeable pods currently in the market and raised capital in the week before the consultation was released.

The company wanted to raise £3 million and managed to raise £1.2 million plus a conversion of liabilities (inventory debt financing) into equity of £1.2 million from an existing significant shareholder.

My belief is the company could have raised more cash by dropping the price, and this wouldn’t have been a bad idea given the company was coming into an event that had a large tail risk.

In any case, the news was released and the stock dropped to as low as 2.2p – a more than 40% fall in price.

After several days, the market is still not impressed.

My belief was that the news was to be expected, and therefore the price reaction would not be as strong.

I was wrong. It just goes to show that news that should be expected, can often blindside the market and affect the price.

But Chill Brands is also a SETSqx stock – the market maker-driven platform on the London Stock Exchange.

Perhaps the market makers gapped the stock down to see who would bite and follow the bid?

Maybe they knew the more they dragged the stock down the more investors would be spooked and the more stock they could accumulate, before running the price back up.

This is what I call ‘the puke trade’. When capitulation has hit and the market makers are now looking to run the stock back up the trade is to go long with a tight stop and catch the bounce.

It’s high risk but when done well can be a great scalp trade. The key is to watch the RSP closely – when market makers are actively bidding for plenty of stock but will no longer let you buy as many shares it means they’re viewing the stock long.

And when they’re viewing long it means they’ll be bidders of the stock in larger volume and not let stock go on the cheap.

This is the time to buy as they now want to push out the stock they’ve accumulated back into the market but make a profit on it.

Here’s the chart.

We can see the puke in action and the rally towards 3p.

One of the benefits of the puke trade is that you’re not reliant on guessing market direction from the bell.

You wait for the stock to set up, therefore you increase the chance of success in taking a profitable trade out of the stock.

Imagine if you’d tried to go long on the bell, thinking that this was the bottom. Exactly. You would’ve taken a big hit.

Supreme (SUP)

The puke set up on Supreme (SUP) too.

However, Supreme also released a trading update later that day – powering the stock higher than its last close before the consultation news.

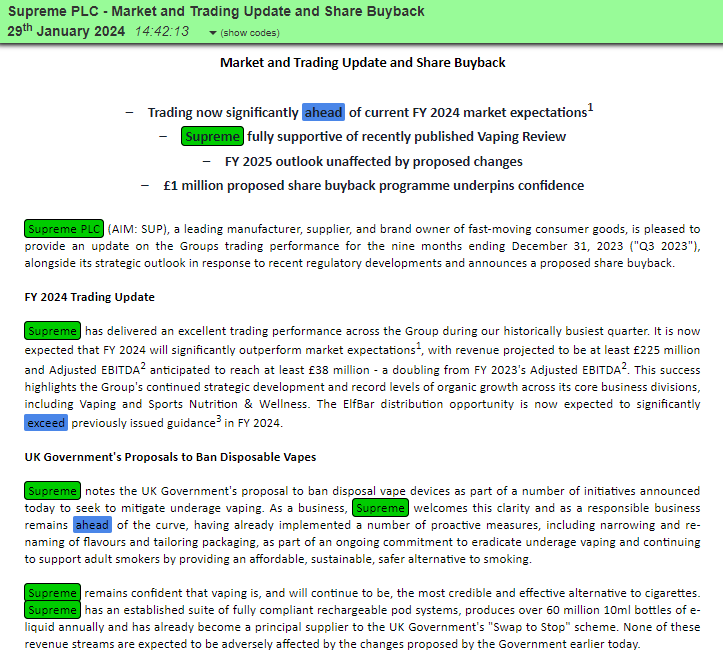

Here’s the update.

Supreme is one of my top picks for 2024, and it looks to be already on top of the consultation and even notes that it has pushed the government for responsible vaping controls.

But even though the market cap was more than £100 million, the stock still sold off on the news of the consultation.

I traded the puke here too but perhaps I should’ve tried shorting both stocks on the bell as well.

Yellow Cake (YCA)

Yellow Cake was also the beneficiary of an uplift due to news on another stock Kazatomprom (KAP).

Kazatomprom is the biggest producer of uranium globally (more than 20% of global production) and it lowered its production guidance for the year by 12%-14%.

What does lower production mean? Higher commodity price.

Yellow Cake saw an uplift as a result of that.

Bizarrely, the stock price opened lower than the previous day!

It just goes to show that the market isn’t efficient.

Michael holds long positions in SUP and YCA.

Get detailed analytics on all of your trades with Michael’s trading journal available free here: www.tradesmash.com

Twitter: @shiftingshares

Got some thoughts on this week’s article from Michael? Share these in the SharePad chat. Login to SharePad – click on the chat icon in the top right – select or search for a specific share or the “Traders chat”