Michael provides a breakdown on why cutting losses is crucial to scaling as a trader and two actionable steps to manage this

Everyone pays lip service to risk management.

However, it’s easy to move your stops “just this once”.

Those three words are some of the most dangerous words in trading.

If you move your stop once, and it works out, guess what?

You’ve now been conditioned that moving your stops can work out.

And if it doesn’t?

Then you’re now taking on an even bigger loss – bigger than you originally intended to risk.

This is why cutting losses needs to be something you believe in with an almost fanatical fervour.

The truth is, that though cutting losses and running winners is simple advice, it is, in reality, extremely useful if you endeavour to follow it.

Of course, it’s easy to parrot a phrase and not say how to do it. Nobody is suggesting that cliches are worthwhile. Most of them sound great whilst being entirely unactionable.

But I cannot stress how important cutting losses is when it comes to trading.

I had a great conversation with my friend Tim Sunderland of Mitto Markets recently (full interview coming out on my YouTube).

He spoke about how he once placed a wrong trade and ended up £6,000 in the hole. He was liable for this loss as a broker but instead, he decided to run it in the hope of getting it back to flat.

But the loss grew and it became £20,000. And Tim at that time was not in the position to be able to wear a loss like that.

However – the then President Trump tweeted something and the market went nuts. Within seconds, the position had gone back to flat and Tim closed it out.

Talk about luck!

That said, Tim admitted that he would never do that again and instead just cut the loss.

We’ve all been there.

When you’re seeing a loss bigger than expected, the emotions kick in.

The rabbit in the headlights. The unwillingness to take a loss.

Suddenly, you’re willing to risk even more to avoid crystallising the loss.

This is called loss aversion.

It’s the overwhelming fear of loss that can cause both traders and investors to make irrational and fundamentally bad decisions in order to try and avoid closing the trade or investment.

The best way to avoid this is to plan the trade before opening the position.

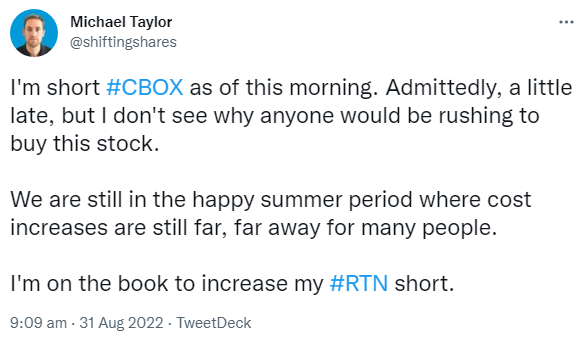

Here’s an example of a trade I tweeted earlier this week.

Source: My Twitter

I went short at 112p.

The stock initially fell to around 98p, before rallying and recovering its gains, and stopping me out at 115-116p.

Given that I was already up 14p on the trade, it was annoying to give back 4p.

But this is trading.

My view on the trade was that I would try to run this, because in my opinion though the stock was relatively cheap assuming it didn’t warn again, my belief is that it will warn again.

However, trading accounts are not built on opinions. They’re built on risk management and discipline.

Here’s the chart of CBOX.

You can see the big hammer candle on the first day of the profit warning. The stock not only took my stops out but rallied to close at 125p.

It carried on the next day and rallied further, and at the time of writing is trading at 146p.

Imagine if I’d held onto my position?

I’d now be 34p in the red or over 30% down.

This is why trading opinions doesn’t work in trading.

Do you want to be right or do you want to make money?

You can’t have both. You must choose.

I’ve long accepted that the market will always tell me I’m wrong and I’m quick to accept that.

Being right is an expensive hobby.

So, how to prevent ending up as the rabbit in the headlights?

1. Get comfortable with your potential loss upfront.

By deciding your maximum risk on the trade (you can use my position size calculator to do this) you are happy to risk this on the trade.

If you’re not comfortable with losing your risk on the trade then you need to revise this risk down.

When you’re not comfortable, you’re more likely to do irrational things led by your emotions.

Trading is about managing your emotions and sticking to a process that works.

2. Set either physical stop losses or alerts so you can close the position.

Automation is the best way to ensure you follow your plan. If you are disciplined enough to follow your own rules then alerts are great – but if the alert goes off and you don’t close the position then you were either not comfortable with the risk or you’re not disciplined.

You need to fix this.

Cutting losses is easy to say. But harder to do.

However, it is absolutely essential skill to make second nature if you’re to have any chance of succeeding in trading.

Over time, your instincts will reverse. As a beginning trader, I couldn’t stomach losses. And this was preventing me from scaling.

Think about it: if you’re risking 100% of your position to make 20% then you’re risking 5 to make 1.

You’d need to be right at least 80% of the time to make money.

This is accurately defining risk – and adhering to it – is the only way to scale up your trading account.

Michael Taylor

Michael Taylor holds a short position in CBOX

Buy the Breakout trading newsletter available at: www.shiftingshares.com/newsletter

Twitter: @shiftingshares

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.