Profit warnings are appearing on an almost daily basis. Despite two years of a grinding bear market, there are still companies out there that have yet to be beaten down.

Stocks falling 40 percent or more on the day is not unusual.

The risk/reward has dramatically changed when it comes to shorting profit warning news.

This is because of the mechanics of the market.

When a stock has good news, there are buyers who want to be in the stock and there are sellers who want to take advantage of liquidity and crystallise their P&L. Generally, shorters don’t short good news of stocks that are in an uptrend (unless they have a fetish for losing money).

Despite the narrative of shorters being evil, companies with great management teams delivering on a strategy that is delivering for shareholders don’t need to worry.

It’s only the companies that are heavily reliant on shareholder cash injections and selling stories that are susceptible to shorters.

Put it this way. If we assume that the market is (generally) efficient, and a shorter puts out a short report on a solid company, there may be an initial dip but eventually, the price will recorrect. In a complete dog’s dinner of a business, the shorters may be proven right.

There are no examples of shorters driving a solid business that generates lots of cash flow into the ground. Zero.

There are plenty of examples of shorters doing damage for garbage stocks, because, well, they’re garbage.

And the risk for shorters is higher than those going long. Losses are potentially unlimited and they are swimming against the trend. It logically doesn’t make sense to attack any stocks that isn’t fundamentally weak or has a catalyst to drive the price lower.

However, when a stock issues a profit warning, and the chart has been in a firm downtrend, then you may have sellers who want to crystallise their short positions.

You may also have buyers who are looking 6-9 months ahead and thinking of the recovery, as well as bottom pickers and falling knife gamblers.

So there are two sets of buyers:

- Buyers going long

- Buyers going flat

This can exacerbate price movements and so shorting a stock that has already heavily fallen can sometimes see your position go the wrong way from the bell as short positions are closed and buyers step in.

The breaking down chart with a potential profit warning

Charts that are breaking down can provide examples to go short.

Calnex is a stock that issued a profit warning this week.

It gave an indication when it broke trend and fell on big volume.

Calnex had already sold off in March on a FY24 cautionary statement from the board (emphasis mine):

“Based on short-term order run-rates, the Board believes that the financial performance in FY24 will be below that achieved in FY23, with the Company’s revenues more heavily weighted to H2 of FY24.”

The results didn’t fill anyone (or shouldn’t have filled anyone) with confidence either with this outlook.

It then took out the Big Round Number of 100p after a sharp fall from 115p.

My view was that nobody is going to buy chart-breaking support like this in a market like the current one. Therefore, my risk/reward on the trade was attractive.

Plus, there was the added bonus that if the above did come to pass, then the stock could crater.

That’s exactly what happened.

This is the first way to play a (potential) profit warning. Spot a downtrending chart-breaking support, with an added potential catalyst to drive the shares lower.

The rising chart unexpected profit warning

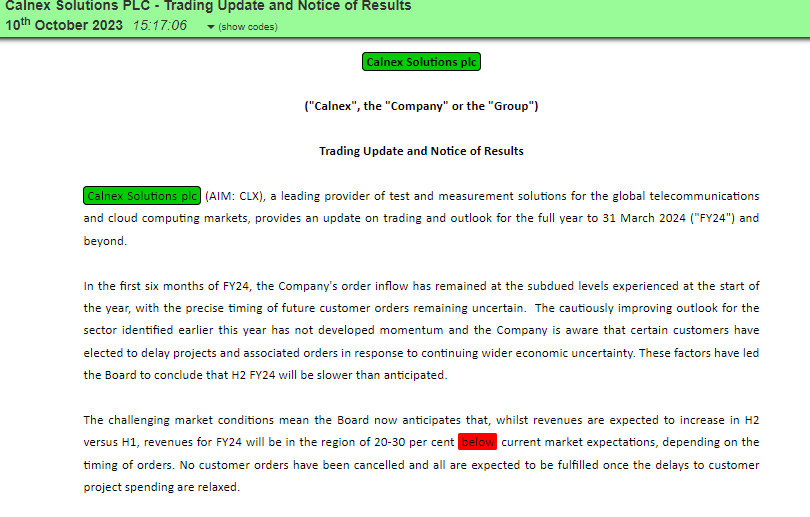

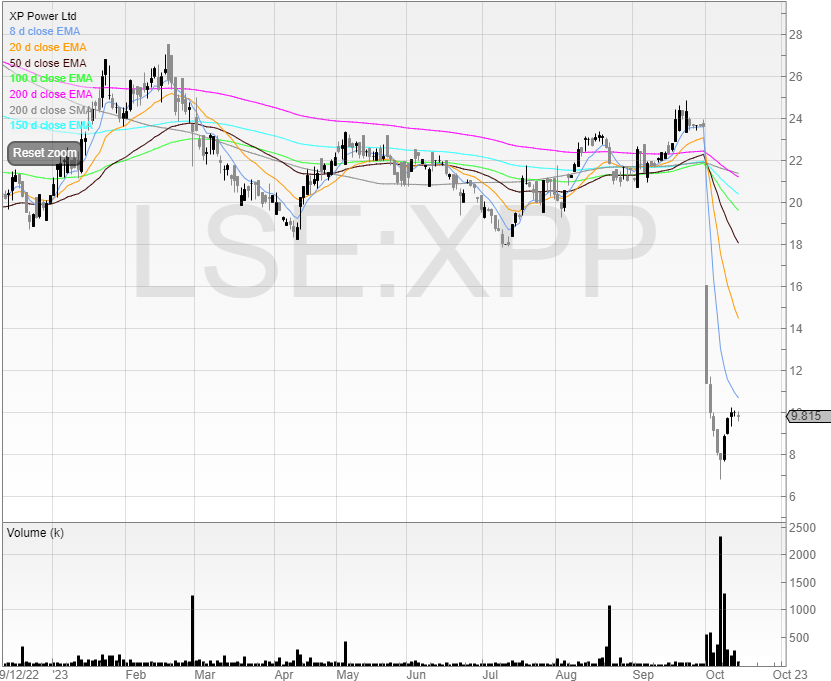

The second way is to short an unexpected profit warning. XPP is a great example of this.

Here’s the chart.

The stock had been gently rising and so the profit warning on the surface looks unexpected.

But go back to the Interim Results on 1 August 2023 and there was no mention of any bad news.

This was the outlook (emphasis mine): “Full-year expectations are unchanged with, as guided, a modest second-half weighting.”

In just two months, trading had been weaker, the debt was expected to be close to the covenant limits, and that no further dividends will be paid for the rest of the 2023 financial year.

A huge surprise!

Whenever you see an unexpected profit warning it makes sense to look to go short.

The expected profit warning rally

This is the hardest way to play profit warnings because the rallies can be sharp. If you go short on a chart where the stock has fallen a lot and is still falling, perhaps the warning isn’t exactly unexpected.

This can leave other shorters closing their positions helping the stock to rally.

Croda is an example of this.

The stock had already rallied on a profit warning, and my view is that shorting a stock that has been heavily down-trending can be risky.

When you’re shorting at the stage 3 level and early stage 4 level, the risk/reward is far better.

But the later in stage 4 you get the riskier it becomes.

Michael Taylor

Get detailed analytics on all of your trades with Michael’s trading journal available free here: www.tradesmash.com

Twitter: @shiftingshares

Got some thoughts on this week’s article from Michael? Share these in the SharePad chat. Login to SharePad – click on the chat icon in the top right – select or search for a specific share or the “Traders chat”.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.