I released a new filter several weeks ago. This was a new filter I was testing and mentioned this in my Investors Chronicle column. I’ve released it onto the library due to popular demand and in this article I’ll explain how to get the best out of this filter.

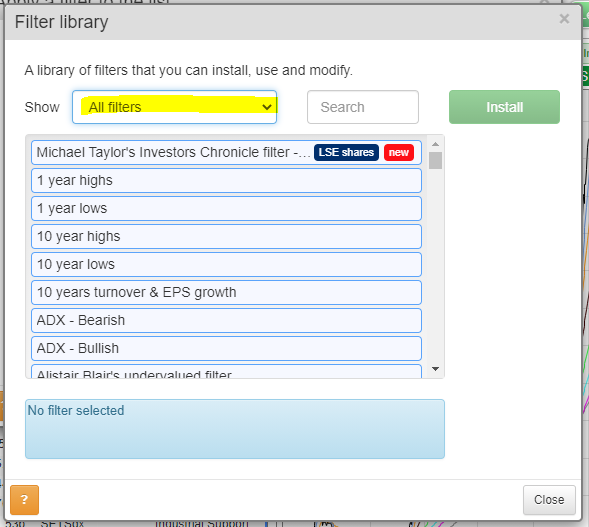

First of all, you can find the filter by visiting the filter library and searching “Michael Taylor”.

To get to the filter library, click “Filter” on the blue screen, “Apply filter” and then “Library”. You’ll then see a dropdown box (highlighted in yellow).

You can see my filter at the top already.

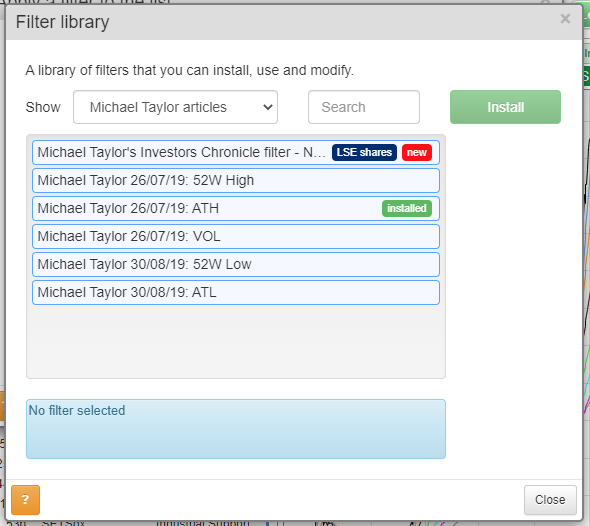

To get all of my filters, click the dropdown box and you’ll see “Michael Taylor articles”. Click it, and you should see these.

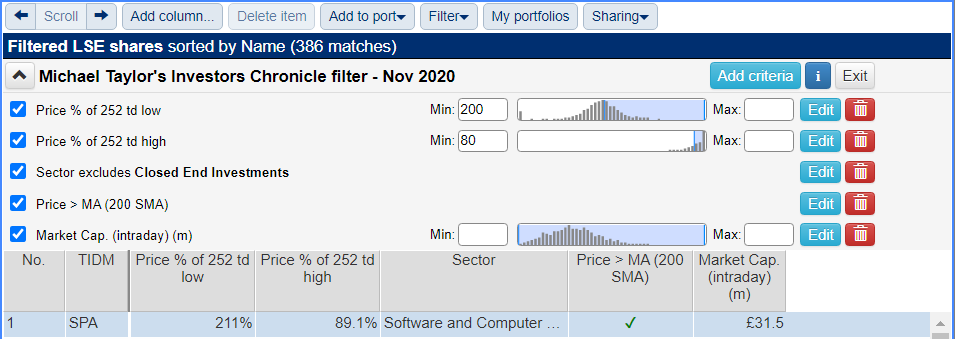

The filter we’re going to use is Michael Taylor’s Investors Chronicle filter.

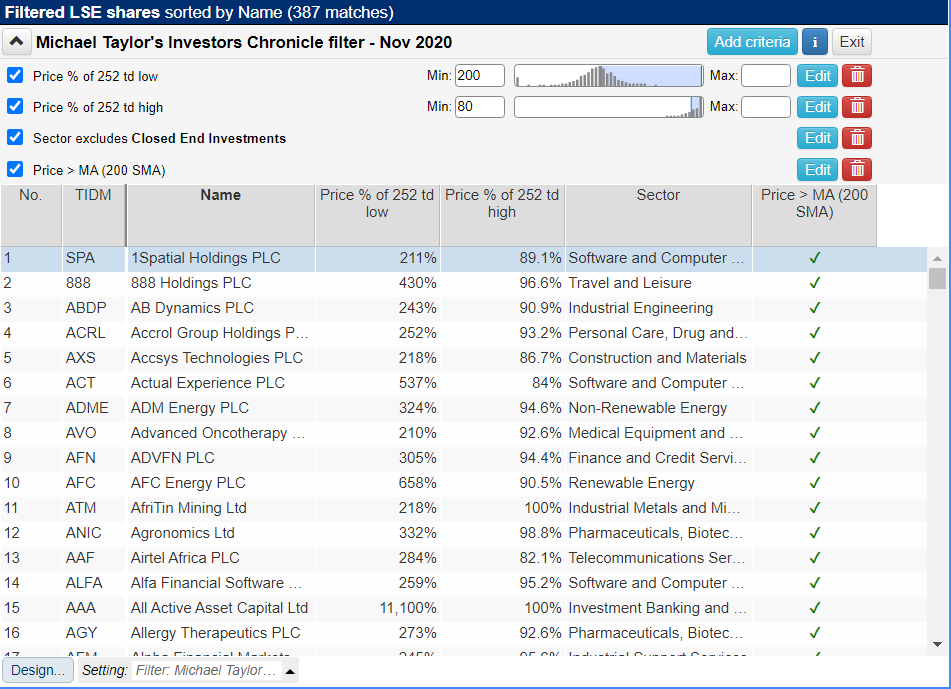

Here are the filter results as of 15/01/2021.

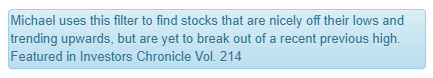

The goal of this filter is to find stocks that are nicely off their lows and trending upwards, but are yet to break out of a recent previous high.

Why do I want to find stocks like this?

There are several reasons:

- The current market is seeing all boats float

- There are many breakouts now but I want to focus on quality setups

- This filter will identify stocks before they break out unlike my other breakout filters which show new highs

The market has been on a stormer since we had the vaccine news.

It’s a market where you can’t help but make money if you’re long (which, incidentally, is my favourite kind of market).

This is the type of market to take on extra risk and put your foot down, because when opportunity is in abundance it makes sense to cast your nets. Market veterans might say “back up the truck”.

However, there are many breakouts and not all breakouts are created equally. Rather than be bloated with many poor-quality trades, I’d prefer to find better setups using less of my time.

This filter is the result of my goal.

Additional criteria

One criterion I have added since is a market cap filter. This is because it’s the smaller stocks that move the fastest.

My goal is capital growth and so I’m looking to generate higher returns on my trading account.

To add the market cap criterion we click “Add criteria” > “General” > “Market cap. (Current)” and then click OK.

This is now the result. We have a market cap criterion added to the bottom and on the column as well.

If we input a market cap limit of £200 million, this gives us 214 results and has done away with nearly half.

A £200 million market cap company can multibag and still be relatively small. But to bag a £2bn market cap company is going to take some patience. That’s not to say it can’t be done of course, but capital and patience are limited!

One point worthy of noting is that by putting in the minimum price % of the 252 td high we will see all stocks that are above 80%.

That means we’ll see stocks that are currently at their 252 trading day highs too. Remember, the goal of this filter is to find stocks before they broke out – so if you want to remove these stocks and only focus on stocks that have yet to break out then you’ll want to put a maximum number in the criterion too.

This is discretionary and up to you. Putting in 99 will give you stocks that are around 1% off their recent high. Have a play and see what you want to find. If you are wanting meaningful dips, then perhaps 99 isn’t the best of numbers to put in because it’s not going to show meaningful dips (this does, of course, assume that a stock trading at 99% of the stock’s recent isn’t what you class a meaningful dip).

If you found this article useful – you might find my subscription newsletter (free) of interest. In it, I’ll be talking about trading ideas and things I’ve learned in that month. You can sign up at my website below.

Michael Taylor

Buy the Breakout trading newsletter available at: www.shiftingshares.com

Twitter: @shiftingshares

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.