Michael looks at the indices after a spate of bank collapses that rocked financial markets.

Worries about contagion and banks failing caused the markets to take a lurch downwards.

Or did they? Am I making it up after the fact? The truth is nobody ever knows and it’s easy to say why something moved after the event.

The run on Silicon Valley Bank arguably helped the demise of the bank. Banks rely on confidence in the system because if everyone tries to withdraw their money at the same time then the bank has no money left.

This was the case with Northern Rock back in 2007. As the global financial crisis intensified in August 2007, Northern Rock found it increasingly difficult to borrow money from wholesale markets, and this led to a severe liquidity crisis. News broke that Northern Rock had requested emergency funding from the Bank of England in that year, which triggered a run on the bank.

Customers of Northern Rock became concerned about the safety of their deposits and rushed to withdraw their money from the bank. The queues of people outside Northern Rock branches were widely broadcasted in the media, which exacerbated the panic and led to more people withdrawing their funds.

The UK government and the Bank of England intervened to try to stabilize the situation, but the bank run continued for several days. It was only when the government announced that it would guarantee all deposits made by Northern Rock customers that helped to calm the situation.

This is similar to what happened with Silicon Valley Bank.

And since Silicon Valley Bank there has been a spate of collapses.

- Friday 10 March – The US government’s Federal Deposit Insurance Corporation (FDIC) took control of Silicon Valley Bank. This is the biggest banking collapse in America since Washington Mutual in 2008.

- Sunday 12 March – The FDIC shuts down Signature Bank as a run begins with the loss of confidence stemming from SVB.

- Thursday 16 March – A group of American lenders props up First Republic Bank as customers again rushed to withdraw deposits.

- Sunday 19 March – UBS buys out Credit Suisse in a rescue deal as the latter fails.

Here’s how the indices have responded.

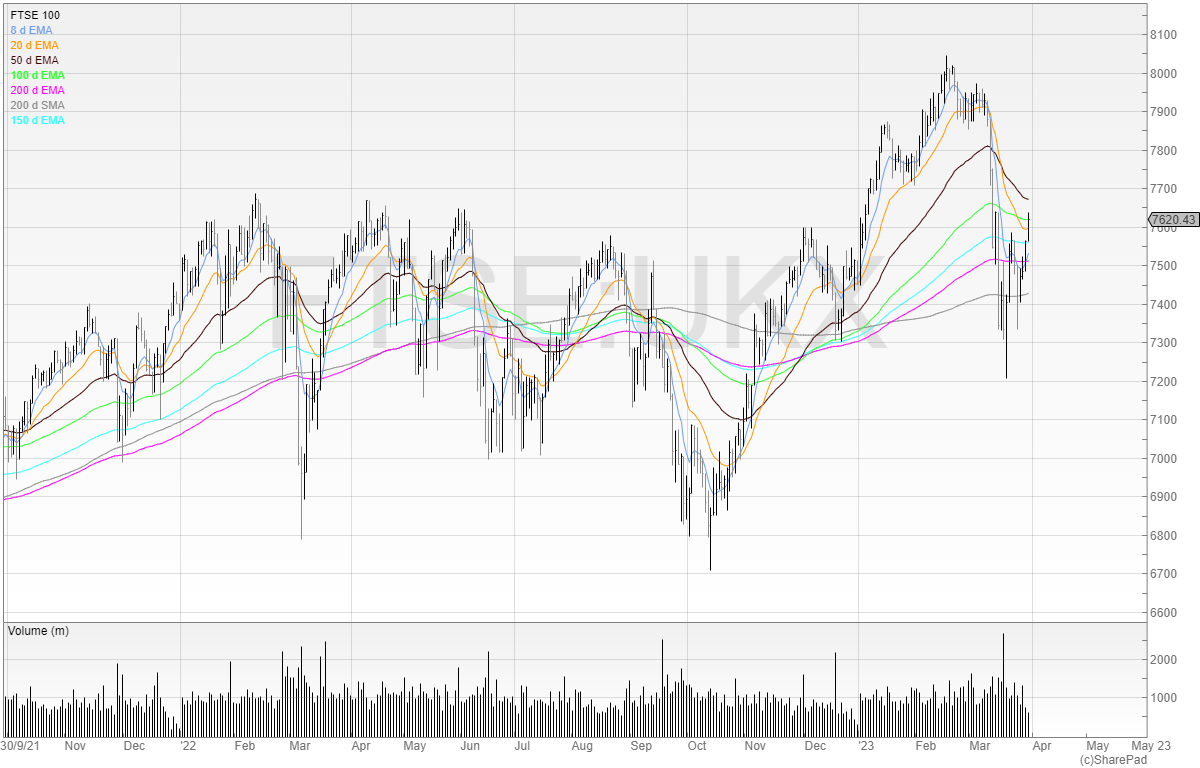

FTSE 100

We can see the FTSE 100 fell sharply in the period. However, it has since rallied and regained its position above the 200 EMA suggesting market sentiment across these top 100 stocks is bullish.

That said, the FTSE 100 is not indicative of the smaller stocks that I typically tend to trade.

Let’s have a look at the FTSE 250.

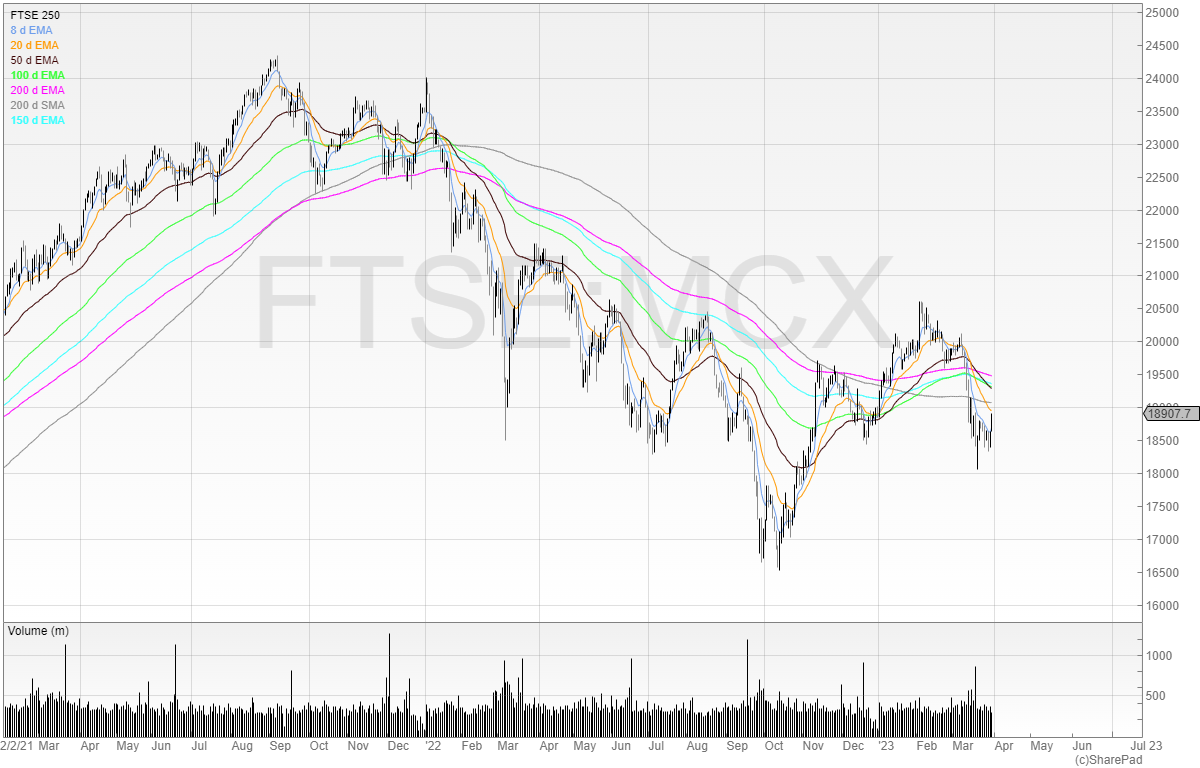

FTSE 250

The FTSE 250 has been hit hard and is still trading below many of the moving averages. Sentiment here has been hit harder and has yet to recover.

The FTSE 250 is still clearly in a downtrend and despite rallying a little off the recent bottom it’s still well off the highs in February this year.

The indices are worth following because when the market is trending, we see cash inflows into funds, market participants become risk-on, and money flows into equities lifting prices.

This is what happened during the lockdown period where people had money to spend and were bored at home, working hard, or working hard at hardly working. Money poured into the markets sending prices rocketing.

My view is that we’re deep into bear market territory.

The US markets started falling in the early days of January 2022 and so we’re now heading into the 16th month of downtrend. Does this mean it’ll be over soon? No. You can look at history and decide for yourself, but all you can say for sure is that we’re another month closer to another bull market.

More and more private investors are throwing in the towel every month.

Months and months of shares continuously grinding down – and that’s without including the average downs that keep falling – have worn many market participants out.

Watching your net worth dissipate month on month is mentally tough. And those who have average down may find themselves out of powder and helpless to act as their favourite stocks continue to slide.

Eventually, the losses become too big and they capitulate and sell. And when markets do rally, many look to sell quickly in relief expecting markets to fall further.

That said, wait for the right setups and play them as you would in a bull market. But be ready for false breakouts and to be stopped out of stocks – even the same one continuously.

All that means is that it’s not ready to move – at least not just yet.

At some point, the market turns. And when it does, those still standing will be ready to take advantage.

Michael Taylor

Buy the Bull Market premium trading newsletter available at: www.buythebullmarket.com

Twitter: @shiftingshares

Got some thoughts on this week’s article from Michael? Share these in the SharePad chat. Login to SharePad – click on the chat icon in the top right – select or search for a specific share or the “Traders chat”.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.