Breakouts are an excellent way to swing trade and profit from bull markets. I love breakouts because they’re a high probability pattern of continuation and also because it means that the price is rising.

However, many people try strategies that that are inherently risky. Sadly, one private investor commented that they’d invested into a stock called Helium One and after averaging down had invested £65,000. They sold the lot at a share price low on an RNS that showed the drill had found no helium, and took a loss of £57,000.

This is horrifying, and one can only hope this person is able to bounce back. But averaging down on binary events is not a good strategy. It’s a strategy that you’d take if you were hoping to get lucky.

I’ve never understood the hurry that some are in to get rich quick. Most people underestimate what they actually need to do to build wealth.

Warren Buffett averages around 19% a year. But compound even half of this number every year for many years, by the sheer nature of compounding you’ll eventually be fabulously wealthy.

If you compound £10,000 for ten years at a rate of 10%, you’ll eventually have £25,937.42.

This amount will not see you quit the day job anytime soon. But ten years is also not a long time.

If you compound £10,000 for 20 years at a rate of 10%, you’ll eventually have £67,275.

But let’s say you’re relatively young, and you compound your £10,000 for 30 years at a rate of 10%.

This will leave you with £174,494.02. Not bad from a £10,000 investment.

Some critics of this will say 10% is a tough hurdle.

It’s a fair point, as markets generally only tend to average 7-9%.

However, many private investors and traders can and do beat the market on a consistent basis.

Of course, none of the above calculations include additions. If you were to only add £1,000 per year this would make a material difference to your ending total.

It’s clear that the best way to build wealth is to stick around and let the magic lever of compounding do the hard work for you.

All you have to do is not lose money.

Here are some ways new traders can avoid making mistakes.

1. Don’t anticipate binary events – trade the reaction

Lots of people like to take high risks on drills, phase III trials, and other binary events.

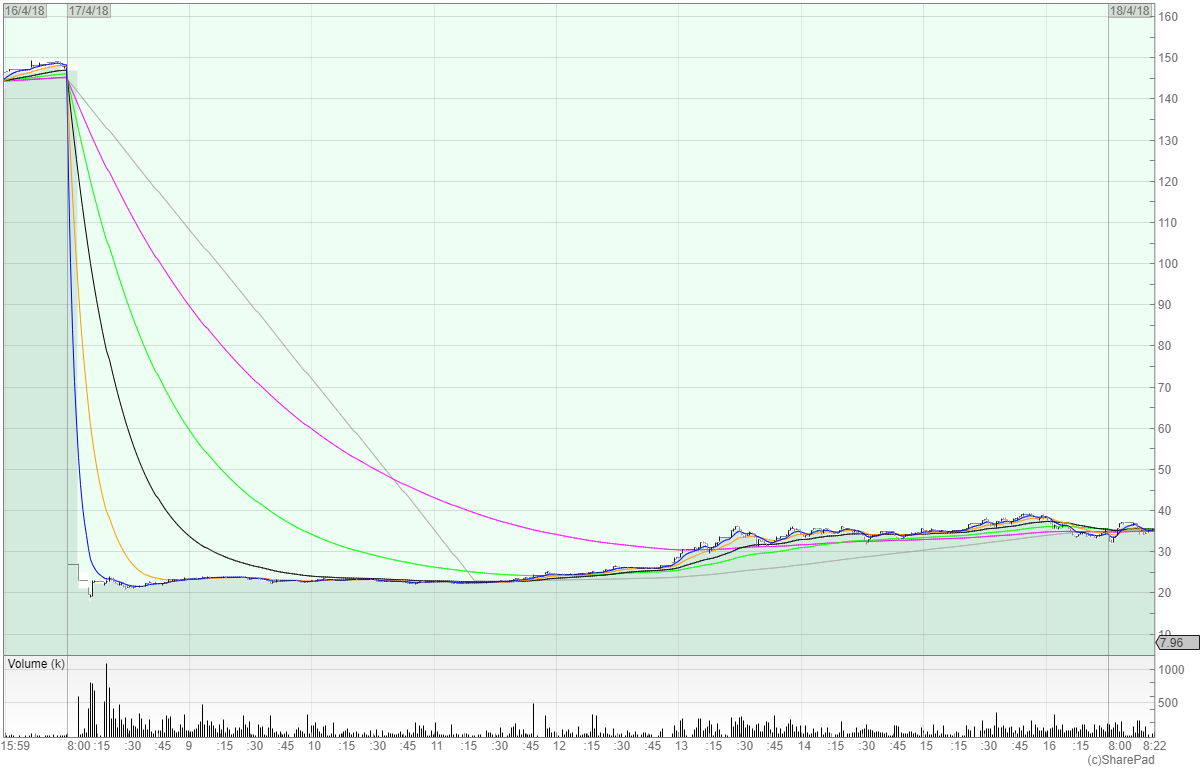

Here’s Immupharma’s phase III trial result:

We can see the stock dropped by around 75%.

But if you look at the intraday chart – the stock traded in a range of 100%.

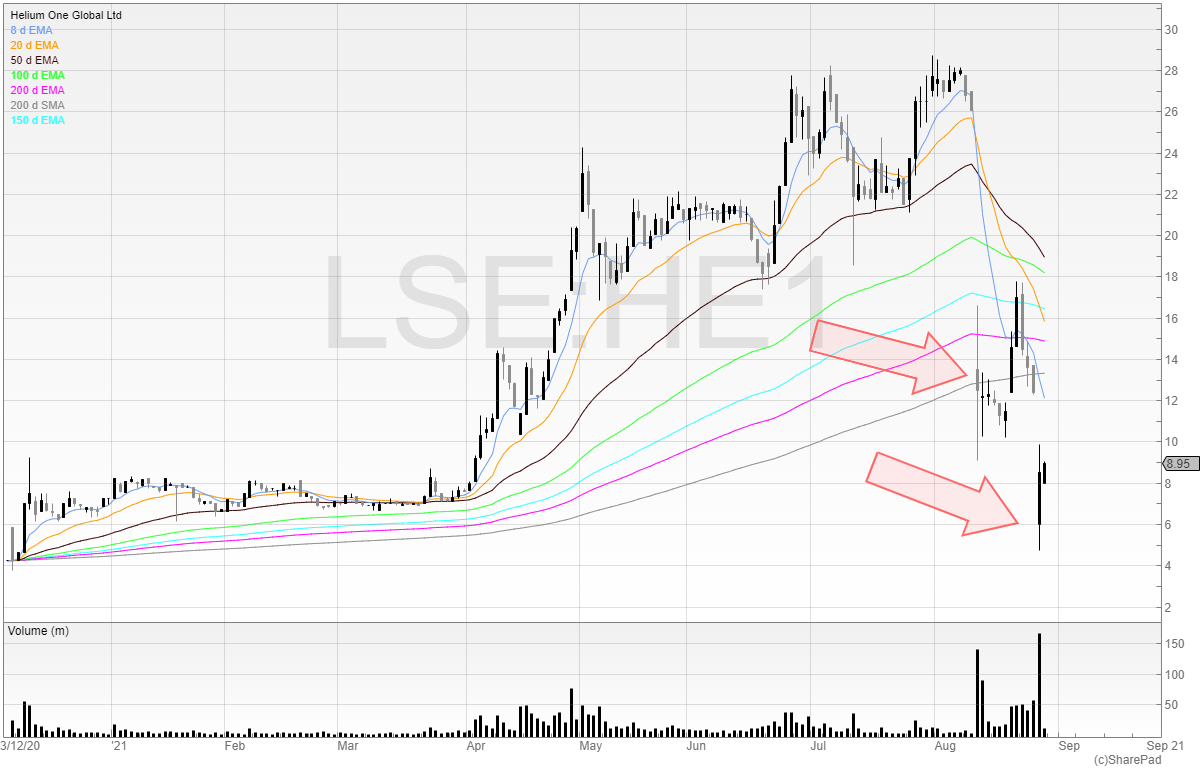

Here’s a more recent one from Helium One.

I’ve marked two arrows on the chart so we can see the results of the first drill and the second drill.

In both instances, the shares traded in a volatile range on the day.

If you were in the stock when this was announced to the market, then you probably had a bad day.

But instead, if you traded the reaction, it’s possible you might have had a good one.

Here’s the intraday chart for Helium One on the second drill.

We can see that the price opened up, plummeted down, tagged up, then rose up to hit just under 10p.

Opportunities like this in trading come about when expectations don’t match reality.

It was expected that Helium One would find helium, and so when it didn’t the price cratered.

If markets were efficient, then this risk would’ve already been priced in. Especially after the first drill!

When it comes to high risk plays like this, it’s always better to trade the reaction.

Maybe you’ve heard about one time when someone bet big on an oil drill and won. But ask yourself: how many times does that actually happen?

Trading is about playing the odds in your favour.

2. Trade the trend

This is a simple saying that will keep you on the right side of the trade.

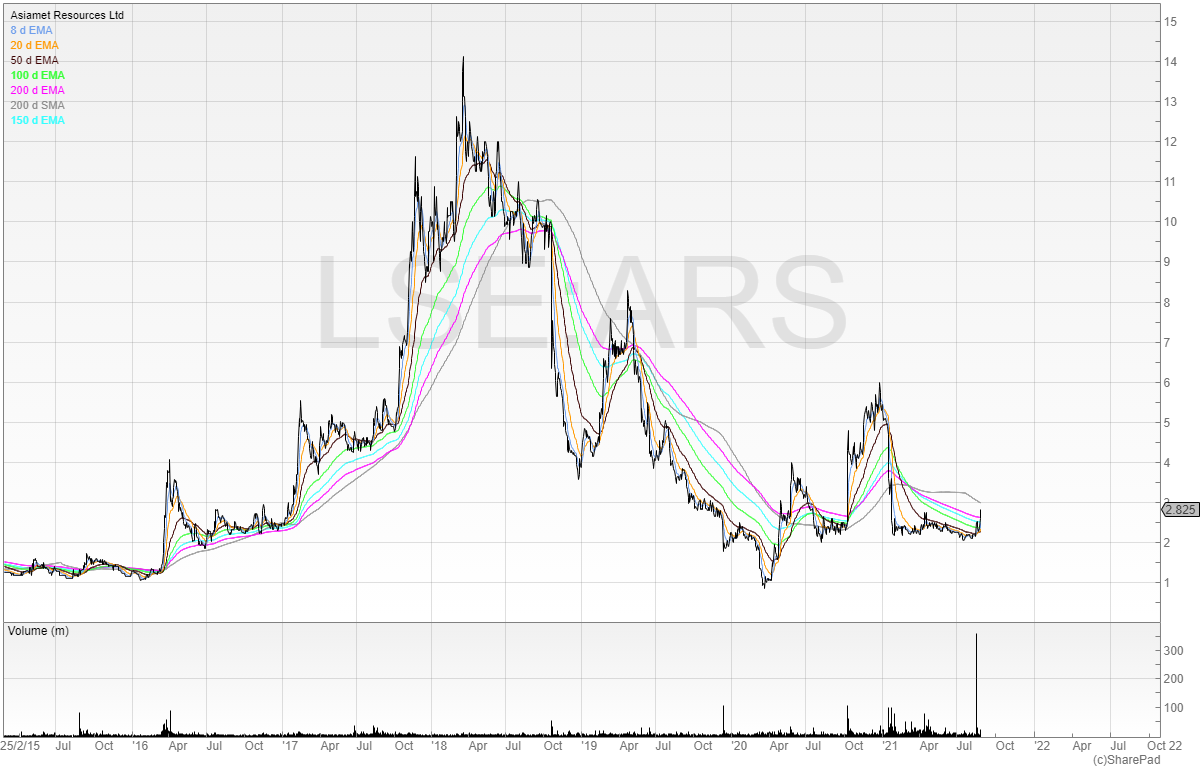

Here’s the chart of Asiamet Resources. It’s a firm favourite of many private investors.

We can see the stock went from 1p to 14p, and then it did a Grand Old Duke of York back to 1p.

The moving averages told the story here.

It’s easy to say in hindsight, but look at lots of charts and you’ll see that moving averages often set the trend.

Here’s a more recent chart. Maybe the trend is starting again?

3. Do the work

For some reason, trading is the only occupation where people think they can ‘have a go’ and see instant success.

If your toilet was fully blocked, would you:

- Choose to have a go?

- Call a plumber?

Plumbing is a profession that takes time to learn and train. So are most professions.

You can’t expect to jump into stock trading and instantly be a success.

It takes time to find an edge in the market.

Once you’ve found an edge, you need to work on it and keep working on it.

What works now might not work tomorrow. Markets change, strategies evolve, and nothing is constant.

There is always something to learn and somewhere you can improve.

I would recommend that all new traders start a trading journal. Most traders don’t do this and very few traders make money. I believe there is a correlation.

Logging your trades has several advantages:

- You collect data which you can analyse and find commonalities

- You can track your progress and monitor aspects of trading you’re trying to improve

- You can track your emotions, how you were feeling, and set in motion constant progress

It doesn’t need to take too much time. A simple A5 daily planner will do or an Excel sheet – whichever works best.

Ultimately, over the long-run, you will get what you deserve for your efforts in the market. Just don’t lose money.

I hold no positions in any of the stocks mentioned.

Michael Taylor

Buy the Breakout trading newsletter available at: www.shiftingshares.com/newsletter

Twitter: @shiftingshares

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

ARS, This looks like a nightmare. No profits & living on borrowed cash. The share price has gone nowhere for 13 years. The directors are taking wages as shares which means they know something that the market does not. This is one you would need to spend a lot of time trying to understand the downside as well as the upside as there are no clear business metrics to base an investment decision on, other than hope & luck. I would say looking at the directors they are a very interesting bunch of people with major knowledge which could make a difference. Not one for me. So best of luck.

The best way to swing trade is to buy the pullback and get into the position within 1-2 bars of the low, the next best way is to buy the breakout – doing both allows you to pyramid positions and returns soon massively outweigh buying and holding and waiting for an elusive 10 bagger