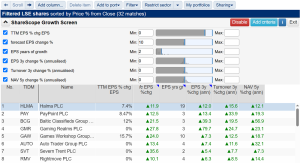

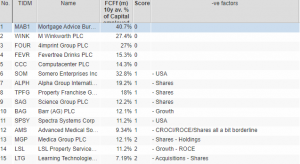

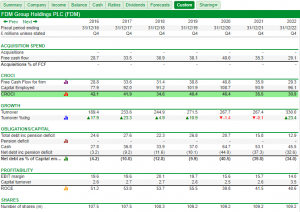

Five companies pass the 5 strikes test. Richard takes a closer look at QinetiQ, the defence technology company underperforming in a booming market. 5 Strikes Since my last update, 10 companies have published annual reports and passed my minimum quality filter. On closer inspection of their long-term financial track-records, five achieved less than 3 strikes […]