Phil uses SharePad to shed some light on the very popular Fundsmith Equity fund.

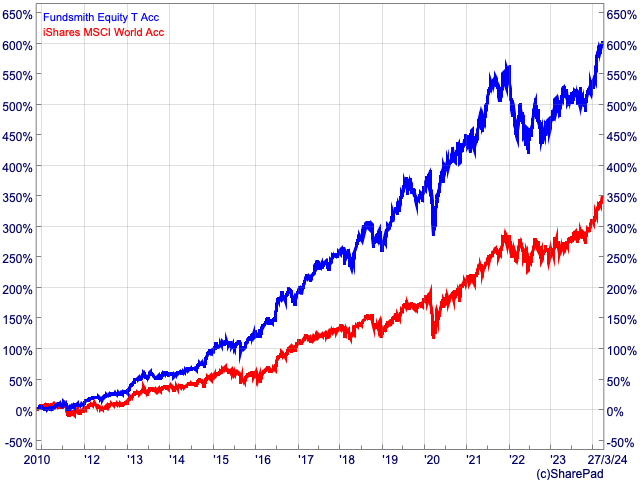

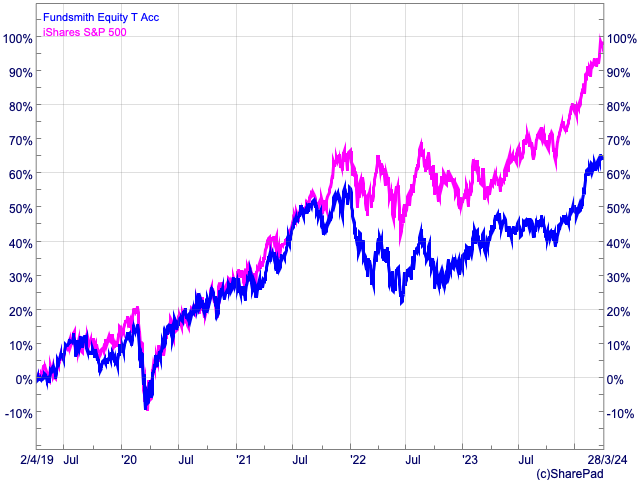

Fundsmith has great long-term performance but recent performance is more modest.

Fundsmith is one of the most popular managed funds out there and gets plenty of column inches due to its high-profile manager Terry Smith. Since starting out at the back end of 2010, the fund has delivered spectacular returns for those who have stayed invested. It has trounced its benchmark, the MSCI World Index.

The fund’s strategy is explained very simply as buy-good companies, don’t overpay for them and do nothing. On the first and third points, Mr Smith has been as good as his word. As we shall see shortly, the overpaying bit is open to debate.

A very good long-term track record is a great way to bring in more customers, but as they say in Hollywood, “you are only as good as your last performance”, could equally apply to fund managers as well.

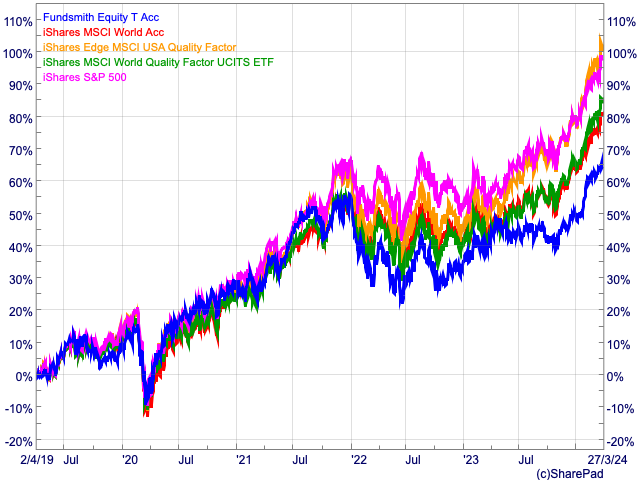

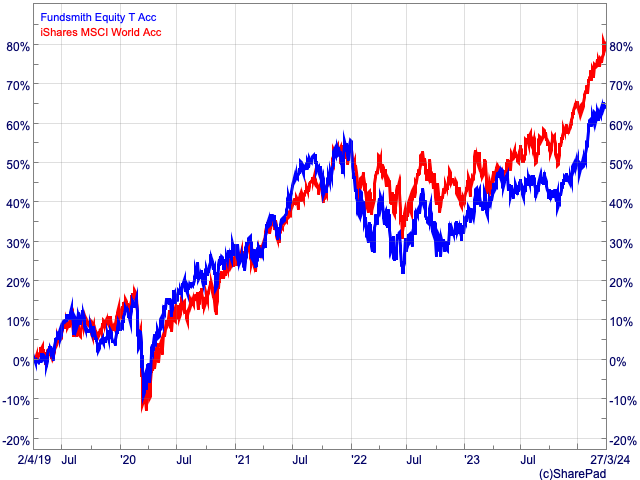

For the last five years, you would have been better off putting your money elsewhere than Fundsmith. According to Citywire, Terry Smith is only ranked 65th out of 162 managers in the global growth category over this time period.

You could also have done very well just sticking your money in the much cheaper MSCI World ETF or an S&P 500 ETF, where the cumulative outperformance against FundSmith has been quite marked.

ETFs continue to evolve and now offer a very viable alternative to active stock picking beyond simple tracking funds. I am a big fan of the quality factor ETFs offered by iShares, which invest in very good companies for a lot less than the 1% fee of Fundsmith and have comfortably outperformed it in recent times.

A Closer Look at FundSmith Equity

Many readers will use SharePad to research and analyse shares, but you can also use it to gain a better insight into the holdings of a fund.

SharePad will give you lots of information on fund performance, fees and the top ten holdings in a portfolio. The top ten holdings are no substitute for a full portfolio breakdown but it can give you a very good feel for how a fund is set up.

By creating a portfolio in SharePad with the top ten holdings, you can look at a wide variety of characteristics of the shares within a fund manager’s portfolio. You might want to look at quality metrics such as profit margins, return on capital employed (ROCE) or free cash flow. Alternatively, you can look at the valuation of shares and the forecast profit growth.

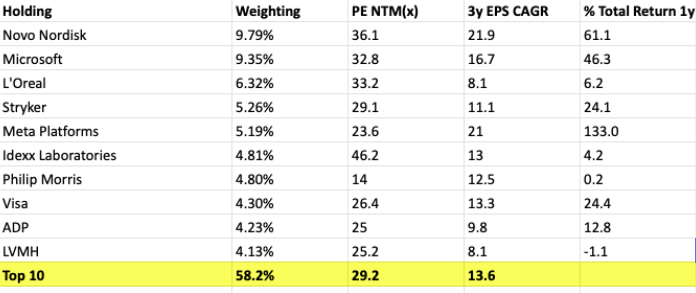

In order to keep things relatively simple, I’ve taken the latest top 10 holdings data for Fundsmith (note this is from last September but given the low turnover rate of the fund it would be surprising if it looked much different at the moment), and looked at the following bits of information:

- How concentrated the fund is – by adding the top ten position sizes you can see how active a manager is.

- The valuation of the shares.

- The expected annual growth in earnings per share (EPS) over the next three years.

- Total returns of each share over the last year.

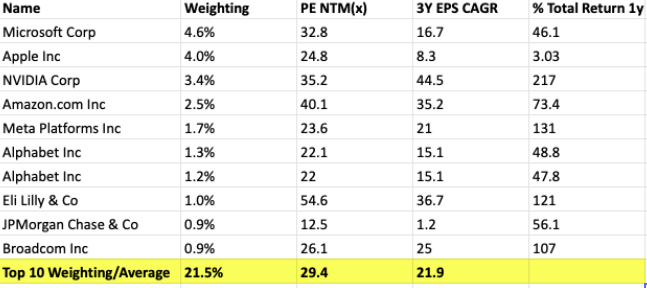

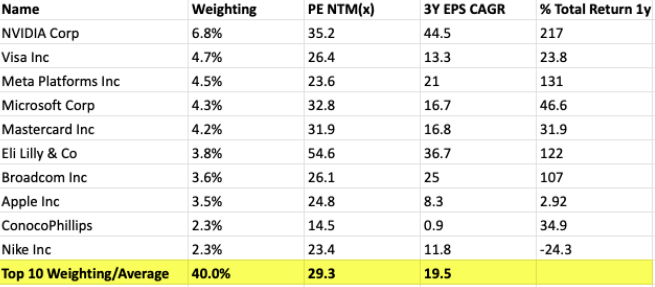

FundSmith Top 10: Valuation & Forecast Growth

Source: SharePad

We can see that Fundsmith is a very concentrated fund with over 58% of the fund invested in the top 10 holdings. This is a good thing as one of the best ways for a fund manager to outperform is to take meaningful positions in a company and have a fund which looks markedly different to the benchmark they are trying to beat. Rest assured, there’s no closet index tracking going on here

The fund holds some shares with very high valuations with the average of the top ten trading on just over 29 times their next year’s forecast EPS. The average expected three-year EPS growth rate is a decent 13.6% which is driven by the fund’s biggest bets in Novo Nordisk and Microsoft.

However, it could be argued that alternative ETFs have similar and lower valuations while offering more growth. Could this see them continue to outperform Fundsmith?

Fundsmith’s bets have paid off handsomely in terms of performance as has the position in Meta, but the fund has suffered due to the lacklustre performance of shares such as Idexx Laboratories, L’Oreal, Philip Morris and LVMH.

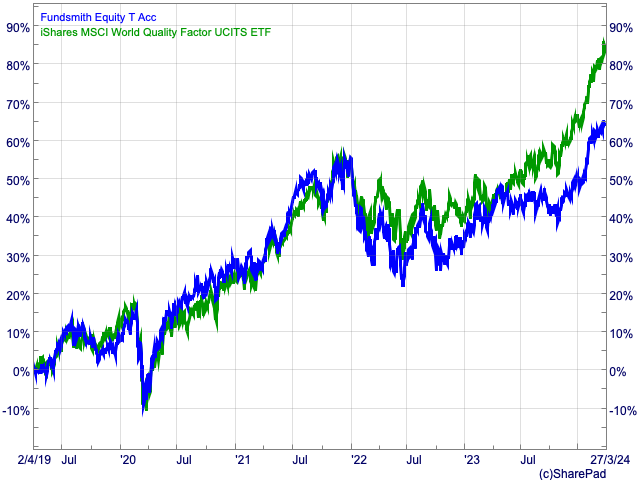

iShares World ETF outperforms

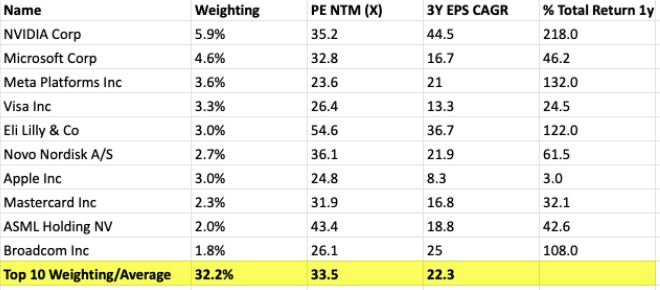

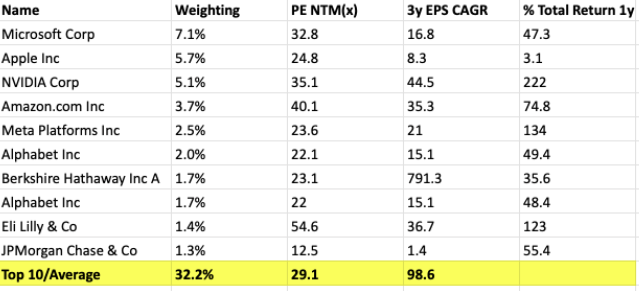

If we look at the makeup and performance of the iShares MSCI World ETF, we can see that it is much less concentrated than FundSmith; has a similar average top-10 valuation and a higher average expected growth rate.

Despite not having any massive positions, the ETF has outperformed Fundsmith due to stellar returns from the likes of Nvidia, Eli Lilly and Broadcom as well as Amazon which Fundsmith sold out of.

iShares MSCI World ETF: Valuation & Forecast Growth

Source: SharePad

World Quality ETF outperforms further

The iShares World Quality Factor ETF has performed slightly better than the World MSCI index. It is slightly more concentrated, has a higher average valuation and higher expected growth rate.

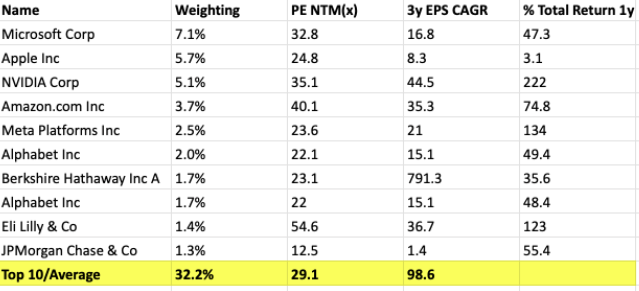

IShares World Quality ETF: Valuation & Forecast Growth

Source: SharePad

With the exception of Apple, this fund has had the same impressive performers in Nvidia, Eli Lilly and Broadcom but has benefited from a higher weighting than in the MSCI World ETF.

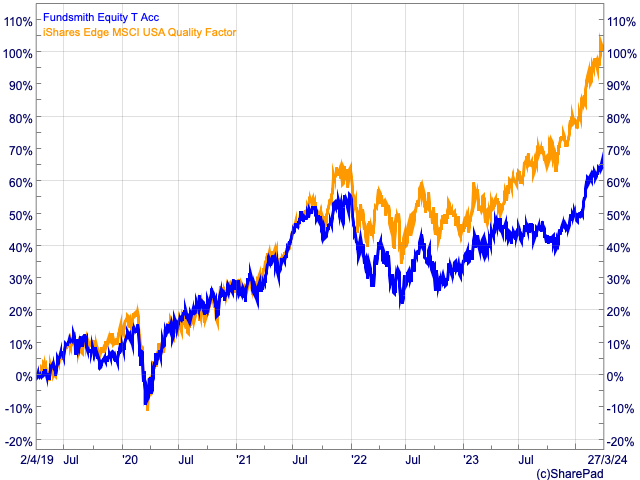

iShares Edge MSCI USA Quality Factor – a gem of an ETF

One thing that is coming through is that Fundsmith’s lack of exposure to Nvidia has been painful. The relatively big exposure to this share has helped the iShares MSCI USA Quality Factor substantially outperform Fundsmith over the last year. The higher exposure to Eli Lilly and Broadcom has also been helpful in this regard.

Readers may be surprised to see the likes of ConocoPhillips in a quality fund but it has served its investors well.

This ETF is more concentrated than the World ETF, but less so than Fundsmith.

iShares Edge US Quality Factor ETF: Valuation & Forecast Growth

Source: SharePad

An S&P 500 ETF continues to deliver

For those of you that like to keep investing simple, an S&P 500 has still been doing a very good job for investors. UK investors owning the iShares S&P 500 ETF for the last five years will have been comfortably better off than if they had put their money into Fundsmith and would have only paid an ongoing charge of 0.07% for the privilege.

iShares S&P 500 ETF: Valuation and Forecast Growth

Source: SharePad

Are Fundsmith’s best days behind it?

It’s too early to say this, but for a fund charging 1% annual fees it needs to up its game. Its investment process is very sound and it does own some good companies. So far in 2024, it is marginally ahead of the MSCI World index which is good considering the lack of exposure to Nvidia.

Should Nvidia and artificial intelligence-related shares fall out of favour in a big way, then the fund may begin to outperform again.

IShares S&P 500 ETF: Valuation & Forecast Growth

~

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.