“Investing success is two-thirds avoiding mistakes, one-third doing something right.”- Ken Fisher

Private investing offers the opportunity for individuals to take control of their finances and even achieve financial freedom. However, without proper knowledge and preparation, private investors can unknowingly make mistakes that hinder their portfolio investment returns. Of course, because we are human, it is natural for us to make mistakes, and we will be more successful through our continuous learning. To make life a little easier though, this article will look at some of the common mistakes that private investors make and provide insight on how to reduce and even avoid them, ensuring a higher chance of long-term success for your investment journey.

1. Overconfidence

“Overconfidence is a powerful source of illusions, primarily determined by the quality and coherence of the story that you can construct, not by its validity”. – Daniel Kahneman

Most investors are overly optimistic about the prospects for the shares they own, & overconfident in how much they know about said company they are invested in.

The more research undertaken, the more overconfident we can become. Without a strategy to realise our overconfidence and how to mitigate that, every investor will eventually fail.

Psychologists believe overconfidence increases whenever there’s a higher level of expertise associated with a task. It is often said that people who consider themselves to be very smart actually perform worse as investors. Warren Buffet’s business partner, Charlie Munger, put it simply when asked what was the key to his success at Berkshire Hathaway; he said simply one word: “rational”.

2. Lack of diversification

“Diversification is an established tenet of conservative investment” – Benjamin Graham

One of the most prevalent mistakes made by investors is a lack of diversification within their portfolio.

Before diversifying, each investor should first assess and attempt to understand underlying risks across their asset allocation, their tolerance to those risks, their time horizon, and their goals.

We are investing in a VUCA world i.e. one which is Volatile, Uncertain, Complex and Ambiguous. There is so much out of our control and the fate of a particular company; its stock can change overnight. For example, Patisserie Valerie, Carillion, Theranos*(privately held), 4D Pharma, Credit Suisse, and the Woodford Equity Income Fund all had experienced unexpected changes to their predicted returns.

Failing to diversify investments across different asset classes, sectors, and geographical regions can result in heightened risk. By spreading investments across a variety of asset classes, investors can reduce the impact of any single investment’s poor performance and potentially enhance their long-term returns. Case in point, many ISA investors are mainly UK-centric investors and this has led to their investment portfolios lacking exposure to US listed stocks which in the main have significantly outperformed UK listed stocks, especially the US best-performing tech behemoths during the past ten years.

3. Emotional decision-making due to lack of investing psychology

“I’m not emotional about investments. Investing is something where you have to be purely rational and not let emotion affect your decision making – just the facts” – Bill Ackman

Investing is far more about psychology than it is intelligence which is why another mistake investors often make is allowing emotions, such as fear or greed, to drive their investment decisions. Emotion-driven decisions can lead to reactionary buying or selling, which can harm investment returns. Instead, investors should develop a well-defined investment plan and adhere to it, focusing on long-term goals rather than short-term market fluctuations. Staying calm during short-term market fluctuations and not being impulsive should lead to being a long-term investor who has fully researched their chosen investment thus remaining invested and when successful, being rewarded over multiple years rather than months. The compounding impact of fewer trading costs and greater total returns can have a significant multiplier effect on an investor’s long-term portfolio performance.

In addition, we can often become emotionally entangled in our investment, and might not be willing to see the rational and logical challenges that need dealing with. Our brains can trick us into believing that something has more merit than it does. We have many unconscious biases, which act like shortcuts for our brains to help us make decisions, however, they can also prevent us from making the best decisions. There is one called the ‘affinity bias’ which means that we could make uneconomical investment decisions if we believe an investment aligns to our values. For example, if we invest in an ESG company because we believe in their vision and values, we may not pay adequate due diligence or be open to changes that need addressing if they are not performing well.

4. Failure to undertake sufficient research

“Research is the process of going up alleys to see if they are blind.” – Marston Bates

Shrewd diligent investing starts with undertaking enough research to understand the company, (investment company or fund), its business, its fundamental strengths, weaknesses, opportunities, threats and potential under-research catalyst. Investors may fall into the trap of failing to conduct thorough research before making investment decisions. Lack of understanding about a particular investment, such as the company’s financial health or the industry trends, can lead to poor investment choices. To minimise this mistake, investors should dedicate time to researching and analysing investments, including reading financial reports, studying market trends, and seeking expert opinions. As this will enable them to be alert to the potential direct and indirect changes in performance of an otherwise solid long-term core holding.

5. Market Timing

“Far more money has been lost by investors preparing for corrections, or trying to anticipate corrections, than has been lost in corrections themselves”. – Peter Lynch

Attempting to time the market is a common mistake made by Investors. Trying to predict the market’s highs and lows is extremely challenging and often results in missed opportunities or poor timing. Even when fundamental analysis has led investors to add to their armoury by using technical analysis, this can be fraught with long-term regret. Instead, investors should adopt a systematic approach, such as pound cost averaging, where regular investments are made regardless of market conditions. This can mitigate the effects of market volatility and potentially enhance long-term returns. Whilst also reduces the emotional urge to scalp quick gains which are not always easy to replicate and enables the prudent investor to focus on investing and the power of compounding.

6. Neglecting to rebalance their investment portfolio

“The beauty of periodic rebalancing is that it forces you to base your investing decisions on a simple, objective standard” – Benjamin Graham

Investors sometimes forget to rebalance their portfolios periodically. Over time, certain investments may outperform or underperform others, leading to an imbalance in the portfolio’s asset allocation. This means your potential returns over the longer term are more at risk. Rebalancing simply means making the trades necessary to bring a portfolio back to its intended asset allocation (investment mix) after fluctuations in the market has caused your portfolio mix to change. By rebalancing regularly, investors can sell high-performing assets and buy underperforming ones, ensuring their portfolio maintains the desired risk profile and potentially maximising their returns over the long term. On occasions when the asset allocation mix (small-cap stocks, large-cap stocks, funds/investment companies, bonds), are distorted to the extremes the now over-weight segment of the portfolio can be reduced/re-sized back to its original intended percentage and the under-weight segment can be increased if/when it appears undervalued. Long-term this rebalancing and buying of undervalued assets can lead to the regularly rebalanced portfolio outperforming the pure buy-and-hold portfolio.

7. They overtrade

“First of all, never play macho man with the market. Second, never overtrade”. – Paul Tudor Jones

Most investors prefer to do something rather than do nothing, even when that something often proves to be an unnecessary mistake, notably overtrading. Overtrading, or excessive buying and selling or churning of investments, is a mistake that can erode total returns.

It is essentially the mistake of being a ‘busy fool’ or being reactive rather than proactive. We can often believe we are being productive by continually reacting to changes in our investments when we are doing so unnecessarily.

Frequent trading often incurs additional transaction costs and increases the chances of making impulsive, ill-informed and costly decisions. Investors should adopt a disciplined approach and resist the urge to trade excessively.

It is essential to identify a well-defined strategy and stick to it, avoiding unnecessary transaction costs and potential losses. One of the main mistakes people make when trading or investing is focusing only on making very high returns in a short period.

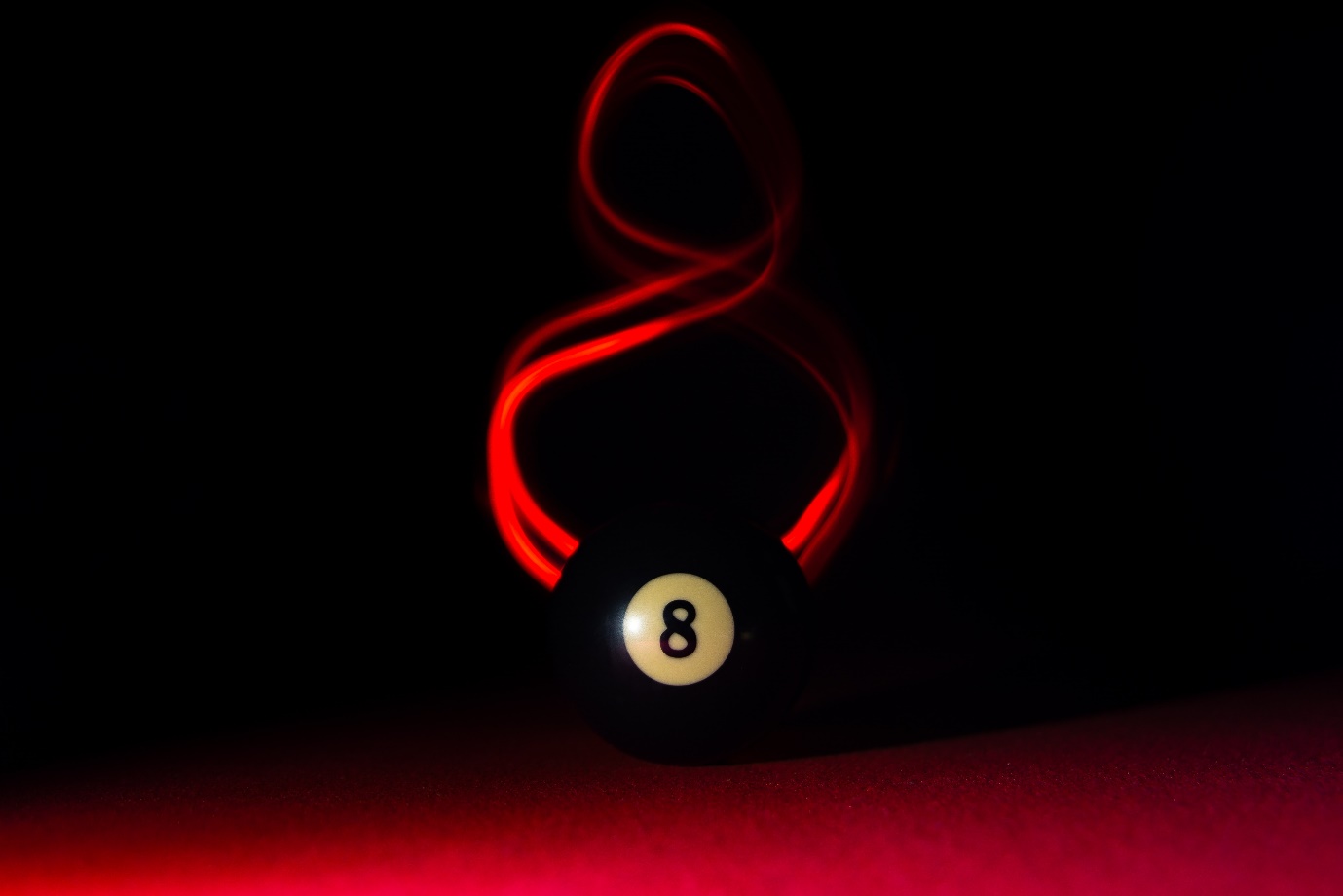

8. FOMO (fear of missing out)

“Don’t believe the hype” – Public Enemy

Fear of missing out (FOMO) is possibly one of our longest and most enduring failings; those religious amongst us would say it goes all the way back to Adam and Eve in the Garden of Eden and that juicy apple.

Fear of missing out (FOMO) is a common emotional investing mistake that can lead to impulsive decisions and poor risk management when investors chase fabulous, exciting, new, shiny and well-marketed ideas. Investors are surrounded by social media, bulletin boards, chatrooms, blogs, podcasts and investing channels on YouTube, and the frequency and level of information disseminated with regards to a single stock, fund, investment company or asset class at any one time can make it extremely overwhelming, for the inexperienced and even the experienced investor.

The confidence of a well-spoken, articulate, well-written and well-meaning individual about e.g. stock X, can lead to private investors being drawn into something which may not be for them and may not be as great, in reality. We can sometimes, make the mistake, through our ‘fear of missing out’ on committing to a ‘surefire, fast-rising, winning, opportunity’, irrespective of where stock X is in its growth journey, revenue generation or even fundraising* activity.

Daniel Kahneman sums this beautifully when he states, “Wherever there is prediction, there is ignorance, and probably more of it than we think.” If we are all thinking alike, then how many of us are actually thinking about the challenges, the risks and the issues? This is not to say that all marketing and sales persuasion is unhelpful, but what it does mean is that you should conduct your own due diligence to make sure that you know what you are buying and what you may realistically gain in return.

*Fundraising activity – means that the marketing and sales persuasion is elevated to gain interest and to increase the return for those who already hold or are looking to sell into the momentum of a rising stock. This often happens with AIM penny shares and private investors can experience a hugely discounted placing after an initial purchase. This can also happen with established, profitable, and even larger market-capitalised companies.

Ultimately, controlling FOMO is about maintaining and improving one’s own strict research strategy and being open to continual learning. Not falling for the next hype stock or asset class. Not believing the investment performance hype of your favoured anonymous Fintwit avatar individual whose proof of buys or sells you have absolutely no clue about. Instead of falling for FOMO, please take the time to analyse, research and evaluate each investing opportunity thoroughly and independently of the hype or noise of any individual or the crowd. There are no investment gurus and all that glitters is not gold! Or as Benjamin Graham famously said, “If everyone is thinking alike, then no one is thinking”.

Conclusion

“Mistakes are the best teachers. One does not learn from success. It is desirable to learn vicariously from other people’s failures, but it gets much more firmly seared in when they are your own” – Mohnish Pabrai

Successful long-term investing can be very rewarding, but it is crucial to avoid common mistakes that can impair investment returns. By focusing on diversification, making rational decisions, conducting thorough research, avoiding market timing, regularly rebalancing the portfolio, refraining from overtrading, and combatting the fear of missing out, private investors can increase their chances of achieving their financial goals and maximising investment returns. Luck may grant a fleeting taste of success, but lasting wealth is forged in discipline and sound strategy.

It is important to remember that as an investor, your goal is to have Emotional Intelligence (EQ) when investing because emotions underpin your decisions and your job is to understand and manage them wisely, otherwise they could rob you of long-term investing success.

~

Peter Higgins

@conkers3 on Twitter

The co-host of the Sharescope-sponsored TwinPetesInvesting Podcast

Twin Petes Investing Podcast | Conkers3

Got some thoughts about this article? Share these in the comment section below.

Not subscribed to ShareScope before? Click here to find out how SharePad can make you a better investor.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

Thoroughly enjoyed the article Pete! As someone just dipping their toe into the pool of investing, there’s some sage advice to take with me on this journey.

It seems that investing is as much about controlling one’s own emotions as it is about making the right decisions!

Hi Jamie,

Thank you firstly for giving my very first Sharescope article a read.

I am thrilled that as one of the newer investors that you found the 8 pointers and solutions of value.

Secondly, thank you for taking the time to write and provide me with your kind feedback. As I am completely outside of my comfort zone when writing such pieces for public consumption. Your generosity reduces my fears going forward.

Finally, I completely agree, investing is very much about controlling one’s emotions.

PSYCHOLOGY Know thy self.

Mastering our emotions, cognitive biases & cognitive #dissonance takes time, which is why our bad habits are often repeated. Hence only those who reflect and learn with an open mindset are able to grow successfully in life and as a long-term profitable investors with the steadfastness to compound significant investment returns.

Thank you Jamie and please share the article with other investors that you know.

Kindest regards Peter

Hi Pete,

I really appreciate your article, it’s both concise but informative. You have an incredible understanding of investing and how to thoroughly dissect company fundamentals. I’m looking forward to your next article, may I suggest and idea for it? I think that you should share your experience on the detective work and process that you follow in scanning, valuation, rationale, people in the BOD, timeframes, wobble plan, size, own projections, when to add or bail in case of price action as just a few topics in my mind. I’m almost certain that you have a formula for research that would make a wonderful day in the life of Pete, share sleuth… anyway once again thank you for your continued support to the investing community

Hi Upthetoffees,

It so very kind and generous of you to have firstly taken the time to read my article and then to leave such wonderful feedback.

“I really appreciate your article, it’s both concise but informative. You have an incredible understanding of investing and how to thoroughly dissect company fundamentals. I’m looking forward to your next article”

Your words are very encouraging indeed for this lacking in confidence novice and reluctant writer. Thank you.

Wrt your next writing suggestions, I have tried my very best over the past number of years after founding & producing the TwinPetesInvesting podcasts, to regularly discuss the topics and my strategies that you raised over several different episodes.

I dare say were I to even attempt to write about all your suggestions. Then like many others have suggested on Twitter/X I ought to write a book. Which ultimately fills me with dread as I have so many other community projects and charitable commitments at this time that require my focus alongside my emotional charge GCSE examination year daughter.

I will continue to support our investing community as best as I can going forward with free content. Additionally please do leave me a message on the Sharepad Chat if you feel I could be of any further use.

Thank you again for your generosity, kind words and continued support Upthetoffees.

Kindest regards Peter @conkers3 on Twitter/X

Thank You for Your Insightful Article

Dear Peter Higgins,

I just wanted to take a moment to thank you for your thoughtful article, *Eight Common Investing Mistakes Made by Private Investors.* Your clear and insightful breakdown of common pitfalls in investing has been eye-opening for me.

As I read through your points, I realised that All of these apply directly to me, particularly regarding researching thoroughly as blind allies are my specialty! Your ability to articulate these challenges in such a precise, yet accessible manner, has given me a fresh perspective on where I need to improve, that is to say all of the 8 key points!

Your article is a valuable guide, and I truly appreciate the time and effort you put into sharing your expertise. I look forward to reading more of your work in the future!

Best regards,

Nigel Woodley