Richard reveals the latest shares to pass his 5 Strikes scoring system, and attempts to bottle the essence of Christie, a big data business back in 1846!

It may be the height of summer, but I am still beavering away scoring shares as companies publish their annual reports.

Two months of top-scoring shares

To recap, I filter SharePad’s list of all shares listed in London to show only those that have earned positive cash flow averaged over the last three years.

I sort the list by last Annual Report date. Then I look for potential bogies (strikes) in the numbers of the companies that have reported recently using One custom table to rule them all, noting each strike in a SharePad note column, and the total in another column.

Shares that have less than three strikes are of immediate interest. Shares that have three or four strikes form a slush pile. Shares that have five or more strikes are struck out until I repeat the process next year.

I call the system Five Strikes and You’re Out. The last cut ended on 15 May. This one contains all the shares that received fewer than three strikes in the two months between 16 May and 16 July:

| Name | AR date | Strikes | # |

| Liontrust Asset Management | 11/07/2023 | – Shares | 1 |

| Telecom plus | 07/07/2023 | 0 | |

| Solid State | 06/07/2023 | – Acquisitions – Shares | 2 |

| Polar Capital | 04/07/2023 | – Growth – Shares – Accounting | 2 |

| Auto Trader | 30/06/2023 | 0 | |

| Castings | 30/06/2023 | – Growth – ROCE | 2 |

| Cranswick | 30/06/2023 | – Shares | 1 |

| Record | 30/06/2023 | 0 | |

| Bloomsbury Publishing | 23/06/2023 | – Shares | 1 |

| Norcros | 23/06/2023 | – Holdings – Shares | 2 |

| Halma | 22/06/2023 | – Holdings | 1 |

| Vp | 22/06/2023 | – CROCI – Debt | 2 |

| Ninety One | 15/06/2023 | – IPO – Growth | 2 |

| Tatton Asset Management | 15/06/2023 | – IPO | 1 |

| CMC Markets | 13/06/2023 | – CROCI – Growth | 2 |

| Airtel Africa | 09/06/2023 | – IPO – Debt | 2 |

| Burberry | 07/06/2023 | – Holdings – Growth | 2 |

| RS | 07/06/2023 | – Holdings – Shares | 2 |

| Anpario | 06/06/2023 | – Holdings/CROCI/Shares | 1 |

| Tate & Lyle | 06/06/2023 | – Holdings | 1 |

| EMIS | 05/06/2023 | – Holdings – Growth | 2 |

| JD Sports Fashion | 26/05/2023 | – Shares | 1 |

| London Security | 26/05/2023 | – Holdings | 1 |

| Pebble Beach Systems | 26/05/2023 | – Debt -Turnaround | 2 |

| Warpaint London | 24/05/2023 | – IPO – ROCE | 2 |

| Animalcare | 19/05/2023 | – Growth – ROCE | 2 |

| Christie | 19/05/2023 | 0 | |

| Andrews Sykes | 18/05/2023 | – Holdings | 1 |

| Next 15 | 17/05/2023 | – Shares | 1 |

Here is a key to the strikes I found this time (please note the benchmarks are arbitrary and when my assessment is borderline, I move them around a bit):

- Accounting (complex accounting may muddy numbers)

- Acquisitions (company spends more than free cash flow)

- CROCI (often very low, or sometimes negative)

- Debt (debt to capital has recently been > 50%)

- Growth (has grown turnover less than 3% or so a year)

- Holdings (directors own < 3% or > 75% of the shares)

- IPO (company floated in 2016 or later)

- ROCE (sometimes below 10%)

- Shares (count has grown by more than 1% or so a year)

- Turnaround (poor results predate recent good results)

Naturally, I am drawn to the shares with the fewest strikes. The result of my cursory inspection is that four shares, Auto Trader, Christie, Record, and Telecom plus score zero.

They are a good place to start my quest for new long-term investments because, on the face of it, there is not much to worry about!

The next stage is to work out how they make money, which you may recall I am also trying to systematise using The Business Model Navigator.

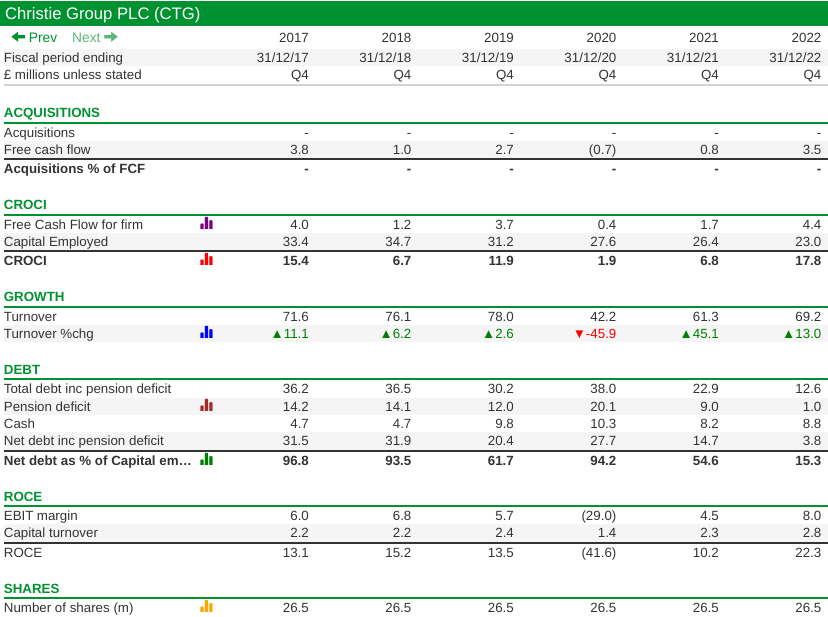

I investigated Auto Trader last November, so let us try and bottle the essence of Christie. First, a reminder of the numbers that attracted me to it:

Source: SharePad custom table. In practice, I look at more years of data, but for reasons of space, I have included six years here.

In retrospect, I may have been a bit generous by not awarding a single strike. Christie lost money during the pandemic, and although its debt-to-capital ratio was a modest 15% at the end of the last financial year, in the past it has operated with much higher levels of financial obligations.

I turned a blind eye to the pandemic performance because, as we are about to see, Christie provides services to businesses in the care, hospitality, and retail sectors, which were in the eye of a freakish storm. Hopefully, we will not experience another like that for a long time.

We may need to look at financial obligations a bit more closely because we can see from the table that the reduction in leverage has coincided with a dramatic reduction in the defined benefit pension deficit, which is a financial obligation to employees and former employees.

The size of the pension deficit is determined mostly by factors outside the company’s control, so it could go back up again.

Navigating the business model of Christie

Now, though, I want to take a shot at understanding the business. Tongue in cheek, I think, Christie describes itself as a pioneer in big data, because in 1846 the founder of Orridge, one of its businesses and Queen Victoria’s pharmacist, launched a stock-taking and valuation business.

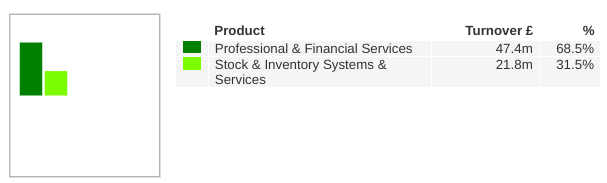

Today Orridge stock takes for retailers and pharmacists across Europe, and along with Venners, which provides inventory services to the hospitality industry, the stock and inventory division still earns Christie about a third of its revenue (although in recent years, including the year to December 2022, it has been loss-making):

Source: Sharepad activity breakdown

The other two-thirds of revenue comes from the sale of professional and financial services to the same customers, which is much more profitable. These are largely Christie-branded businesses that value, buy, and sell businesses, and source financing and insurance.

Briefly, I have attempted to summarise the business model by determining who the customers are, what they value, how Christie meets their needs, and how that combination generates value.

Who?

- Christie supplies businesses in the care, retail, and hospitality industries. I am guessing it works with their finance functions and owner-managers most closely.

What?

- It supplies specialist advice and services relating to the buying and selling of businesses and the management of stock. It also brokers insurance.

- Christie supplies services throughout a business’s life-cycle

How?

- It achieves this by owning firms that meet the routine and occasional needs of businesses in specific property-based industries like care homes, pharmacies, retailers and restaurants, and by recruiting, training and retaining knowledgeable staff.

- The annual report speaks warmly of the prospects of employees and a “treasured” colleague of 30 years who died. It is an employee-focused business that trumpets truth, integrity, trust, knowledge, collaboration and, in turn, client focus.

Value?

- By being good at many related activities, customers of one part of the business may trust it enough to use other services when they need them. For example, Christie Finance financed 10% of the business sales made by Christie & Co.

- This is probably why the company emphasises connectivity and collaboration, and why it expects much from a newly established “Cross Fertilisation Committee”.

Divining the business model

These are preliminary thoughts and generalisations gleaned from the company’s annual report and website, but they get us closer to understanding how Christie makes money.

I am still working my way through the sixty business models in the Business Model Navigator book and businesses, particularly those with many products and services, employ a number of business models.

One that comes to mind, though, is the cross-selling business model (perhaps because I read about it yesterday). This business model benefits customers because they do not have to search for a new supplier every time they want something different. It benefits the supplier because it reduces the cost of acquiring customers. Diverse revenue streams can also reduce a company’s sensitivity to the business cycle.

The danger of cross-selling is complexity. It only works if the firm is universally good, which is tricky. Just as a high reputation for one activity can encourage customers to buy other services, a bad job can be a disincentive.

Since there are many similarities between the care, retail and hospitality industries, principally their dependence on property and assets, perhaps the complexity is manageable.

I worry that software and automation might be eating the stock-taking business (despite its origins in “big data”, ironically), but on the whole, before I tried to bottle the essence of Christie I was sceptical I would be able to. I thought it might just be a sprawling mess.

On the contrary, I see cohesion.

~

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

Got some thoughts on this week’s article from Richard? Share these in the SharePad chat. Login to SharePad – click on the chat icon in the top right – select or search for a specific share.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.