As the number of new annual reports dwindles from a flood to a trickle, Richard examines another cut of shares that he scores highly. It is leading him to think the unthinkable.

The springtime flood of annual reports has abated, so this article probably contains the last big cut of shares that, after scrutinising the numbers for a minute or two, have the potential to be long-term investments.

For the rest of this year and the first two months of 2024, I will be examining the shares in today’s list, last month’s list, and the steadier stream of companies that report at other times of the year.

The rigour of rapidly scoring each share has already achieved two wins:

- Lots of new ideas…

- …That challenge my biases

A year of annual reports

The table below shows that more than half of the annual reports published by companies listed in London are published in the four months between March and June, which I think of as the annual reporting season.

Number of annual reports published per month (whole market)

![]()

Source: SharePad, LSE Shares excluding investment trusts. May 2022 to May 2023

For the select group of shares that interest me, those that pass my minimum quality filter (positive free cash flow averaged over the last three years), most of the action happens in March and April. The green cells in the spreadsheet mark above-average months, and there is a smaller blip in June.

Number of annual reports published per month (minimum quality)

![]()

Source: SharePad, LSE shares excluding investment trusts and companies

with negative average free cash flow over the last three years. May 2022 to May 2023

Companies report at this time, because the listing rules require fully listed companies to publish annual reports within four months of their financial year ends, and companies listed on the Alternative Investment Market (AIM) to report within six months. Many companies choose financial year ends that coincide with the calendar year-end, which gives fully listed companies deadlines in April and AIM-listed companies deadlines in June.

Some people shun AIM-listed shares because it is a less tightly regulated market and, as a group, AIM-listed companies have a reputation for being more youthful, more risky, and for performing poorly. There is truth in these generalisations, but they are blunt, and there are plenty of good AIM-listed businesses.

I prefer to use my own measures of quality, the first of which to come into play is the minimum quality filter. The fact that the minimum quality calendar is less busy in May and June than the whole market calendar, possibly indicates that the filter is doing its job, weeding out lots of speculative AIM companies.

Although the number of annual reports is higher than average, I imagine there are many AIM companies rushing to meet the deadline. That may be in itself a bad sign, and I do not expect a high proportion of those companies to pass the next stage of the process: the scoring system I have been experimenting with since March.

The flood is turning into a slower and more steady stream, until of course next March.

The latest cut

To recap: I filter the market for shares that have earned positive cash flow averaged over the last three years and sort the table by annual report date. Then I score each share that has published an annual report since the last time I checked. Generally, I prefer to spend about ten or fifteen minutes a day doing this than letting the work pile up.

This process takes a bit of experience, and a custom table in SharePad for quick reference. I call this method “Five Strikes and You’re Out”. If a share scores five it goes on the discard pile until the following years annual report. If it scores three or four, it goes in the slush pile and I will probably also ignore it for a year, at least.

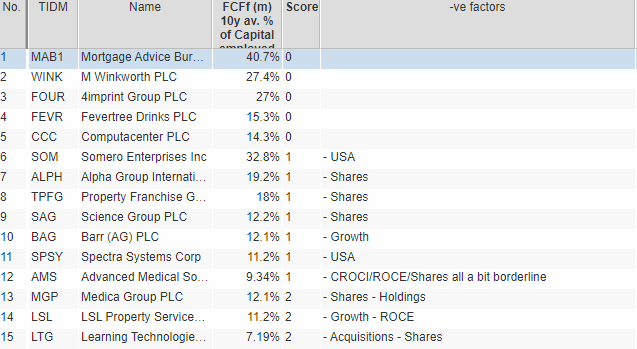

Only those shares that score 0, 1, or 2 get put in my watchlist. Here is the latest cut sorted by score and average Cash Return on Capital Invested (CROCI) over the last ten years. These are businesses that have generated handsome returns and less than two strikes:

Source: SharePad, companies reported between 19 April and 15 May 2023

The following strikes appear in the table this month:

– USA: Domiciled overseas

– Shares: Share count has grown more than about 1% a year

– Growth: Company is growing at less than about 3% a year

– Holdings: Directors shareholdings are insubstantial

– ROCE: Return on Capital Employed is below 10% or highly variable

– Acquisitions: Company spends more than it earns in free cash flow

In the case of Advanced Medical Solutions, I fudged the score. It narrowly passed three criteria, so I gave it one strike.

Confronting semi-conscious bias

These lists are revealing my biases. Last month it was recruiters, a sector I have shunned but that also shone in the table with three high-scoring representatives. That encouraged me to take a closer look at FDM.

This month it is the turn of businesses that operate franchises in the property sector, thereby combining two evils: property and franchising.

I am scared of the boom-bust nature of the property market and I am so prejudiced against franchises, that I can barely articulate a reason for it. True bias is blind after all.

I look for simplicity and coherence in investments. Either my investments do one thing very well. In business school jargon, they occupy a vital position in the value chain that brings a product to market.

4Imprint, a company I wrote about and then invested in, is one of those. It is the world’s biggest direct seller of promotional goods, which sits in a sweet spot mediating efficiently between numerous suppliers and over 100,000 business customers.

Or they do something very unique. They are, pretty much, the value chain. Games Workshop is one of those. It does not make the resin for the models itself, but it does nearly everything else.

With franchises, the situation can be more complicated. Franchises often occupy more than one position in the value chain. They provide the brand and help with marketing, while a restaurant franchise might also supply ingredients, for example.

We must worry about whether two types of customers are happy, the franchisee and the end-customer, which seems like twice as much to worry about.

Is Domino’s, which experienced a franchisee “rebellion” a few years ago but nevertheless made my first list of 5 Strikes shares, the exception that proves the rule?

The numbers suggest property-related franchises can be very good businesses.

Top of the latest 5 Strikes list is Mortgage Advice Bureau, which supplies mortgages to mortgage advisers, second is M Winkworth, an estate agent franchise, eighth in the list is Property Finance Group, which supplies loans and mortgages to landlords. Fourteenth is LSL Property Services, which operates mortgage, surveying and estate agency businesses, and estate agent franchises.

~

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

Got some thoughts on this week’s article from Richard? Share these in the SharePad chat. Login to SharePad – click on the chat icon in the top right – select or search for a specific share.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.