Richard employs some fuzzy logic to narrow the number of companies returned by his filter. A bit like we might do a set of press-ups every day, it is a routine to make him a stronger investor.

While everybody is talking about the latest developments in artificial intelligence, getting computers to think more like humans, I am injecting fuzzy human logic directly into my computer to pick shares by scoring each company.

Scoring in SharePad

This is not my first experiment with scoring. It is a fresh start, an opportunity that came about after I designed One custom table to rule them all last December, and used it routinely with a Minimum Quality filter to help identify candidates for investment.

The Minimum Quality filter discards shares that have failed to achieve a positive cash return on capital invested (CROCI) averaged over the last three years. This reduces the number of potential candidates listed in London, from thousands to 600 or so.

The filter knocks out speculative shares, those companies that have probably not been earning enough cash to sustain their businesses over the long-term. Unless their cash flow improves at some point, they will have to raise more money or go out of business.

Six hundred shares might sound like a lot to consider, but I only consider them once a year, when they publish annual reports.

If we can come to a decision in a minute or two, an average of about three or four shares a day seems reasonable. It is a bit like doing a set of push-ups every day or practising Duolingo for five minutes.

The custom table helps because it reduces the time spent clicking around SharePad by gathering the information we need in one place.

Damning shares to oblivion

Until recently, I made summary judgements. Having consulted the table, I would type a symbol into my notes for the share: “1” marked it for further investigation, “2” put it in my slush pile, and shares marked “X” were damned to oblivion.

But there is a problem with summary judgements, at least for ditherers. I would find something interesting or intractable about a share, and try to work it out.

Minutes could turn to hours as I forgot I was supposed to be filtering and slipped into analysis mode, leaving shares unfiltered and opportunities unexamined.

Following the old Peter Lynch maxim, I believe success in investing comes after turning over many rocks, all 600+ that meet the minimum quality standard, and to do that distractions are the enemy.

There is also a problem with the three shares a-day average. Most days are not average. In January and February, very few companies publish annual reports, but by March the trickle turns into a flood as companies with financial years ending in the most popular month, December, publish.

As the number of shares passing the Minimum Quality filter grew to double figures on some days, I had a need, and the need was for more speed.

A faster scoring system

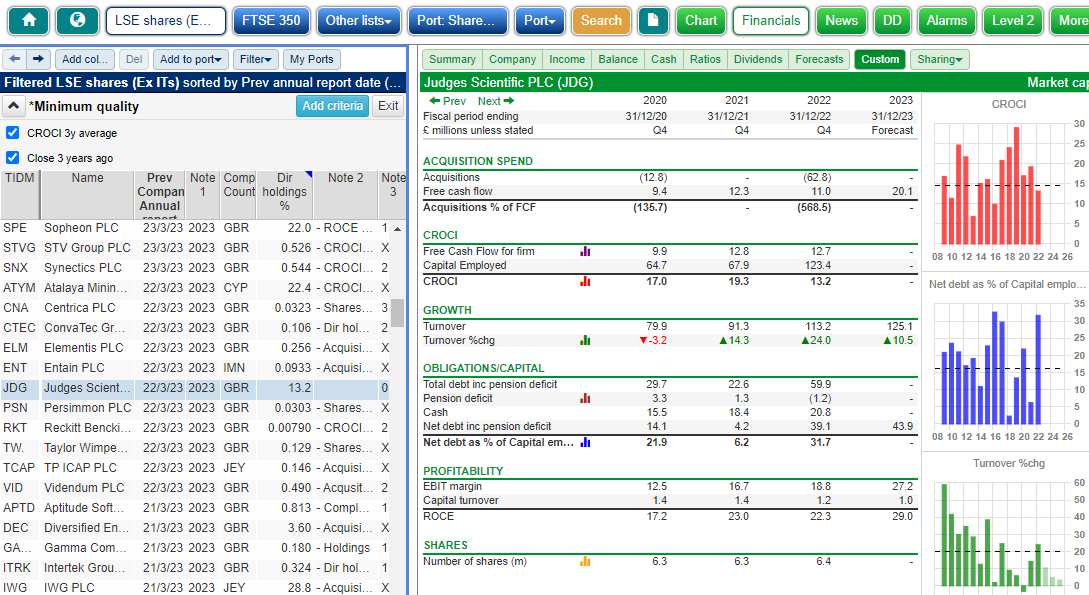

Screenshot of my SharePad setup, showing the Minimum quality filter on the left and One table to rule them all on the right. On my screen, I show as many years of data as I can in the table, but for reasons of space, the screenshot only shows four. Click on it for a full-sized version.

The screenshot shows my setup. The Minimum quality filter list has been augmented with two new columns: Company Country, and Director holdings %. These are two factors that cannot be included in the Custom table.

I prefer my investments to be domiciled at home where British laws and regulations apply, there is a good prospect that the company’s directors are accessible, and the Annual General Meeting will be here.

I also prefer it if the directors have a meaningful amount of their own money invested in the shares, and one way to get an impression of that is to consider the percentage of all the shares in issue that they own.

The table is ordered by “previous annual report date”, and I follow the following daily sequence to score the shares:

- Check the date in Note 1. If it is 2023, I have already scored it this year. If it is 2022 I change it to 2023.

- Check the list and the table looking for things I do not like and record them in Note 2.

- Tot up the number of things I dislike and record the total in Note 3.

This is what the scores mean:

- 0s,1s and 2s are earmarked for more investigation, 0s first

- 3s are my slush pile, if I run out of higher-scoring companies

- 4s are very likely to be investigated this year

- 5s will not be investigated, at least until I re-score the share next time the company publishes an annual report. It gets the X of death.

On the day I drafted this article, 11 new shares had published annual reports, and it took me 19 minutes to score them all, just under two minutes a share.

To show you how I scored these shares, let us take one share that scored X, and one, the only one so far, that scored 0.

First up, STV. I like to invest in companies that make great products and STV produced Blue Lights, a police drama we really enjoyed at home, even though I am not a fan of the genre.

It pains me to say, though, the Scottish broadcaster and programme maker is an X.

These are the five strikes:

– CROCI

– Turnover growth

– Debt

– Shares

– Holdings

Further analysis might overturn these judgements. This ‘verdict’ does not make STV a bad investment, it just bumps it down my list of priorities.

STV’s Cash Return on Capital Employed has been reasonable in recent years, but it has been variable, and it was negative in 2022. There may be a good reason for negative cash flow, but it is a complication especially because STV has substantial financial obligations, principally its pension deficit.

The company has tended to grow and contract, the Directors own some shares but their holdings are not substantial, and STV increased its share count in 2020. Had its finances been stronger, it may not have had to raise more money.

The fuzzy logic comes in as we can weigh up these variables. We are not only considering their values but their evolution over time, and their interaction with each other. Experience tells me volatile cash flow is particularly hazardous when companies have other financial obligations.

Fuzziness also came to bear in the score I gave Judges Scientific.

If I were applying rules strictly, Judges Scientific would have scored 1. That is because in 2022 it spent more than five times as much cash as it earned on an acquisition. Since the year-end it has made a subsequent payment relating to the same acquisition.

I prefer companies not to spend more than they earn, to live within their means, in other words.

Judges Scientific probably is living within its means, though. It had spent less than it earned in previous years, so it was in a good financial position, and I expect it to reduce its borrowings before splurging again.

That said, since I scored Judges, I have read its annual report and I think we need to be a bit circumspect about debt.

There is nothing else not to like. Judges Scientific is domiciled here, directors own a substantial proportion of the shares (13.2%), CROCI and ROCE are consistently high (generally well in excess of 10%). Turnover contracted marginally in 2020 (3.2%), but we can forgive Judges that given what was going on in the World.

The share count has risen slightly, which dilutes shareholders, but the dilution is orders of magnitude lower than the growth in revenue and profit.

What no price?

There are, of course, two aspects to fundamental investing, the quality of the business and how much to pay for the shares. My score assesses the quality of the business. It says nothing about price.

There are two reasons for that. The share price does not endure, it bobbles around all the time and I do not want to have to change my scores every week or every month.

The second is I prefer to judge how much to pay for a share after I have understood the business and know what I am paying for. That comes after further investigation.

Final thoughts on scoring (for now)

Lewis Robinson wrote about rapidly scoring shares last January. If my article has intrigued you, you should read his, and the comments on that article.

Lewis is an experienced investor. Experience allows us to interpret data quickly and include prior knowledge in his scores.

If we are backing ourselves to improve on the raw data, experience should help, but I suspect one good way to get experience is to score shares and revisit our scores once a year.

In my next article, I will share the first tranche of 25 shares to join my watchlist, those that have scored 0, 1 or 2.

~

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

Got some thoughts on this week’s article from Richard? Share these in the SharePad chat. Login to SharePad – click on the chat icon in the top right – select or search for a specific share.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.