Richard puts one last company through his process in 2022. It gives him a chance to reflect on how he has changed the way he uses SharePad this year.

Towards the end of every year, I reflect on the year gone by, what has gone right and what has gone wrong, and how I can improve.

This is not a review of which shares have gone up and which have gone down, because I do not buy shares in the expectation that their prices will rise over the course of one year.

It is a process review designed to make me better at finding and analysing potential buy-and-hold investments, shares that might pay for my retirement in companies that might employ my children and, one day, grandchildren.

By refining the process, I may have time to play with those theoretical grandchildren.

One inefficient tendency is spending too long investigating shares that end up on the discard pile.

This year, I have simplified my process for deciding whether a share is worthy of attention and, in the course of reflecting on that process and preparing this article, simplified it some more.

From idea to investigation

All investments start with an idea.

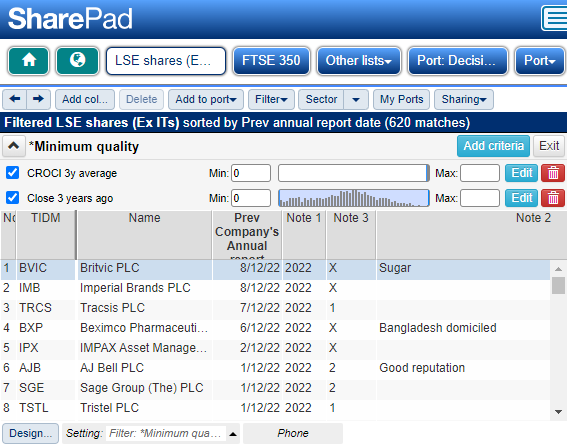

Many of mine come from scanning the results of a very simple filter every day named “*minimum quality”. Because the filter sees action so often, I want it to appear first in SharePad’s menus, hence the asterisk.

To pass the filter, a share must have been listed for more than three years and have earned a positive Cash Return on Capital Invested (CROCI) averaged over the previous three years.

This is a way of making sure the companies I appraise are making some money, and that they have enough of a track record to tell me something meaningful.

Amazingly, only 620 companies out of the 1,552 listed in London meet these basic criteria.

The results are sorted so companies that have published Annual Reports recently are at the top. I am looking for companies that have published an annual report since my last trawl, usually the day before.

I record the current year in Note 1 as a reminder that the share has been evaluated this year. Then a code each share: “1” flags a share for further investigation, “2” puts it in my slush pile, and “X” is the end of the road, for this year at least.

When I have time to investigate a share the 1s are my priority, and the 2s may receive my attention if there are no 1s left. To help decide whether a company is a 1 or a 2, I examine the financials in a custom table in SharePad.

To demonstrate, instead of picking one of the shares highlighted by my *minimum quality filter recently, I have picked Norcros, an idea that came from a reader.

Paul writes: “I wonder what your thoughts on Norcros are? The figures look good but the sp [share price] is well down, which is strange.”

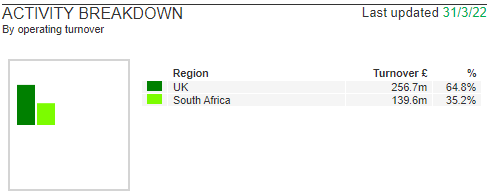

A mate who used to work for the company introduced him to the share and, Paul says, the financials look good. Norcros supplies bathroom and kitchen products: taps and tiles. He reckons its most famous brand is Triton, perhaps the UK’s most famous shower brand. He also likes the fact that it has overseas sales.

It earns substantial revenue in South Africa:

Source: SharePad > Companies

Five key numbers

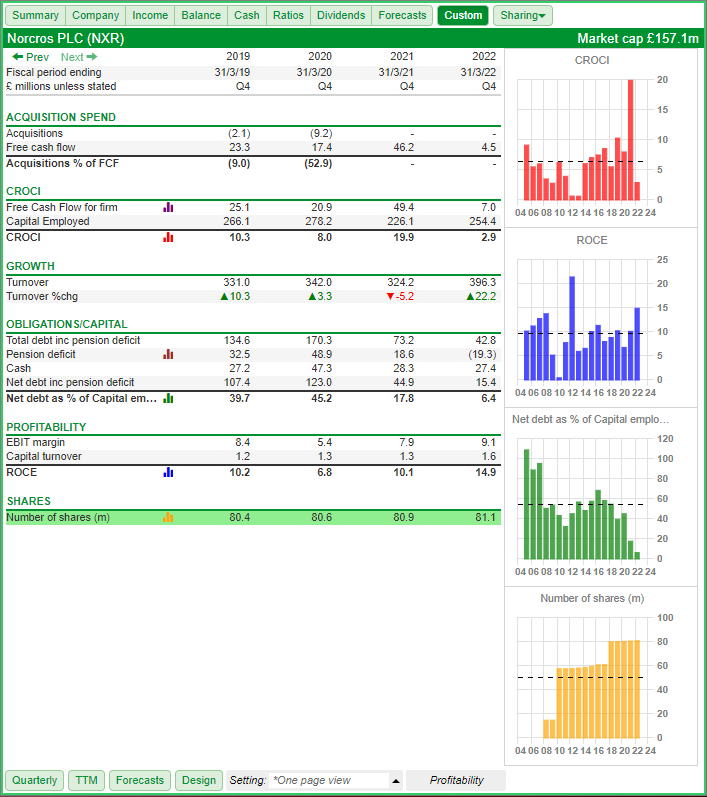

Before we discuss the financials, a quick note on the table below. It focuses on five numbers that tell us about how a company performs in good times and bad times, and whether it is sufficiently profitable to grow under its own steam.

Where available, I choose lease-adjusted figures in SharePad so the numbers before the introduction of the IFRS 16 accounting standard in 2019 are at least somewhat comparable to the numbers after it. IFRS 16 essentially mandated lease adjustment.

Normally I look at more years than the four that fit in the screenshot:

Taking the numbers at face value, Norcros is a viable business, but probably not a great one. Profitability in terms of ROCE is typically about 10% and CROCI is a bit lower. This should be enough to power some growth, and, except in the worst year of the pandemic and the worst year of the Great Financial Crisis when it contracted, Norcros has grown.

Not all of that growth has been self-funded though. The acquisition spend in the table is a fairly modest proportion of free cash flow (9% in 2019 and 50% in 2020). But in 2018, the company splurged six times free cash flow on acquisitions, which was probably funded by borrowing and selling more shares (the share count increased in 2018 (see the yellow chart).

Since 2020, net borrowing (including leases and the pension deficit) has fallen from £123 million to £15 million, which is good news but raises another issue.

Nearly £50 million of the fall in net borrowing was due to the elimination of the pension deficit, which may be temporary because pension deficits are volatile.

My reading of the numbers, incline me towards giving Norcros a priority of 2. I might read its annual report on a slow day.

But much has happened since the end of Norcros’ last financial year, and I would be doing Paul a disservice by stopping here.

Five key events

Here is a chart correlating Regulatory News Service (RNS) announcements (the purple squares) to the share price since the beginning of the year, soon after the chart had hit a record high (in SharePad you can click on the squares to read the headline):

Included among more mundane news in the year to date, is:

- January: Norcros is not planning to take any action following a shareholder rebellion against executive remuneration at the AGM the previous July

- May: A big acquisition will cost the company between £80 million and £92 million, mostly funded by borrowing

- May: A placing of new shares raised £18 million to part-fund the acquisition and reduce borrowings a bit.

- June: Full-year results. Trading recovered from a pandemic induced lull but cash flow was weak due to high levels of stock. The outlook was uncertain

- November: Half-year results. Life-for-like revenue growth stalled, profit contracted, and Norcros reported £60 million of net debt.

Norcros’ acquisition may be a very good fit, but it cost many times Norcros’ average annual free cash flow so the business is likely to be saddled with debt for some time.

To make that financial commitment at a time when trading may be deteriorating is risky, particularly as Norcros’ finances could weaken through no fault of its own because of its pension fund, and the high levels of stock it is holding during the “perma-crisis” we are experiencing.

Some of that stock is manufactured in China and a dependency on China is itself a risk, as we have seen in recent years with a tariff war and now supply shortages.

I had hoped my last article of the year might end on a positive note, but I am afraid this year Norcros is an ‘X’. Acquisitiveness and the adequate numbers incline me to believe it does not do anything particularly special.

That does not mean the shares, which trade on a PE ratio of just 5, will not go down in 2023. As I said at the beginning of the article I do not have an opinion on that.

Happy Christmas!

I am glad I finished with a request from a reader even though it did not turn out the way either of us would have wanted. It has been a privilege to share my thoughts with you this year and I look forward to your correspondence next year.

In the meantime, have a great Christmas.

~

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

Got some thoughts on this week’s article from Richard? Share these in the SharePad chat. Login to SharePad – click on the chat icon in the top right – select or search for a specific share.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.