Richard reveals the top-scoring shares to have been through his “Five strikes and you’re out” scoring system. Top of the list is a company he has never investigated before.

In Five strikes and you’re out, I introduced a method for rapidly scoring shares by eyeballing the financials in SharePad using one custom table.

Every day I look at the data for companies that have just published annual reports, but only if they have achieved positive free cash flow averaged over the last three years.

Spring is peak annual reporting season, so at this time of year it can mean appraising more than ten shares a day, but mercifully it only takes a minute or two per share.

Today I am sharing my first cut of the stockmarket.

What Richard did next

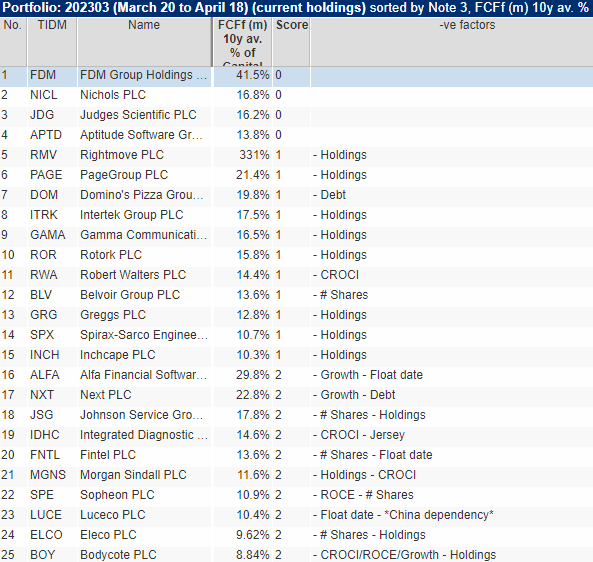

I took this cut on 18 April, having scored 149 companies since I started almost a month earlier on 20 March.

Since I add to a share’s score every time I find fault with it, the lower the score the better.

Of the 149 free cash-flow positive shares, 80 scored 4 or more. I am most unlikely to investigate any of these shares again until next year when I score them again.

Thirty-eight companies scored 3, I may come back to them if I run out of companies that scored less. It is the lowest scorers, the shares with the fewest red flags, that I will investigate.

Sixteen shares scored 2, eleven shares scored 1, and four shares scored 0.

To make the analysis easier, we can add the 31 shares to a portfolio, and then get to work prioritising which ones to research using SharePad’s sort and subsort capabilities.

I chose to sort using my score, and subsort using a homemade version of SharePad’s CROCI ratio: 10-year average Free Cash Flow for the Firm as a percentage of 10-year average Capital Employed.

This prioritises shares that have the same score, so we are looking at companies that have sustained the highest levels of profitability.

There are other ways we could have subsorted this list. For example, we could use a valuation ratio like EV:EBIT or debt-adjusted PE, which would focus us on shares trading on the lowest valuations first.

Finally, because I do not believe I will get that far down the list, I have chopped the bottom off, which happens to be companies that score 2 and a long-term CROCI ratio of less than 8%. These are, by the numbers, the lowest quality companies in the selection.

Here are the remaining 25 shares, in priority order. You are likely to hear more about some of them in the coming weeks:

Source: SharePad

Happily, scoring the shares was quick, and, based on what I already know about some of these shares, the list contains good quality businesses. Maybe the ones I do not know as well are good quality too.

You can see what I did not like about each share in the right-hand column of the list. Here’s a brief explanation of each factor that weighed against the top 25:

– # Shares. The company has increased its share count significantly

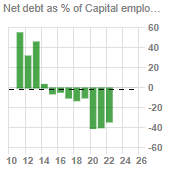

– Debt. The company owes a lot to lenders, landlords and/or pension funds

– CROCI and ROCE. Profitability is erratic or not very impressive

– Float date. There is limited data on the company because it floated recently

– Growth. Growth in turnover is erratic, or not very impressive

– Holdings. Directors do not own substantial shareholdings in the company

– Anything else I am already worrying about is marked with an asterisk*

There is a lot of room for interpretation, for example, Bodycote’s ROCE and CROCI were just good enough, but with turnover growth that was also just good enough, I decided the combination of factors was underwhelming and added one point to the company’s score.

There is also scope to bring our knowledge about each company to bear, if there are negative factors we already know about. For example, I am concerned about Luceco’s dependence on manufacturing in China due to deteriorating trade and geopolitical relations.

Even though deciding whether a company fails each criteria is a fuzzy decision, you have got to start somewhere. These were my starting points:

– #Shares. The count rises by more than about 1% a year

– CROCI. Often below 10%, sometimes negative

– Debt. Often more than 25% of capital, more than 25% in the current year

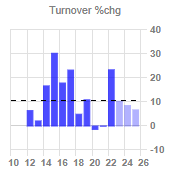

– Growth. Turnover growth is below 3% or so a year, or very choppy

– Holdings. Directors in small companies own less than 2% of 3% of the shares. Directors in large companies hold shares worth less than many times what they probably earn.

– ROCE. Has fallen below 10% more than once

FDM tops the list

How delightful. Top of the list is a company that I have never investigated before, FDM, it is substantial too. A FTSE-250 business with a market capitalisation of £755 million.

You may have noticed that so far I have said nothing good about any of the shares in the top 25. That is because I am a nit-picker. I look for bad things, the reasoning being that if you find only a few nits and you can live with them, what you are left with is probably very good:

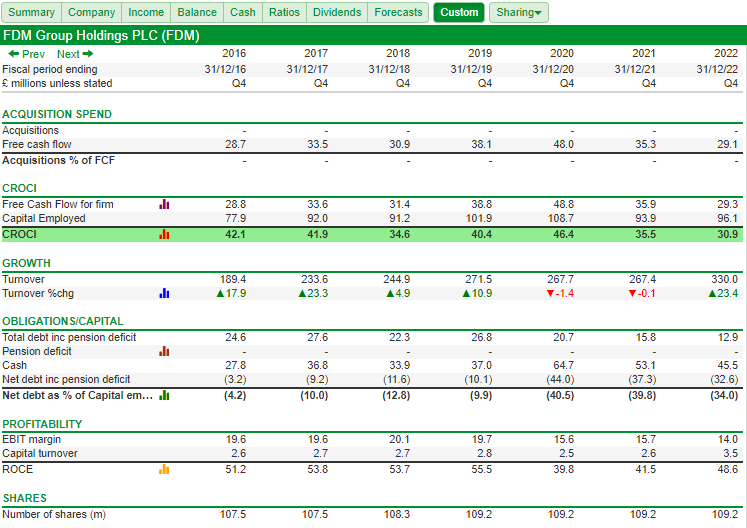

Source: SharePad custom table, “One custom table to rule them all”. For reasons of space, the date range in the screenshot is limited to 2016-2022, however, I considered earlier years too.

One of the other factors I consider is whether a business spends more on acquisitions than it earns in free cash flow. Perhaps unsurprisingly, none of the top 25 did.

FDM has spent nothing on acquisitions, and its share count has only ticked up modestly so it has probably not traded shares for businesses either. Its prodigious profitability and growth, therefore, have come from the company’s own efforts. This, to me, suggests the business has been doing something special.

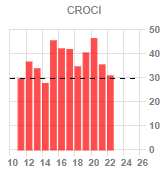

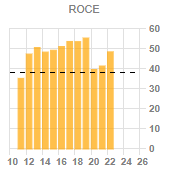

How good is FDM? Sometimes, pictures can make the case more eloquently than numbers:

|

|

|

|

Source: SharePad custom table, “One custom table to rule them all”. The charts show more years than the table!

The next question is, how does FDM make money? The company’s homepage says:

“We recruit, train and deploy IT and business professionals to work with our clients around the world, creating careers and bridging the digital skills gap.”

I like this pithy statement. FDM is a recruiter, but the emphasis on training, deployment, and IT, suggests it has plenty of opportunity to add value to the ‘product’, which is people, and perhaps give them rewarding careers.

Intriguingly two more recruiters feature prominently in my list: PageGroup and Robert Walters. I have not previously investigated these companies either.

Joyfully, it appears that I have a sector, and at least three companies to get to know better.

There are probably many other good ideas lurking in this list, and in a month or two’s time, I expect to be able to share my next cut of the stockmarket.

~

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

Got some thoughts on this week’s article from Richard? Share these in the SharePad chat. Login to SharePad – click on the chat icon in the top right – select or search for a specific share.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.