Michael looks at the overall market and another intraday play in this article.

AI will be the growth driver for the next bull run. At least that’s what everyone is saying.

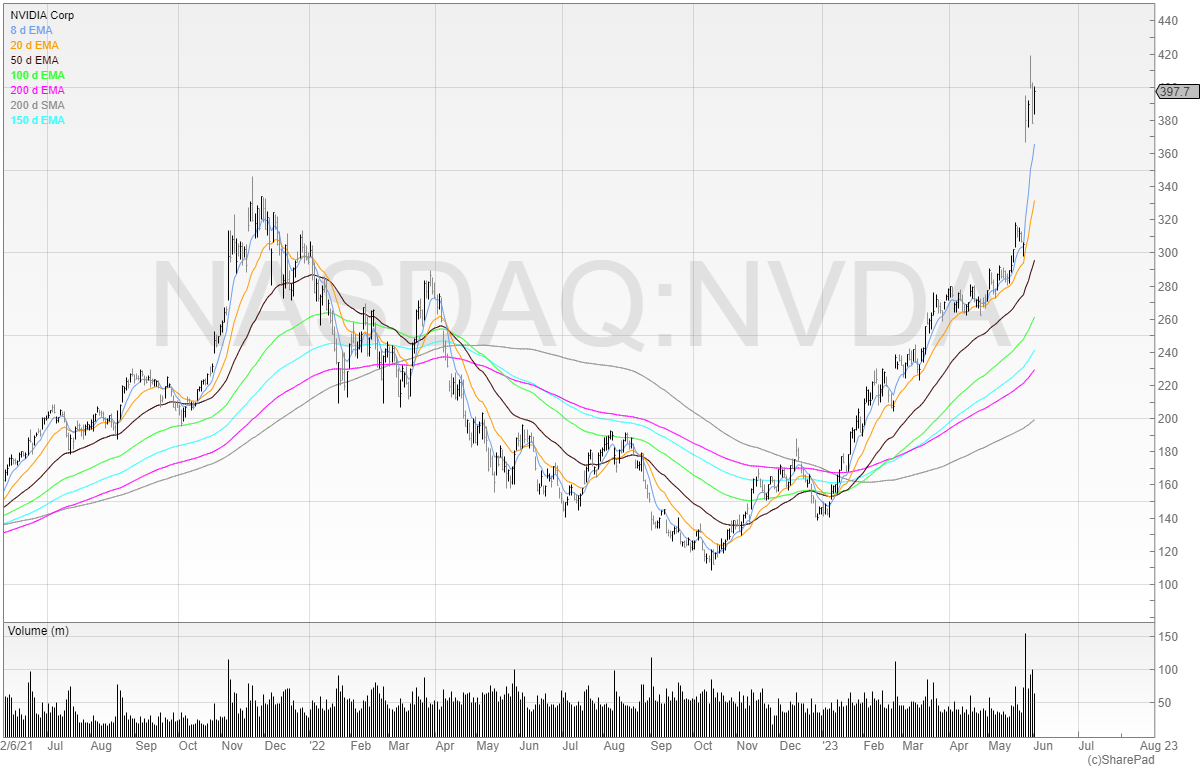

Here’s Nvidia’s chart. The stock gapped up more than 25% on earnings. Not something you see on mega caps every day. Or even every year.

Basically: the numbers from its AI unit were impressive and everyone jumped on the stock. Does that mean we’re going to see a new market leader? I don’t know, but new technologies often drive an increase in productivity and this provides an earnings driver for many years.

You’ll no doubt have heard stories about AI. Its use cases are growing daily, and advances are increasing exponentially. And after an 18-month bear market, people are looking for excuses for the market to rally.

Apple is within 2% of its all-time high. Microsoft is within 5%. Nvidia is printing all-time highs. Amazon, Meta, Tesla, and Alphabet are trending upwards. These stocks seem to have made lows and started to rebound. It’s possible that the market leaders from the last bull market could be the same market leaders in the new bull market.

However, Jim Cramer has labelled these “The Magnificent Seven”. For those who haven’t heard of Jim Cramer – he’s an excitable and well-known financial analyst who hosts the CNBC show “Mad Money,”. He’s often referred to as a “fade indicator” by some market participants because stock prices seem to move the opposite direction once he’s recommended buying them.

Someone has even tested this and found that alpha could be generated by going directly against whatever he says.

So, when he calls the best stocks in the market “The Magnificent Seven” – people will be wary.

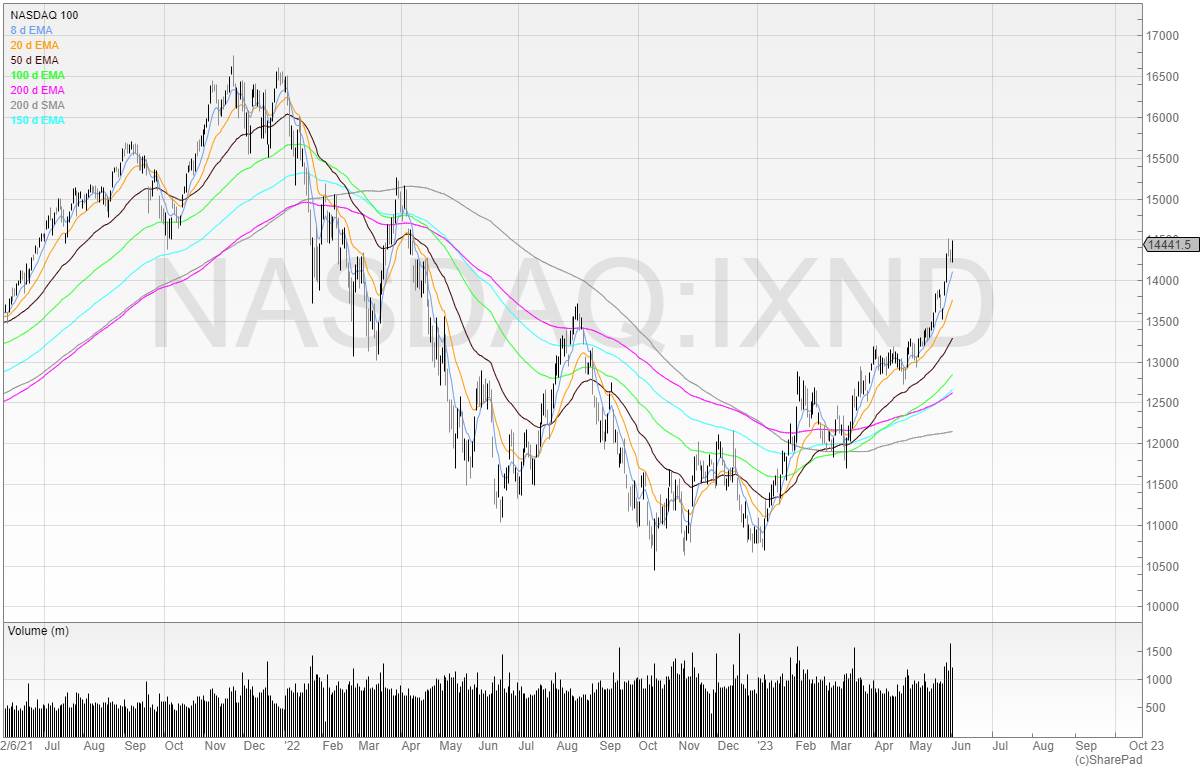

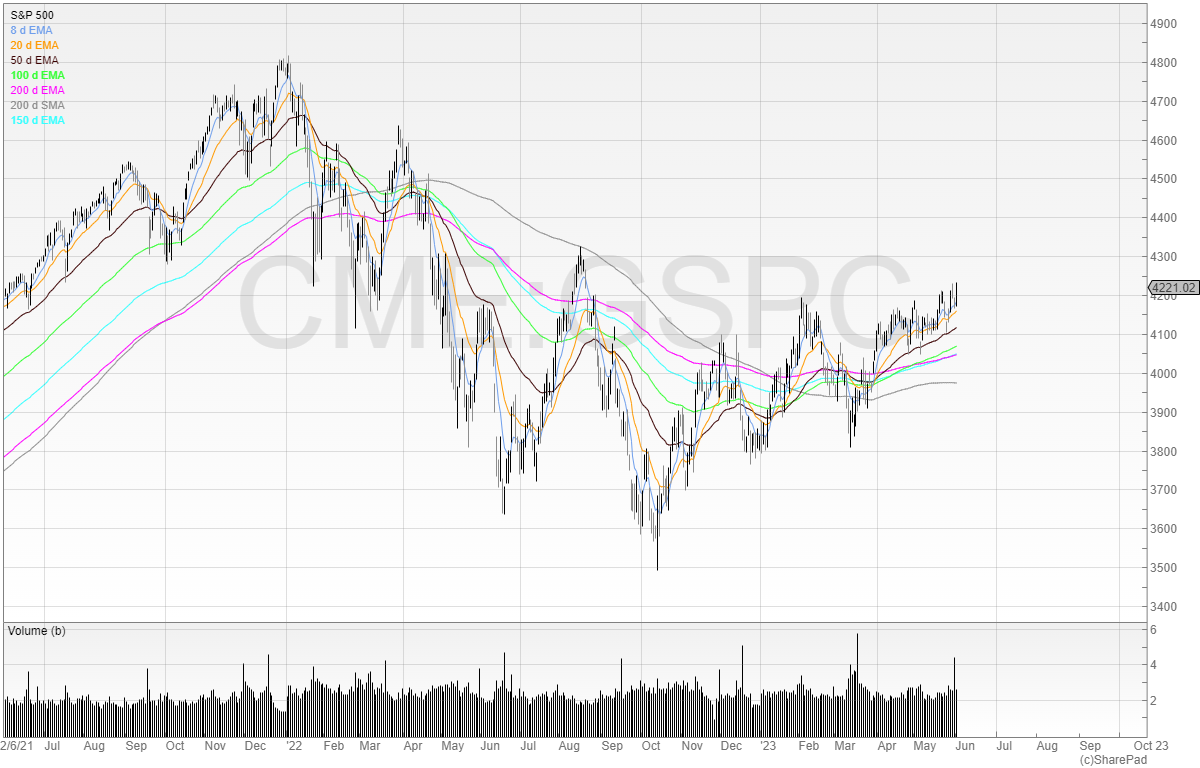

But the charts are telling a positive story.

The NASDAQ is moving into 52-week highs.

The S&P 500 is hitting 9-month highs.

A more relevant chart for UK traders and investors would be the FTSE 250. It shows we’re not out of the woods just yet.

Another intraday trading play

Two weeks ago I wrote about intraday trading and some rules I use in order to open and close positions intraday.

Here’s another one I use whenever there’s a placing in a liquid stock.

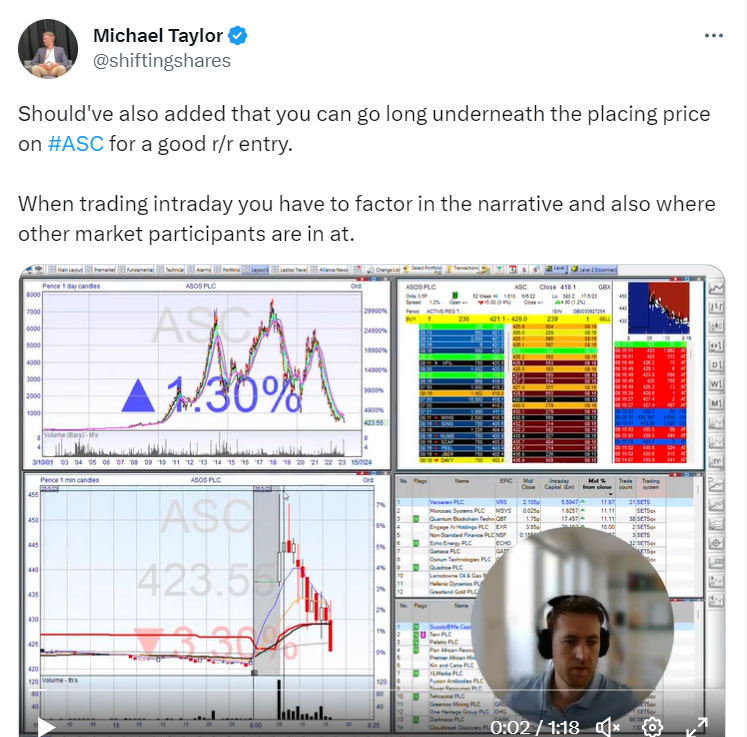

I detailed this in my tweet here.

Whenever a company does a large placing, the next day is always important. There could be a potential trading opportunity.

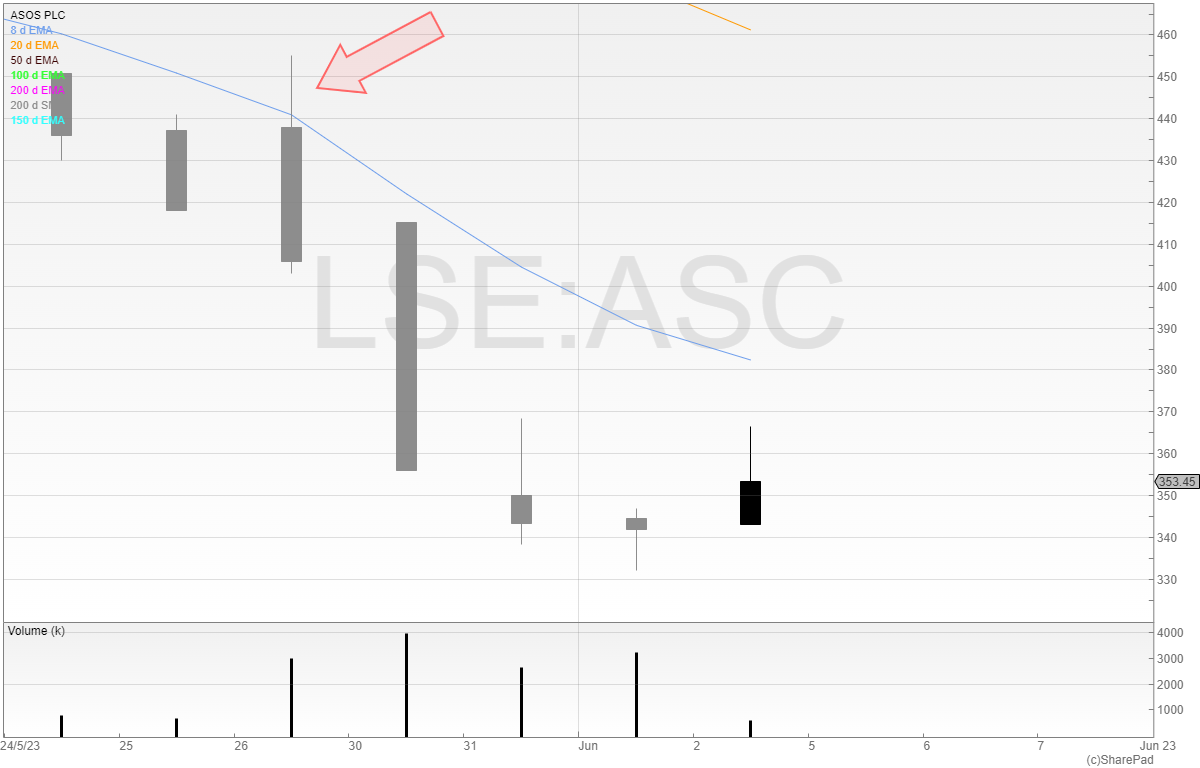

In this instance, ASOS had done an accelerated bookbuild placing the night before at 418.1p for £75 million. That’s a decent-sized amount, and when the stock was gapping up it meant there was a lot of profit.

Here’s what happened.

The stock uncrossed at 438p meaning anyone who took the placing was up 4.76%. And the stock rallied higher in the first few minutes.

That’s quick money – and my thesis is that whenever a large amount of money is made quickly, there will be a rush to the bank and crystallise those profits.

In this instance, my belief was that this quick money selling and banking profit would provide a drag on the stock price, at least whilst the stock was meaningfully above the placing price of 418.1p.

I shorted the stock into the rally. I’ve learned from experience that being too aggressive and going short in the uncrossing can sometimes be immediately on the wrong side as the stock rallies and gets sold into. Therefore, a better risk/reward entry (although not guaranteed to be executed unlike getting involved in the uncrossing trade) is to put an ambitious order in and hope to be filled.

My thesis played out, and the stock gradually came back towards the placing price, and I closed for a profit.

You could say I closed early looking at the below chart.

But this was an intraday trade, with a clear intended entry and exit point based on a logical assumption. Naturally, there are plenty of examples where this trade doesn’t always work out.

However, the beauty of entering close to the point where you know you’re wrong means you can get an attractive risk/reward.

Again, don’t be fooled by anyone extolling the virtues of intraday trading. It’s a grind, and there’s a lot of money chasing the same alpha. Often with bigger bankrolls, bigger computers, and in my case bigger brains.

The way to trade intraday is to find a pattern that is recurring and develop a way to test that thesis whilst keeping the risks tight.

Michael Taylor

Buy the Bull Market premium trading newsletter available at: newsletter.buythebullmarket.com

Twitter: @shiftingshares

Got some thoughts on this week’s article from Michael? Share these in the SharePad chat. Login to SharePad – click on the chat icon in the top right – select or search for a specific share or the “Traders chat”.