I’m often asked about my strategies on intraday trading. Intraday trading is fun but incredibly difficult. And whilst it often looks cool in films with all the screens and flashing lights and plenty of action, the reality is somewhat different.

The failure rate of intraday traders (individuals who engage in short-term trading within a single trading day) can vary significantly – but most agree it’s a losing endeavour for the overwhelming majority. It’s widely acknowledged that a significant majority of intraday traders experience hefty financial losses and are ultimately unsuccessful.

There are numerous factors that contribute to the high failure rate of intraday traders here. First of all, the inherent volatility and unpredictability of financial markets make it challenging to consistently predict short-term price movements accurately. The shorter the time frame, the harder it is to trade because the market is constantly going through price discovery. Though the market is (generally in larger companies) said to be efficient – people are buying and selling for all sorts of reasons. One fund manager may’ve been canned and his holdings are being sold across the board. Someone else may’ve heard from their buddy that one company is a shoo-in for a government contract and decides to load up. Another holder may need liquid capital because of a divorce. Or they want to buy a flash car. You never know why anyone is buying and selling and sometimes it has absolutely nothing to do with the price.

Also, intraday trading requires a deep understanding of market dynamics, technical analysis, and risk management strategies, which are not typical traits of retail traders who are often 1) ignorant in their lack of knowledge, or 2) aware of their lack of knowledge but just don’t care.

Research and industry data suggest that the failure rate among intraday traders can range from 70% to 90%. This means that a large proportion of individuals who attempt intraday trading are unable to generate consistent profits and may incur substantial losses.

It’s worth noting that while the failure rate is high, there are also successful intraday traders who are able to generate consistent profits. Successful intraday trading requires continuous learning, adaptability, and the ability to control emotions in the face of market fluctuations. That last part is key. When prices are moving quickly, emotions can jump just as fast. Especially if one has taken a large position. This is why risk management is of paramount importance when it comes to risk management.

Despite that, I still think intraday trading is fun and it can profitable.. but the idea that you need to be trading every day is silly. Sometimes there aren’t any trades, and if you try and force them, you end up losing money.

However, there are two rules I like to use and I’ll break them down in more detail now.

The undisturbed

The undisturbed refers to the last closing price before an offer announcement. It’s the price that, if the offer were to be rescinded and all other things were equal, the share price would logically go back to.

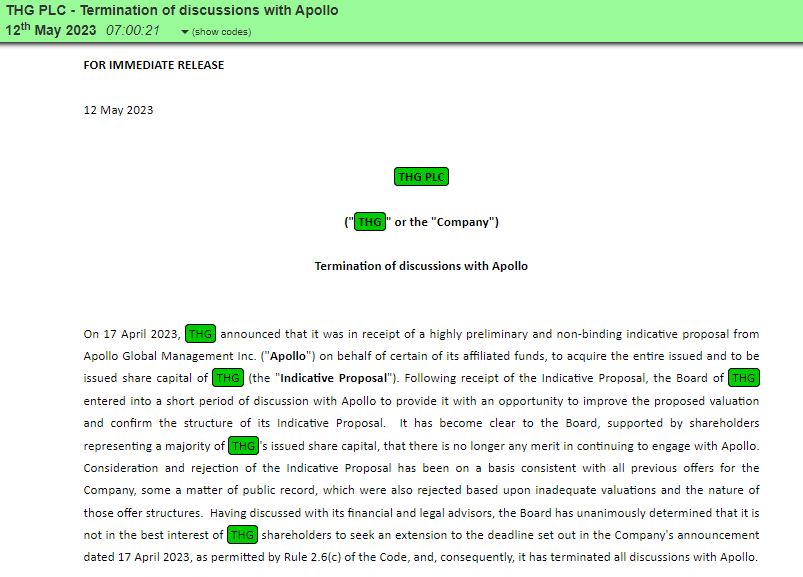

Why is the undisturbed important? Because offers can and do lapse (Apollo have lapsed on both THG and Wood Group within the last two weeks) and prices naturally fall. Sometimes this offers opportunity.

Let’s look at THG first.

We can see that in this case, the undisturbed price (the last closing price before the offer news was either leaked or reported to the market) was around 66p.

The price hit a peak of near 120p, then started to sell off significantly and on volume. You don’t exactly need to be Warren Buffett or Bill Ackman to conclude that there may be a strong chance the deal isn’t going through.

And that’s exactly what happened.

We then see the price open around 60p, fall slightly, and then rally sharply. But a few days later and it’s back to around 60p.

I think this was difficult to trade because in between that period of the original price move due to the offer and the discussions with Apollo being terminated the company’s FY2022 preliminary results were out. That means that suddenly all things are not equal, and we would have the undisturbed price plus or minus the effect the results would’ve had on the undisturbed.

That said, if the results were in line, then, in theory, this shouldn’t matter. But the market can’t seem to agree on what a fair price for THG is, and so this makes it much harder.

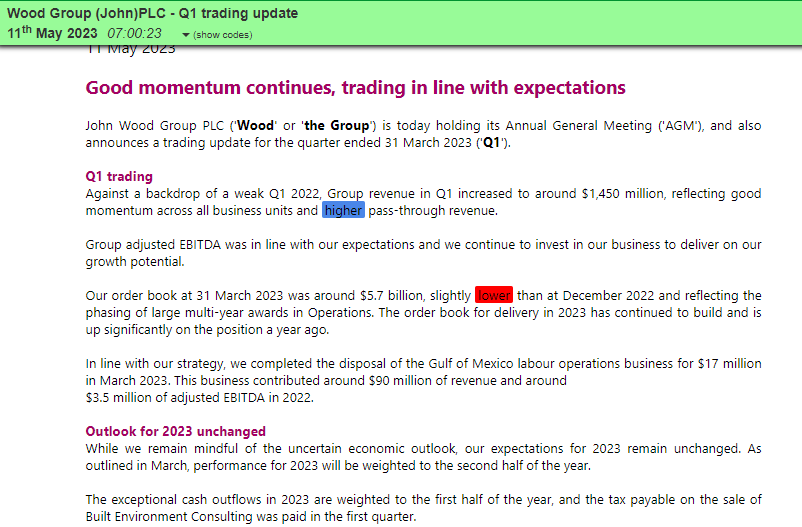

It’s easier to see this on Wood Group.

We can see Wood Group’s undisturbed was 155p. After several negotiations and upped offer prices, Apollo decided it was no longer for them and walked away.

With the price opening at 135p, I felt that 20p below the undisturbed was overdone.

Especially since a few days before we had an in-line update from the company.

My trade thesis was that if the stock didn’t move North from the get-go I’d be out and take a small loss. But if I was right, there could be some drift in the direction of the undisturbed.

That’s what happened in this case, although before anyone starts to think that intraday trading is easy, I have to confess that my intraday strike rate is barely above 50 per cent. I’m losing almost half of my trades. But if I’m right I’m taking more P&L out than when I lose.

The read-across trade

The read across trade refers to a correlated move in stocks in a similar sector. For example, if there is a big takeover in one stock then the others can get an uplift as the market assumes the sector is hot.

If there’s a big profit warning in a stock, then the other stocks in that sector may also see a drift down too. Especially if they’ve not reported recently and there can be uncertainty.

Sometimes the read-across trade can be the best trade.

Here are some examples from my Twitter.

Sometimes American stocks have a correlation to UK stocks. For example, JD Sports has been known to move off the back of strong Nike earnings.

Boohoo and ASOS once had a strong correlation. If one rose or fell sharply, there was a good chance the other did.

And the reverse this time. Boohoo has a profit warning and ASOS is affected!

CMCX and IGG are both spread bet providers. And both have had previous correlations.

How to trade the read across? If the main event is gapping too much for your liking – and even if not – check for the read-across.

If a stock that could potentially be correlated is opening up flat? Then you’re getting almost a free option. If there’s read across the stock will fall. And if there’s not, then nothing will happen.

And if a stock you’re in has a sector compatriot that has had a warning? Check your own stock.

Genus put out a profit warning earlier this week. It rallied from the gap down. But similar sector stock Eco Animal Health (pigs in China) opened flat and dropped from the opening.

Whether you’re an intraday trader or not, it pays to be aware of the read-across.

Intraday trading is certainly not easy (and anyone who says the opposite is a certified muppet).

But by having a detailed plan, solid risk management, and a willingness to try and solve the puzzle of why stocks move how they move, you have a fighting chance at least.

Michael Taylor

Buy the Bull Market premium trading newsletter available at: newsletter.buythebullmarket.com

Twitter: @shiftingshares

Got some thoughts on this week’s article from Michael? Share these in the SharePad chat. Login to SharePad – click on the chat icon in the top right – select or search for a specific share or the “Traders chat”.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.