As Richard trawls the stock market for high-quality businesses that are less pricey than they used to be, he takes a first look at Auto Trader, a company that is growing from a position of financial and competitive strength.

Following on from Dechra Pharmaceuticals and Halma, Auto Trader is another high-quality business that has experienced share price declines this year.

The share price of the former classified advertising magazine, now online motor vehicle marketplace, has declined 30% since the end of 2021:

There is a reason highly profitable companies have generally fallen substantial in price this year. These companies are priced so highly because investors take the view that they will grow and earn high returns in the future.

Now we are experiencing rising inflation for the first time in almost a generation, traders are worried that inflation will eat into the value of those returns.

I, though, am sticking with my mission. I do not know what will happen to inflation over my ten-year minimum holding period, so I want to be invested in companies that generate high returns to offset inflation, as long as I do not have to pay too much for them.

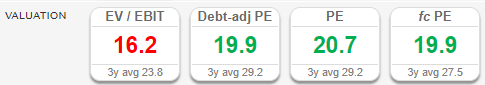

Declining share prices are good news as shares we might previously have considered to be expensive are entering the buyzone, which roughly approximates to a PE of twenty or less in my case.

Auto trader is knocking on the door:

.

.

The Auto Trader setup

When Auto Trader’s annual report dropped in June, I checked the financials.

With the exception of the first year of the pandemic, when turnover declined, and the second year, when it rebounded strongly, Auto Trader has grown revenue at a compound annual growth rate of 8% a year since it floated in 2015. Profit has grown at a CAGR of 19%.

The company earns extremely high returns on capital employed (ROCE) and cash returns on capital invested (CROCI).

It has achieved this performance under its own steam. Lease-adjusted net borrowings have fallen steadily, and at the end of the financial year in March, the company had more cash than financial obligations. The share count has also declined modestly.

These numbers were enough for me to add Auto Trader to my watchlist, but I also remembered that Phil Oakley, author of the book How to Invest in Quality Shares, had written the company up in January 2020.

His article gave me a headstart understanding the businesses, which is useful because I have not bought a car since my first one, a Citroen 2CV, in the late 1980’s.

Phil’s article is titled “A case study in market dominance and network effects”.

He thought Auto Trader was a good business because it had become the biggest intermediary between car sellers (dealerships, car supermarkets, independent retailers, and home traders) and car buyers by far. Retailers advertise on Auto Trader and also consume other services.

My daughter habitually scrolls through Rightmove, the property website, when she is bored. She is a young professional but not yet in the market for a house. She just enjoys imagining where she might live one day.

Read the Auto Trader app reviews and you will see that many petrol-heads enjoy Auto Trader, without any intention of buying that Studebaker they lust after. One day they will buy a car of course, even if it is just a VW Polo, and that is what makes Auto Trader so valuable.

The more of us that use Auto Trader, the more valuable it is to car sellers because a car sitting on a forecourt is a wasting asset.

Phil’s analysis revealed that year after year Auto Trader has extracted more money from retailers in terms of average revenue per retailer.

This is a good sign as long as the service remains good value. However dominant your market position, gouging your customers is not a sustainable strategy in the long-term.

Since I added Auto Trader to my watchlist, one news item in my feed caught my attention because it may tell us something about Auto Trader’s strategic intent.

In October, it sold Carzone, Ireland’s second biggest car marketplace, to focus on the UK and specifically to “enable retailers to do more of the car buying journey online, on Auto Trader”.

This is how the already dominant car marketplace intends to grow.

Evolving from number one

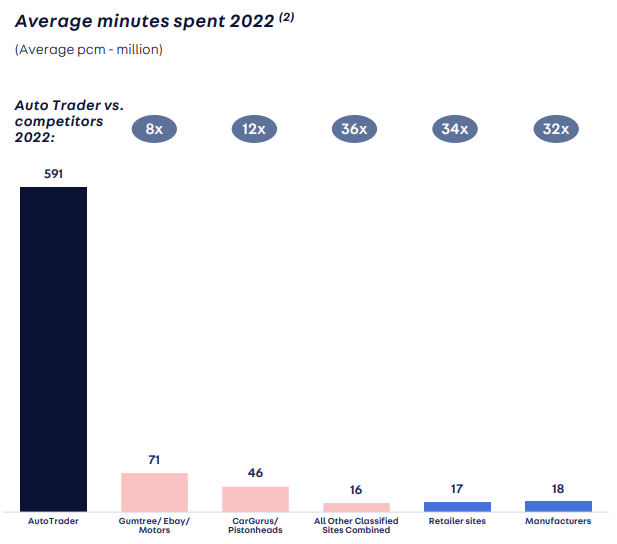

Auto Trader’s dominance is illustrated by this chart showing that people spend eight times as much time on Auto Trader’s websites as they do on its nearest competitor, and 30 times as much as they do on all car manufacturer sites combined:

Source: Auto Trader presentation, data from Comscore MMX®

Car retailers probably cannot afford to ignore Auto Trader.

So what exactly does the company mean by doing more of the car buying process online? We can gain some clues from the acquisitions the company has made.

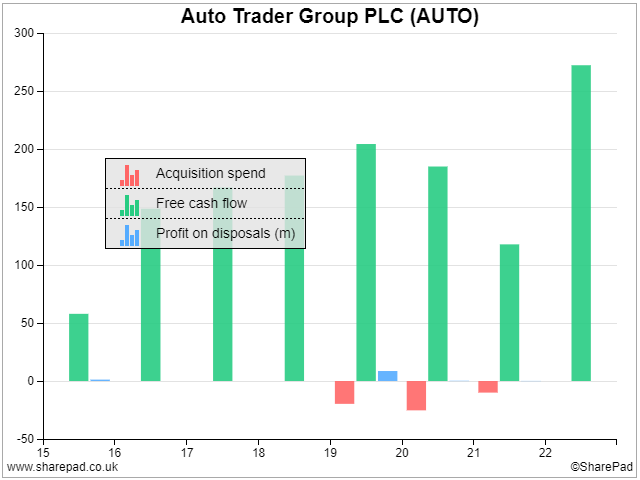

Auto Trader has not spent much money buying other companies, compared to the £150 million to £250 million of free cash flow it has earned in most of the years:

But its acquisitions do give us clues about its strategy.

The first, in April 2017 was Motor Trade Delivery, a marketplace for trade delivery of vehicles. This allowed retailers to use Auto Trader to organise their logistics as well as advertise their stock.

The second, in August 2019 was Kee Resources, a supplier of data on vehicle specifications, pricing, and the whole-life cost of vehicles. Data subscriptions allow retailers to market their vehicles more effectively.

The third, in June 2020 was AutoConvert, a finance, insurance and compliance platform. This connects retailers to lenders and enables them to offer finance through Auto Trader (for which they also pay a subscription).

These three acquisitions along with part-exchange are broadening the range of services Auto Trader can charge retailers for, simplifying, automating and bringing the entire process online, often at the expense of disparate offline suppliers.

Auto Trader’s most recent acquisition was completed after the year-end in 2022, so the financial consequences are not included in my chart. At £200 million, the acquisition of Autorama is more consequential (although it is still fairly modest for a company that earned £250 million in free cash flow).

As well as being Auto Trader’s biggest acquisition by far since it listed, Autorama also addresses a new market. Autorama, and now Auto Trader, owns the Vanorama business, started about 20 years ago as a kind of Auto Trader for van lease deals. It is an aggregator of deals from lenders and manufacturers.

Autorama is loss-making, but Auto Trader says this is because of subdued new vehicle sales due to semiconductor and other shortages. In any case, it seems the acquisition is not really about profit now, it is strategic.

Covering off risks

Vanorama also aggregates car lease deals these days and Auto Trader appears to be covering off a potential risk: As the adoption of electric vehicles increases, so too may the proportion of people that lease their car.

The upfront cost of electric vehicles is high, so fewer car buyers can afford to buy them outright, and depreciation is doubly a concern to owners because much of the cost is the battery, which has a finite and relatively short life.

The way we buy new and used cars is also changing as manufacturers switch to an agency model from the franchise arrangements of the past.

Insurgent electrical vehicle brands like Tesla and Polestar are sold directly to consumers, although some have an agency relationship with dealerships. This means the manufacturers pay the dealership a commission when it facilitates a sale.

Mercedes-Benz is introducing an agency agreement with retailers in the UK and Europe (it already uses an agency model in Sweden, South Africa and India) and VW sells its ID range of electric vehicles directly.

Manufacturers prefer the agency model because it means they own the customer relationship, and it is more transparent. Many people find haggling with dealerships unpleasant and it means buying a car cannot take place entirely online.

Selling directly is also a way to reduce cost. This may increase profit margins, which are under pressure because of the high price of electric vehicles.

The benefits for retailers are less obvious. As a service provider, they would no longer have to hold depreciating stock, but manufacturers will be assuming more of the car-buying journey. This is a threat Auto Trader acknowledges in its annual report because retailers are its biggest customers.

Manufacturers currently send little revenue to Auto Trader and no doubt there will be disruption as the industry changes. Maybe manufacturers will become more important customers if, for example, they buy advertising and data as they take more responsibility for marketing vehicles locally.

Auto Trader, meanwhile, is a business growing from a position of financial and competitive strength. It has the eyeballs, and unparalleled market data, and perhaps that is not going to change.

~

NB: At the time of writing, Auto Trader’s half-year results were imminent. They may have been published by the time you read the article.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard