In my previous article, I discussed the reasons for investing in good companies and how you can search for them in SharePad.

We saw that investing in good companies can generate stellar returns for investors over time but being able to buy the shares of them at a reasonable price is often difficult.

It is also true that buying the shares of good companies is no guarantee of success. Good companies can, and do, underperform the stock market and can even lose investors money.

Good companies that have underperformed

The definition of a good company is debatable and does not just boil down to how profitable or safe it might seem to be.

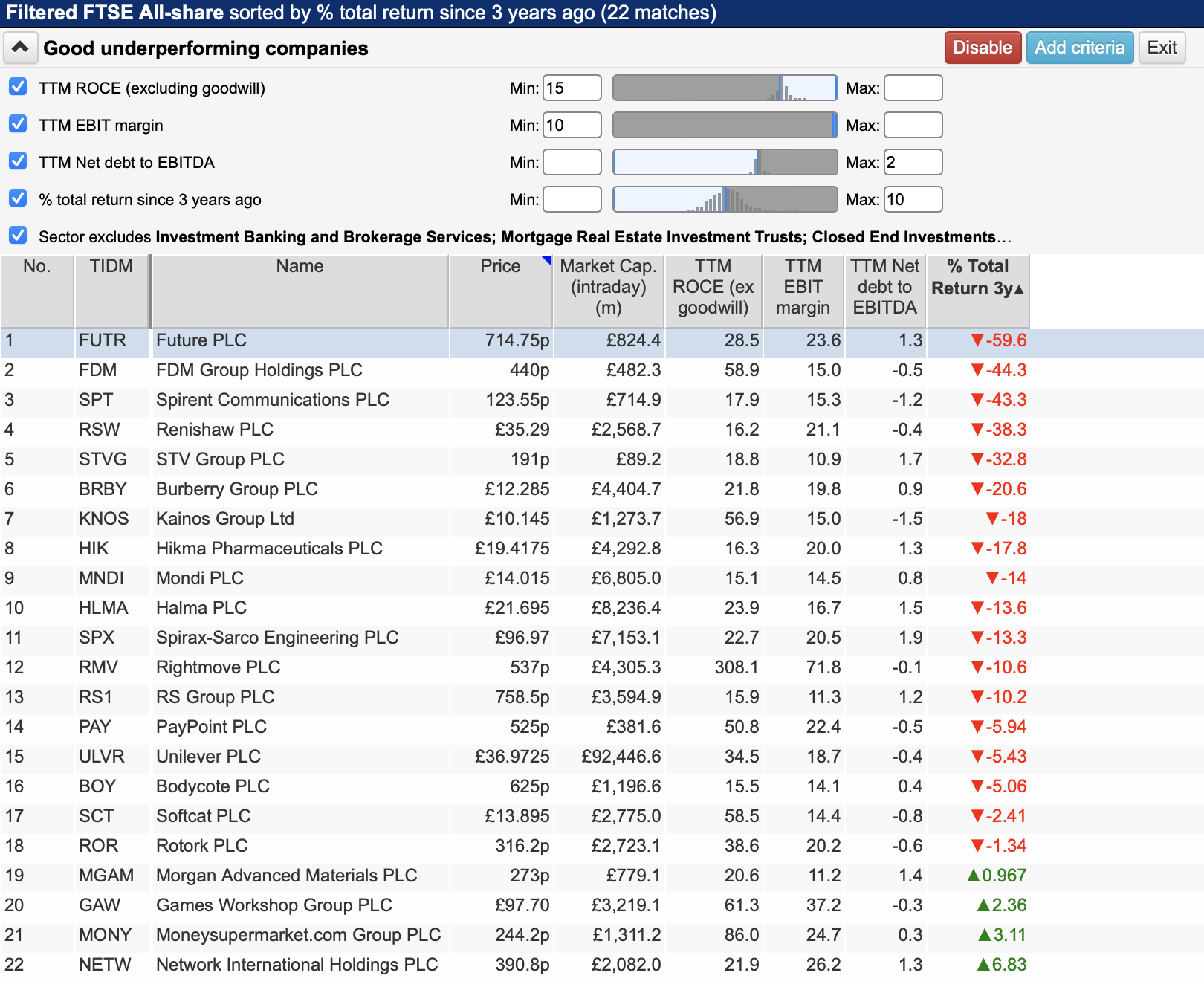

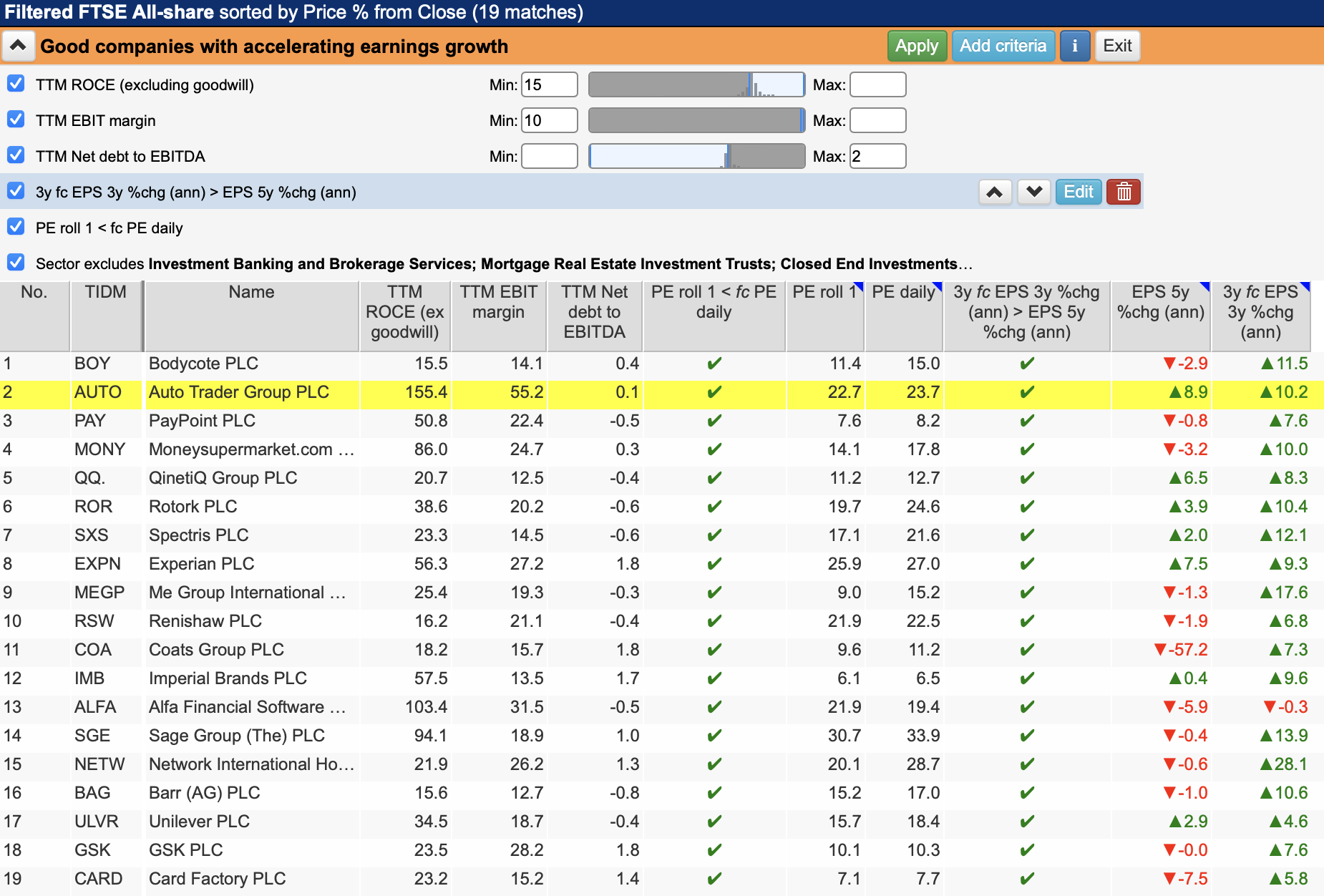

That said, I have asked SharePad to find companies that fit the very simple criteria of a good company without too much debt (and financial risk).

- Trailing twelve-month (TTM) return on capital ex goodwill of at least 15 per cent.

- TTM EBIT(trading profit) margin of at least 10 per cent.

- TTM net debt to EBITDA of no more than two times.

I’ve then asked SharePad to find companies which match this criteria and have also underperformed the FTSE-All Share index over the three years. The threshold for underperformance is any share that has delivered half the return of the index or less.

With the three-year total return of FTSE All Share index at 20 per cent, this means any share with a total return of 10 per cent or less.

This provides a list of 22 companies in the FTSE-All Share. It includes some that are widely regarded as being outstanding businesses such as Renishaw, Halma, Spirax-Sarco, Rightmove, Rotork and Games Workshop where long-term investors have made plenty of money.

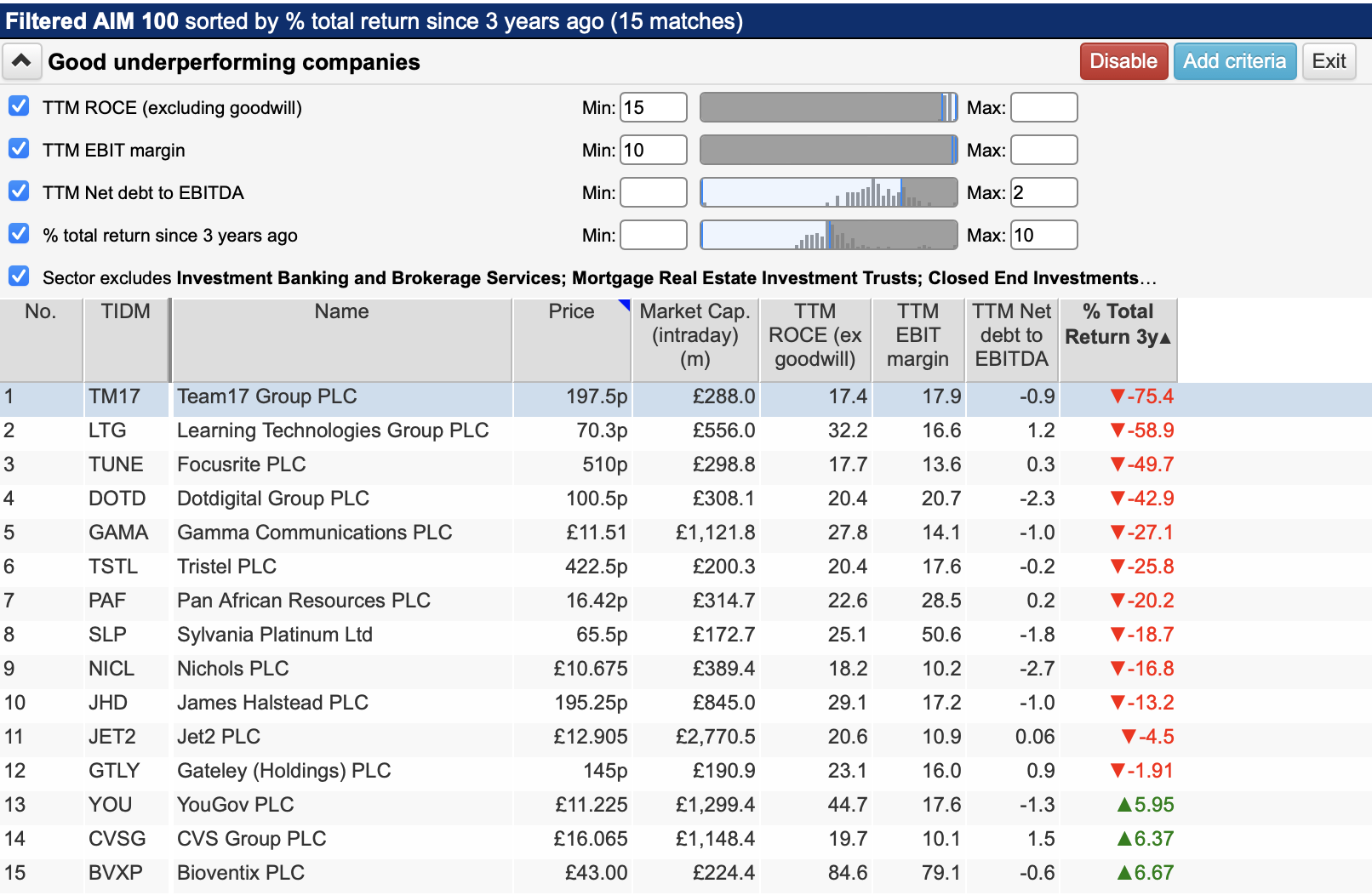

Turning our attention to the AIM 100 index, we can also see some prominent underperforming companies such as Tristel, Nichols, James Halstead, Jet2, YouGov and Bioventix.

Why the shares of good companies can underperform

They become too expensive

Shares underperform for a number of reasons. One of the key reasons is that they become too expensive.

Good companies deserve high stock market valuations but sometimes investors can get carried away with their enthusiasm for them.

This was definitely the case when interest rates on cash and government bonds were very low and pushed investors into high-quality, growing companies. As interest rates have risen, and bonds and savings accounts have become more attractive, the high valuations attached to many shares have come down sharply.

Share prices can also fall when companies cannot meet the lofty expectations of profit growth that are baked into their share prices.

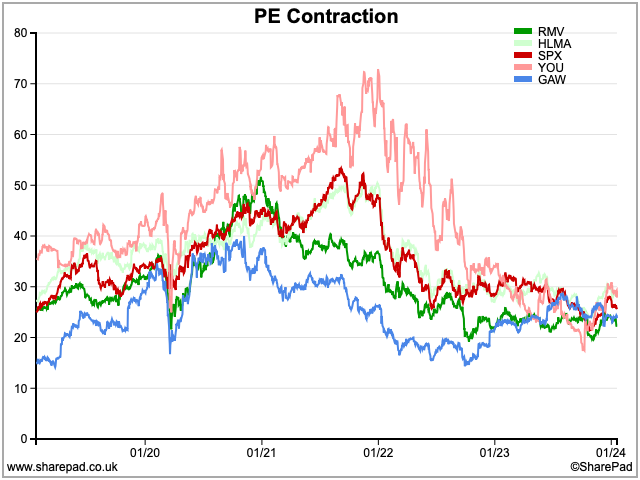

As the companies do well and grow their profits at a healthy rate – and often at a higher rate than investors previously expected – their share prices have a tendency to increase faster than their profits as more investors buy in. This causes the price-to-earnings (PE) ratio of the shares to increase.

The increase in the PE ratio can be dramatic, especially if future profit expectations continue to improve. This is what happens with a classic momentum trade but eventually, the upward momentum comes to an end, causing problems for more recent buyers.

High PE ratios imply high expectations of future profit growth. When the trend of improving profit forecasts comes to an end, it becomes more difficult to entice new buyers of the shares because the valuation can be seen as being too high.

What often happens in this case is that share prices and PE ratios fall back sharply.

This has arguably been the case for the shares shown in the chart below.

Rightmove (RMV), Halma (HLMA), Spirax-Sarco (SPX), YouGov (YOU) and Games Workshop (GAW) have all seen their shares trade on very high PE ratios which have subsequently fallen sharply and led to them underperforming the UK stock market.

This has not happened just because interest rates have increased and brought valuations down.

There has been another factor at play:

Slowing rates of earnings growth

As well as interest rates, the rate of profit growth of a company is a major factor in determining the valuation of shares.

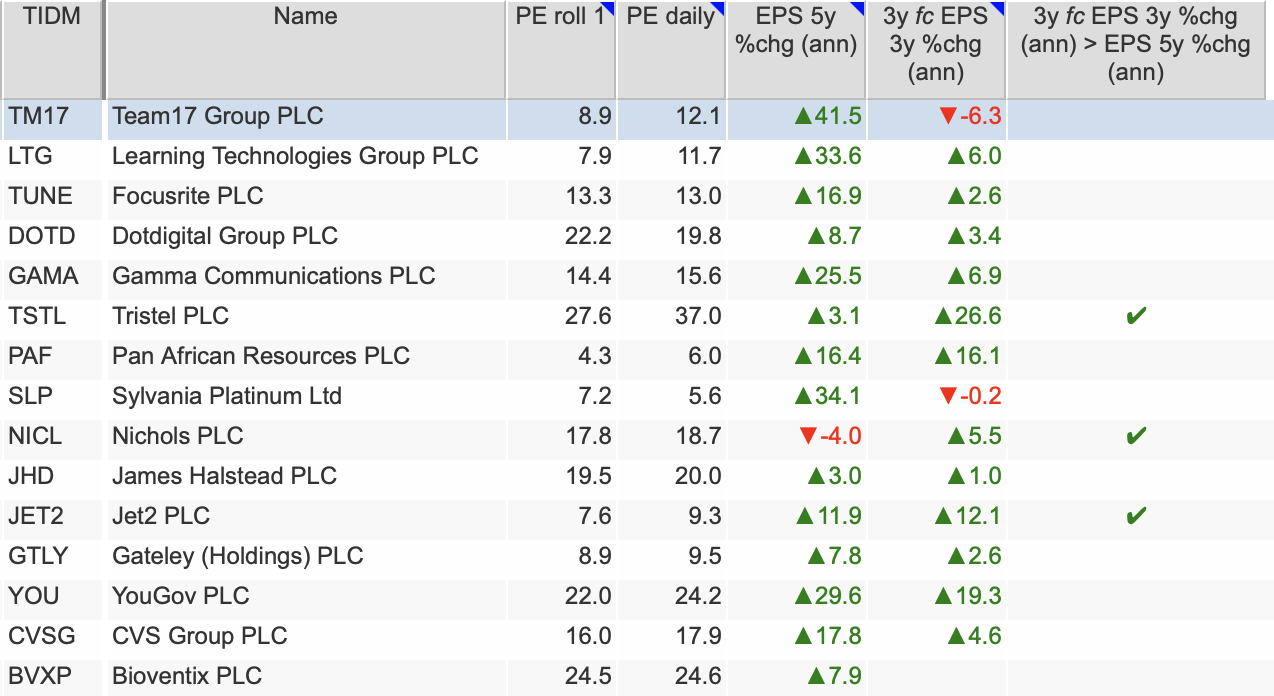

If we return to our table of underperforming shares from the FTSE All-Share index, out of 22, only seven of them are expected to see a higher rate of earnings growth over the next three years than they have experienced over the previous five.

Some of the slowdowns or reversals are expected to be savage at companies such as Future and Spirent Communications and can explain why their shares have become so disliked.

The five companies above which have seen rapidly declining PE ratios are also expected to see lower rates of earnings growth – although not by much in the case of Rightmove.

The picture in the AIM 100 is similar. Only three out of the 15 companies are expected to see a higher rate of earnings growth going forward.

Slowing rates of earnings growth are quite normal as companies mature but this tends to mean that the PE ratio on their shares will tend to fall back to a more modest level, especially if it has previously been high.

Searching for good companies with accelerating rates of expected earnings growth

Growth is arguably the most important factor that investors should consider when they are thinking about buying a share. Without it, you are unlikely to be able to grow the value of your investment over time.

The other key criteria is to avoid paying too high a price for a share. This can result in you losing money even if profits continue to grow. If the growth is not enough to justify a high valuation, over time, the stock market tends to be very good at bringing share prices down to reflect this.

Promising investment candidates can be found where the valuation of a share is reasonable and perhaps lower than its recent history and where earnings growth is expected to accelerate.

SharePad has found 19 companies in the FTSE-All Share index that meet this criteria.

Very high-quality companies such as Auto Trader and Experian make this list. Sage is also expected to have much better rates of profit growth but some investors might be put off by its current valuation of more than 30 times its next year’s forecast earnings per share (EPS).

It’s understandable why some investors don’t want to invest in tobacco companies but the very low valuation and decent earnings outlook for Imperial Brands would look very compelling in most other industries.

Shares in aerospace and defence company QinetiQ may also be worth a look. Unilever shares have gone nowhere for the last three years. However, it remains to be seen whether a slight improvement in its modest profit growth record is enough to drive its share price higher.

When you are looking at the results of a filter like this, it’s a good idea to consider what is happening to the trend in profit growth.

For example, are the company’s profits moving from a falling trend to a growing one or are they a continuation of a growth trend?

If previous falling profits were a temporary blip and the company is back on a growth path then the investment case can still be strong.

However, falling profits may be a sign of a cyclical business and are likely to happen again. It may therefore be a better strategy to invest in a company which has had a more consistent growth history.

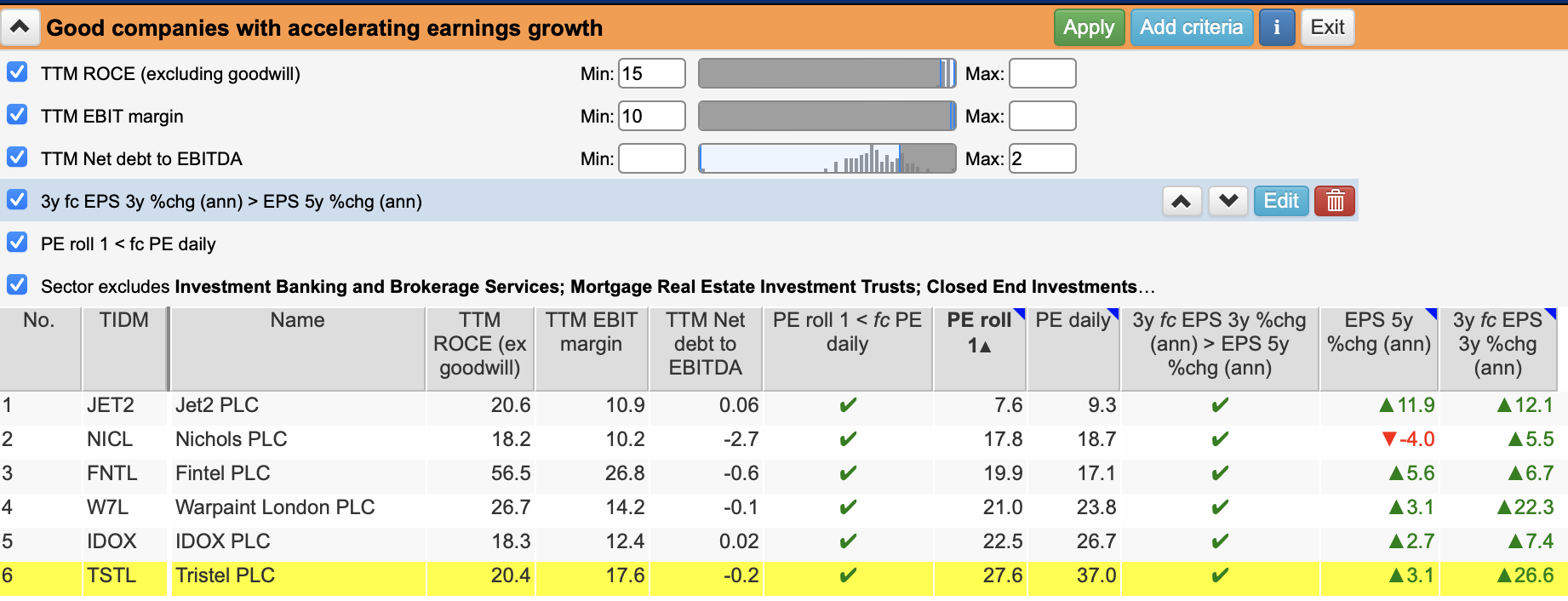

In the AIM 100, SharePad has found six qualifying companies.

Tristel and Warpaint may still have high valuations attached to their shares but if they deliver the rates of earnings growth currently expected by City analysts then both could perform well.

~

Got some thoughts on this week’s article from Phil? Share these in the SharePad chat. Login to SharePad – click on the chat icon in the top right – select or search for a specific share.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.