Investing in good companies is one way to grow the value of your portfolio. In this article, Phil takes you through his method of searching for outstanding British companies using SharePad.

When I first started out in the investing world more than a quarter of a century ago, value investing was still very much in vogue. I was told that you shouldn’t invest in good companies because everybody already knew they were good and that their share prices had priced this in.

It was supposedly much better to buy unloved, beaten-up shares that people had given up on or just ignored. When the company behind the shares started to experience better times then the returns would be worthwhile.

If only that were true. No doubt, there are investors out there that can do well buying cheap unloved shares, but for many who try to do so the results are often disappointing.

Just as good companies can be highly-priced because they are good, bad companies are cheaply priced because they deserve to be.

Too often, plumping for cheap shares means you end up investing in mediocre or bad businesses which do not improve. In fact, they often get worse and you end up losing rather than making money.

Why it makes sense to invest in very good businesses

Good businesses are very much like good pieces of furniture. They are dependable, give good service and can keep on giving you good results for years. If you can buy them at a bargain price then great, but even paying up for them can still serve you well.

But what makes a very good or outstanding business?

There is no generally accepted definition, but they tend to have a number of common characteristics.

Very good businesses first and foremost serve their customers well and do it better than their competitors. They have products and services that are best in class and are often difficult to copy.

Most importantly, they operate in markets where they can keep on growing their revenues and profit and compound the growth in the value of the business for their investors.

Very good businesses are also very resilient. They may go through the odd rough patch but their profits will tend to hold up fairly well even if the economy goes into recession.

What this means in practice is that their profits, share price and dividends are unlikely to collapse because of their business results.

The example of a company’s share price halving and then needing to double just to get back to where it was is arguably one of the most simple but powerful lessons an investor can learn. They can minimise their risks of owning these kinds of shares and avoid painful losses by investing in good businesses.

When it comes down to numbers, very good companies also tend to be very profitable with high profit margins and good returns on the money they invest in their businesses.

They are good at turning their profits into cash and do not have lots of debt which can threaten the wellbeing of their shareholders if profits fall.

The search for outstanding companies in SharePad

Numbers found in financial statements do not tell you everything about a company, but they can be used to identify very good companies.

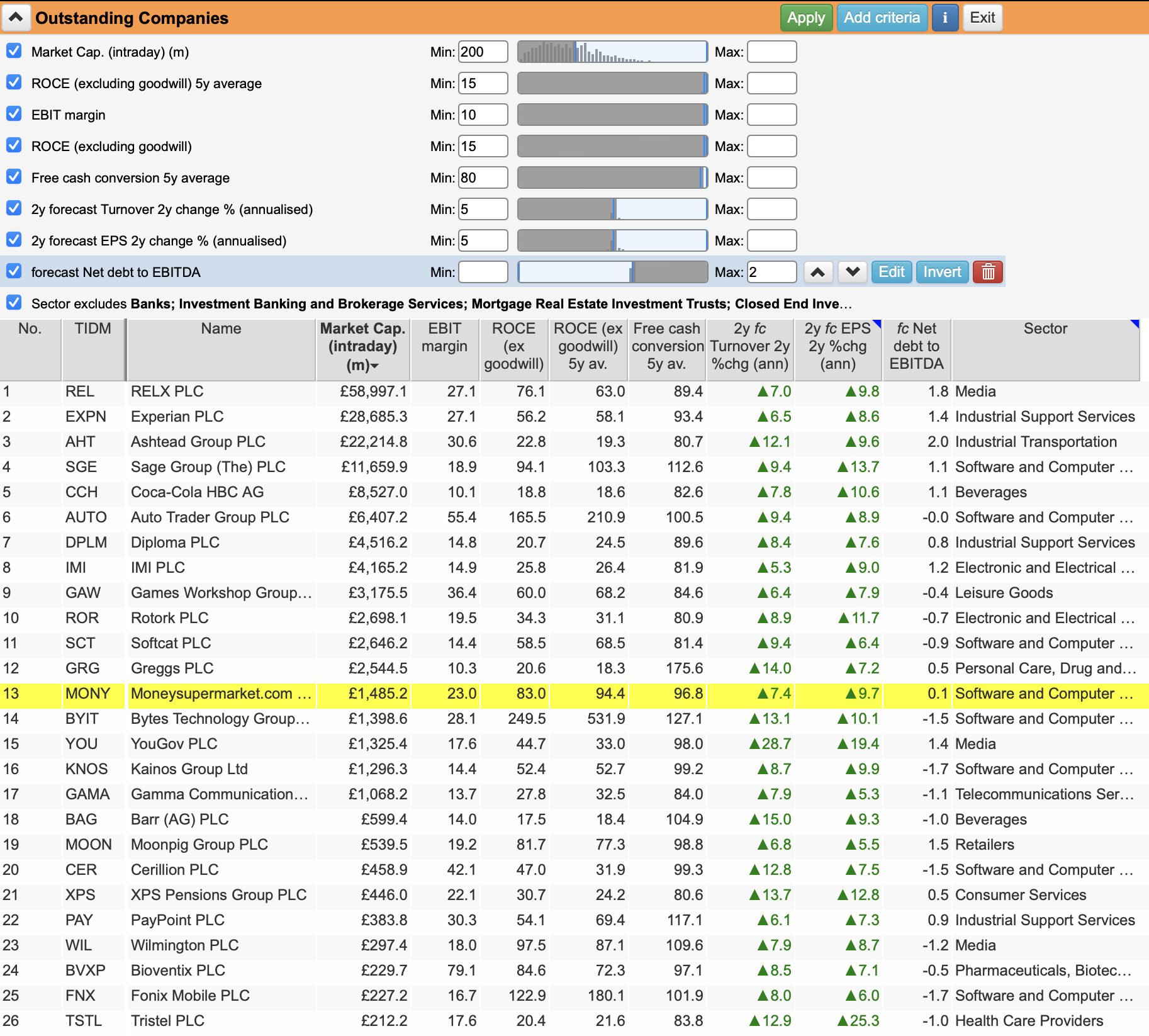

I’ve asked SharePad to try and find me some very good or even outstanding companies that are currently listed on the London Stock Exchange.

As with any stock screen or filter, there are always going to be some good potential investments that slip through your net. However, I am hoping that the following criteria will give me a list of very good companies:

- A market capitalisation of at least £200m – whilst there are good smaller companies, their shares are often hard to trade (illiquid) and more volatile. By sticking with larger, more established companies this risk is reduced.

- A return on operating capital employed (ROOCE) of at least 15 per cent – Very good companies get a decent amount of profit back for every pound they invest and they consistently do so. This is why there is criteria for a minimum ROOCE of 15 per cent and a five-year average ROOCE of 15 per cent.

- Five-year average free cash flow conversion of at least 80 per cent – good companies turn most of their profits into free cash flow. They may not turn all of their profits into cash because they are re-investing some of them for future growth which is a good thing.

- Trading profit (EBIT) margins of at least 10 per cent – High-profit margins are a hallmark of quality companies. They are also a reassuring safety buffer. The higher a company’s profit margins are, the more its profits can fall before it makes a loss than a company with low-profit margins.

- Turnover and earnings per share (EPS) growth of at least 5 per cent per year for the next two years – without growth, the value of a business is going to struggle to grow over time. Even modest levels of growth can make a big difference if you own the shares for long enough. It is important that a company can grow its profit by growing its turnover or revenue and not by just cutting costs.

- Forecast net debt to EBITDA of no more than 2 times – too much debt is the enemy of the shareholder. Setting sensible debt level reduces this risk.

The filter is set to search amongst non-financial companies whilst ignoring investment trusts.

The results are shown in the table below.

Source: SharePad

I’m sure some readers will point out that there are some very good companies missing from this list but in general, I’d say it contains some very decent ones.

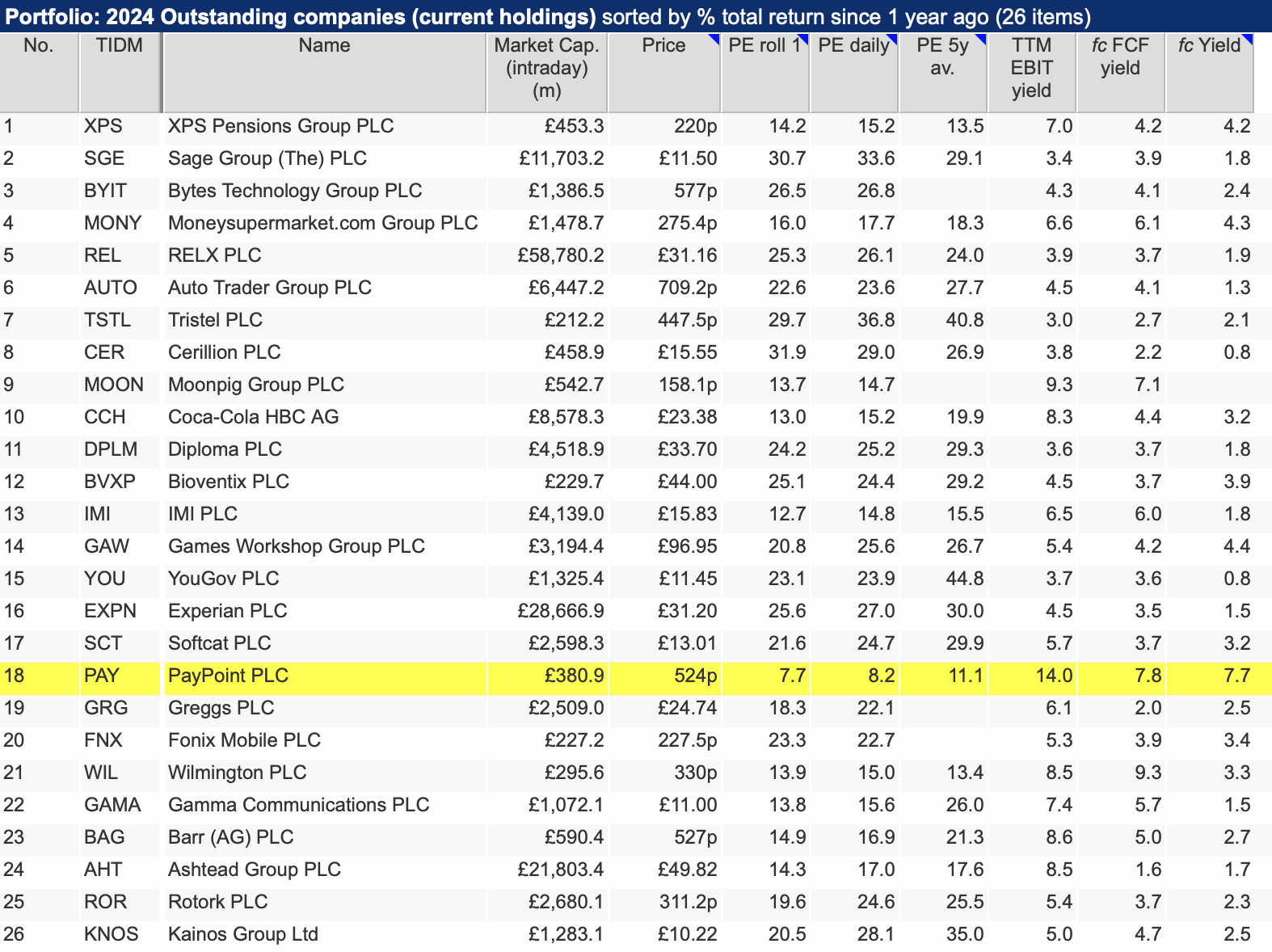

The list has then been saved as a portfolio in SharePad so that some more analysis can be done.

How have the shares performed in the past?

Past performance is often not a predictor of future performance but it is interesting to see how the companies in the filter have performed over varying lengths of time.

The list of shares has performed very well. In some cases, there have been some spectacular results.

It is reassuring to see that there is not a lot of red ink showing losses in the table.

The FTSE All Share Index has delivered the following total returns with the shares in our list beating this benchmark shown in brackets.

- 1 year +3.5% (21/26)

- 3 years +20.5% (12/25)

- 5 years +32.7% (18/23)

- 10 years +68.2% (11/17)

We can see that the majority of shares in the list have done a good job in beating the returns of the UK stock market as a whole.

Whether they can do so in the future will be dependent on their rates of profit growth and if their valuations are not too optimistic (high) – has a rosy outlook already been priced in?

Can the shares be bought for a reasonable price?

Valuing shares is more of an art than a science.

When it comes to the shares of very good companies, the biggest lesson I have learned is that you should not be afraid to pay up. If you intend to own a share for a reasonable length of time then obsessing over whether it might be slightly more expensive than you would like it to be is not worth it.

Discipline and not overpaying for shares cannot be stressed highly enough though. If you pay too much for a share and the future results are not as good as the market expected them to be then painful losses can be the result.

There are lots of things you can do to try and work out whether a share is attractively priced or not.

In the table above, I’ve looked at the one-year forecast price-to-earnings ratio (PE roll 1) and compared it with the forecast PE over the last year (PE daily) and its average PE over the last five years.

For example, if you have a share with a very high PE ratio (say more than 25) and it is above its recent and long-term average PE you might want to think hard before buying the shares.

If the PE is below its averages then that might signal a potential buying opportunity.

The EBIT yield compares the company’s trading profit with its enterprise value (the market value of its assets). A high yield essentially tells you the return available to someone buying the company outright. The higher the yield, the better the return and the more attractive the valuation.

Free cash flow yield is a valuation yardstick used by many investors and expresses a company’s free cash flow as a percentage like the interest on a savings account. High free cash flow yields can be a sign of a reasonable valuation.

I’ll leave you to work out whether these shares are attractively valued or not, but I have highlighted PayPoint (LSE:PAY) as a share which looks interesting.

The historic returns of this share have been very disappointing but if profits are expected to show reasonable growth over the next few years they might be worthy of further research.

~

Got some thoughts on this week’s article from Phil? Share these in the SharePad chat. Login to SharePad – click on the chat icon in the top right – select or search for a specific share.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.