Banks have been one of the best-performing sectors in the UK market so far in 2024. Phil undertakes a very simple SharePad analysis of the sector to see if the good run can continue.

Banks sustain their outperformance

The long-term performance of UK bank shares has not been good. Many owe their survival to taxpayer-funded bailouts after the financial crisis where bad loans and stretched finances almost wiped them out.

Many investors refuse to own banks because they openly admit to not being able to understand them. By that, they mean that it is difficult to understand what they own and what they owe.

Bad loans that can blow a hole in a company’s finances are often only known about after they have gone bad, as are complicated financing arrangements.

That said, in more recent times, UK banking shares have been doing rather well and making decent money for their investors.

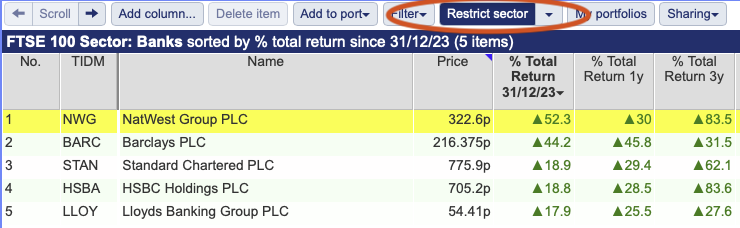

The sector is up 17.6 per cent year to date compared to the 10 per cent return of the FTSE-All Share Index. It has also outperformed over the last year and the last three years.

In terms of individual stocks, NatWest and Barclays are the two best-performing shares in the FTSE 100 year to date.

What investors want to get a feel for is if the strong financial performance can continue.

The good news is that you can do this with the help of SharePad. Some simple analysis using created data tables can give you a good insight into how healthy or otherwise the sector might be.

For this analysis, I’ve limited it to the FTSE 100 banks.

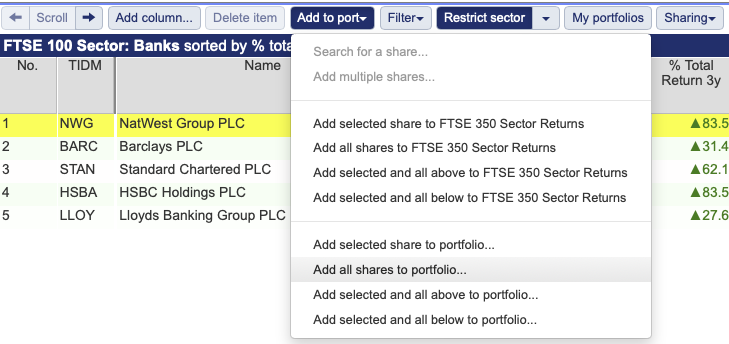

To analyse a sector in SharePad, select a share from a list and then click on “Restrict Sector”. As NatWest is in the FTSE 100, this will give you all the banks in the index.

You can then add all these shares to a portfolio to do some analysis on.

The big banks are in decent financial shape

First and foremost, investors don’t have to worry that banks are financially stretched like they were before the financial crisis in 2007/08.

You can measure a bank’s financial position in different ways – such as core equity tier 1 ratios which I won’t explain here – but the simplest and arguably most powerful measure is to compare the value of a bank’s assets with its shareholders’ equity or net asset value (NAV).

At its last annual balance sheet date, NatWest had an asset-to-equity ratio of 18.6 times. What this means in reality is that it has £18.60 of assets supported by £1 of equity.

This is quite a high number for a non-financial company but is deemed reasonable for a bank. The ratio arguably has more meaning if you turn it around and look at equity as a percentage of assets.

For NatWest this is 5.4 per cent. This means that the value of its assets can fall by 5.4 per cent before its equity is wiped out. This could happen in a severe recession or depression when lots of loans (assets) could default, but this does not happen in most economic states of the world.

To put this into some kind of perspective, before the financial crisis, Barclays was in a position where its assets only had to fall by 2 per cent in value before its equity would have been wiped out – something that was seen as a real possibility at the time.

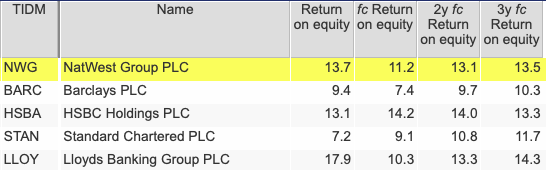

Returns on equity (for some) are at respectable levels

Profitability has been improving with NatWest, HSBC and Lloyds predicted to earn quite respectable returns on equity. Barclays and Standard Chartered arguably have some work to do.

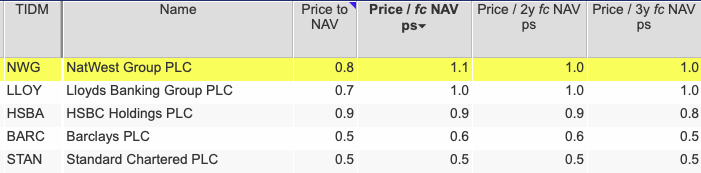

Valuations do not look stretched

Despite improving returns on equity, banking shares are not trading at a premium to their book values of equity or net asset value (NAV) and in some cases trade at a discount.

As a simple rule of thumb, shares trade at a premium to NAV when their returns on equity are expected to be sustained above their cost of equity (the minimum return shareholders want to own the shares) and at a discount when returns are expected to remain below it.

If the cost of equity is 10 per cent, then a sustainable return on equity of 10 per cent or more would justify a share price equal to or at a premium to the NAV per share.

On this basis, you could make a case for saying that the sector looks undervalued based on the returns on equity expected over the next three years. Another interpretation could be that investors don’t believe these returns are sustainable due to the risk of a recession.

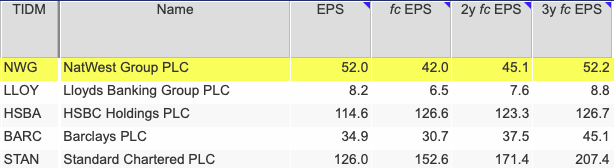

Earnings growth is expected……

It’s not always easy to know what items – one-off gains and losses – are included in EPS numbers and their forecasts.

At the moment, the outlook for earnings per share (EPS) growth is for an upwards trend over the next three-year forecast period.

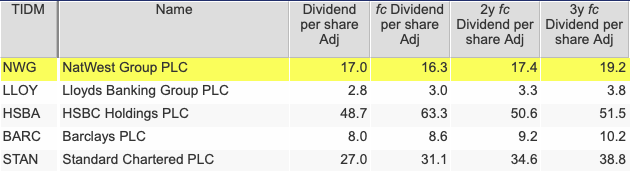

….As is dividend growth

Banks are expected to keep on growing their dividends in general which underpins their attractions as income shares while providing a tangible source of shareholder returns that once paid, cannot be taken away.

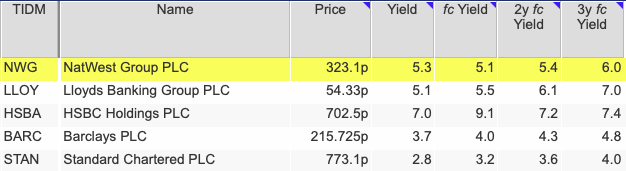

Dividend yields are attractive and growing

You can use SharePad to calculate something known as the dividend yield on cost. This takes the current and forecast dividend as a percentage of the current share price.

What we can see is that over the next three years, the income return on banking shares at their current share prices are expected to increase, resulting in some chunky income returns if the forecasts are met.

Can bank shares continue to outperform?

Predicting the future is difficult. That said, with decent financial strength combined with increasing profits and dividends and still modest valuations, further gains cannot be ruled out.

As long as economies remain healthy and large chunks of loans do not go bad then banks look reasonably well placed. Higher interest rates for longer than expected also support higher net interest income and profits.

~

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.