The latest companies to pass Richard’s 5 strikes system include a direct seller of swag, an estate agent franchise, an engineer that should galvanise investors, a soft drinks company, and a market-leading mortgage intermediary.

Since my last update, I have run 16 shares through the 5 Strikes system. Five achieved less than three strikes. This means that judging by the numbers, they have been pretty successful businesses.

5 out of 16 ‘aint bad

The other eleven have more chequered histories. Their returns have been low, or choppy (indicated by – CROCI and – ROCE), they have substantial debt, pension, and lease obligations (- DEBT), growth has been inconsistent or negative (- Growth), they have spent a lot on acquisitions (- Acquisitions) or the directors have not invested alongside the rest of us (- Holdings).

| Name | TIDM | AR date | Strikes | Score |

|---|---|---|---|---|

| M&C Saatchi | SAA | 26/4/24 | – CROCI – DEBT – ROCE – Shares | 4 |

| Epwin | EPWN | 25/4/24 | – Holdings – Debt – Growth | 3 |

| Mortgage Advice Bureau | MAB1 | 25/4/24 | – Shares | 1 |

| Serica Energy | SQZ | 24/4/24 | – CROCI ? Growth – ROCE – Shares | 4 |

| Barr (AG) | BAG | 23/4/24 | ? Growth | 1 |

| EKF Diagnostics | EKF | 22/4/24 | – CROCI – Growth – ROCE ? Shares | 4 |

| Billington | BILN | 19/4/24 | ? Holdings – CROCI ? Growth ? ROCE | 3 |

| Eurocell | ECEL | 19/4/24 | – Holdings – Debt ? Growth – ROCE | 3 |

| Central Asia Metals | CAML | 18/4/24 | – Holdings ? Acquisitions – Growth – Shares | 4 |

| Ferrexpo | FXPO | 18/4/24 | – Holdings ? CROCI – Growth – ROCE | 4 |

| Hill & Smith | HILS | 18/4/24 | – Holdings ? Acquisitions | 1 |

| M Winkworth | WINK | 17/4/24 | – Growth | 1 |

| TClarke | CTO | 17/4/24 | ? Holdings ? CROCI ? Growth ? ROCE – Shares | 3 |

| 4imprint | FOUR | 16/4/24 | 0 | |

| Forterra | FORT | 15/4/24 | – Holdings – CROCI – Debt – Growth ? ROCE | 4 |

| Vistry | VTY | 15/4/24 | ? Acquisitions – CROCI ? Growth – ROCE – Shares | 4 |

5 Strikes uses a Minimum Quality filter and a scoring system to identify shares that might be suitable for long-term investment

While there are no guarantees, the idea is that shares that have performed well through thick and thin know how to prosper for the long term and will make good candidates for investment.

The next stage is to understand what they do and then look to the future.

4Imprint

One share received no strikes. It is the estimable 4Imprint, a direct seller of promotional goods, aka swag: Clothing, mugs, bags, and technology products, for example, embossed, embroidered or printed with logos and messages and given away by 4Imprint’s customers to promote their brands and campaigns. It is one of the 40 shares I write up routinely for interactive investor.

Also of particular interest, are four shares that received one strike: M Winkworth, Hill & Smith, AG Barr and Mortgage Advice Bureau.

M Winkworth

M Winkworth operates an estate agency franchise, with franchisees across London and South East England. Maynard blogs about the share, and reckons its competitive edge is based upon ensuring franchisees provide a high-quality service.

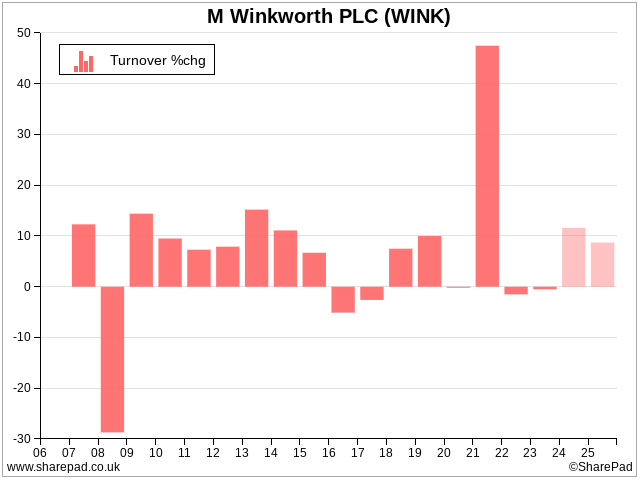

Its one strike is for growth. In five of the last eight years, revenue at M Winkworth has contracted, although never by much. Its worst year in recent times was 2016, when revenue fell 5.6%, although a near 30% drop during the Great Financial Crisis is a reminder of what can happen in the worst of times.

Mind you, revenue was 58% higher in 2023 than it was in 2015, mostly thanks to a 48% increase in 2021. Perhaps in elevating the company’s performance that year and depressing it in 2020, 2022 and 2023, the pandemic has distorted what might otherwise have been a steadier growth trajectory.

Hill & Smith

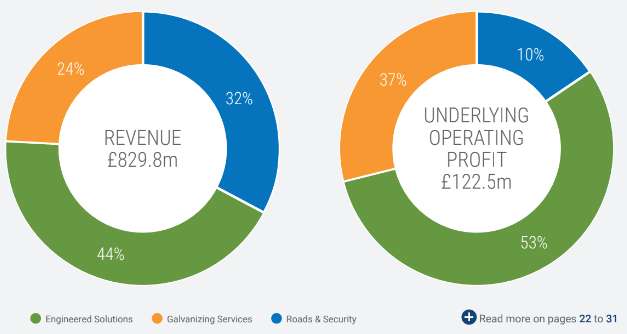

Hill & Smith manufactures steel and composite products that furnish our roads and are used in the construction of other infrastructure, predominantly in the USA and the UK. It also galvanises (coats) steel, a process that protects it. This reduces maintenance costs and means steel infrastructure lasts longer.

While Galvanising Services is the smallest segment by revenue, it has the highest profit margin. Hill and Smith’s biggest business, infrastructure products, also seem to be highly profitable.

It employs the often successful strategy of acquiring niche manufacturing businesses and allowing them to operate autonomously.

Source: Hill and Smith annual report 2023

Hill and Smith received a strike for directors’ holdings.

Combined, the Directors only own 0.14% of the company according to SharePad. Most of those shares are in the hands of the executive chairman Alan Giddins. He owns 93,100, which at an £18.90 share price is worth £1.75 million.

Mr Giddins is a stop-gap. The former chairman has been running the company since July 2022 while it searches for a new chief executive, a role it expects to fill later this year.

Phil examined Hill & Smith back in 2018 and he thought the executives were overpaid. Mr Giddins, though, does not participate in the bonus scheme or incentive plan, so his salary of just under £585,000 in 2023 was his total pay, which is 18 times the median pay at the company.

Hill and Smith’s chief financial officer, though, received a total pay of over £1.4 million, 44 times the median pay of £32,204. I think it’s fair to assume that once appointed, no doubt on a higher salary than the CFO, the new CEO will be a member of the high-pay league.

The combination of low shareholdings and high variable pay is a bit discombobulating as both can encourage short-termism, which is at odds with the company’s track record.

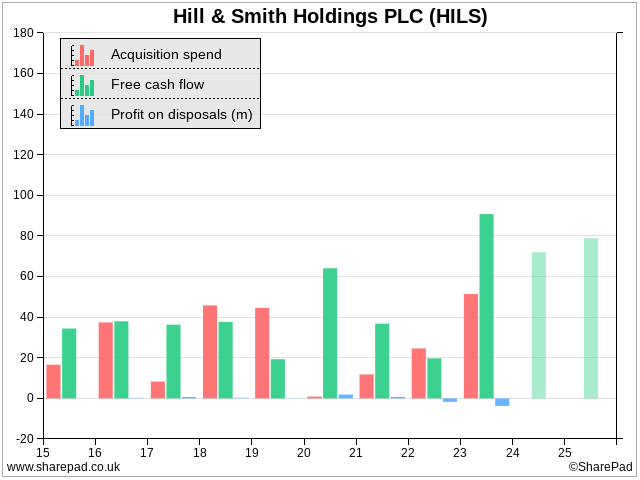

I also questioned the company’s acquisition spend. In 2018 and 2019 Hill and Smith spent more than it earned in free cash flow.

In total, though, over the last eight years Hill and Smith’s free cash flow exceeds its acquisition spend by £118 million, and since debt has declined as a proportion of capital and the share count has only ticked up very modestly, I do not think we need to worry that the business is living beyond its means.

AG Barr

Following Nichols, which I evaluated in my last article, AG Barr is another soft drinks company. Nichol’s signature brand is Vimto, and one of AG Barr’s signature brands is eponymous (Barr). The other is made from girders (it’s Irn Bru).

A comparison of the two businesses might be fruitful. On the face of it, Barr is more integrated. Nichols outsources much of its production and is actively simplifying the business, while Barr makes and cans its own drinks.

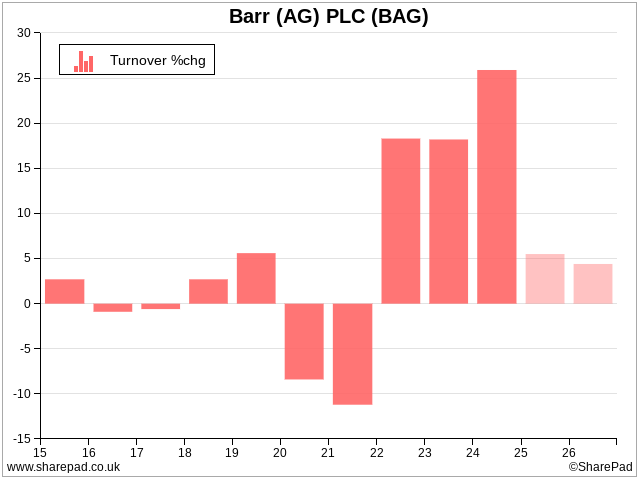

AG Barr’s strike was for growth. Like Nichols, AG Barr contracted during the pandemic. This was probably because of reduced sales to restaurants and hotels.

Barr also contracted slightly in some of the years leading up to the pandemic, though. Since the pandemic, Barr sales have grown very strongly.

Mortgage Advice Bureau

Mortgage Advice Bureau is a mortgage intermediary. Its platform serves mortgage brokers who pay a share of their income from arranging mortgages, insurance, and providing advice.

Fifty per cent of its representatives trade under the Mortgage Advice Bureau name, which makes it the leading intermediary serving the estate agent and new build sectors.

Mortgage Advice Bureau’s strike was for the increase in its share count. It issued shares to part fund the acquisition of Fluent Money, which cost nearly three years of free cash flow.

Fluent Money is a national telephone-based broker that generates business from price comparison sites.

Mortgage Advice Bureau says that estate agents, the new build sector, and price comparison websites are “by far” the biggest sources of new customers for intermediaries, so perhaps this was money well spent.

~

Contact Richard Beddard by email: richard@beddard.net, Twitter: @RichardBeddard, web: beddard.net

Got some thoughts on this week’s article from Richard? Share these in the SharePad chat. Login to SharePad – click on the chat icon in the top right – select or search for a specific share

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.