If ever there was a company that demonstrated complexity can be bad for business, it’s Nichols. When diversified, profitability crumbles. When it sticks to marketing soft drinks it prospers. Guess what it is doing now?

The one thing you will not read much about in this article is Vimto. Vimto is a soft drink and Nichols’ big money spinner. It has made the company so much money it is one of only five shares to achieve no strikes so far this year:

|

Name |

TIDM |

AR date |

Strikes |

Score |

|---|---|---|---|---|

|

Computacenter |

CCC |

11/4/24 |

? Growth |

0 |

|

FDM |

FDM |

8/4/24 |

0 |

|

|

Nichols |

NICL |

28/3/24 |

? Growth |

0 |

|

Porvair |

PRV |

13/3/24 |

? Holdings |

0 |

|

Quartix |

QTX |

7/3/24 |

? ROCE |

0 |

5 Strikes uses a Minimum Quality filter and a scoring system to identify shares that might be suitable for long-term investment

This article is not about Vimto, it is about why Nichols hasn’t made even more money from it in the past, and why that may be changing.

Source: Annual Report 2023. Winning products, mostly they are purple and begin with “V”!

Lessons of the pandemic

I wrote about Nichols in December 2020. You may remember that time. It was the first year of the Covid-19 pandemic. Having just come out of the second national lockdown, we were unsure whether we would be spending Christmas with our families. A third national lockdown was just weeks away.

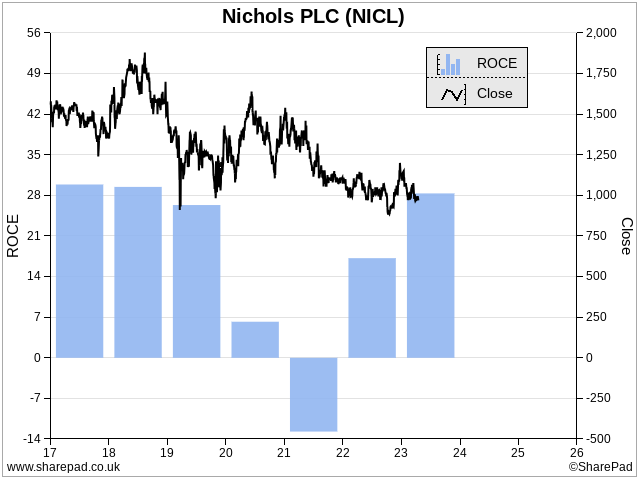

Like many companies, Nichols was struggling and the share price reflected it. Profitability in terms of return on capital has recovered since then, yet the share price has continued to decline.

A word of warning though. This chart requires some interpretation.

First off, the business did not lose money in 2021. In fact, it made more profit from selling soft drinks than it did in 2020, but this was wiped out by a goodwill impairment.

Secondly, while Return on Capital Employed (ROCE) has recovered to its 2019 level, the absolute level of profit has recovered substantially but it is not all the way there.

The elevated ROCE is only partly a result of the profit recovery. It is also because of the goodwill impairment…

Goodwill is the difference between the value of a business and the value of the assets within the business that can be identified. It is recognised when a company like Nichols acquires another company.

The tangible assets, property and equipment, and some intangible assets, like brands, are recorded on the acquirer’s balance sheet, but if the acquirer pays more than the value of these things, it is recorded as goodwill.

You might ask why an acquirer would overpay for the assets. It is because value is in the eye of the beholder and the business people making the decisions see more value (i.e. potential) than the bean counters are allowed to count.

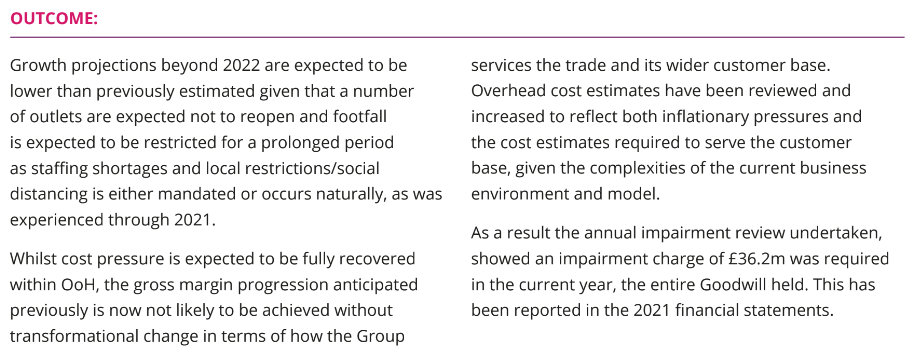

In 2020 and 2021, we were drinking less in pubs and restaurants and Nichols’ Out of Home business, the part of the business that supplies them, was not making as much money. Maybe it was losing money. Frustratingly, the company’s annual reports from those years do not tell us.

In the years leading up to the pandemic, Nichols had beefed up its Out-of-Home business with acquisitions, and it was the goodwill associated with these that it wrote off.

Source: Nichols Annual Report 2021. OoH is Out of Home

Since goodwill is part of capital employed, the denominator in SharePad’s calculation of ROCE, the smaller the goodwill the higher Return on Capital (other things being equal).

I am sure it isn’t as easy as this in practice, but with one metaphorical press of the delete key, the accountants shrank Nichols’ capital employed and boosted its ROCE.

A tale of doomed investment

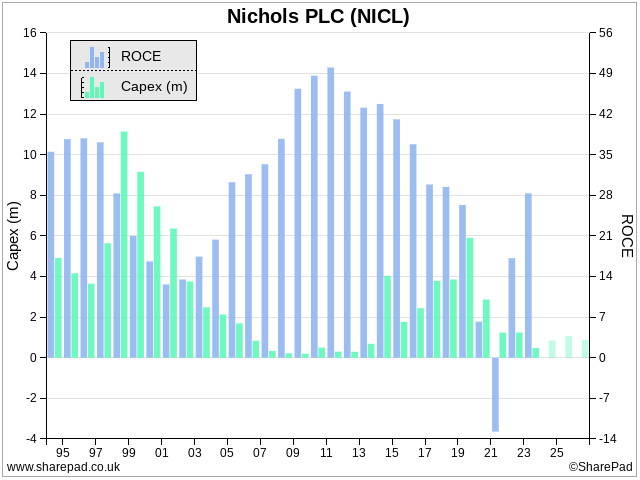

Zooming out further, Nichols has been a very profitable company over the years, but its profitability has waxed and waned a lot.

This chart plotting ROCE and Capex, is an updated version of a chart in my earlier article, but I believe the story may still be playing out.

At Nichols, Return on Capital has improved when it has reduced capital expenditure. Investing in factories, equipment and so on has made the businesses less efficient.

The improvement in Return on Capital through the naughties’ occurred after Nichols out-sourced the manufacture of Vimto, by far its biggest selling product, divested a food manufacturing business, and switched to supplying pubs and restaurants through distributors. This meant it no longer had to provide equipment for dispensing drinks

The buildup in capital expenditure between 2014 and 2020 coincided with falling ROCE. It also coincided with acquisitions for the Out of Home business. One came with a factory that required capital expenditure. A frozen drinks business needed refrigeration, and more capital expenditure. A coffee business required it to supply coffee machines.

New Nichols

The poor performance of the Out of Home business during the pandemic sparked a strategic review conducted in 2022 that highlighted high operating costs and overheads, and a complex mixture of business models. The company decided to operate Out of Home as a separate division, slim it down and run it for profit.

Among the more eye-catching decisions (because they came with the earlier acquisitions) was an exit from coffee and also national frozen drinks accounts, which required it to operate a nationwide refrigerated distribution network.

Another notable finding was the need to improve financial reporting. It is almost as though Nichols did not have the numbers to understand what a millstone the Out of Home division can be. Happily, it has put that right too.

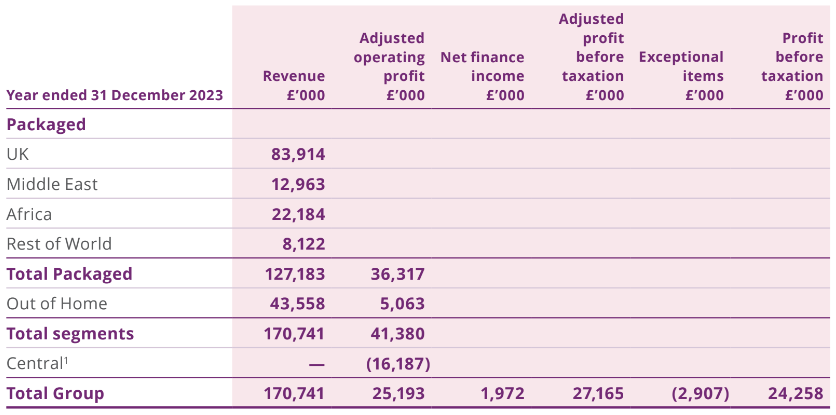

Unlike in 2021, Nichols now includes Out of Home as a segment in the Annual Report.

Source: Nichols Annual Report 2023

The other segment, which earns much more revenue, is “Packaged”, the product we buy in supermarkets. Its big money spinner is Vimto. The company does not make the Vimto, or bottle it, but it owns the recipe, and markets the drink.

In 2021, Nichols reported that Vimto had exceeded £100 million of sales for the first time, compared to £144 million in total revenue that year, so the purple stuff is the fountain of Nichols’ profitability.

It’s early days, and profitability has already improved on an adjusted basis, but at 14% before central costs the adjusted operating margin for Out of Home is half of the 29% achieved by Packaged.

Streamlining Out of Home should make it more profitable.

It may give management more time and resources to focus on the purple profit fountain too.

Latest from 5 Strikes

15 companies that pass my Minimum Quality filter have published annual reports since I last updated you. Here they are, with their strikes:

|

Name |

TIDM |

AR date |

Strikes |

Score |

|---|---|---|---|---|

|

Next |

NXT |

12/4/24 |

– Debt ? Growth |

2 |

|

PageGroup |

PAGE |

12/4/24 |

– Holdings ? Growth |

1 |

|

Computacenter |

CCC |

11/4/24 |

? Growth |

0 |

|

Ibstock |

IBST |

11/4/24 |

– Holdings – CROCI – Growth – ROCE |

4 |

|

Greggs |

GRG |

10/4/24 |

– Holdings |

1 |

|

Marshalls |

MSLH |

10/4/24 |

– Holdings – Growth – Shares |

3 |

|

Keller Group |

KLR |

9/4/24 |

– CROCI – Holdings ? Debt ? ROCE ? Shares |

3 |

|

FDM |

FDM |

8/4/24 |

0 |

|

|

Savills |

SVS |

8/4/24 |

? Holdings – CROCI ? Growth ? ROCE |

3 |

|

Macfarlane |

MACF |

5/4/24 |

? Holdings ? Growth – Shares |

2 |

|

Morgan Advanced Materials |

MGAM |

5/4/24 |

– Holdings ? CROCI – Debt ? Growth |

3 |

|

Reckitt Benckiser |

RKT |

5/4/24 |

– Holdings – Debt – Growth – ROCE |

4 |

|

Bodycote |

BOY |

4/4/24 |

? Holdings – Growth |

2 |

|

Michelmersh Brick |

MBH |

4/4/24 |

– ROCE – Shares |

2 |

|

Centaur Media |

CAU |

3/4/24 |

? Acquisitions – Growth – ROCE |

3 |

5 Strikes uses a Minimum Quality filter and a scoring system to identify shares that might be suitable for long-term investment

~

Contact Richard Beddard by email: richard@beddard.net, Twitter: @RichardBeddard, web: beddard.net

Got some thoughts on this week’s article from Richard? Share these in the SharePad chat. Login to SharePad – click on the chat icon in the top right – select or search for a specific share

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.