Having used the 5 Strikes system for nine months, Richard has decided it is a keeper. Commenting on the latest investment candidates to achieve less than 3 strikes, he explains what he was thinking while he was separating the wheat from the chaff.

Happy New Year! At the turn of every year, I review my SharePad set-up to consider which innovations are keepers and which should quietly stalk off into the night.

This year, I made only one major innovation. I tied a filter and a custom table together into a share scoring system I dubbed 5 Strikes.

It is a keeper. A big change. It changed the way I discover new candidates for my portfolio. It has also evolved during the year, so I am going to devote most of this article to explaining it in more detail.

Before I get into the nitty gritty, I need to mention how 5 Strikes fits into my wider SharePad set-up. I also use the Default layout, to manage my portfolios and catch up on the news.

SharePad gets on with the job of portfolio management so competently, I do not have anything else to say about it.

Every day, I read the news most days, in the same way I have for years. I look at the RNS news that passes my “Irrelevant News” filter for the 50 or so shares in my watch list.

These are increasingly derived from 5 Strikes.

5 Strikes

5 strikes is a method of deciding which shares to analyse. Basically, it is a way of gauging how difficult a share will be to work out, and whether it is worth my while trying.

The system arranges a SharePad filter and the corresponding list view above a SharePad custom table to show me the data I need to make a preliminary evaluation in a custom layout called “5 Strikes”.

Unless I am on holiday, I perform the same five or ten-minute routine every day the stockmarket is open. I could do it once a week, or once a month, it would just take longer each time.

I look for reasons I might not want to invest in any company that has passed the filter and published its annual report since I last did the routine. For every reason, I record a strike.

Generally, I consider shares with less than 3 strikes to be good candidates, candidates with 3 or 4 strikes to be reserve candidates, and I rule companies with 5 or more strikes out of further investigation for at least a year.

The decision to record a strike is arbitrary, but I will do my best to describe what I am thinking, as we take a closer look at the system.

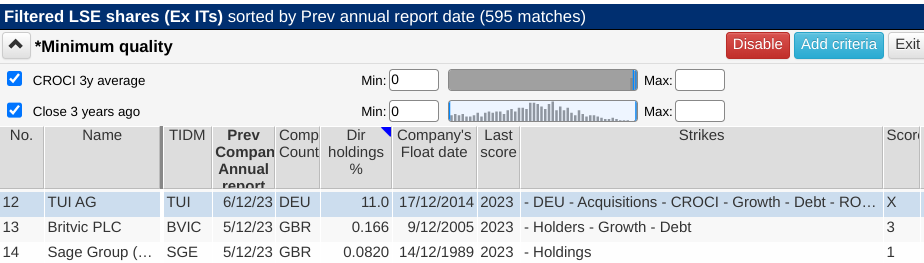

Minimum quality filter

First I run a “Minimum quality” filter on SharePad’s list of LSE shares (excluding investment trusts). This filters out all companies that have been listed for less than three years or produced negative cash flows over the last three years. For such companies, there is very little data to go on.

Source: SharePad list view

The list view is customised, to show:

Previous company annual report date: This sets the order of the list, showing the most recent annual reports first. That way we can see any companies that have published annual reports since we last looked. Scoring companies soon after they publish their annual reports makes sense because the annual report may well be the next place we look for information.

It also has three columns of data to help us evaluate the share (record strikes):

Company country: If a company is not domiciled in the UK I record a strike because it is more difficult to meet overseas companies, the laws may be different, and there may be complications collecting dividends and so on. This may not be true of a big German company like Tui, which received a – DEU (for Germany) strike in the screenshot above, but I am no expert in overseas domiciled companies so it is something I would have to look into.

Director’s holdings: I like it when directors stand to gain if they manage the company well and lose along with the rest of us if it does badly. Insubstantial holdings of, say, below 3% of all the shares in a smaller company earn the share a strike.

With larger companies, it becomes less meaningful to talk in percentage terms but I still want to see holdings worth many, many times how much the executives are paid. The average FTSE 100 chief executive earns £4 million, so let’s say they should hold £40 million in shares.

Float date: While companies that have been listed less than three years are filtered out, ideally I want to consider more data than that. If the float date is later than 2015, I record a strike.

The final three columns are where we record information relating to these decisions. They are SharePad note columns:

Last Score: Since I only score shares once a year, the first thing I do is enter the current year so I know I have already scored the share when I look at the list again.

Strikes: This column contains a list of the reasons I might not want to invest in the share. You have read about three of them already. If the company is domiciled I put the country code (e.g. “- BGD” for Bangladesh). If the directors’ holdings are insufficient, I put “- Holdings”. If it floated since 2015 I put “- IPO”.

Score: This is the total number of strikes. If a company receives 5 or more strikes I record an “X”.

To find more reasons not to like a share, I turn to a custom table, positioned below the filter and list.

One table to rule them all

Two great things about SharePad’s custom tables are:

- We can see decades of data for a share, and

- We can focus on exactly the data we want

The custom table shows the financial statistics that matter most to me. I think they are important for evaluating how well a company has performed over the long term. Companies that have performed well in the past are a good place to start if we are looking for shares that will perform well in the future. For a start, they know how to profit, and secondly, they have a track record we can analyse.

Interpreting these statistics requires us to make judgments though. For example, I find myself giving shares a pass if they lost money or contracted during the pandemic because pandemics are rare and their impacts are different to those we experience in more common events like recessions.

These are judgements investors make all the time, but by scoring the shares I am trying to bring rigour to the process and cast my net over a wide set of opportunities.

The examples below are from the latest crop of shares. They are deliberately borderline decisions because those are the most difficult ones to adjudicate. Most strikes are obvious.

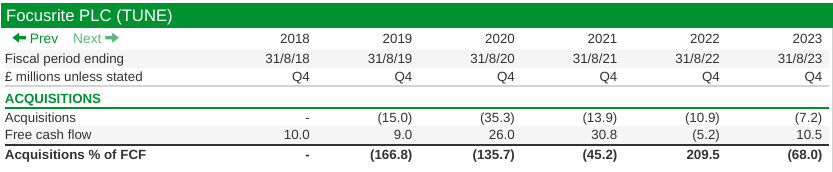

Acquisitions as a % of Free Cash Flow

Focusrite, which makes audio equipment, scored only 1 strike (- Acquisitions). The company has spent more in recent years on acquisitions than it has earned in free cash flow and that is not sustainable over the long-term.

Generally, I just eyeball the two rows to make the comparison, although a purist might add them up! One strike is very good, I might add, so Focusrite is very much in the frame for investment.

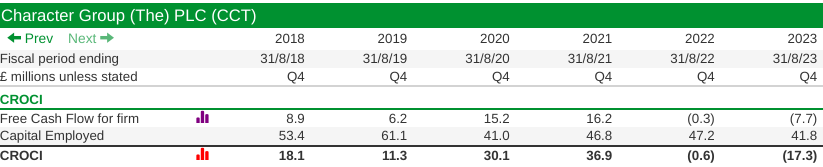

Cash Return on Capital Invested

Character Group makes toys under licence based on popular children’s film, TV, and comic characters. It scored 2 strikes in my recent evaluation, one of which was – CROCI.

I am quite tolerant of low CROCI. Companies need to invest, which can use up cash for example. But I do not like to see CROCI turn negative.

With only two strikes, Character Group could be a candidate for investment, and one of the first things I would do would be to investigate its recent negative cash flow.

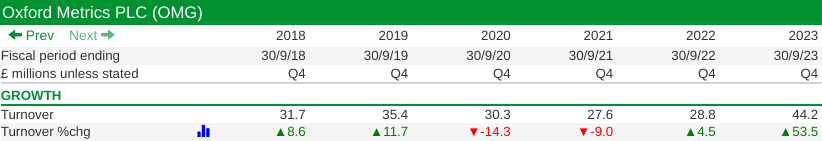

Growth

Oxford Metrics makes sensors and software for tracking motion. Its products’ most eye-catching application is capturing the motion of actors and athletes.

The company actually struck out in my recent evaluation (it scored “X”), although I found much to like when I looked at the share in 2022 and it has subsequently sold off its puzzling Yotta division.

Almost every decision was borderline, none more so than the strike I gave for – Growth. Oxford Metrics contracted during the pandemic, which I can forgive. But it also contracted in 2014.

That was a long time ago, too far back for me to fit on this web page, but I would have to look into it if I were to investigate the company again.

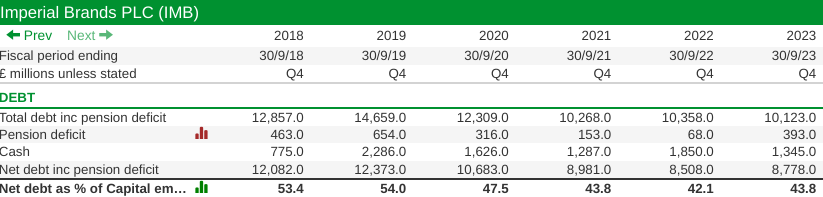

Debt

Imperial Brands changed its name from Imperial Tobacco in 2016. Even though its dependence on leases and borrowings has declined as a ratio of capital employed it is still quite high. It scored 3 strikes recently, and – Debt was one of them.

I prefer the businesses I own to have at least as much cash as they do financial obligations at their year-ends. I will give them a strike if net debt was over 25% in the most recent financial year or has often been over 25% in the past.

Leverage is a way mature businesses like tobacco companies can improve returns to investors, and some would argue that addiction is a very steady business that can support a lot of debt. I hope it is a declining business, and would fear the debt could become burdensome.

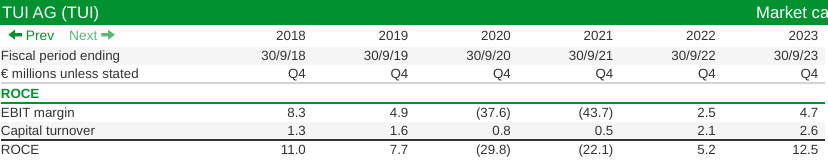

Return on Capital Employed

Travel company Tui received 7 strikes and a big “X” when I last reviewed it and I do not think I was being harsh at all! One of them was for Return on Capital Employed. To invest in a business long-term we want it to be capable of earning a good return on its investments. I think good starts at 10%, and I do not like seeing companies dip below it.

We can make an exception for the pandemic. No travel company I am aware of profited through it, but just in the last six years Tui has failed two other times to clear this hurdle, and if you look back further in time it is the same.

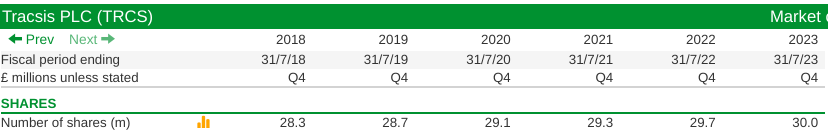

Shares

I prefer the companies I invest in to be self-sufficient, capable of self-funding investment and executive pay, the most common reasons for increasing the share count. Any company lifting the share count by more than about 1% a year, maybe taking liberties and gets a strike.

In giving Tracsis a strike (- Shares), I was being an absolute stickler for the rule. It was one of 3, which just tips Tracsis out of my watchlist, but I look forward to revisiting that decision next year!

Tracsis is a serial acquirer. It buys transport technology and consultancy businesses.

Latest high scorers

Every month or so we publish the latest batch of companies to score 0, 1 or 2, so here is a late Christmas present for you. All the high scorers since my last list 🙂

| Name | TIDM | Strikes | Score |

|---|---|---|---|

| AJ Bell | AJB | – Holdings – IPO | 2 |

| Character Group | CCT | – CROCI – Growth | 2 |

| Focusrite | TUNE | – Acquisitions | 1 |

| IMPAX Asset Management | IPX | – Growth | 1 |

| Sage | SGE | – Holdings | 1 |

I should mention one other wrinkle in this list. AJ Bell gets a strike because the directors do not have substantial shareholdings. One of the non-executive directors is Les Platts, though, a representative of founder and former chief executive Andy Bell.

Andy Bell owns a significant shareholding and his influence may be significant too.

The scores are not sacrosanct. A score of 1 is not necessarily better than 2. We will always need to look beyond the data. But the fewer the number of strikes, the less, on the face of it, we will have to worry about and the easier it will be to decide whether the share is a good or bad investment.

~

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

Got some thoughts on this week’s article from Richard? Share these in the SharePad chat. Login to SharePad – click on the chat icon in the top right – select or search for a specific share