As we all know, there is a lot of functionality in ShareScope and there are many different ways to use and customise it. Last year’s customer survey also showed us that the majority of you use ShareScope every day.

Inspired by this and some social posts from long-term subscribers who talked about their daily ShareScope routine, we thought we would put an article series together to celebrate the different ways you, our subscribers use ShareScope.

In the first of the series last week, we had Stock Whittler and Sue from East Anglia kindly sharing a bit about their investing journey and how they use ShareScope.

This week, we have one of our writers Richard Beddard and long-term subscriber Riva.

If you have your own routine you would like to share, or some interesting custom settings, layouts or screening filters – we would love to hear about you and them! Just send them in to marketing@sharescope.co.uk. When we publish them, we’ll even add a free month to your account!

Richard Beddard | @RichardBeddard

Investing experience

More than 25 years. I founded an investment club in the 1990s. That was how I got started

ShareScope experience

I first subscribed to ShareScope in the very early 2000s (maybe 2000!) and moved to ShareScope soon after it came out.

How often do you use ShareScope?

I use ShareScope every weekday, at least once a day unless I am on holiday.

How I use ShareScope

During a quiet moment, usually near the end of the working day, I boot up ShareScope to read the news for shares I own and those I am watching closely (about 45). I make notes on news items that I think have strategic (i.e. long-term) implications, but I don’t act on the information (i.e. trade). I only re-evaluate holdings and potential holdings once a year, so I use my notes then.

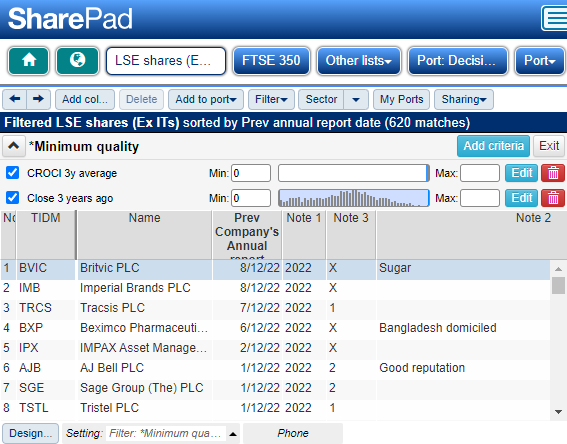

Next, I filter shares listed on the London Stock Exchange (LSE) to find all those that have earned a positive cash flow over the last three years and sort the resulting list by the date each company last published its annual report, most recent at the top. I’m interested in the annual report because it, and ShareScope, are my main sources of information. Then for each company that has published an annual report since I last checked, I look at a custom table, which I call “one custom table to rule them all”. It shows the performance of a company over many many years. I give the company a score, which is the number of strikes or bad things I see in the numbers. Companies that score two strikes or fewer are effectively my research list – my source of new ideas.

Companies that score five or more strikes are rejected. Companies that score 3 or 4 are my slush pile; ideas I might come back to. I call this system “5 strikes” because if a company scores 5 strikes, it is out of contention until next year’s annual report.

I also export data from ShareScope and use it in my more detailed analysis of companies, but that is on a more ad-hoc schedule. Once a week, typically.

I have written about my custom table here: One custom table to rule them all.

My “5 strikes” system often gets a mention in my articles, this one includes a good summary: 29 top scorers, and Christie bottled.

Riva

Investing experience

I’ve been investing since the privatisation days in the mid-’80s but became more active from 1998 when I started using Updata’s real-time package in 1998. I continued to use it till they lost their feed supplier.

ShareScope experience

Since I was already a Sharescope Gold user, I became aware of ShareScope and started using it in 2016 and have been continuously ever since.

How often do you use ShareScope?

I use ShareScope whilst the market is open and also evenings and weekends.

How I use ShareScope

I start the day reading the RNSs, picking out stocks to invest/trade or avoid. I also check the live business papers, such as FT Live to hear how markets were overnight.

After the morning rush, I tend to focus more on lists and sectors and also use the filters, along with looking at lots of charts to find those stocks to buy and ones to sell.

I like filters that pick out strong stocks so reducing the number in each index or watch list to scroll through when looking for trades and investments – for example, the Mark Minervini filter in the ShareScope library.

Then in terms of charts, I typically look for stocks rising parabolically above the 200 ma and 500 ma with regular breakouts giving you the choice of either buying dips, which the MACD crossover helps to time, or by buying the breakouts.

The US opening often creates another busy time and then the last hour when I watch stocks closely again generally to sell if the market is poor, particularly if it’s a Friday afternoon.

I wrap up by watching the 4.30pm auctions and any interesting late RNSs. Finally, I like to check how the US closes and have another look at the news.

~

Got some thoughts or questions on the two How do YOU’s above? Leave them in the comments below.

And remember, if you have your own routine you would like to share, or some interesting custom settings, layouts or screening filters – we would love to hear about them! Just send them in to marketing@sharescope.co.uk. When we publish them, we’ll even add a free month to your account!

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.