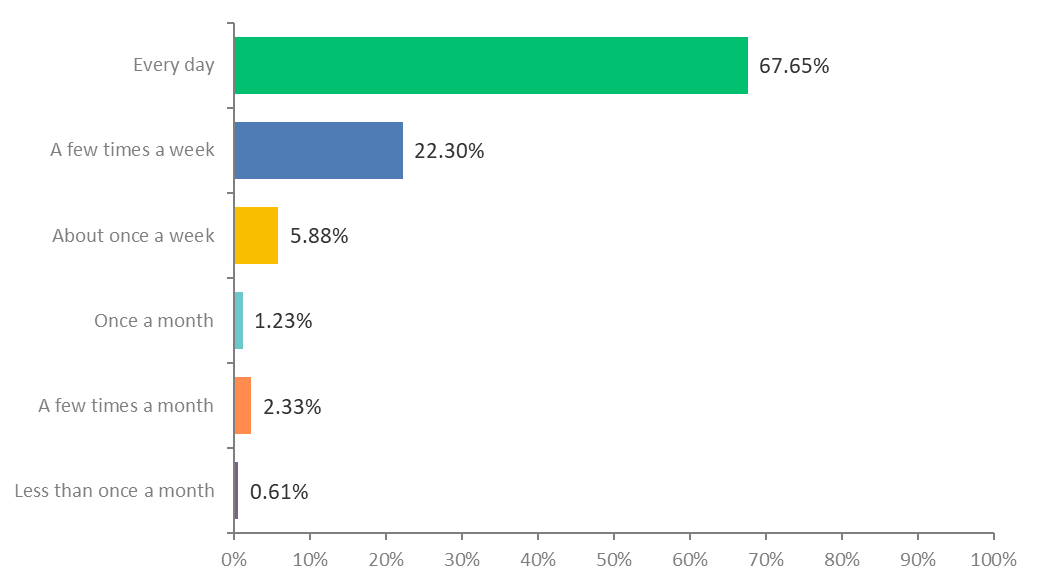

As we all know, there is a lot of functionality in SharePad and there are many different ways to use and customise it. Last year’s customer survey also showed us that the majority of you use SharePad every day.

Inspired by this and some social posts from long-term subscribers who talked about their daily SharePad routine we thought we would put an article series together to celebrate the different ways you, our subscribers use SharePad.

This week we have Stock Whittler and Sue from East Anglia kindly sharing a bit about their investing journey and how they use SharePad.

If you have your own routine you would like to share, or some interesting custom settings, layouts or screening filters – we would love to hear about you and them! Just send them in to marketing@sharescope.co.uk. When we publish them, we’ll even add a free month to your account!

Source: SharePad customer survey 2022

Stock Whittler @dosh100

Investing experience

I started investing in stocks during the early privatisation stages of the water companies originally doing what was called stagging and investing in just about all of the utilities that came to market. So, all in all over 25 years of serious investing.

SharePad experience

I was probably one of the earliest subscribers to ShareScope very shortly after it came into existence in the 1990s. I maintained my ShareScope subscription to this day and took out a subscription to SharePad very shortly after it was launched.

How often do you use SharePad?

I use SharePad daily with most of my research work taking place over the weekend. Every day the market is open, I have SharePad in use right throughout the day although typically I mainly use it at market open and market close.

How I use SharePad

My typical Monday to Friday routine is to read RNS announcements shortly after 7am and digest the company updates of interest comparing them with progress against forecasts. This may or may not lead to some sales or purchases later in that day/week.

I then leave the screen to return after the close of the market to view new 1-year highs/losses and see if there had been any interesting director/institutional buying or selling.

At the weekend I do a lot of filtering for various financial ratios and technical chart moves. This then condensates to a list of maybe 25 or 30 stocks of interest for me to follow up further (usually the list holds a good number that I already own as it’s my base way of identifying opportunities).

I also like to make dated notes on my chart to record events or observations so I maintain a history of the price movement.

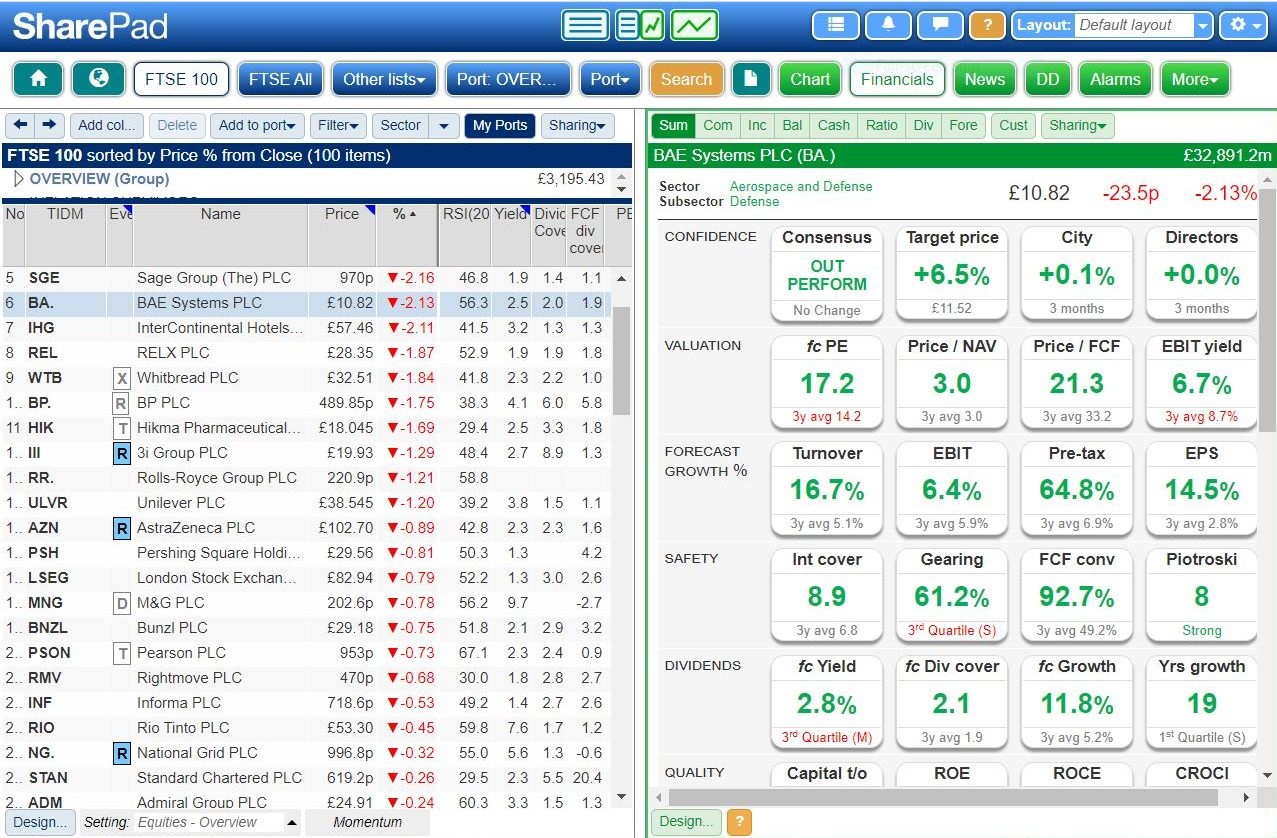

Overall with SharePad, I use a combination of positive trading news/breakout/momentum/insider dealing/good financial ratios/volume traded etc to make a smaller universe of stocks for more in-depth research. SharePad of course makes this further research rather easy with direct links to the various companies and their sites.

Sue from East Anglia

Investing experience

Investing since 1967 – first share bought was SmitKline Beecham because my then toddler daughter was consuming her Ribena for England!

SharePad experience

Subscriber to SharePad since it was introduced. Before that, subscribed to ShareScope within a year or two of its introduction and ever since.

How often do you use SharePad?

I use Sharepad every day, also weekends when I do research or a valuation.

How I use SharePad

My typical routine involves checking my various portfolios shortly after they open at around 8:45am and then during the day on the PC; occasionally also via the mobile – just for a quick update on prices.

I now have one self-invested ISA and manage my husband’s self-invested ISA, as one big portfolio – mine for capital gain, his being defensive. In SharePad, I have portfolios for indices, dividend kings, inflation survivors, investment trusts, shares which benefit from a strong dollar and prospects – all grouped as an overview.

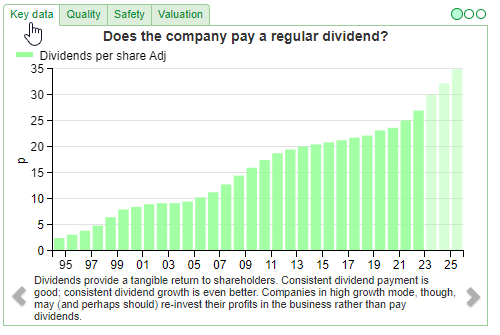

Research-wise, I mostly use charts and the Financials tab as well as the handy charts for key data/quality/safety/valuation.

I don’t have screens as such, but use SharePad columns to compare relative strength, yield, dividend cover, ROCE, CROCI and others. I also look very, very carefully at the charts/moving averages of shares which interest me.

This may all sound a bit amateurish and ‘flying by the seat of my pants’ stuff, but it works. My portfolios have really thrived. They’ve seen me very successfully and safely through various bull and bear markets, including the 1974 oil crisis, Black Monday, October 1987, the Millennium, the 2008 financial crisis, Brexit, etc. I hold tight and don’t panic in a crisis – best not to even look!

While my investing can nevertheless sometimes be a tad too cautious to really shoot the lights out (I failed to buy Poseidon, oh, if only!), I’m pretty happy with their growth and SharePad is an absolutely essential part of my system. We built a large extension to our house on the profits of Cambridge Antibody alone!

Got some thoughts or questions on the two How do YOU’s above? Leave them in the comments below.

And remember, if you have your own routine you would like to share, or some interesting custom settings, layouts or screening filters – we would love to hear about them! Just send them in to marketing@sharescope.co.uk. When we publish them, we’ll even add a free month to your account!