Phil puts the embattled Reckitt Benckiser under the SharePad spotlight.

Last Friday saw a sharp fall in the share price of Reckitt Benckiser – one of the world’s leading household and consumer goods companies. A judge in the US awarded damages of $60m after ruling that Reckitt’s infant formula products may have contributed to the death of a child.

This is the kind of news that investors dread. Despite disclosing details of cases in its annual results, Reckitt said that it believed that any major costs resulting from them was unlikely.

The size of the damages from just one case will inevitably have led investors to worry about more cases to follow and the potential costs ballooning. Given the potential size of the final bill – which theoretically could run to billions of dollars – it was no surprise to see the share price tank.

Have investors overreacted? Could now be a time for brave contrarian investors to buy the shares?

Reckitt continues to protest its innocence and investors can and do overreact. So, I’ve decided to put Reckitt through a SharePad analysis to see how attractive or otherwise the shares might be right now.

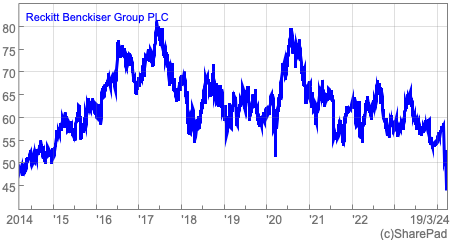

The shares are at a 10-year low

The share price chart is one of clear distress. Sentiment is very negative and has been for a number of years now. This is a sign that Reckitt’s problems are beyond any potential further lawsuits.

It is also a chart that will pique the interest of contrarian investors. A change in fortune for the company could see a sharp upwards bounce from here. How long that will take is anyone’s guess.

A serial underperformer

Having created a portfolio in SharePad, it is possible to see how Reckitt’s shares have performed against its global peers.

The answer is not very well. Its shares have significantly underperformed and show that investors have had concerns about the company for some time.

Weak growth

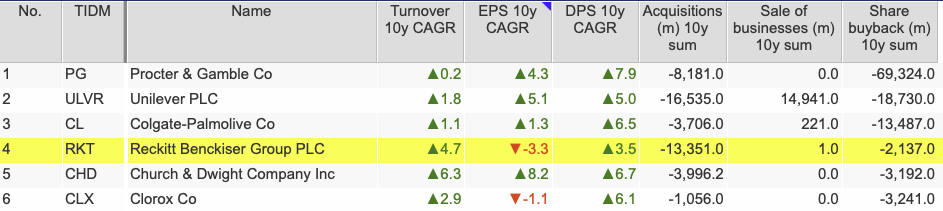

It seems that the chief reason for Reckitt’s underperformance has been weak growth over the last decade. It spent a lot of money buying the infant formula business Mead Johnson in 2017 and demerged its pharmaceuticals business, Indivior (LSE:INDV) at the end of 2014. Management hoped that this would accelerate the company’s growth.

While Indivior has delivered stunning total returns of 193 per cent over the last five years, Reckitt has had the weakest earnings per share (EPS) and dividend per share (DPS) growth of its peer group over the last decade.

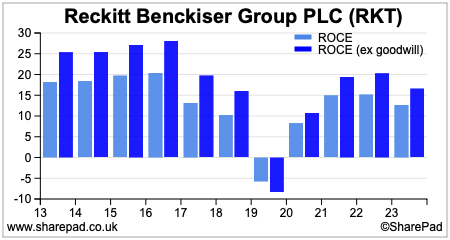

Falling returns on capital employed (ROCE)

Its weak growth has coincided with falling returns on capital employed (ROCE) and returns on operating capital employed (ROOCE) which is not what you want to see.

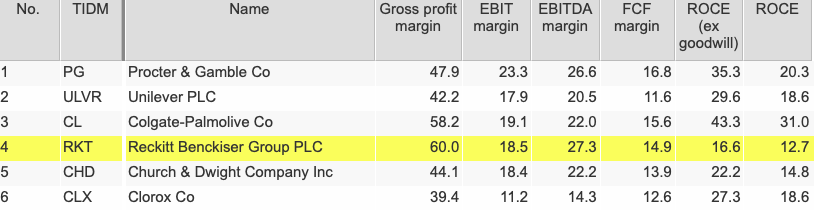

We can also see that Reckitt Benckiser has the lowest ROCE and ROOCE figures amongst its peer group currently.

Revenues – the root cause of Reckitt’s problem

Companies whose shares make good long-term investments tend to grow their profits by selling more of their products or services to customers. You want to see evidence of growing revenues or turnover both in the past and importantly, the potential for more in the future.

It’s much easier to grow profits by cutting costs which Reckitt has been focusing on recently, but high-quality businesses grow by selling more.

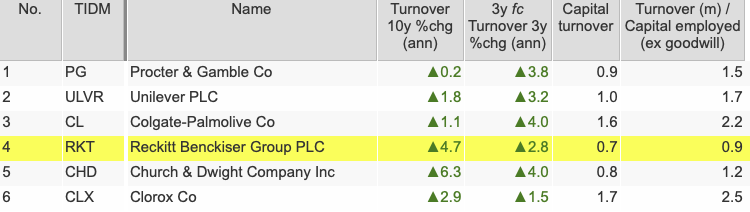

On this issue, the evidence against Reckitt is damning. Whilst its historic revenue growth looks alright, this does include the acquisition of Mead Johnson which added more revenues than Invidor took away.

If you were to look at organic sales volume growth – sales growth from existing businesses excluding price increases – its performance would not be as good. In the final three months of 2023, the company’s like-for-like revenues fell by 1.2 per cent.

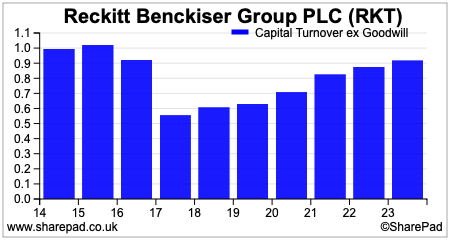

One measure of a company’s ability to generate sales is to compare its turnover with the money invested in the business by calculating the capital turnover ratio.

Reckitt’s capital turnover ratio – based on its operating assets – collapsed with the acquisition of Mead Johnson. While it has recovered, it remains much lower than its peers which suggests it is not as good at generating sales from the money it invests.

(I calculated this ratio in SharePad using the combine feature by dividing turnover by capital employed ex-goodwill)

If we look at forecast turnover growth over the next three years, Reckitt has one of the weakest outlooks from a sector where growth is difficult to achieve.

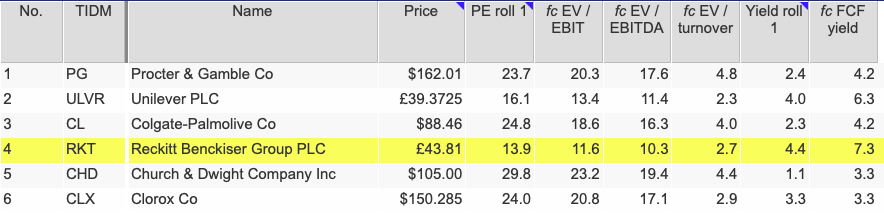

Cheap valuation will lead to takeover speculation

Reckitt shares are going to be under a cloud for some time to come until the legal issues it faces are dealt with.

In the meantime, the fall in its share price has pushed its valuation to a big discount to its peers on a number of measures. This is likely to lead to chatter about Reckitt becoming vulnerable to a takeover bid.

Fifteen years ago, Reckitt was linked with Colgate-Palmolive but it is unlikely whether any company would take on the legal uncertainty right now.

Private equity could be interested in a business that has a good reputation for generating lots of free cash flow.

A trade buyer could undoubtedly make a lot of cost savings, but how do they get sales growing at a decent level?

Readers might be able to get some insight into this question themselves by looking at how many Reckitt brands are in their cupboards.

The main concern facing Reckitt – and other consumer and household brands – is that it faces increasing competition from high-quality private-label substitutes that sell for much lower prices.

If you look at Reckitt brands such as Nurofen, Finish, Strepsils, Dettol, Gaviscon, Harpic and Vanish, they can all be easily replaced by supermarket own-label brands.

To generate more sales, a company such as Reckitt might have to significantly reduce its selling prices and hope that higher sales volumes can offset lower profit margins and grow total profits. This is no easy task.

Perhaps another company can do a better job with selling Reckitt’s brands but if they cannot meaningfully grow then the current valuation might be about right rather than a bargain buy for the brave.

~

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.