In this week’s Market Moves, Ben takes a look at some of the biggest winners and sector trends over the past week, including a look at the performance of gold and gold shares, plus a look ahead to another big week of financial results and updates.

Despite the market drifting sideways and a sense of economic malaise hanging in the air, it’s clear that share prices are being rewarded when companies beat guidance, up expectations and perform better than hoped.

There were a couple of examples last week. One was Diploma, the buy-and-build industrial supplies group, which jumped 9.2% relative to the All-Share. Diploma is an acquisitive growth play with some strong quality running through its financials. It upped its own full-year guidance after a strong first half and brokers including Jeffries and RBC responded by raising their price targets.

Yougov, the market research agency, was another to see its price react well to positive news. A capital markets day last week saw details of ambitious growth plans, including aims to double revenues to £500 million and take profit margins to 25%.

The biggest mover last week was luxury car group Aston Martin Lagonda, where shares jumped 28.4% versus the All Share. At least part of the reason was down to Barclays raising its price target to 300p from 250p. That said, it has been a brutal five years for the company’s shares since its IPO in October 2018. It floated at £19 and was trading at £2.68 towards the close last Friday – a painful 86% reversal.

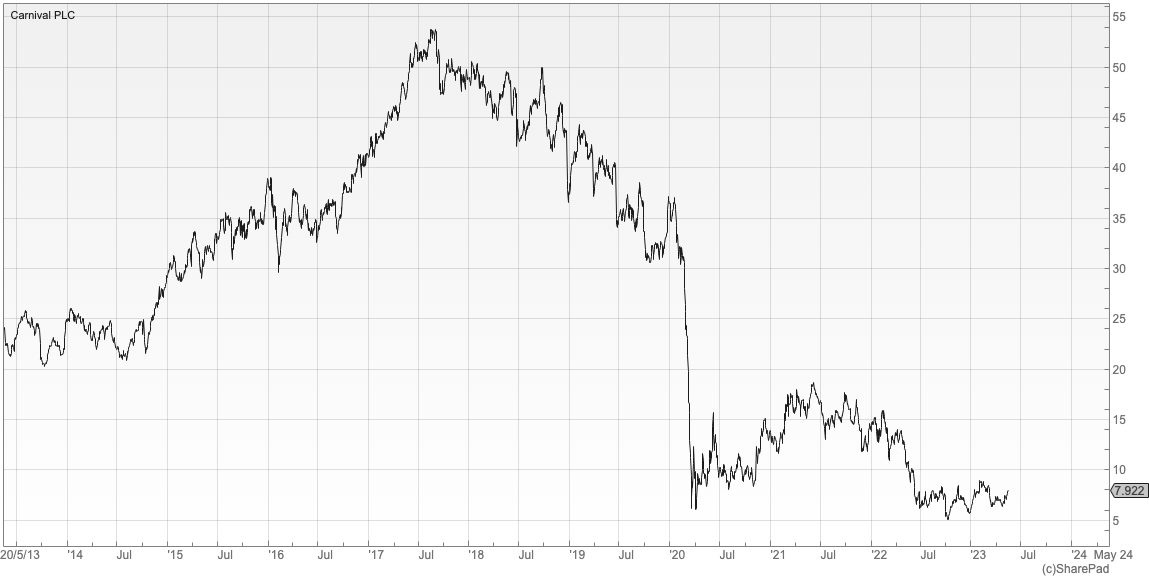

Another of last week’s big risers facing questions was cruise operator Carnival. Shares in the group haven’t really made a meaningful recovery from the collapse following the Covid pandemic in early 2020. Yet there could be brighter news on the horizon. Fellow cruise group Norwegian Cruise Line beat earnings expectations recently, and the read-across is that the industry could be on course for a recovery. In the meantime, Carnival’s share price is still drifting, as this 10-year chart shows:

SharePad: Carnival plc, 10 year chart

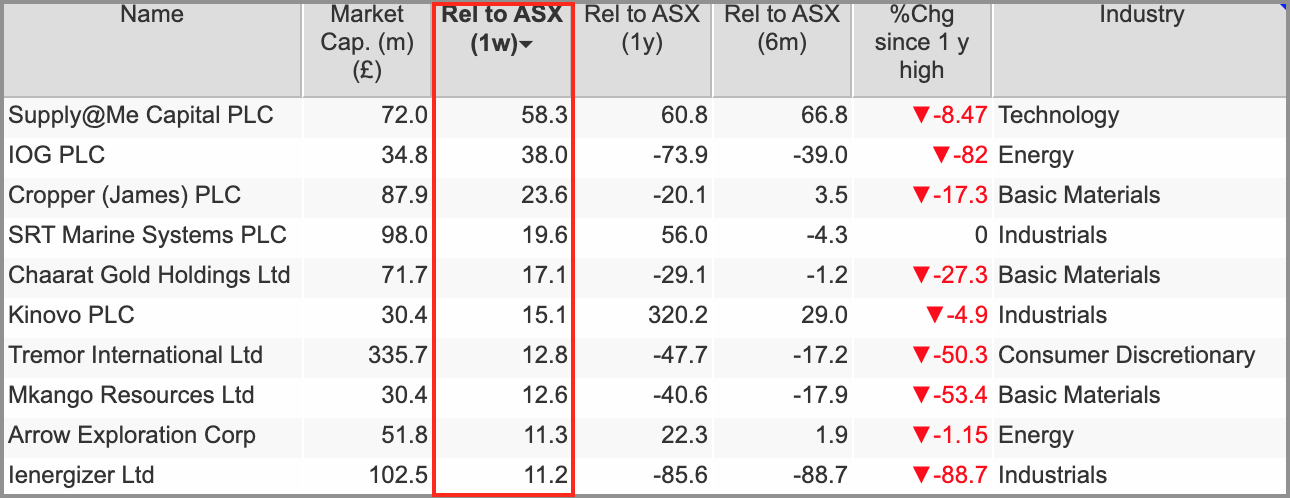

Among the small-caps (sub-£500m market cap) perhaps the most eye-catching of the big movers last week was SRT Marine Systems. It approached the close on Friday up nearly 20% relative to the All Share and trading at close to a 12-month high. SRT has been trying to get traction with its marine tracking technologies for many years. Could news this week of a $180 million contract with a US national coast guard be a hint that it’s finally getting there?

Trending sectors – uncertainty ahead for gold miners?

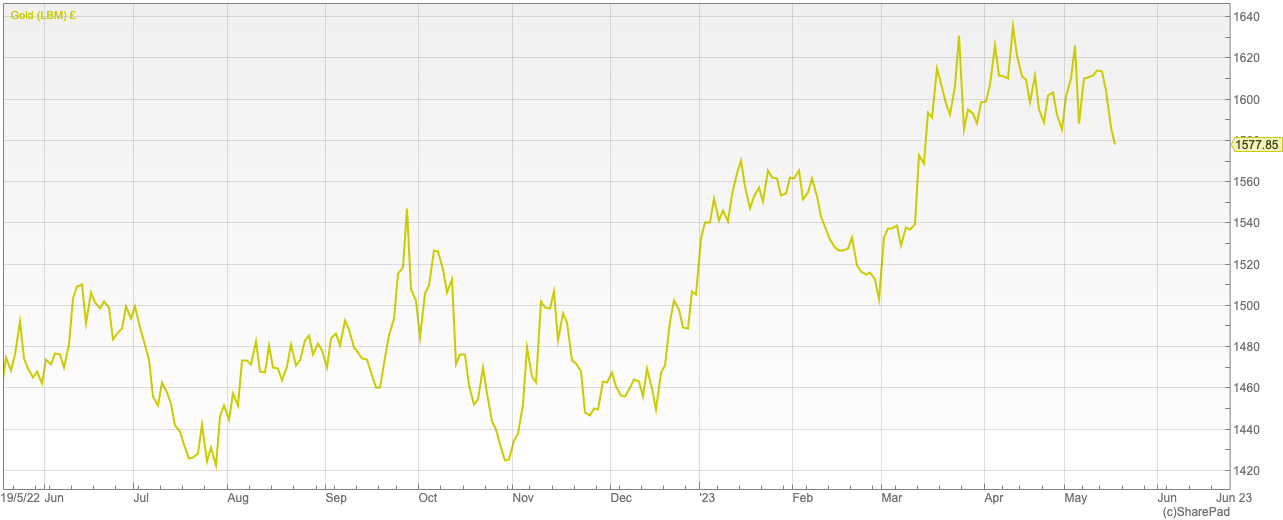

Gold has been one of the better-performing asset classes over the past three years. It continues to hold up quite well despite the fact that conditions have changed dramatically, and the appeal of other assets, including the yields on bonds, have improved over the past 18 months.

This 10-year chart below gives a good illustration of gold’s appeal in a crisis. The price soared as equities collapsed (and many economies ground to a halt) in the early months of 2020 when Covid arrived.

But post-Covid, the price has continued to rise. Among the possible reasons for this are its correlation to rising inflation, big buying last year by central banks and continuing uncertainty among investors about the outlook for world economies.

SharePad: Gold price £, 10 year chart

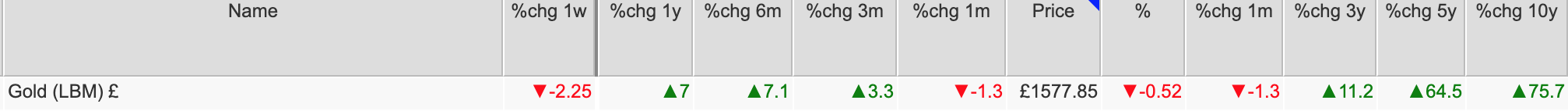

As this nearer-term one-year chart shows, the price has drifted in recent weeks and last week saw it take a leg down. While the trend isn’t exactly against it, the factors that likely drove the price higher in recent years may not exist in the same way from here. Certainly, that’s showing up in the share prices of some of the UK’s mining stocks.

SharePad: Gold price £, 1 year chart

Across the market, there are 39 shares classified as gold miners, and 14 of them have market caps greater than £100 million. As shown below, they all slipped in price last week, they are generally weak over one month, and the one-year performances are a mixed bag.

Gold shares are understandably closely correlated to the gold price. If demand for gold weakens, there could be more downward pressure on the sector’s stocks.

Results to look out for

We have got another busy week of results coming up. As always, note that precise dates are never certain, so keep an eye out for changes – and what follows is not a comprehensive list.

Recent ONS stats suggest the UK economy just managed positive growth in the first three months of 2023. But it contracted in March, with retail and car sales falling sharply. So all eyes will be on some of the outlook statements coming from firms in those sectors, with M&S and Kingfisher two of the largest out with figures this week.

Today (Monday) we’re scheduled to get full-year results from Big Yellow Group, Kainos, Ryanair and Wincanton. Wincanton issued a 2024 profit warning in early March after a major contract loss and concerns over tough conditions, so investors will be looking for better news there.

Tuesday is a hectic day with full-year figures from Assura, Bytes Technology, Cranswick, RS Group and FD Technologies among others. Interims are due from Avon Protection, Topps Tiles and Victorian Plumbing.

Wednesday is when we’ll get full-year results from Marks & Spencer, Severn Trent and SSE. Trading statements are scheduled from Assura, Bakkavor, Bodycote, Intertek, Kier, Kingfisher (Q1s), Mortgage Advice Bureau and Tullow Oil. Tullow’s shares have really struggled for momentum over the past 18 months, and are down by 32.4% alone in 2023, so investors will be looking for reasons to be cheerful there.

Thursday sees another big slug of full-year results, with figures due from Intermediate Capital, Johnson Matthey, Pets at Home, QinetiQ, Tate & Lyle and United Utilities. Interims are set to come from AJ Bell and trading updates are due from Fevertree Drinks, Headlam and S&U among others.

Friday looks quieter, with preliminary numbers in from Paypoint and small-cap auto dealer Caffyns.

Have a great week.

Ben Hobson

Got some thoughts on this week’s article from Ben? Share these in the SharePad chat. Login to SharePad – click on the chat icon in the top right – select or search for ‘share chat’.