Richard’s 5 Strikes systems discover four more potential long-term investments, but he doesn’t investigate any of them. Instead, he’s drawn to B-Corp aspirant and gaggle of consultancies Next 15. It has only two strikes to tarnish its name.

Since the last 5 Strikes update, my 5 Strikes system has discovered four more candidates for long-term investment. That is to say, they have less than three strikes against them:

| Name | TIDM | AR date | Strikes | # Strikes |

|---|---|---|---|---|

| Card Factory | CARD | 16/5/24 | – Holdings – Debt | 2 |

| Advanced Medical Solutions Group | AMS | 14/5/24 | ? Holdings ? ROCE | 1 |

| Andrews Sykes Group | ASY | 14/5/24 | – Growth | 1 |

| Ferroglobe | GSM | 13/5/24 | – Holdings – CROCI – Growth – ROCE | 4 |

| Churchill China | CHH | 10/5/24 | – CROCI | 1 |

Advanced Medical Solutions is a manufacturer of dressings, sutures, surgical glues and other methods of putting our torn flesh and organs back together. Churchill China is a manufacturer of tableware for the hospitality industry. Because I have been to the AGM twice and walked away with a gift each time, it is also the manufacturer of my coffee cups.

My entire collection of AGM tableware, two cups from Churchill China and a mug from Howden Joinery. The Churchill China cups are better quality, but then again Howdens makes kitchen units!

I am about to score and profile these shares for interactive investor, so I won’t say any more about them except… Churchill China is a long-time favourite!

I’ve not been tempted to analyse Andrews Sykes despite its track record. The company rents out portable air conditioners and other heating and cooling equipment. There’s nothing wrong with that, but traditionally I have been put off by the controlling family’s 86% holding.

The 5 Strikes system favours companies that have owner-managers. One of the strikes is “Holdings”, which penalises companies run by directors that do not have a substantial interest. But at more than 75%, a company can be taken private in the wink of an eye (in fact a vote at an Extraordinary General Meeting (EGM)) and I find that possibility unsettling.

The Murray family have been good stewards for twenty-five years, though. For most of that time, Andrews Sykes was chaired by Jacques-Gaston Murray, who died a business legend at the age of 103 last year. Now his son Jean-Jacques Murray chairs the business. Maynard follows Andrews Sykes.

Finally, Card Factory is a chain of card shops. Like many retailers it has managed down its financial obligations in recent years, helped no doubt by the declining cost of leasing stores. Although its debt-to-capital ratio is above 25%, my high watermark, it is only a little higher. A slight sense of incredulity and snobbishness has probably knocked it down my research list.

My head has been turned by another company.

Next 15 [2 strikes]

Next 15 was in the list from my previous article, but I did not get around to writing about it. I want to because it’s one of the very few listed businesses that has, or aspires to, B Corp status.

B Corps are companies committed to working for all stakeholders; employees, suppliers, customers, shareholders, and society. At first glance this purpose might seem to be at odds with maximising shareholder value, the objective many investors think should be paramount.

I do not think it is, if you take a long-term view. A business might make more money in the short-term by cutting corners, short-changing customers, underpaying employees, gouging suppliers, or despoiling the environment but as we may be seeing with the water companies, shareholders often pay up in the end.

Working out that a company is benefiting all of us is difficult to do, which is why I like B Corporations. They have been certified by an outside agency, B Lab, and as part of the process, B Lab scores them. Scores are my thing!

Elvis has entered the building

Next 15 is taking a very cautious approach, subsidiary by subsidiary. It has many subsidiaries because it is essentially a roll-up of niche advertising, marketing, data, and business transformation consultancies.

I do not know whether the whole group will ever achieve B Corp status. The chair says the company is working towards it and its Environmental, Social and Governance report uses the B Corp framework.

Elsewhere in the annual report though, the B Corp strategy is more refined:

“In keeping with our decentralised philosophy we are giving our brands the opportunity to certify as a B Corp, if they believe it is the right thing to do for the business.”

One brand has achieved certification, “elvis” (score 91.5). Since there are 23 brands listed on Next 15’s website, the journey has only just started.

As is always the case with companies that score less than three out of five, Next 15 has a pretty good financial track record. I gave it two strikes.

? Growth

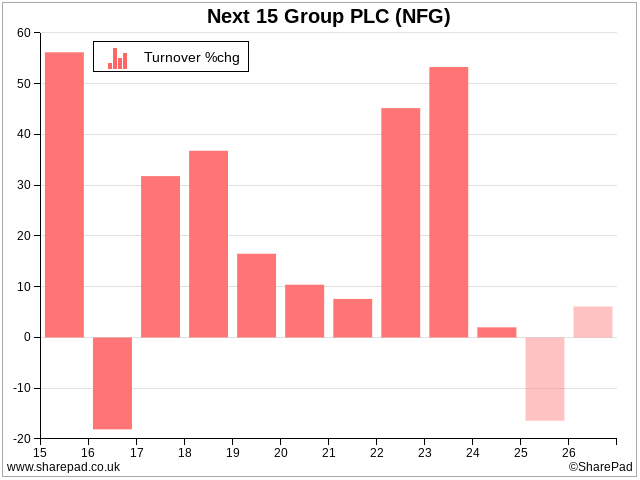

I gave it half a strike for growth (? Growth). Turnover has only fallen once in the last eight years – by 18% in 2016, near the beginning of the period. Otherwise, Next 15 has grown pretty impressively, except for one wrinkle. Analysts seem to be forecasting a similar drop in revenue in the current financial year (to January 2025):

Actually, I don’t think either decline represents how the company traded.

Bear with me, the explanation is a bit convoluted, but it demonstrates why we should always check the data if we see something weird.

The forecast decline looks weird because, although this year’s annual report (published in April) didn’t say much about the firms’ outlook, what it did say was positive.

I think this is a glitch. SharePad uses statutory revenue, but Next 15 and analysts focus on a different metric, net revenue. That is statutory revenue less “direct costs”.

Direct costs are third-party services provided as part of a Next 15 project but paid directly by the customer to the supplier. In other words, Next 15 does not make any money out of them.

SharePad is probably comparing statutory revenue in 2024 with the net revenue figure used by analysts in 2025.

Net revenue is more relevant to shareholders and would-be shareholders. We don’t really care how much other businesses are getting if Next 15 does not get a slice of it.

Next 15 published a broker research note on its site in January, which can help us unravel this mystery.

These are the net revenue figures, while the analyst thinks the rate of growth may be pedestrian in future they’re not forecasting contraction:

| Year to January… | (Net) revenue (£ million) | % change |

|---|---|---|

| 2022 (actual) | 362.1 | |

| 2023 (actual) | 553.8 | 53% |

| 2024 (estimate)* | 577.9 | 4% |

| 2025 (estimate) | 624.3 | 8% |

| 2026 (estimate) | 663.0 | 6% |

| Source: h2Radnor

*Actual net revenue for the year to January 2024 was £577.8 million |

||

The fall in turnover in 2016 has a different explanation. It relates to a change in the company’s financial year-end date. The statutory results show a decline in revenue because the 2015 financial year was eighteen months long, which made the comparatively short but actually normal 12-month year of 2016 look bad.

Compared to the previous twelve months, revenue grew 19% in 2016.

? ROCE

I also questioned profitability (? ROCE). Return on Capital Employed (ROCE) was below my benchmark of 10% during the pandemic years of 2020 and 2021 and also before 2018.

Generally, I’m inclined to forgive weakness during the pandemic. Because Next 15 acquired its brands, ROCE will also have been impacted as the company amortised acquired intangible assets.

This cost relates to how much Next 15 paid for the brands, not the profitability of their operations, so it does not mean that the group of 24 brands is insufficiently profitable to interest me.

One indication that the standard ROCE number may be misdirecting us is that Cash Return on Capital Invested (CROCI) has generally been very strong. Amortisation is an accounting judgement to balance the books, not a cash cost incurred during the year.

However, if I were to take this analysis further I would need to consider how much Next 15 paid for the acquired brands because, if it has overpaid in the past, it is quite likely to overpay in the future.

– Shares

The only full strike I awarded against Next 15 was the growth in the share count (- Shares). Since 2015, the number of shares has risen 41% from 70.5 million to 99.5 million.

The most likely explanation is that Next 15 part funded its roll-up by issuing more shares.

I prefer companies to fund acquisitions entirely from their own cash flow while maintaining a stable ratio of debt to capital because that is sustainable.

Consequently, I tolerate no more than a 1% or so increase in share count per year (to allow companies to pay executives and staff share-based incentives).

~

Contact Richard Beddard by email: richard@beddard.net, Twitter: @RichardBeddard, web: beddard.net

Got some thoughts on this week’s article from Richard? Share these in the SharePad chat. Login to SharePad – click on the chat icon in the top right – select or search for a specific share.