Phil looks at the recent bid interest in Hargreaves Lansdown and suggests that more bids for unloved companies could be on the way.

From loved to laggard

Many investors like to own shares in companies that are doing well and where the share price is heading upwards. This is perfectly understandable as this situation provides a lot of comfort and reassurance at the time.

That said, the stock market is a very fickle and unforgiving place. Once the good times appear to have come to an end, a share price can embark on a downwards path and then tread water.

In fact, the share prices of yesterday’s glamour companies can take on the resemblance of a dormant volcano. For many it will look like an extinct one and then an event – such as a takeover approach – brings it back to life and investors are interested in it again.

This scenario could be used to explain the fortunes of investment platform business Hargreaves Lansdown over the last few years.

Once lauded by investors for its dominant business model and brand strength, the company’s competitive position has been under attack and its profits have been declining.

That Hargreaves Lansdown is a very good business has never been in dispute. That said, over the years, I and a few other writers have commented that perhaps its high levels of profits were a sign that it was charging its customers too much.

The investment platform business is all about scale. It requires high fixed-cost investments in qualified staff, customer service teams and customer-friendly information technology systems.

This then needs lots of paying customers to cover the costs. Once these have been covered, a large chunk of the additional revenues drop through to profits. The more customers added, the fatter the profit margins can become.

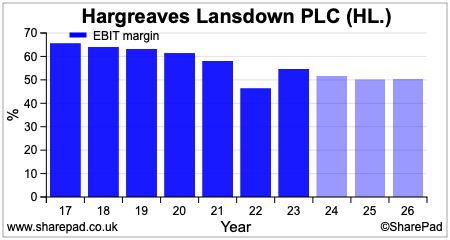

As recently as 2020, HL was earning operating profit margins of 60 per cent. There are not many businesses listed on the London market capable of this and the stock market – as it tends to do – priced HL shares as if this could continue.

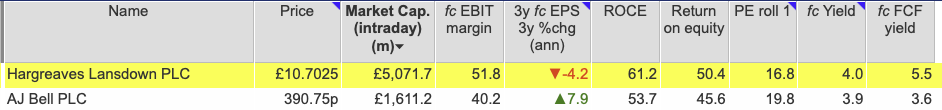

The chinks in HL armour began to appear with Covid-19 and the at-home stock trading boom that came with it. Its high trading costs initially saw a boom in revenues but fierce competition from the likes of AJ Bell (LSE:AJB) and Interactive Investor (LSE:ABDN) as well as the emergence of new trading apps has seen that business drift away.

However, it has been HL’s high platform fees for holding investments that has seen it lose its most profitable chunks of revenue. Having been a big beneficiary of the old trail commission agreements with fund managers, it persisted for years with high fees to replace these when they were banned more than a decade ago.

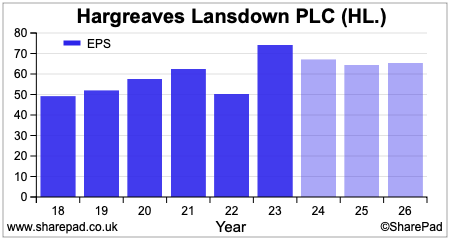

For some investors with large savings pots, the savings of moving to rival platforms could not be ignored. Throw in some bad publicity about its pushing of Neil Woodford’s funds and HL’s customer retention rates fell as a result. When combined with rising IT costs its margins have plummeted with City analysts predicting no earnings per share (EPS) growth for the foreseeable future.

HL’s share price has fallen by more than 50 per cent since its five-year high back in May 2019 and up until a week ago there was very little investor interest in it.

Hindsight is all well and good, but while HL has a growth problem, it was very clear to anyone who looked that it was still a very profitable business with a strong competitive position.

With 1.85 million active customers and £149.7bn of assets under management, it is still a business that commands substantial value and one that would be nigh on impossible to create from scratch given the scale that is needed to make its current profit margins.

An indicative private equity bid of 985p per share on 26th April valued HL at 14.7 times its 2024 forecast EPS and was rejected.

Now, investors are buying up the shares and speculating on how much it could be taken out for.

There is no guarantee a formal bid will be forthcoming – the current bidder has until 5pm on June 19th to tell the market if it intends to – as HL has a lot of problems to fix and isn’t likely to grow its profits for a while.

A valuation similar to AJ Bell’s near 20 times EPS might be a bit of a stretch, but what is arguably more important is the lesson contained within any takeover bid. It is that a business is often worth more to a trade or financial buyer than it is as one listed on the stock market.

This is because of opportunities such as cost savings, efficiency gains and the ability to make decisions that grow the long-term value of the business at the expense of short-term profit growth.

Sleepy companies that could attract a takeover bid

At the moment, it seems that there is rarely a day that goes by without some news of a takeover bid on the London market.

Much has been written about how cheap UK stocks are but buying in the hope of a bid is no guarantee that one will come.

That said, there are many solid companies out there whose share prices have fallen a long way from their five-year highs just like Hargreaves Lansdown.

I’ve used SharePad to compile a list of them but with the added attractions of forecast EPS growth of at least 5 per cent and in most cases, valuations that look reasonable.

Many of these companies have been experiencing tough times which explains why their share prices have fallen a long way. If these prove to be temporary then the businesses could be worth a lot more in a few years’ time and this is what could attract takeover interest.

For example, Whitbread has a very well-regarded budget hotel brand in Premier Inn, but its share price is a third off its five-year high. It is also a business that is underpinned by substantial freehold property assets.

Yet according to SharePad, the company is valued by the stock market (Enterprise Value) at barely above the value of the money that has been invested in it (capital employed). An earnings recovery should drive up returns (ROCE) and make it more valuable.

Reckitt Benckiser faces challenging trading conditions and the threat of crippling legal costs regarding its baby food business. Its shares look very cheap right now compared with many large consumer goods companies. Investors are rightly wary of the ongoing litigation risk which makes it a buy for the brave, but should these risks reduce, the shares are likely to be much higher than they are now.

SSP and WH Smith benefit from having retail outlets with captive customer bases in locations such as airports, railway stations and motorway service areas. These are very profitable and both companies plan to add more of them. Both shares are way off their five-year highs and trade on undemanding valuations.

EasyJet shares are off nearly 65 per cent, and have a decent earnings outlook yet trade on a very low PE multiple. Moneysupermarket is a highly profitable platform business like Hargreaves Lansdown, with a cheap valuation and earnings growth.

If these businesses attract takeover bids in the coming months or years then no-one can say that the potential for them did not exist.

~

Got some thoughts on this week’s article from Phil? Share these in the SharePad chat. Login to SharePad – click on the chat icon in the top right – select or search for a specific share.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.