Phil takes a look at some of the issues investors should consider when owning a share that has performed very well. He does this by taking a look at Rolls-Royce shares.

It’s always nice to own a share that performs very well. However, there will come a time when investors will ask themselves whether they should hold on or take profits.

Simple advice is often to “run your winners” but sometimes share prices can get too frothy which makes banking profits a sensible choice.

Can Rolls-Royce shares continue to deliver stellar returns to investors?

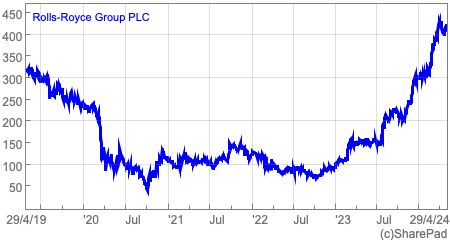

Rolls-Royce shares have been standout performers in the UK market. They are up 38.6% year-to-date, 173% over the last year and 297% over the last three years.

If you’ve owned these shares for the last three years then you have done very well. Holding on and running your winner has been the right strategy. No doubt, there will be some investors who have taken profits and looked back at what might have been.

That said, it’s always good to review your shares from time to time. For example, anyone holding Rolls-Royce might have seen it become a very significant portion of their portfolio. This will have served them well so far but could be a major source of risk if the shares stop delivering.

By asking a few simple questions, investors can weigh up whether it is worth sticking with a winning share or cashing in.

Is the business performing well?

Share prices are ultimately driven by changes in a company’s profits. A business with growing profits and a healthy outlook is the first and most important check.

Rolls-Royce scores well here. The company has recently reported very strong growth in its profits and cash flows for 2023. This has come from improvements in the way the business has been run and healthy end markets.

Rolls-Royce’s commercial aviation business which supplies aircraft engines has always had the potential to be a very good business. The Trent engines are great aircraft engines with a generally good reputation for quality and reliability.

It’s not uncommon for aircraft engines to last 30 years and while the initial sale of the engine can be unprofitable, the many years of servicing and maintenance provide a source of secure and very profitable cash flows.

Up until recently, the problem for RR shareholders is that the business has not been run very well. It has sold too many engines at too low prices in an attempt to gain market share and incurred big losses as a result. The business has also been very inefficient.

This is being put right under the direction of a new chief executive with costs being reduced and prices on engines and service contracts being increased.

What does the stock market expect?

This is all well and good, but this is all known and arguably already comfortably priced into the shares. To continue to make money from RR shares, expectations for future profits have to go up from where they are now.

Commercial aviation is a business that is very sensitive to the ups and downs of the global economy. This makes predicting future profits for anything more than the short-term quite difficult.

However, it is generally true that good things can keep on happening to good companies. A business with strong forecast upgrade momentum often has a lengthy period of time when it keeps raising its guidance on future profits.

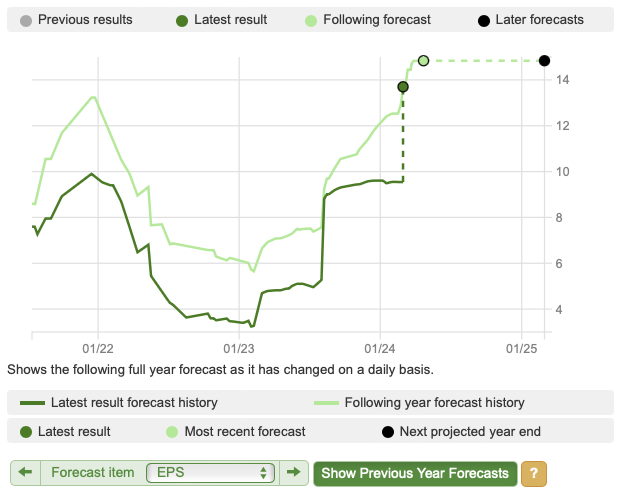

In SharePad, you can easily look at the momentum in profit forecasts. Below is a chart which shows how RR’s earnings per share (EPS) forecast for 2024 has evolved.

In early 2023, City analysts expected RR to make under 6p of EPS in 2024 (the light green line) and now expect more than 14p.

This is underpinned by healthy end markets in commercial aerospace, defence and power systems which should generate decent levels of revenue growth and a further improvement in profit margins.

The EPS forecast chart is a very healthy one. You can see that there have been several upgrades including a recent one. This is no guarantee that the upgrades will continue but often they do.

Rolls-Royce 2024 EPS Forecast History

Source: SharePad

There are at least two reasons to think that they could in RR’s case.

The first one is business momentum. It has been winning new orders for engines and this will feed through into future deliveries where better pricing could improve the profit outlook. The impact on servicing revenues on new orders will take much longer to be seen.

As RR is growing its profits with self-help initiatives such as cost savings, there is always a possibility that it will deliver these faster than expected or find new sources of savings.

Another thing to keep an eye on is provision releases. RR has £2bn of provisions on its balance sheet. Some of these are to cover the losses expected on previous contracts.

Sometimes, a company can find out that its provisions are too big which means that some of them are released back into the income statement rather than utilised to cover costs.

Last year, RR’s profits were boosted by a £385m provision release against contracts but this was offset by £410m of new provisions against supply chain costs. Future provision releases will not change RRs cash flows but could be a source of profit forecast upgrades.

Comparing forecasts against company targets

RR has helpfully disclosed some key financial targets which it hopes to achieve by 2027.

These are:

- Operating profit (or EBIT) of £2.5bn to £2.8bn

- Operating margins of 13-15%.

- Annual free cash flow of £2.8bn to £3.1bn.

- Return on capital employed (ROCE) of 16-18%.

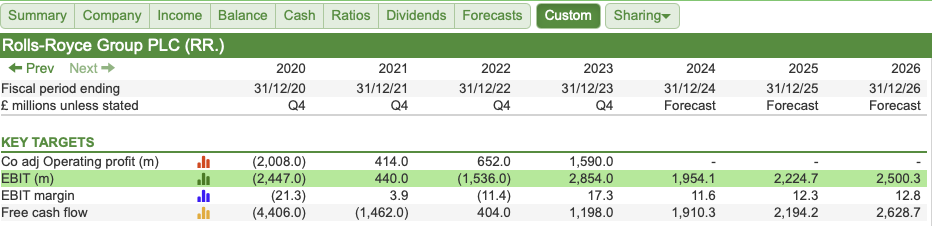

With the exception of ROCE, we can check on how close analysts think RR will get to meeting those targets by looking at forecasts for the next three years which takes us to 2026.

One of the best ways to do this is to create a custom financial table in SharePad.

Source: SharePad

SharePad does not produce forecasts for company-adjusted operating profit but does have EBIT which is similar. We can see that with forecast EBIT of £2.5bn in 2026, RR would be well on the way to getting to £2.8bn by 2027 but maybe some way from £3.1bn.

On margins, it seems that forecasts are for RR to hit the low end of its range. This could be a source of upside. For example, RR is targeting margins of 15-17% in its commercial aerospace division compared to 11.6% in 2023.

This is a decent improvement, but GE Aerospace makes profit margins of 23% in this business which suggests that RR can maybe perform better than expected.

Free cash flow expectations look to be in line with company guidance.

Valuation upside looks limited

A key source of higher future returns is an increase in the valuation multiple attached to shares.

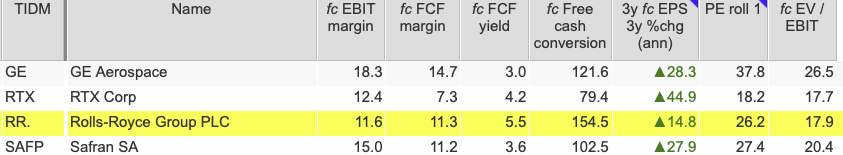

Source: SharePad

We can see that RR operates in a sector that is currently highly valued by the market. Its shares trade at a discount to the market leader, GE Aerospace, which looks justified given GE’s superior financial performance and growth outlook.

At 26.2 times forecast EPS, it’s not impossible that this multiple could increase but given that it is already high and general stock market valuations are under pressure from higher interest rates, this is not something that investors should bank on.

Sources of additional value

It is possible that the market has yet to fully price in some sources of additional value. The company has a £3bn deferred tax asset on its balance sheet which primarily relates to previous losses in its UK business.

This has the potential to lower RRs future tax charge going forward but it seems that analysts’ forecasts may not be anticipating this given that the tax rate seems quite high.

There is also some excitement surrounding the company’s small modular nuclear reactors which could supply a lot of electricity in the UK from the early 2030s. How much value this can ultimately create is hard to estimate.