House building in the UK has experienced numerous peaks and troughs with shareholders in listed housebuilders experiencing similar fortunes.

Buying housebuilder shares when they are unpopular has made investors plenty of money in the past, but is now a good time to invest? Phil takes a look at the sector through SharePad in an attempt to answer this question.

Source: Bellway

SharePad allows you to gain significant insight into a sector as well as individual shares. I will show you how to use its tools to navigate your way through the UK housebuilding sector.

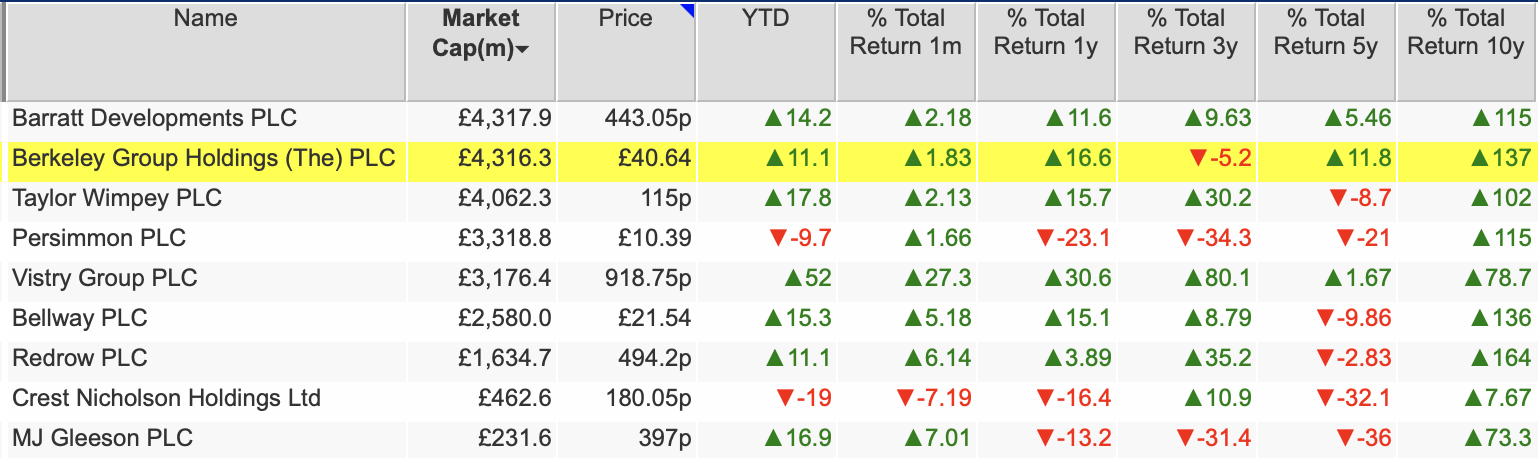

Long-term investors in most UK-listed housebuilders have fared reasonably well over the last decade. Of the nine shares residing in the FTSE-All Share Index, only Crest Nicholson has failed to beat the 68.9 per cent total returns delivered by the index.

Total Returns: UK Housebuilder shares

Source: SharePad

On a five-year view the sector has significantly underperformed the FTSE-All Share (+22.7 per cent) but year to date, most shares are outperforming the All Share’s returns of just over 5 per cent.

The sector had benefited from a very favourable tailwind of low mortgage rates and significant stimulus from government schemes such as Help to Buy. This has now ended and as a result, housebuilders are selling fewer new homes and making much lower profits than they had been in the recent past.

Companies have been reducing their outlook for profits and City analysts have been slashing their forecasts.

House prices and housebuilder profits have always been sensitive to the ups and downs of the economy. The problem that investors currently face is trying to work out where the UK economy is heading.

Is a big recession coming or will the current rough patch the economy is going through soon end? If it is the former, then investors might want to stay away from the sector. If it is the latter, then better times could be on the horizon.

The near-term outlook is very challenging

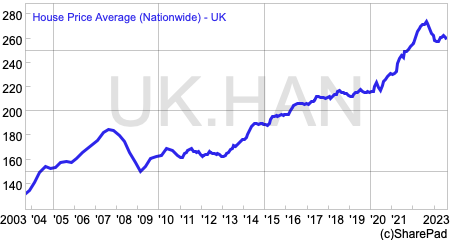

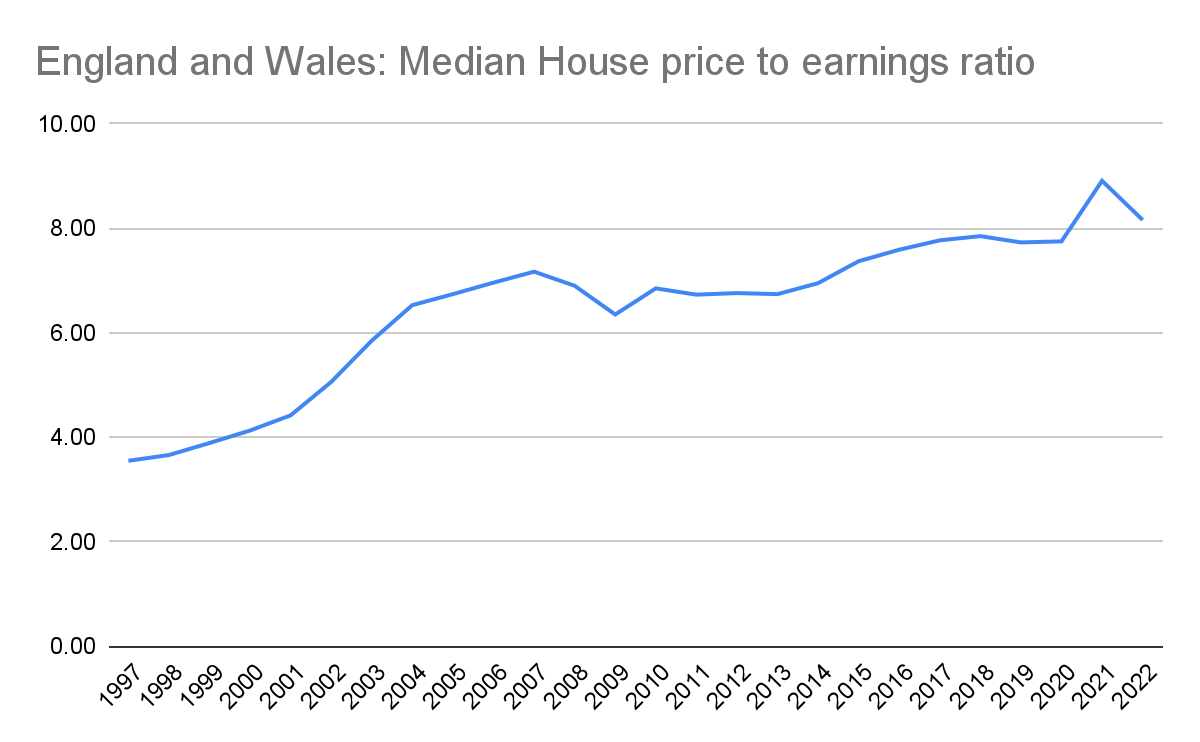

Every prominent survey of house prices is showing that house prices are falling in the UK. Despite wages increasing, higher mortgage rates and stubbornly high inflation mean that buyers are finding houses are becoming more expensive to finance and consequently activity levels in the housing market have fallen.

Source: ONS

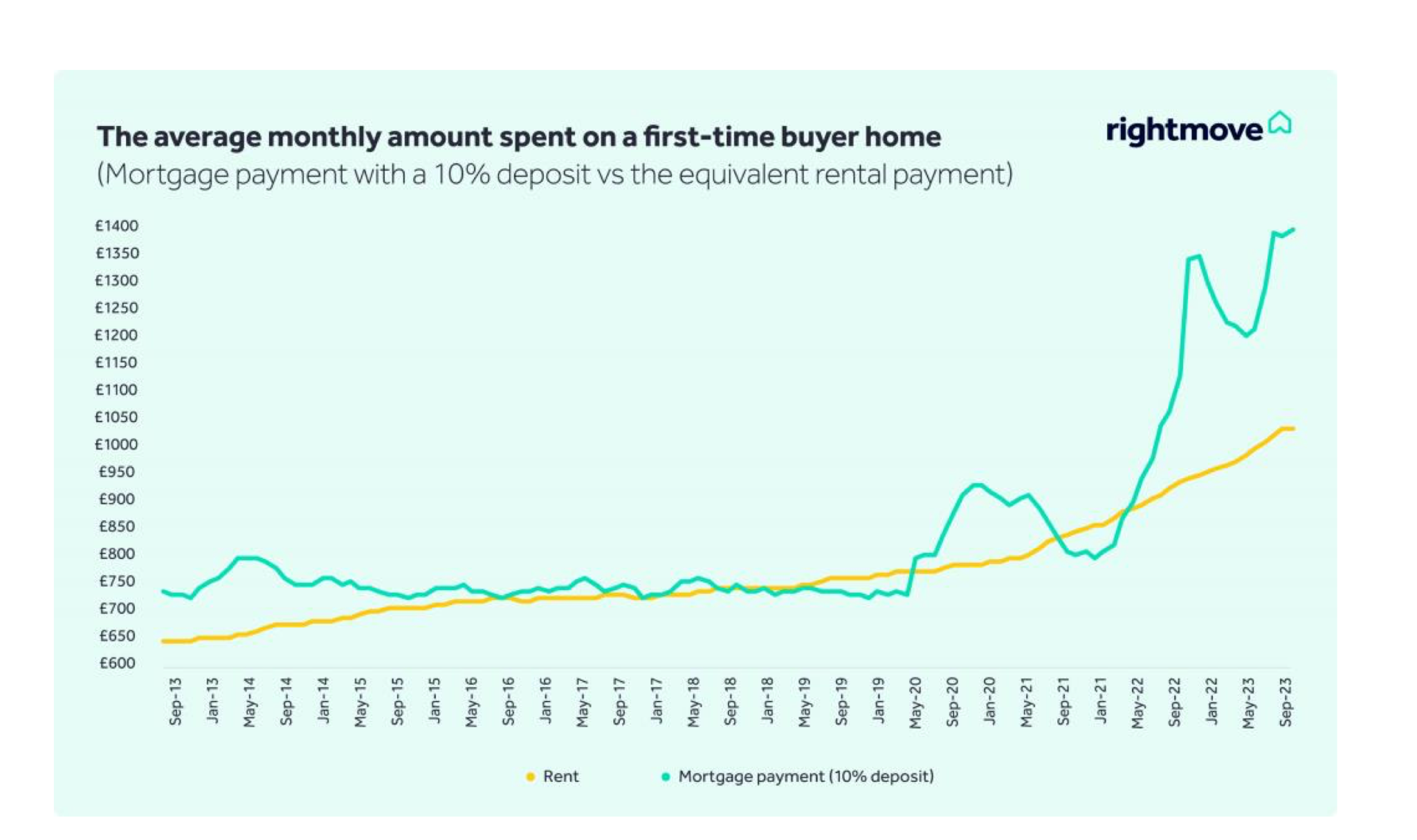

House prices relative to earnings have been increasing for the last 25 years and remain close to record highs. Mortgage payments for buyers with small deposits have soared.

Source: Rightmove

However, some economists and market commentators believe that the period of interest hikes may be close to peaking which could provide some relief to the country’s housebuilders.

Some lenders are starting to reduce mortgage rates in order to try and gain market share. Average five-year fixed-rate mortgages have come down from a peak of 6.1 per cent in July to around 5.7 per cent currently according to Rightmove.

This is undoubtedly welcome, but rates are significantly higher than they have been over the last decade. Unless mortgage rates come down a lot further, it is difficult to be bullish on the outlook for house prices and housebuilders’ profits.

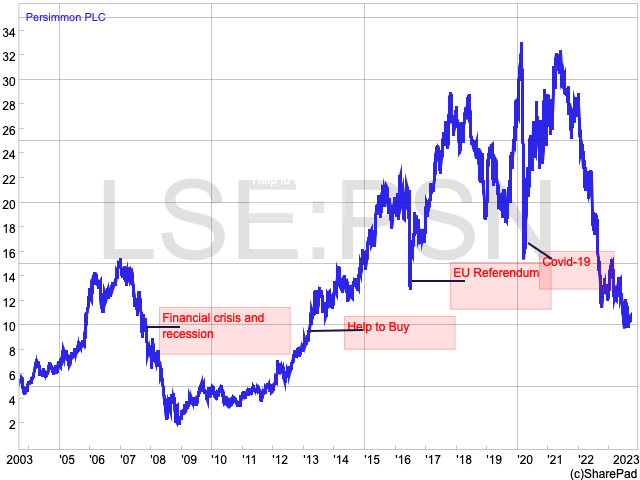

The ups and downs of housebuilder shares

Persimmon’s share price chart is a reasonable proxy for the fortunes of the sector over the last twenty years.

Share prices have been very volatile and impacted by a series of events. The 2007-09 financial crisis and recession that followed saw many builders fighting to stay alive. The sector then stagnated between 2010 and 2013 until the Help to Buy scheme lit the blue touchpaper under the sector and turbocharged profits and shareholder returns.

The recovery from significant share price falls as seen with the EU referendum and Covid can be very strong.

At the moment, many share prices have been on a prolonged downward path since the start of 2022. Persimmon and Crest Nicholson shares are currently trading close to their 10-year lows.

Source: SharePad

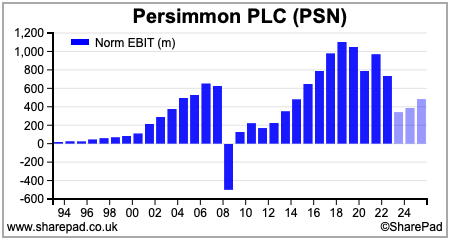

Some might argue that there are good reasons for this. Persimmon’s profits in 2023 are expected to be its lowest for a decade and a long way from what it was making prior to the Covid-19 pandemic.

They are not expected to recover quickly either. If analysts’ forecasts are met then perhaps Crest Nicholson is a better recovery play.

Looking at current forecasts and the expected direction of profits it suggests that Vistry and MJ Gleeson are worth doing some further research on. More on these two companies later.

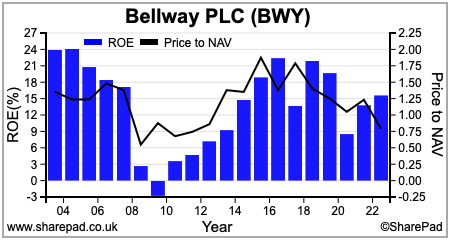

UK Housebuilders: Forecast EBIT £m

Source: SharePad

Low valuations reflect low profitability

The cyclicality of the housebuilding sector means that it rarely commands high valuations on measures such as the price-to-earnings (PE) ratio. History suggests that investors are right to believe that high profits do not last.

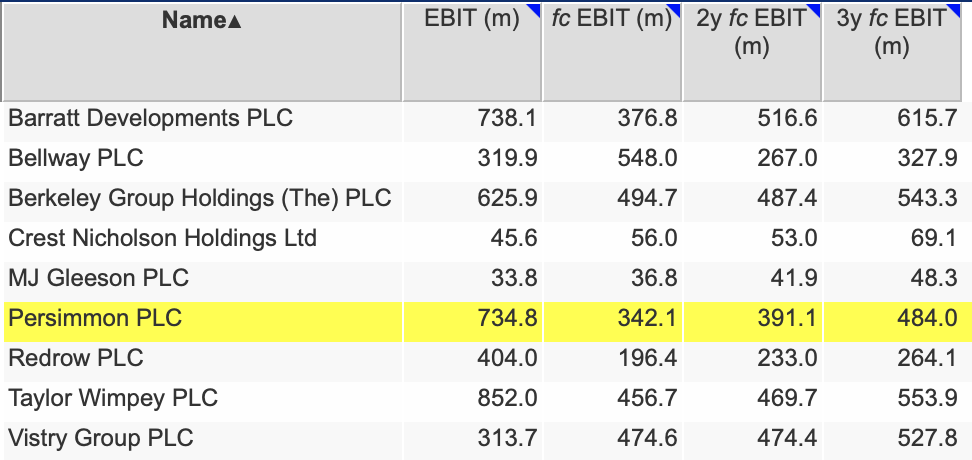

The go-to valuation yardstick for housebuilders is the price-to-book (net asset value) ratio. This makes a lot of sense as the equity value of a housebuilder is essentially a function of how much profit it can make from building houses on their substantial land assets.

Housebuilders’ balance sheets are dominated by the value of their land holdings and so is the value of shareholders’ equity (or net asset value).

As a rough rule of thumb, if a company’s return on equity (ROE) – its after-tax profits as a percentage of its shareholders’ equity – is sustainably higher than its cost of equity – the return shareholders require to own the shares – then the share price should trade at a premium to net asset value (NAV).

For example, if the sustainable ROE is 10 per cent and the cost of equity is 10 per cent then the shares would be fairly valued at a price-to-book value of 1.0x. If ROE can be sustained at 20 per cent – twice the cost of equity – then the price to book value should be 2.0x.

If a company’s shares are trading at a discount to book value then it implies that investors have concerns that the sustainable returns on equity will not be high enough. History shows that there is a reasonable correlation between ROE and price-to-NAV ratios but it does not always hold true.

We can see that a large number of UK housebuilder shares currently trade at a discount to their forecast NAV (to calculate this ratio in SharePad see the appendix to this article). The whole of the sector is expected to earn lower returns based on current forecasts than they have averaged for the last decade.

Source: SharePad

If this is too pessimistic, then perhaps some shares are undervalued. That said, according to SharePad some returns on equity are expected to be very low going forward.

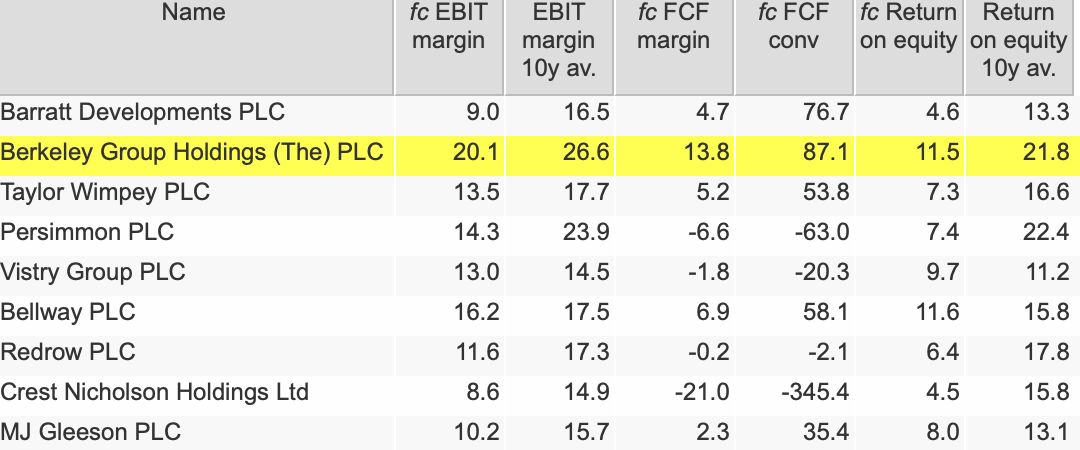

UK Housebuilders: Forecast profitability

Source: SharePad

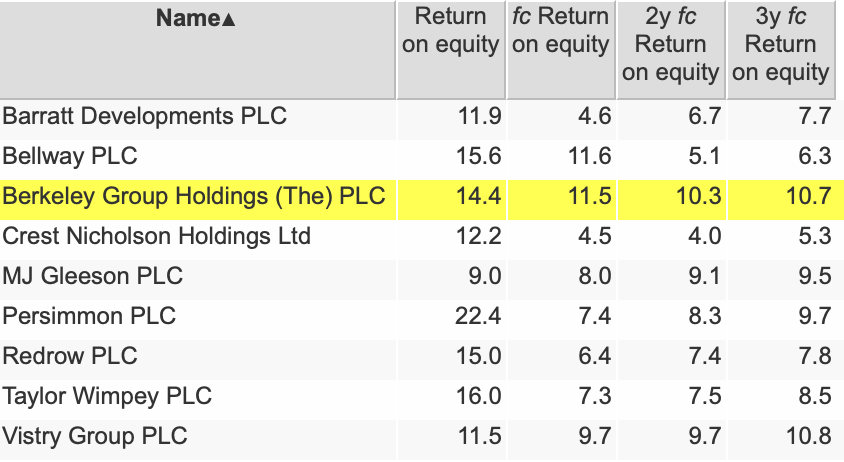

Even on a three-year forecast view, only Vistry and Berkeley Group are predicted to have returns on equity above 10 percent.

UK Housebuilders: Forecast return on equity

Source: SharePad

Dividend income to be hit

Dividend income has been a major attraction of the sector in recent years. This is set to fade as most builders have already cut their dividend payouts or are expected to do so.

Taylor Wimpey is expected to maintain its current chunky yield.

UK Housebuilders: Forecast yields on current share price

Source: SharePad

Could things get worse before they get better?

Possibly but not definitely.

At the moment, house prices are falling but not dramatically. There is not yet a glut of properties on the market that will see a sharp fall in prices, although according to Rightmove, over a third of homes currently on the market have been discounted – by an average of just over 6 per cent.

It would probably take a sharp increase in unemployment or mortgage defaults for supply to lead to a significant house price crash. This scenario is not being predicted at the moment.

Builders of new homes seem to be adopting a strategy of value over volume. They are cutting back on building activity but seeking to maintain selling prices by offering incentives and more part exchange deals.

If selling prices do see a significant fall then the carrying value of land on builders’ balance sheets could see heavy reductions as they have in past downturns. This is something to bear in mind when using asset values as a basis for valuing shares – they might be overstated.

The worry for companies looking to maintain selling prices is that their volumes decline further – especially if price falls in the secondary market start to accelerate. The lack of sales volume would put downward pressure on margins as it would be more difficult for profits to cover fixed overheads.

Vistry and Gleeson could be best placed in a weak market

It’s hard to predict the future, but if house prices and selling activity do not crash it is possible they could stagnate as they did after the financial crisis of 2007-09.

Most of the big builders are still having to face up to the problem that their products are expensive and becoming more unaffordable.

From an investor perspective, those looking to invest in the sector need to pay particular attention to company business models. Those that are playing at the lower price points or the affordable rented sector could be relatively well placed compared with the volume businesses selling at higher price points.

MJ Gleeson has set its stall out as a developer of affordable properties in the Midlands and North of England. It aims to price its homes so that they are affordable to a couple earning the national living wage.

Whilst it has not escaped the current sector malaise, it remains bullish about selling 3,000 homes per year in the medium term – from 1723 last year – and has been attracting interest from buyers who may have previously purchased from more expensive builders.

Vistry has repositioned itself as a provider of affordable mixed-tenure housing. This business is much less asset-intensive than mainstream housebuilding as large chunks of its homes are forward-sold to housing associations and the private rental sector.

This business is underpinned by a big shortage of affordable and shared ownership homes which should make it relatively resilient compared with its sector peers. Vistry is confident that it can grow its revenues at a rate of 5-8 per cent a year and earn operating margins of around 12 per cent.

It also believes that it can get its annual operating profits up to £800m and its return on capital employed (ROCE) to 40 per cent – as assets are sold off from its legacy housebuilding business – which would be an impressive number.

Shareholders are also set to receive £1bn in cash returns over the next three years – nearly one-third of the current market capitalisation – as well as the elimination of the company’s net debt.

With growth, rising returns and a forecast price-to-book value of just 1.0x times, Vistry looks worthy of further consideration despite having performed very strongly year to date.

Appendix

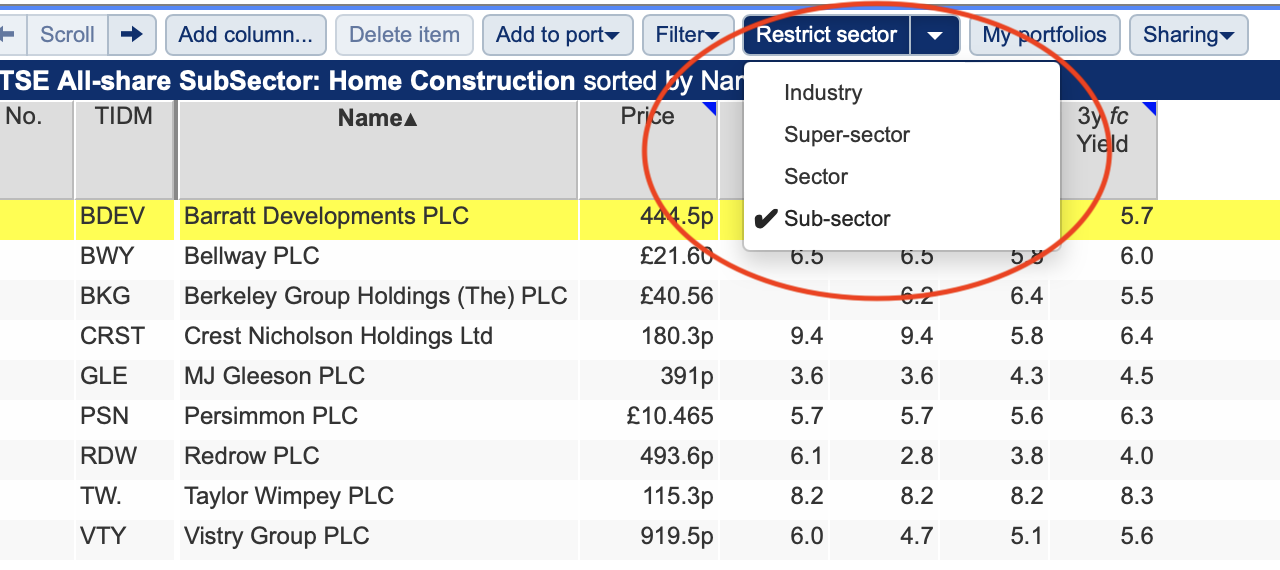

How to start analysing a sector in SharePad.

When you have a share in a list you can quickly select its sector peers by clicking the “restrict sector tab”.

With Barratt Developments above, you can restrict the sector to the sub-sector and also different parts of the UK stock market – such as FTSE 100 or FTSE All Share – which gives you a list of sector peers. You can then analyse the companies with different data columns.

This feature is also available for US, Canadian and European shares.

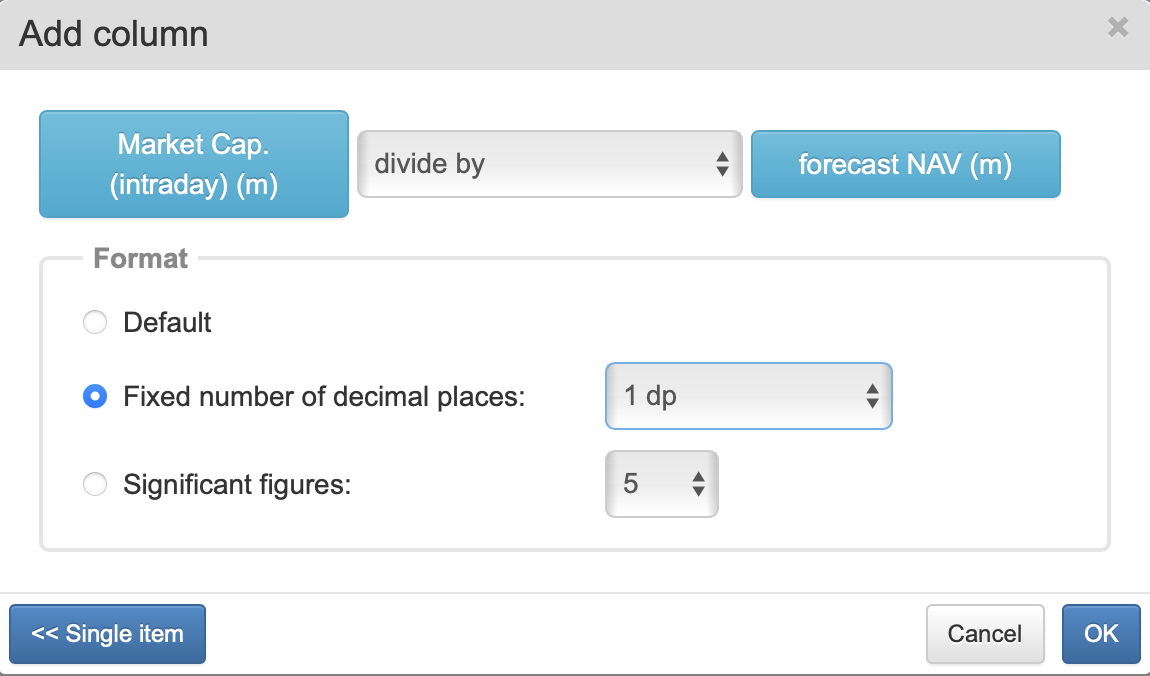

Calculating forecast price to book (NAV) value.

We will be adding this as a column shortly but because SharePad carries forecasts for company NAVs, a forecast price to NAV value can be created by comparing the current market capitalisation with the forecast NAV using the combined items option for adding a data column.

It is possible to perform this calculation for three forecast years where the data is available.

–

Phil Oakley

Got some thoughts on this week’s article from Phil? Share these in the SharePad chat. Login to SharePad – click on the chat icon in the top right – select or search for a specific share.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.